pixelfit/E+ via Getty Images

While we are in a bear market which could last for a while as the Federal Reserve continues to increase interest rates to combat inflation, it is time to look for bargains in the market. My recent research discovered GEE Group (NYSE:JOB) as a profitable company with a deep low valuation and strong future growth potential. My opinion is that GEE Group’s significant undervaluation and continued growth can drive the stock to outperform over the next 3 to 5 years.

Company Background

GEE Group offers permanent and temporary staffing and placement services in the United States. The company specializes in the placement of accounting, IT, finance, office, engineering, and medical professionals. GEE Group also offers temp staffing for the industrial positions. The company also runs a medical scribes business which offers electronic medical record services for specialty physicians, emergency departments, and clinics.

Positive Recent Results

GEE Group achieved positive results so far this fiscal year. Contract staffing revenue increased 9% for the first 9 months of the fiscal year which ended June 30, 2022. The company attributed the gains to increased demand in the GEE Group’s professional contract services markets as the negative effects of the COVID-19 pandemic were reduced.

Direct hire placement revenue increased 60% for the first 9 months of the fiscal year. However, Industrial staffing revenue declined 7.8% in the first 9 months of the fiscal year due to pandemic-related business closings in the Ohio markets. The decline in Industrial staffing revenue is probably temporary as it is pandemic-related (assuming that there will be less business closings going forward).

Consolidated gross profits and margins were 37.7% for the first 9-months of the fiscal year. The company’s consolidated gross margins were above 36% for 5 consecutive quarters. This is higher than the sector median GM of 29%. Overall, GEE Group has a chance to build on this positive momentum as the employment market remains strong for now.

Long-Term Growth

GEE Group experienced a healthy job market recently. While this may continue for a few more months, increased interest rates may have a negative impact on the economy. This is the biggest risk for the company in my opinion. However, CEO Derek Dewan mentioned in the Q3 earnings conference call that if clients put hiring on hold during an economic downturn, it would increase GEE Group’s contract business. Even if the company experiences a slow period or reduced overall revenue during a recession, an economic recovery would likely drive increased business as companies begin to hire again.

The current job market situation is beneficial for the GEE Group. There are more job openings in the market than there are job candidates. So, this keeps business robust for the company as they use their expertise in matching qualified candidates to the needed positions.

The long-term trend has many in the baby boomer generation retiring. About 10,000 baby boomers are expected to retire each day through 2030. That equates to about 3.65 million per year. This will create many job openings through the 2020s. This long-term trend should keep GEE Group busy as they assist clients in filling open positions.

GEE Group always has its eye out for acquisitions for add-on growth. One good aspect of an economic downturn is that it increases the opportunities to find potential acquisitions at low valuations. The good news is that GEE Group has a goal of paying for an acquisition without overleveraging the company. So, this would include using available cash, financing, and seller financing. The company hinted that they would probably not do a stock offering which could be dilutive to the stock.

As a result of the long-term positive trend for GEE Group, consensus estimates show that earnings are expected to grow at an average pace of 15% per year over the next 3 – 5 years. This pace of growth can drive the stock to outperform the broader market over the long-term.

Deep Low Valuation

GEE Group has a deep low valuation on multiple metrics. The stock is trading with a forward P/E of 7x, a PEG ratio of 0.48, and a price/sales ratio of 0.45x. This is significantly below the Staffing & Employment industry’s forward P/E of 18.8x, PEG of 1.6, and price/sales of 2.2x. This is an attractive valuation for a profitable company. The stock is priced as if the company were in serious decline. However, the company is growing and expected to grow at an above-average pace over the long-term.

This low valuation provides some downside protection in the face of a possible recession in my opinion. This is important as stocks can lose significant value during economic downturns. GEE Group may hold up better than many others as rising interest rates continue to put pressure on the economy.

SA Ratings

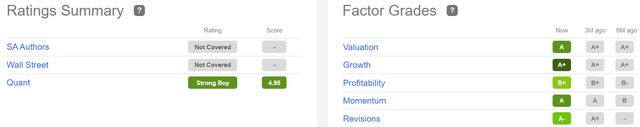

Valuation is just one reason for GEE Group to hold up well in the current economic environment. GEE Group has a ‘strong buy’ quant rating on Seeking Alpha. SA’s strong buy quant recommendations have been back tested to significantly outperform the S&P 500 (SPY) with an average annual annualized return of 25%. Here are GEE Group’s SA ratings:

seekingalpha.com

You can see that the company is performing well in each factor grade category which led to the high strong buy overall rating. GEE Group has a good chance of performing well in the future as the company continues its growth going forward.

One category that I didn’t discuss yet in detail is profitability. GEE Group has a gross margin of 37% and a net income margin of 14%. These are higher than the sector median GM of 29% and net income margin of 6.8%. The company also has an ROE of 26%, ROA of 20%, and ROIC of 5%. I would prefer to see the ROIC in the double-digits, but that is something that can be improved upon over time. The GEE Group’s ROE and ROA are excellent and higher than the sector median percentages of 14% and 5% respectively.

Balance Sheet

GEE Group’s balance sheet is strong with $17.5 million in cash with zero debt. The balance sheet also shows the company with 3x more current assets than current liabilities and 7.3x more total assets than total liabilities. The total equity is $101.6 million.

The company also brought in $10.5 million in operating cash flow over the past 12 months. This allowed GEE Group to increase its total cash, putting the company in a better position for acquisitions and other business investments.

The excellent balance sheet and positive cash flow gives the company the flexibility to grow the business and to do share repurchases, with room to take on some debt if needed.

GEE Group’s Long-Term Outlook

Industry statistics support long-term growth for GEE Group. About 70% of all working people are actively looking for a job change. It is also estimated that most people will have 12 jobs during their lives. The millions of baby boomers retiring each year creates many new job openings during this decade. Of course, the current job environment has been strong with many companies looking to fill positions.

I realize that higher interest rates could lead to an official recession which is a risk for GEE Group in the short-term. However, an economic downturn could put more available job candidates into the market. This can help GEE Group’s business as companies restart the hiring process during the recovery phase of the economic cycle.

Overall, GEE Group’s strong multiple-year above-average expected growth is likely to drive the stock to outperform the broader market from this low valuation.

Be the first to comment