Dusan Stankovic

From licensing to subscriptions

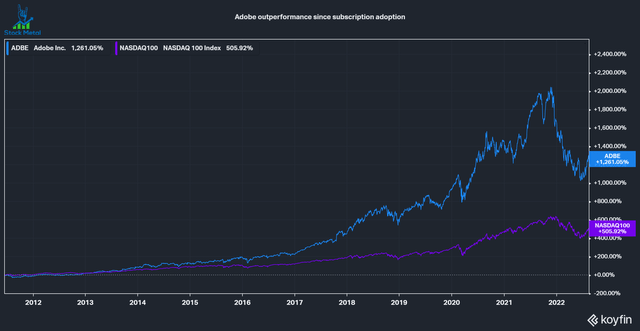

Adobe has been a big shareholder winner since it switched its business model from licensing to subscriptions in 2011-2012. The company is a high-quality compounder with a deep moat in enterprise software and in the wake of the 2022 market correction finally at a reasonable valuation again. I believe that Adobe is well positioned to profit from the tailwinds of the gig economy as one of the primary enablers of this growing trend. I own Adobe shares and consider the stock a buy at these levels.

Adobe outperformance over Nasdaq100 (koyfin)

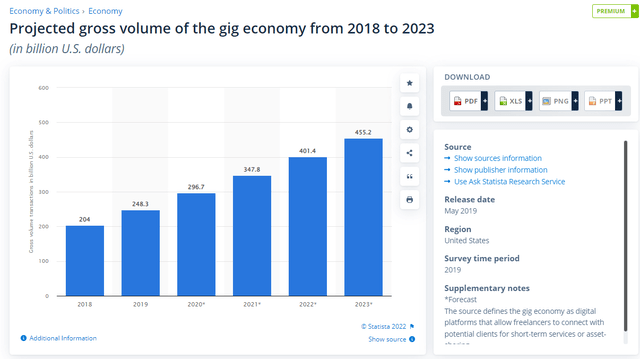

The fast-growing gig economy

According to Statista, the gig economy is expected to grow from $204 billion in 2018 to over $455 billion in 2023, a 17% CAGR. I expect the market to continue growing at a fast pace.

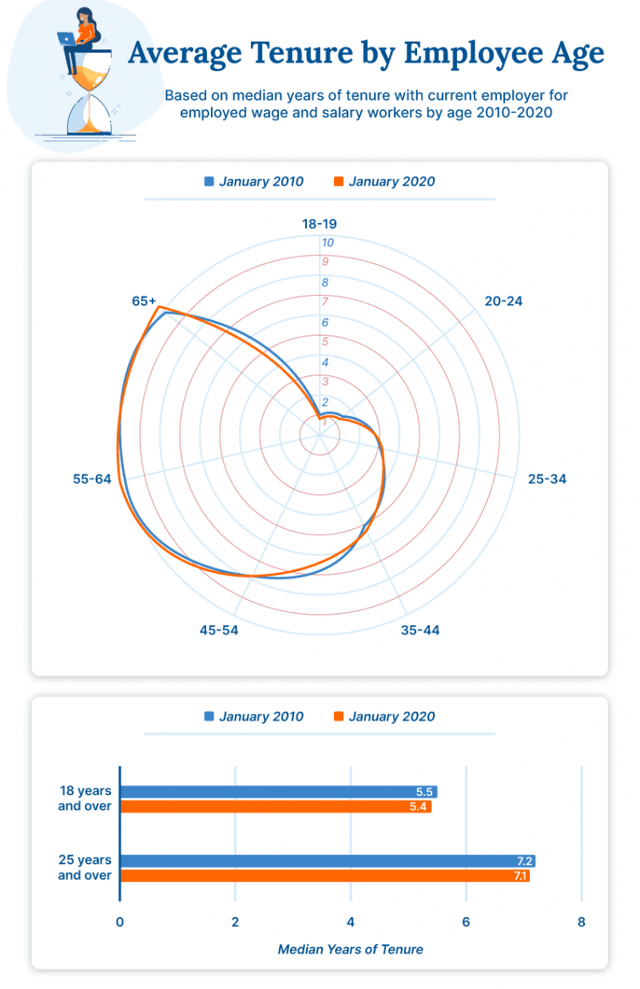

According to Caprelo, the young generation of workers is not interested in staying at the same company for decades. You can see that people 55-65+ years have significantly higher tenures, with the average tenure declining fast as the age declines. This is a tailwind for the gig economy because these newer generations are more likely to prefer a flexible lifestyle with different employers or just being their own boss and joining the gig economy.

Average Tenure by employee age (Caprelo)

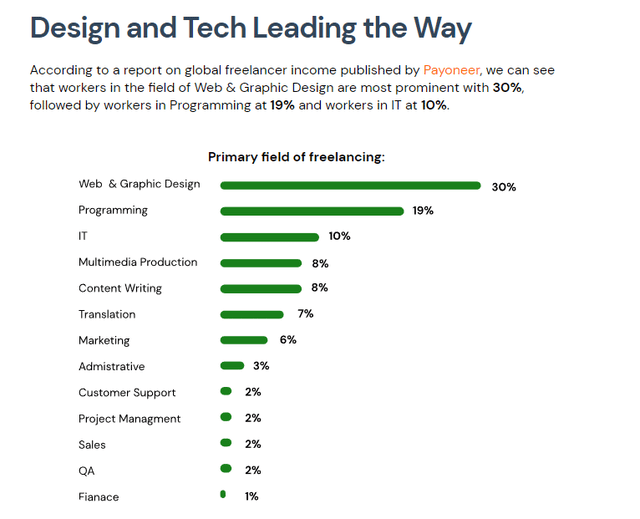

According to brodmin and Payoneer, the primary fields of freelancing are Design and Tech and their various subcategories.

