Robert Way

Introduction

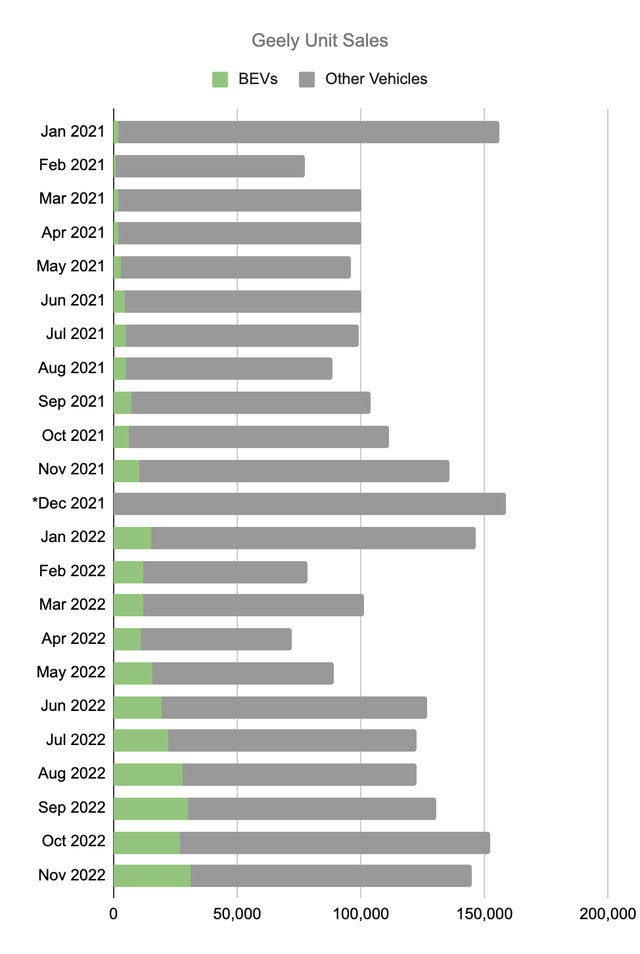

Over the last few years, many auto companies have been talking about increasing their sales of battery electric vehicles (“BEVs”). In many cases the talk hasn’t been backed up with numbers, but Geely (OTCPK:GELYF) is different. My thesis is that Geely has done a nice job ramping up their sales of BEVs in 2022.

The Australian Financial Review talks about Ford (F) selling Volvo following the great financial crisis:

Geely was one of the few to show interest and secured Volvo Cars in 2010 for $US1.8 billion, less than a third of what Ford paid. The sale included a small motorsport division called Polestar.

The Numbers

Looking at Geely’s monthly press releases, BEVs as a percentage of overall unit sales were 22.9%, 23.2%, 17.6% and 21.6% for August, September, October and November, respectively:

Geely Sales (Author’s spreadsheet)

*I haven’t seen the December 2021 BEV number at the time of this writing, but it should be revealed shortly when the December 2022 release comes out and Geely shows the units from the year prior.

Geely sold 224,351 BEVs from January to November of 2022 and this is a huge accomplishment given where they were in 2021! The October China Passenger Car Association (“CPCA”) New Energy Vehicle Report shows Geely’s Zeekr Krypton 001 in the #9 spot and the regular Geely brand in the #10 spot for monthly BEV sales in China below:

Image Source: October China Passenger Car Association (“CPCA”) New Energy Vehicle Report

Spots #1 to #8 above are BYD, SAIC-GM-Wuling, Changan, Tesla, GAC, Chery, Hozon and NIO, respectively.

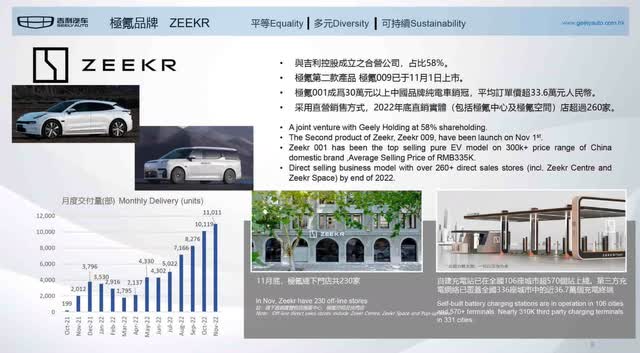

Geely’s December 2022 Corporate Presentation says the following about the Zeekr 001:

Zeekr 001 has been the top selling pure EV model on 300k+ price range of China domestic brand, Average Selling Price of RMB335K.

Zeekr’s monthly deliveries have skyrocketed since October of last year:

Zeekr (December 2022 Corporate Presentation)

Reuters notes that the Zeekr 001 is priced about the same as Tesla’s (TSLA) Model Y:

The 001 model starts at 299,000 yuan in China, slightly more than the 288,000 yuan for Tesla’s Model Y which had a recent price cut. Zeekr has not announced pricing for overseas markets.

Geely’s Geometry is targeted towards the global mass BEV market with a lower price point than the Zeekr 001:

Geometry (December 2022 Corporate Presentation)

Zeekr’s 2022 BEV sales have been laudable, and forward-looking investors should keep tabs on the proposed spin-off:

The Proposed Spin-off is currently intended to involve (i) an offering of shares in ZEEKR represented by ADSs in the U.S. to be registered with the SEC (the “IPO”); and (ii) a distribution in specie of ADSs to the Shareholders (or cash alternative for those Shareholders who are entitled to fractional ADSs, who elect to receive cash in lieu of ADSs, who are located in the U.S. or are U.S. persons (as defined in Regulation S), or are otherwise ineligible holders of ADSs). The IPO is expected to commence as market conditions permit and is subject to ZEEKR’s filing with the SEC a registration statement on Form F-1 in compliance with the U.S. Securities Act of 1933, as amended, and the SEC’s declaring such registration statement effective.

At the time of this writing, 1 RMB is equal to about $0.14.

Looking at the interim report, 1H21 gross profit was RMB 7,759,047 thousand on revenue of RMB 45,032,091 thousand for a gross margin of 17.2%. 1H22 gross profit increased 9.2% to RMB 8,475,802 thousand or $1,187 million on revenue of RMB 58,183,773 thousand for a gross margin of 14.6%.

Apart from Tesla, auto companies tend to say that BEVs are not yet profitable. Forward-looking investors need to look at Geely’s year-over-year gross margin decline and figure out what this means as the unit mix continues to shift towards BEVs. The December 2022 Corporate Presentation shows that Geometry units increased from 8.6 thousand for November 2021 to 13.8 thousand for November 2022. Meanwhile, the higher priced Zeekr with the direct selling business model saw units skyrocket from 2 thousand for November 2021 all the way up to 11 thousand for November 2022. I’m guessing that the higher priced Zeekr units have better margins than the lower priced Geometry units, but both may lag the margins Geely sees with many of the internal combustion engine (“ICE”) units.

I will continue watching Geely, especially when the Zeekr F-1 comes out for their IPO. At that point, we’ll be able to drill down on the profit margins and have a better idea about the amount of cash the business should generate in the future. Forward-looking investors should keep an eye out for this important F-1 document.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment