Robert vt Hoenderdaal/iStock Editorial via Getty Images

About one and a half years ago I covered Geberit (OTCPK:GBERY) for the last time and according to the headline it was still overvalued. Although I rated the stock as a hold, I concluded:

Geberit certainly is a great business with a solid balance sheet and a wide economic moat. But the stock appears to be extremely overvalued at this point as the market seems to expect growth rates for the years to come that are just unrealistic in my opinion. And while this is a description that is fitting many different companies and stocks at this point in time, we still have to remain patient and continue to search for good investment – and Geberit isn’t one.

Since then, the stock lost more than 40% in value, and it seems like my thesis was proven right that Geberit was actually overvalued. The question which can’t be avoided right now is if Geberit is a bargain after losing about 50% of its previous value or if the stock is at least fairly valued, but we start with a small business description.

Business Description

(You can skip this part if you are already familiar with the business)

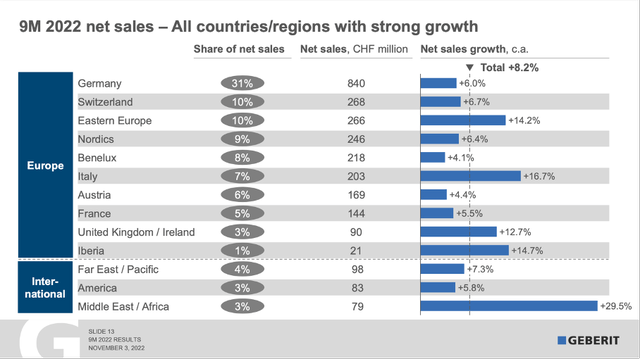

Geberit is specialized in manufacturing and supplying sanitary parts and related systems to customers all over the world and is the market leader in its field in Europe. The company was founded in 1874 and is headquartered in Rapperswil in Switzerland. Today, the company has almost 12,000 employees and offers installation and flushing systems for toilets. It also offers piping systems – including building drainage systems and supply systems as well as bathrooms ceramics and furniture, showers and bathtubs. In fiscal 2021, the company generated CHF 3,460 million in sales and has almost 12,000 employees. And while the products are sold in many countries around the world, the most important market is Europe (being responsible for about 90% of total sales) with Germany alone being responsible for 30% of sales.

Quarterly Results

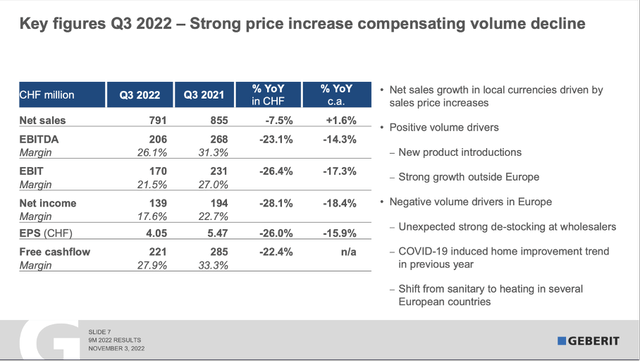

On November 3, 2022, Geberit reported third quarter results and the market did not like the numbers as the stock declined almost 10% following the results. Net sales declined from CHF 854.8 million in Q3/21 to CHF 790.7 million in Q3/22 – resulting in 7.5% year-over-year decline. Operating profit (EBIT) also declined from CHF 230.7 million in the same quarter last year to CHF 169.8 million this quarter – resulting in 26.4% year-over-year decline. EBIT margin also declined from 22.7% in the same quarter last year to 17.6% this quarter. And finally, diluted earnings per share declined from CHF 5.43 in Q3/21 to CHF 4.04 in Q3/22 – reflecting 25.6% year-over-year decline.

However, we must be careful when interpreting these results as currency fluctuations had a huge impact on the quarterly results. And in constant exchange rates the results are a little different. With the currency fluctuations in Q3/22 having a negative impact of 9.1%, net sales would have grown 1.6% in local currency.

Still Able to Offset Increasing Costs

The biggest problem for Geberit – like for many other businesses – are the exploding energy prices in Europe. During 2021, energy prices almost doubled which created a huge problem already, but in 2022 energy prices really surged. In Q3/22, energy prices increased 184% compared to the same quarter last year. And although management is expecting prices to be a bit lower again in Q4/22, prices will still be substantially above the prices in Q4/21.

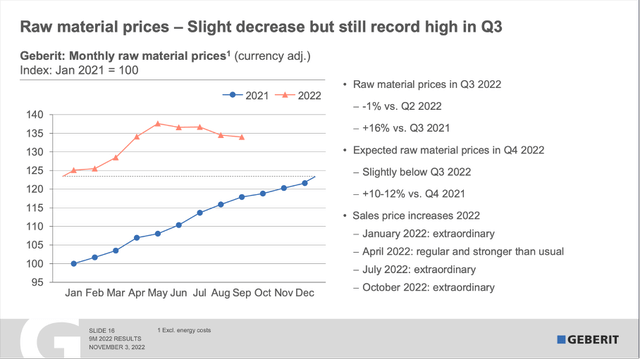

And the surging energy prices have somewhat overshadowed that raw material prices have been increasing with a high pace as well. In 2021, raw material prices increased almost 25% and in the first half of 2022 prices continued to increase. For the last few months, raw material prices are now trending sideways at a high level (about 35% higher than in January 2021).

But Geberit was able to offset the increasing energy and raw material prices. And in 2022, the company increased sales prices four times (so far). Aside from the regular price adjustment in April 2022 (which was already stronger than usual), we saw three extraordinary price increases in January, July, and October.

The ability to increase prices four times in only 10 months is underlining the wide economic moat Geberit has. And while I already mentioned in past articles the switching costs coming into play, I would like to explain once again why the switching costs are so strong for Geberit (an aspect I did not mention in previous articles).

Especially in Germany, Switzerland, and Austria (and these three countries account for almost 50% of total sales) – the sanitary and heating construction companies which are installing the sanitary facilities must guarantee the quality of the installed products and must pay for damage (even if it is the manufacturer’s fault). And hence these companies won’t install any cheap, no-name products they don’t know but will push customers towards buying products from companies like Geberit. This makes it rather difficult for new competitors entering the market by offering cheap prices.

The result is a wide economic moat for Geberit, which is stemming from switching costs as the sanitary and heating construction companies face huge switching costs because the risk of switching to a cheaper product of a competitor is generating an economic risk for the companies. And Geberit not only has a wide economic moat but is also rather recession resilient.

Quite Recession-Resilient

When looking at the data of the last 25 years we can describe Geberit as quite recession resilient. When looking at the last three recessions we have data for, revenue and earnings per share declined, but not very steep. Especially in 2001 and 2020 earnings per share declined only slightly and one year later the company could already report much higher earnings per share again. Only in the years following the Great Financial Crisis, we see earnings per share declining a bit steeper and Geberit struggling for several years to reach pre-crisis levels again. It took until 2014 before the company could report higher earnings per share again.

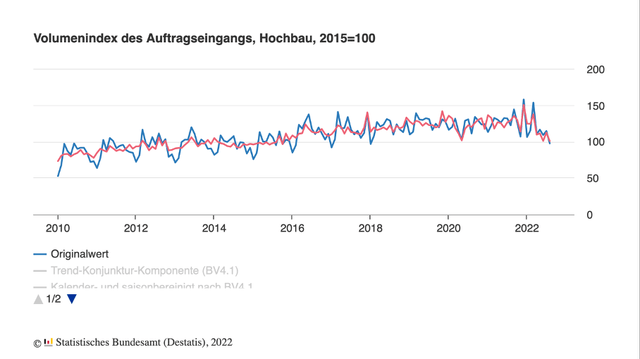

When looking at the performance during the last decade, we should also not forget that we witnessed a booming housing market in many countries – especially in Germany, the most important market for Geberit. The following chart is showing incoming orders for building construction in Germany (indexed to 2015).

And we not only see the increasing numbers from 2010 until recently, but also the decline starting in 2022. In the last few months several reported data should make us rather cautious – including the number of building permits declining 9.4% in August in Germany. Especially the number of building permits for single family houses declined 15.8% in the months from January 2022 to August 2022 compared to the same timeframe a year earlier. With fewer buildings being constructed, the demand for Geberit products will also decline – however this decline will happen with some time lag after the number of building permits declined.

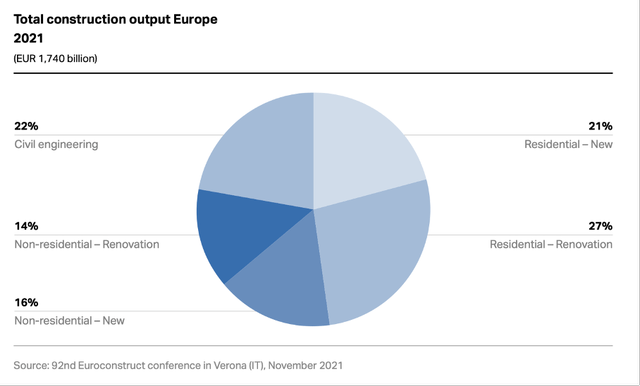

But of course, we should not just focus on new residential homes as this category is only responsible for about 21% of total construction output in Europe. About 27% is residential renovation and about 30% stem from non-residential (new as well as renovation) construction. So, we can’t just focus on new building permits as large parts of Geberit’s revenue might not necessarily stem from new residential homes. On the other hand, non-residential construction as well as residential renovation will also decline in case of a recession as renovations are also expensive and with disposable income being lower residents will postpone renovations.

Combining the different aspects, we must expect sales slowing down in the coming quarters due to a potential recession. But we should not be too pessimistic as Geberit has been able to perform quite well during past recessions and saw only moderate declines.

Intrinsic Value Calculation

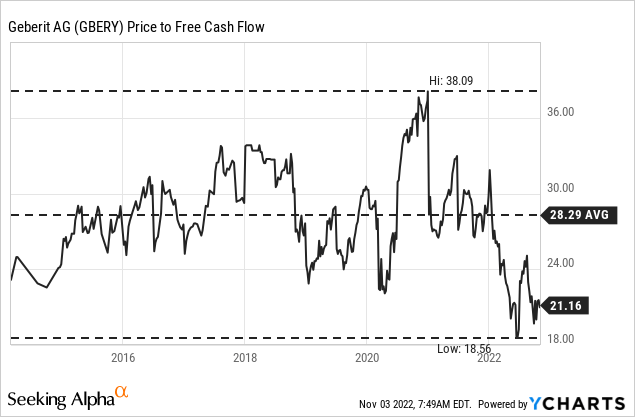

After declining about 50% from previous all-time highs, Geberit is actually trading for one of the cheapest price-free-cash-flow ratios of the last 10 years. With a P/FCF ratio of 21, we are rather close to the 10-year low of 18.56 marked earlier in 2022 and clearly below the 10-year average of 28.29. I usually don’t make investment decisions based on a P/E ratio of P/FCF ratio, but a valuation multiple of 15 can be seen as reasonable for high-quality businesses with a wide economic moat that are growing in the mid-to-high single digits.

Aside from making investment decisions based on price-free-cash-flow ratios we can also use a discount cash flow calculation to determine an intrinsic value for Geberit. And in a first step we must make several assumptions. For fiscal 2022 we assume free cash flow to be around CHF 500 million (nine months FCF is CHF 412 million so far). And for fiscal 2023 I assume a similarly low number due to the recession and negative impact it will have on Geberit. We saw above that Geberit performed quite well during previous recessions and compared to a FCF of CHF 809 million in 2021 this is already a steep decline.

For fiscal 2024 we assume Geberit coming out strong of the recession and calculate with 15% growth which will slow down over the next few years until fiscal 2031 when Geberit will grow “only” 6% – the growth rate we also assume for perpetuity. When calculating with these assumptions (and 35.67 million in outstanding shares right now as well as a 10% discount rate) we get an intrinsic value of CHF 423 for the stock making Geberit fairly valued.

Of course, we can discuss these growth assumptions and it would take until fiscal 2028 before Geberit can reach pre-crisis free cash flow levels again. In the chart above we saw Geberit growing with a CAGR of 11.52% since 1997 and can ask if our growth assumptions are not a bit too pessimistic. But in my opinion, it is better to be cautious right now as we really don’t know what will happen in the next few quarters.

Conclusion

After the stock price getting cut in half, Geberit seems to be fairly valued right now. However, I won’t pull the trigger just yet on Geberit. Similar to most other stocks I assume the worst is yet to come and we will see much lower stock prices for most equities. Of course, we can argue that Geberit is recession-resistant and has a wide economic moat – nevertheless, I expect declining metrics in the coming quarters, which will have an impact on the stock price once again.

Be the first to comment