oatawa/iStock via Getty Images

Gelesis Holdings, Inc. (NYSE:GLS) is a commercial stage biotechnology company with a weight management product cleared by FDA. The Company is also advancing novel therapies for GI-related chronic diseases including Type 2 Diabetes, Non-alcoholic Fatty Liver Disease (“NAFLD”), Non-alcoholic Steatohepatitis (“NASH”), and functional constipation. The Company’s products are based on superabsorbent hydrogels that mimic some properties of raw vegetables, increasing volume and firmness while decreasing caloric density of foods.

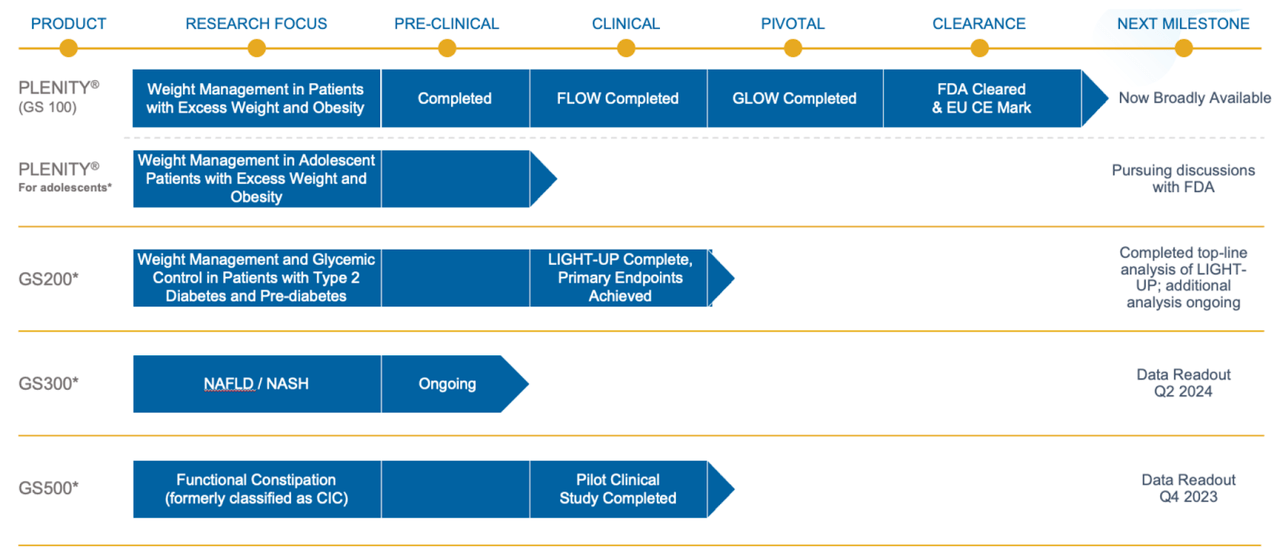

Products & Pipeline

Plenity or GS100, which received de novo clearance by the FDA in April 2019 as a Class II medical device, is an orally administered, non-stimulant, non-systemic biomimetic aid for weight management in adults in conjunction with diet and exercise. The product was also approved for marketing in Europe in June 2019 with the CE mark as a class III medical device for weight loss. The capsule form product comprises naturally derived ingredients that simulate fullness in the human stomach using cellulose-based superabsorbent hydrogels, the first and only such platform, which is proprietary to Gelesis.

“Thousands of small firm pieces of gel act mechanically in the stomach and small intestine, increasing the volume and firmness of the meals, to potentially alter the course of certain chronic diseases. Those pieces of firm gel have no calories and are constructed mainly of water (~99%) held by a 3D structure of modified cellulose.”

GS100 demonstrated favorable safety and efficacy in clinical studies. A six month pivotal study showed that, compared to placebo, GS100 doubled the odds of achieving 5% or more weight loss. However, GS100 had more adverse events in the GI category compared to placebo. How this will pan out for the candidates in the pipeline remain to be seen, as these are mostly related to GI-related chronic diseases. The Company is pursuing discussions with the FDA for expanding use of GS100 in adolescents for the same indication as for adults.

Pipeline (Company website)

GS200 is targeting weight management and glycemic control in diabetic and prediabetic patients. Topline analysis of LIGHT-UP study showed primary endpoints being achieved. Additional analysis is ongoing.

GS300 is being evaluated in NAFLD/NASH indication. Preclinical study is ongoing with data readout expected in 2Q-2024.

GS400 is being investigated in a preclinical study for use in IBD.

GS500 is being evaluated in functional constipation. Pilot clinical study is completed and data readout is expected in 4Q-2023.

Financials

Gelesis has a market capitalization of approximately $360 million at last quoted price of $4.45 on 4/18/2022. Outstanding shares are 72.21M, of which PE/VC firms, public corporations, institutions, private corporations and the public hold 33.56%, 23.16%, 22.73%, 13.84% and 3.49%, respectively, while insiders hold 3.21%.

The Company has started earning revenue from its one FDA-cleared product. Revenue in 2021 was $11.19M, all of it from product sales, up more than 300% from $2.7M in 2020. Total revenue in 2020 also included $18.7M from licensing, which was nil in 2021. During 2021 the Company received an aggregate $40M of fully paid preorders for Plenity, reaffirming guidance for 400% growth, with $58M anticipated from product revenue in 2022. Operating expenses were $96.1M. Net loss in 2021 was $93.34M. Operating losses and negative cash flows from operations are expected to continue in 2022.

In January 2022, the Company consummated a business combination with a SPAC – Capstar Special Purpose Acquisition Corp. – raising approximately $105 in gross proceeds from the combination and PIPE financing. Together with the cash and cash equivalents of $28.40M as of 12/31/2021, the Company expects a cash runway into 1Q-2023, but for less than 12 months.

While total debt at the end of fiscal 2021 was $66.27M, the Company had total current assets of $66M, which, apart from cash, includes $0.73M accounts receivable, $9.1M grants receivable, $13.5M inventories and $14.2M prepaid expenses. The Company also has property, plant, and equipment worth $58.5M. The Company also received grants from the Puglia region in Italy, as an incentive to manufacture and carry out R&D activities in Italy, which envisages adherence to regulations and laws in Italy, and to not move the reimbursed assets for five years from project completion date of November 2023.

Risks

The Company is an “emerging growth company” and may take advantage of exemptions in reporting requirements.

As of 12/31/2021, the Company’s accumulated deficit was $265.5 million. The Company will need to raise funds at least one more time.

The Company’s intellectual property is owned by “One S.r.l.,” the original inventor and owner of the Company’s core patents and a related party to the Company. The Company has 10% equity interest in One. The master agreement was amended and restated in June 2019 and “will remain in effect until the expiration of the last patents covered by the agreement or until all obligations under the amended and restated master agreement with respect to payments have terminated or expired.”

Bottom Line

The global anti-obesity drugs market is estimated to reach $11B by 2031, at a CAGR of 14.76% from $2.8B in 2021. Gelesis has guidance for less than 2% penetration of this market, which certainly looks doable. The global GI drugs market was valued at $49B in 2019 and is expected to reach $71B by 2027. Even a 1% penetration into this market would be substantial for Gelesis. However, it needs to bring more data from the trials of its proprietary technology in GI diseases. We will keep a watch on this company for further data.

Be the first to comment