piranka

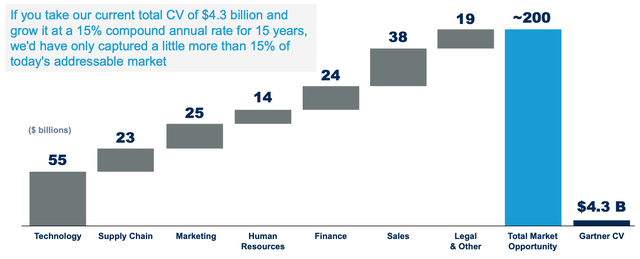

Gartner (NYSE:IT) is a leading technology research and consulting firm. The company was founded in 1979 and IPO’d in 1993, since then Gartner has rode the growth in the IT and Software industry. It has a solid subscription based model, with high renewal rates and a vast opportunity to expand its total addressable market outside of pure IT services. According to Gartner, its technology TAM was worth $55 billion as of June 2022, but if we layer on other business units this TAM expands by nearly 4X to $200 billion.

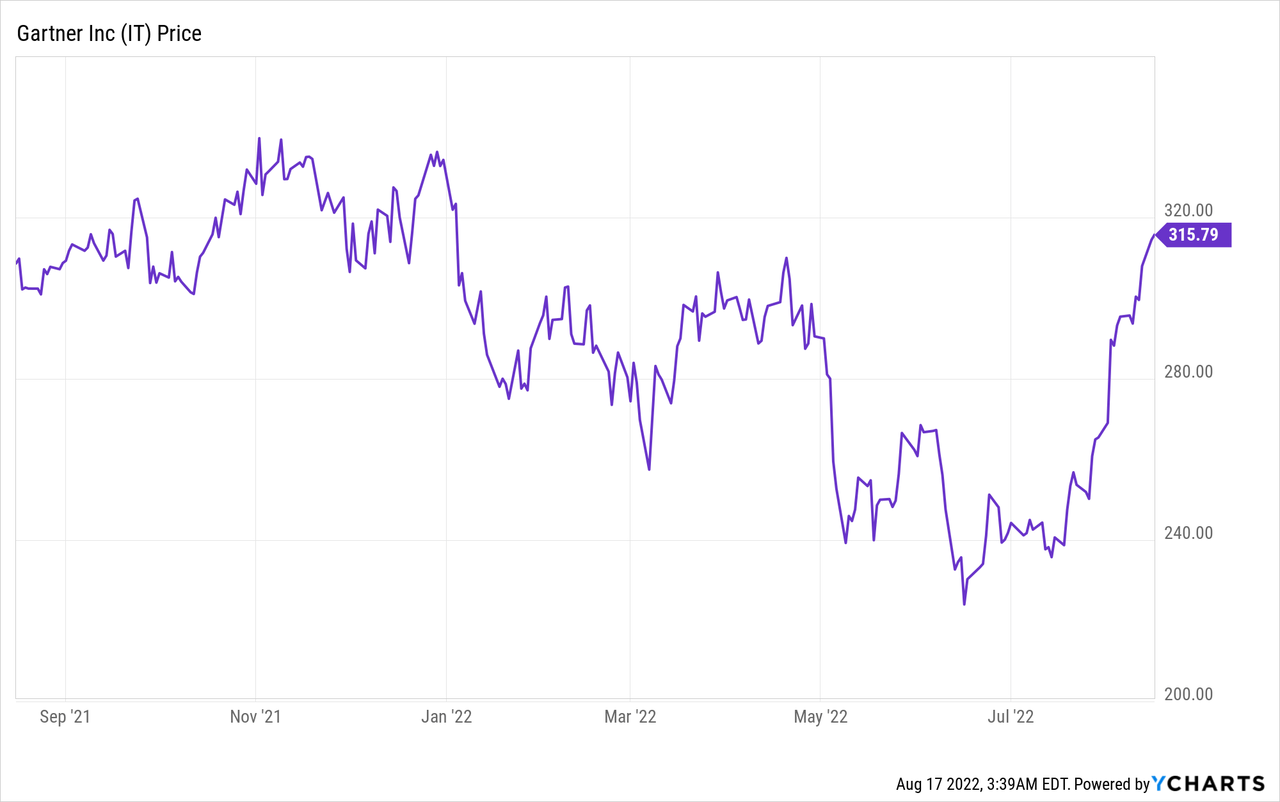

Gartner’s share price has increased by ~10,000% since 1993 and over the past two months has popped by ~37% alone. Management recently announced strong financial results for the second quarter and has continued to buy back shares. In this report I’m going to dive into its business model, financials and valuation for the juicy details, let’s do it.

Business Model

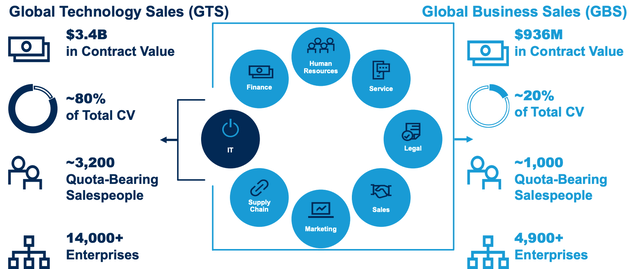

Gartner’s business can be divided into two main segments. The largest is Global Technology Sales [GTS] which makes up ~80% of its entire contract value. This segment has over 14,000 enterprise customers and an army of over 3,000 sales people. The smaller segment is Global Business Sales [GBS] this makes up the remaining 20% of contract value. This unit includes supply chain, marketing, finance and even legal services. This segment represents the market expansion opportunity as the company can use a “land and expand” approach to serve all parts of an enterprise.

Business Model (Investor presentation)

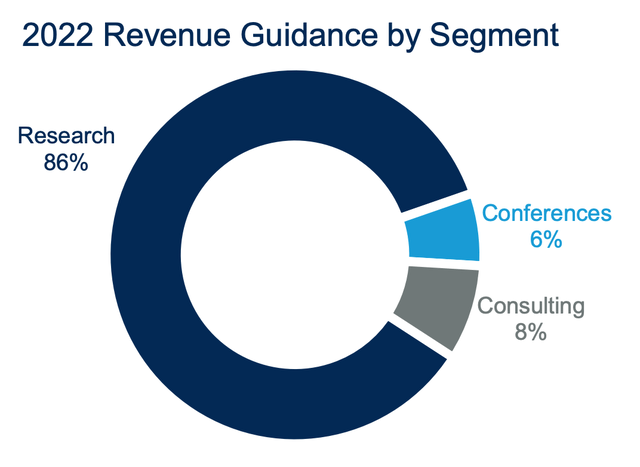

The bulk of Gartner’s revenue (86%) comes from Research and the company is most well known for it’s technology benchmarking reports and the Magic Quadrant. In the world of B2B enterprise software having an independent body who can assess and verify different players is a key part of the sales process and helps with building customer trust. I believe Gartner’s embedded relationships with key enterprises and software providers is its competitive advantage. In addition, these players will wish to keep Gartner happy (out of fear of a bad review) and thus I imagine the company will find it easier to arrange up-sell sales calls. Its position as a trusted third party and industry expert also makes its consulting arm, which makes up 8% of Revenue, very attractive. The digital transformation industry is forecasted to grow at a rapid 23.6% CAGR over the next few years and be worth over $1.7 trillion by 2028. I believe this industry growth will be a key tailwind behind the growth of Gartner’s consulting arm. Conferences which make up 6% of revenue are also a rapidly growing segment for the company and I forecast this section to increase revenue share over time.

Revenue split (Investor Presentation)

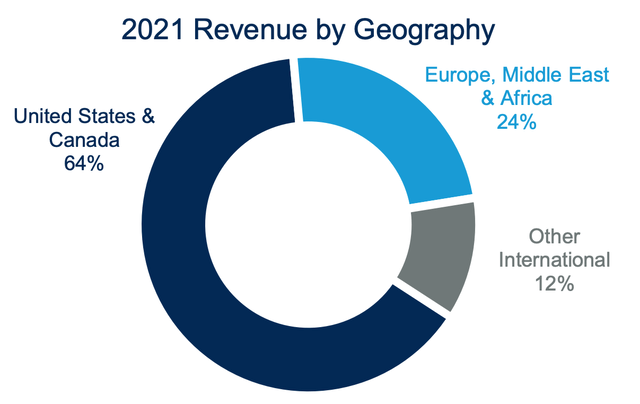

Gartner makes 91% of its revenue from subscription services which is my favorite business model as it allows for more consistent and predictable cash flow. The majority (64%) of its sales come from the U.S. and Canada but they also have nearly one quarter of sales from Europe, the Middle East and Africa.

Revenue by Geography (Investor relations)

Growing Financials

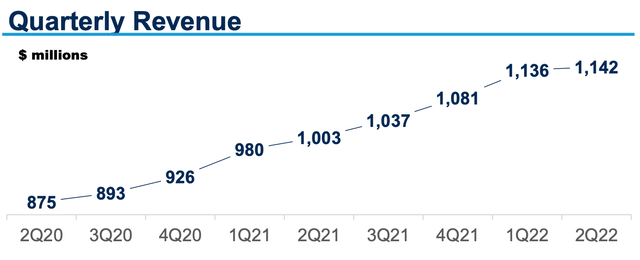

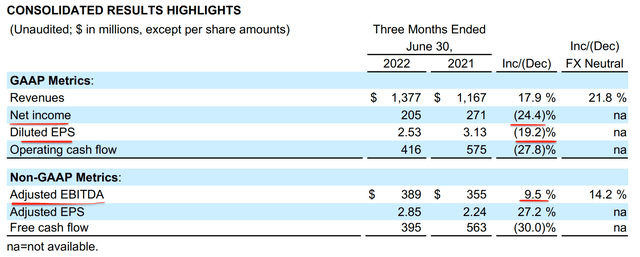

Gartner generated strong financial results for the second quarter of 2022. Revenue was $1.4 billion, which beat analyst consensus estimates by $52.51 million and was up 17.9% year over year. This was driven by strong growth in the Conferences segment, which popped by 95.1% to $114 million. Its largest segment Research also popped by a healthy 13.9% year over year to $1.14 billion. While the smaller Consulting segment increased by 13.9% YoY to $121 million.

Research Segment Revenue (Q2 Report)

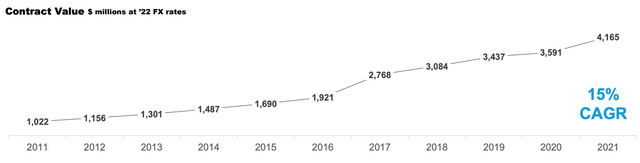

Overall contract value was $4.3 billion up 15% year over year. This was driven by rapid growth in its smaller Global Business Sales segment, which had a contract value of $0.9 billion, up 23% year over year. Global Technology Sales contract value also popped by a solid 13.5% year over year to $3.4 billion.

GAAP Net income was $205 million in the second quarter which did decline by 24.4% year over year. However, adjusted EBITA rose by 9.5% year over year to $389 million. In addition, GAAP EPS was $2.53 which beat analyst consensus estimates by $0.62 even despite the decline year over year. Adjusted EPS was $2.85, which popped by over 27.2% year over year.

Gartner Financials (Q2 Earnings Report)

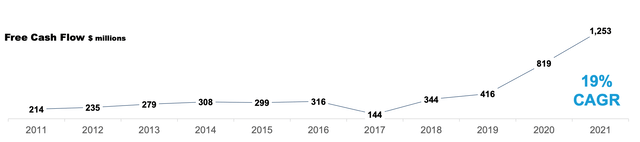

Gartner generated Operating cash flow of $416 million in the second quarter of 2022. This was down 27.8% year over year which may look bad, but if we make an adjustment for insurance proceeds (which were received in Q2,21) it was only down 2% YoY.

It also should be noted that a large CapEx increase of 76% year over year to $21 million didn’t help overall numbers. But this was mainly due to capitalized software costs, laptops and other infrastructure so not a major worry.

The company generates free cash flow well in excess of net income which is a positive sign. In the second quarter of 2022, free cash flow was $395 million, down 30% year over year, but again after adjustment for insurance proceeds the decline was not stark. Also if we look at the historic trend between 2019 and 2021 free cash flow has grown strong which is a positive.

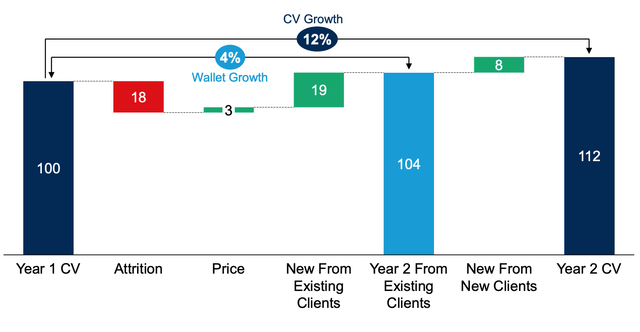

Wallet Growth is an interesting metric which is comprised of attrition, modest price increases (3% to 4%) and new sales to existing clients shows a solid 4% growth between year 1 and year 2. While overall contract value (including new clients) grew by 12% year over year.

Wallet Growth (Q2 Earnings Report)

As of the second quarter of 2022, Gartner had cash and short term investments of $360.5 million. Its debt balance was ~$2.5 billion, which may seem high but given only $6.9 million is in current debt (due within the next two years) and gross debt to trailing 12 month EBITDA was less than two then this is manageable.

Management has also showed confidence through the buyback of 1.8 million common shares for $479 million in the second quarter which has resulted in a 5.5% reduction in outstanding share count YoY.

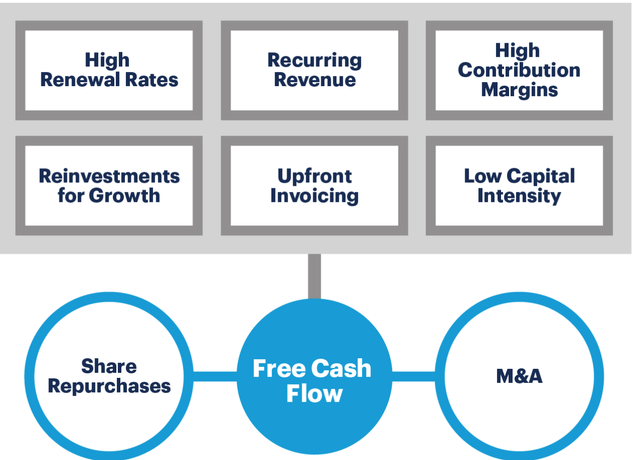

Management’s full strategy is shown in the image below. Overall this is a low Capex Model, which high recurring revenue and margins. Free Cash Flow generated is then deployed into share buybacks or acquisitions.

Strategy (Investor Presentation)

Moving forward management is guiding for double digit revenue growth. Margins are expected to be in the “low twenties” well above pre pandemic levels and the expectation is they will increase over time. However, the business is forecasting a 370 basis point FX impact on revenue growth which has been raised from the 260 basis points guided for previously.

Advanced Valuation

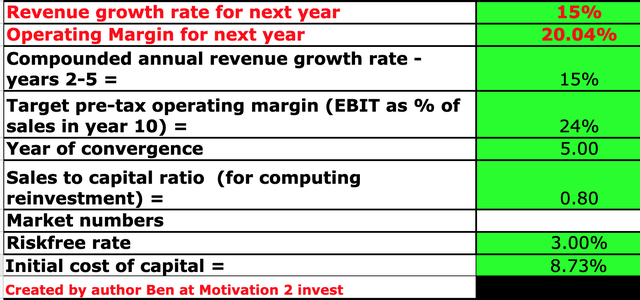

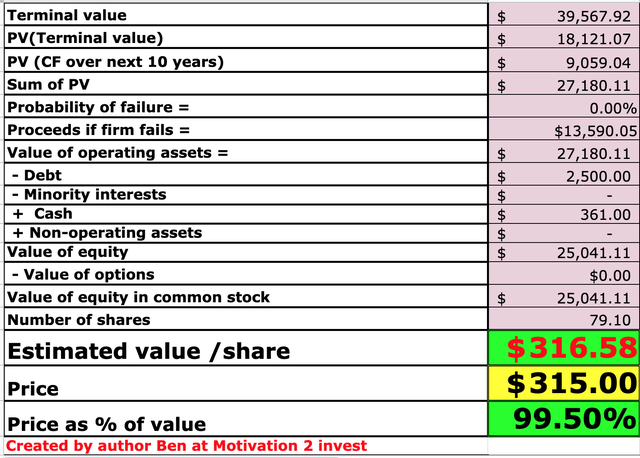

In order to value Gartner, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 15% revenue growth per year over the next five years which is slower than prior growth rates and inline with management’s forecast.

Gartner Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted margins to “increase over time” as guided by management to a healthy 24% on the operating margin over the next 5 years.

Gartner Stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $316/share, and the stock is trading at ~$315/share at the time of writing and is thus “fairly valued” in my eyes.

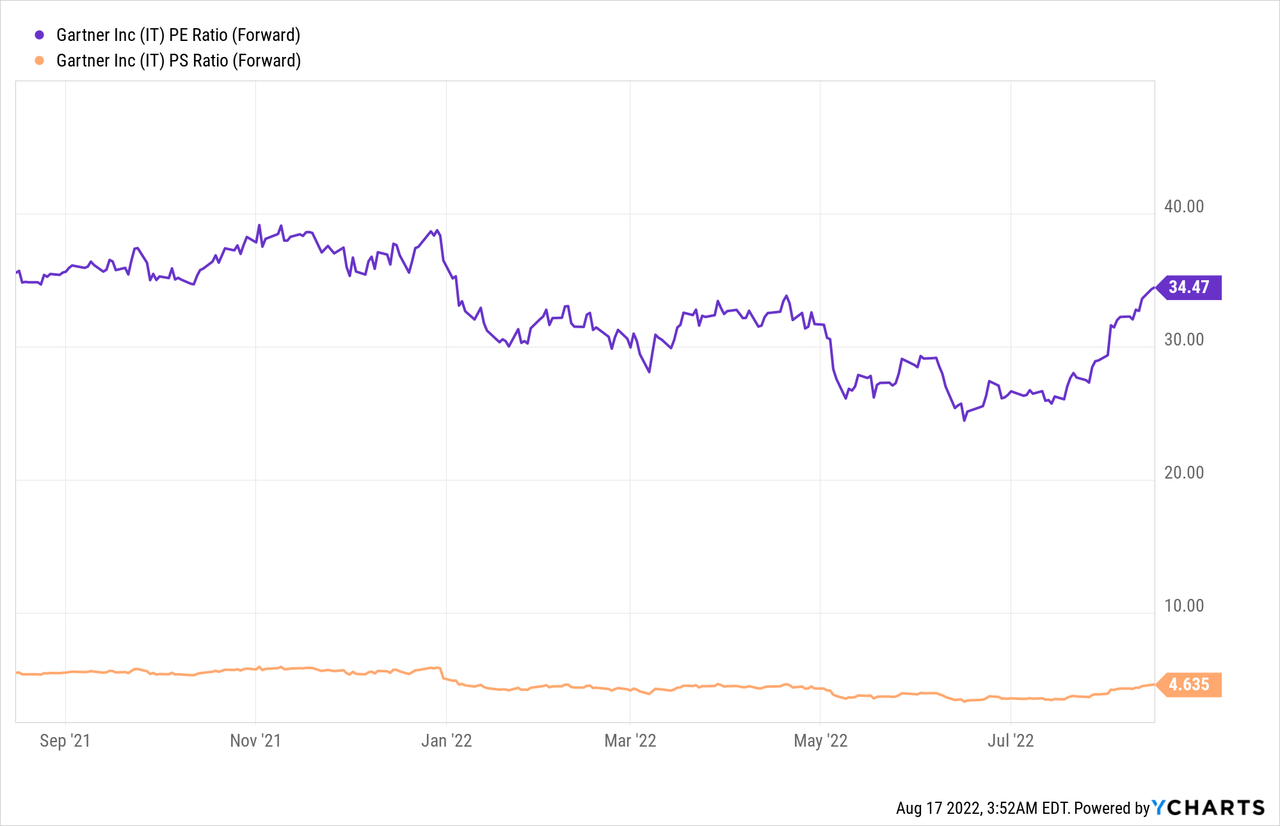

As an extra datapoint Gartner trades at a P/E Ratio [FWD] (Non GAAP) of 34, which is approximately 8% cheaper than its five year average. While its Price to Cash Flow [TTM] is 21.38 which is ~15% cheaper than its 5 year average.

Risks?

Recession/Lower IT Spending

The high inflation and rising interest rate environment has resulted in many analysts forecasting a recession. This may result in companies decreasing their IT spend and taking on less external consultants, thus this may impact Gartner’s revenue in the short term.

Final Thoughts

Gartner is an incredible company which is effectively “in bed with” the greatest Enterprises and software providers globally. The company has a solid recurring revenue model and has produced strong financial results recently. As mentioned in the intro the stock price has increased by a substantial 37% over the past two months and thus those of you who are contrarian investors may wish to wait for a pullback. I personally like to buy when others are selling, but some people prefer a momentum style. Either way this stock looks like a great one for the long term.

Be the first to comment