Bet_Noire/iStock via Getty Images

Introduction

On April 19, I wrote an article on SA in which I said that I think silver is likely to perform well during the current high-inflation environment and that my top pick in the sector is Silvercorp Metals (SVM). In light of this, I think that it’s worth taking a look at more intermediate silver producers and today I want to talk about Gatos Silver (NYSE:GATO). The company looks cheap at the moment but there are reserve issues that need to be resolved for me to consider investing in its shares. Overall, I think it’s possible that zinc or lead reserves could be overstated and not silver reserves. Let’s review.

Overview of the business

Gatos Silver has a 70% stake in a joint venture company that operates the Cerro Los Gatos polymetallic mine in the state of Chihuahua in northern Mexico. The company is backed by American billionaire Thomas Kaplan and in November 2020, it completed a $172.5 million initial public offering on the NYSE and the TSX.

Gatos Silver

The project covers an area of 103,087 hectares and a total of 14 epithermal mineralized zones have been discovered so far. Over 85% of the mineral rights package has yet to be drilled.

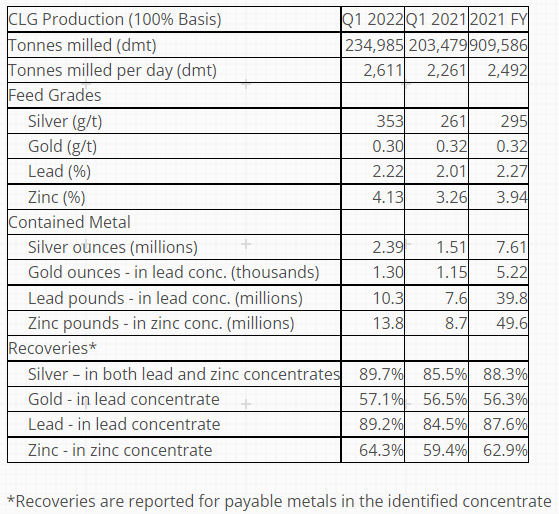

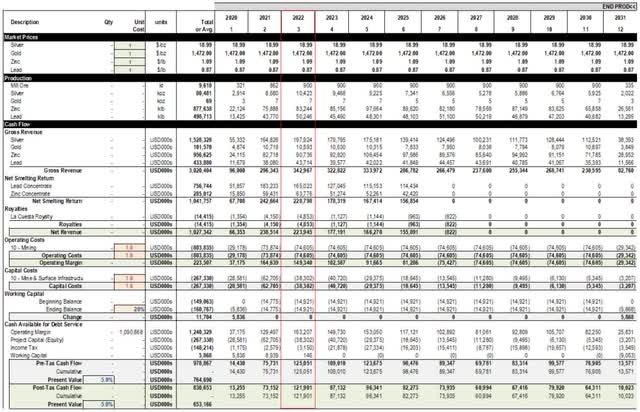

The mine has a mill with a 2,500 tpd design capacity and Gatos Silver plans to increase plant throughput levels to 2,700 tpd in the second half of 2022. The mine started operations in 2019 and in Q1 2022 it produced 2.39 million ounces of silver, 10.3 million pounds of lead, and 13.8 million pounds of zinc. As you can see from the chart below, silver production was 58% higher compared to the same period in 2021 and the main reason for this is higher grades.

Gatos Silver

As of March 2022, the joint venture company operating the mine had over $40 million in cash, which is about $20 million compared to December 2021. The JV company is investing $21.8 million in a paste plant to improve costs and productivity, with commissioning expected in Q3 2022. It also plans to invest $6 million in a new leaching plant to reduce fluorine levels in all zinc concentrates produced.

In my view, one of the key issues for Gatos Silver is that Cerro Los Gatos is a high-cost mine and it’s encouraging to see the JV company taking steps to optimize the cost structure. According to the 2022 production guidance, all-sustaining costs (AISC) on a by-product basis are expected to come in at $13.00-$15.00 per ounce of payable silver.

Gatos Silver

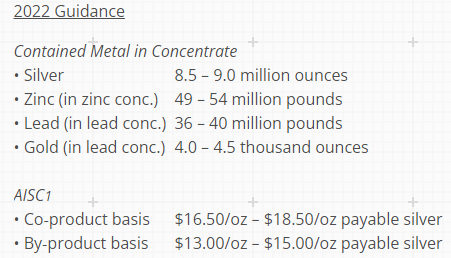

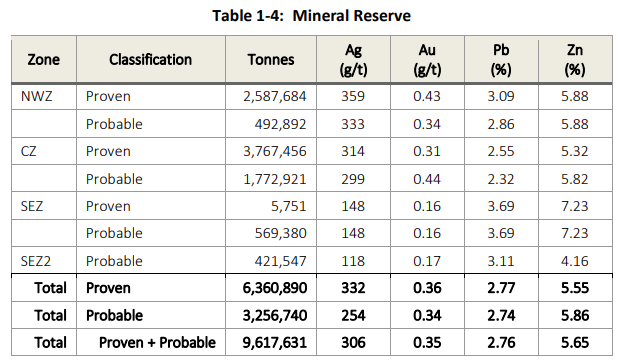

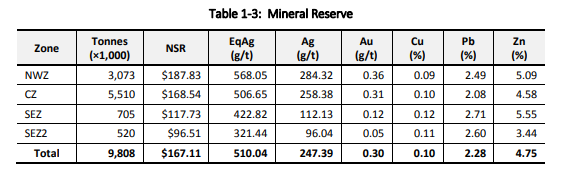

And speaking of issues, let’s talk about the major red flags in regards to the mine and Gatos Silver. It could be argued that it all started in January 2022 when the company revealed that during a resource and reserve update process it concluded that there were errors in the 2020 technical report for the project and that it estimates a potential reduction in the metal content of the mineral reserve ranging from 30% to 50% of the metal content remaining after depletion. This news sent the shares of Gatos Silver tumbling down by 65% in a single day and led the company to delay the release of its 2021 financials. It’s very rare for a mining company to have to decrease the reserves of a project by such a large amount and I think the move was unexpected by the market. The reason I say this is because the mineral reserves in the 2020 technical report:

Gatos Silver

Were almost unchanged compared to the 2017 technical report for Cerro Los Gatos:

Gatos Silver

In fact, you can notice that the silver grades were lower in the 2020 technical report.

Overall, this all means that the life of mine could be less than 5 years at the moment. Sure, the production guidance for 2022 looks strong but you have to remember that this was always expected to be the best year for the mine in terms of silver production and that it’s only a matter of time before high-grade ore is depleted. According to the 2020 technical report, silver production at Cerro Los Gatos would peak at 10.4 million ounces, which is why you could view the 2022 guidance provided by Gatos Silver as disappointing.

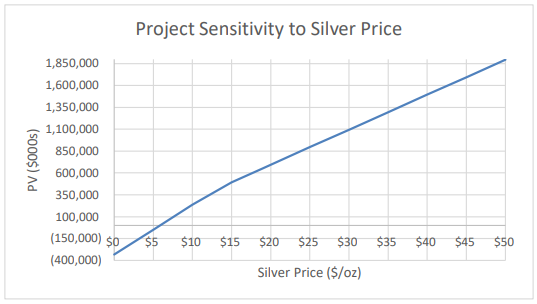

However, we can also notice that the 2022 guidance is much worse for lead and zinc production compared to the mine plan – especially zinc. This leads me to think that the market is overreacting at the moment as the overestimation of the reserves could be related to the zinc and lead content. Notice the words that the company used – the metal content. This means that if the issue is related to zinc or lead, silver reserves won’t change that much. Yes, this would increase AISC on a by-product basis but it won’t decrease the mine life by a large amount. On a silver equivalent basis, zinc accounts for a little over a third of the total metal content according to the 2020 technical report. Cerro Los Gatos should remain highly profitable unless silver prices decline over the next few years, and I see that as unlikely. Keep in mind that the 2020 technical report was done using silver prices of $18.99 and the metal is trading at $25.22 as of the time of writing.

Gatos Silver

In my view, Gatos Silver is worth keeping on your shortlist with the idea of opening a position if it turns out that the overestimation of the metal content in the reserves does not decrease the silver reserves at the deposit by much. I expect an updated mineral reserve estimate to be released around the fall or winter of this year.

Investor takeaway

I think that silver prices are likely to increase over the next few years due to high inflation rates across the world and I’ve been taking a closer look at several stocks in the sector. Gatos Silver is currently on my shortlist and the company has been punished by the market after announcing a major potential reduction in the metal content of the mineral reserve at Cerro Los Gatos. However, I think it’s possible that zinc or lead reserves could be overstated. Silver reserves, not by much. If this turns out to be true, I think that the share price of Gatos Silver could get back to levels of around $10. I’m keeping an eye on this company.

Author’s Note: Thank you for reading my analysis. Please note that I will be launching a marketplace service named Bears and Resources soon. I plan to share my live portfolio and my shortlist, and discuss exclusive investment ideas. Early subscribers will receive a legacy discount. Stay tuned for more details.

Be the first to comment