Freelancing income by segments (Payoneer/Brodmin)

Creative cloud powering the gig economy

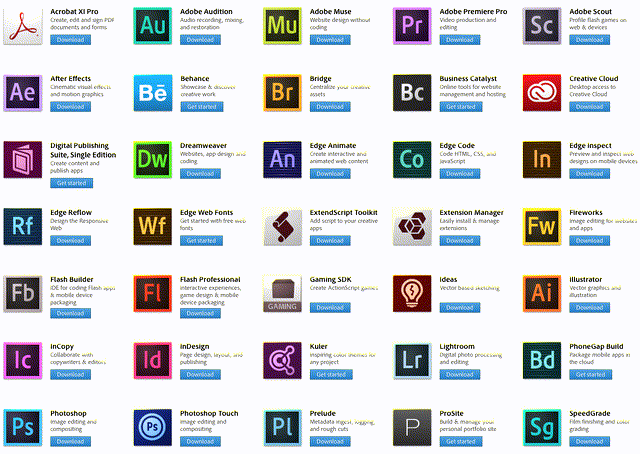

In the following picture, you can see an overview of some of the products Adobe offers in its suite of products. These products cover pretty much the entirety of the creative spectrum of applications a freelance worker would need. In some areas like Photoshop Adobe has market shares above 90% with its combined products. If you’re planning on working in a Design field more often than not knowledge of Adobe products is an expectation for employees. Adobe managed to become entrenched in the workflows of many digital segments and in the enterprise world.

Creative Cloud overview (getpcsoft)

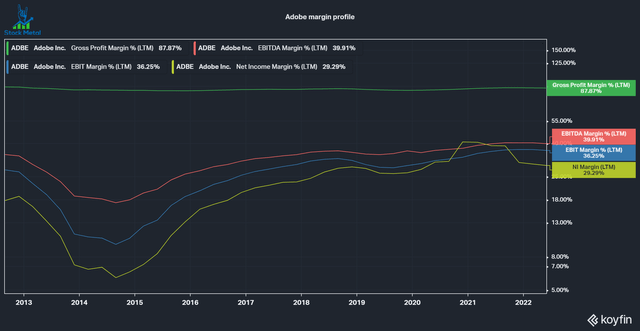

Adobe managed to become entrenched in the workflows of many digital segments and the enterprise world. This deep moat allowed Adobe to maintain its margins after transitioning from the high-margin licensing business into a subscription business, which offers much better predictability of earnings and opens the software suite to more people by charging a small monthly fee rather than a large one-time purchase.

Adobe Experience Cloud

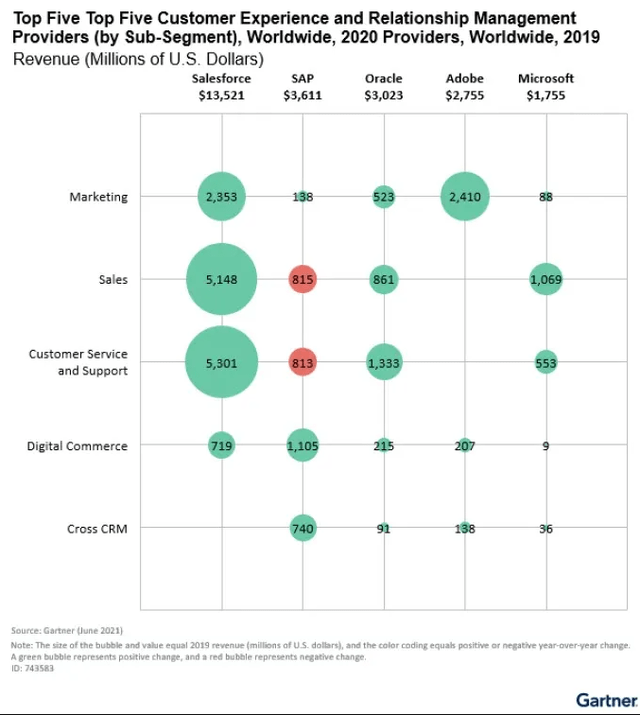

Besides creative work, there is also a need for general workflow optimization inside companies. Adobe addresses these needs with its Adobe Experience Cloud, which aims to increase customer experiences with comprehensive data insights, content and engagement management. Content management is also a direct link to its other solutions in the creative cloud. Adobe is a leading player in this space, behind Salesforce (CRM), SAP (SAP) and Oracle (ORCL). Especially in marketing the company excels, beating Salesforce in revenue, according to a June 21 graphic from Gartner.

Customer experience management 2020 (Gartner)

The Experience Cloud is now a business generating over a billion dollars each quarter, $4.15b TTM.

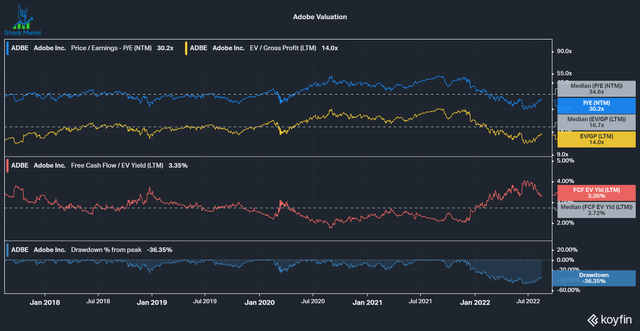

Valuation is finally attractive again

Adobe has seen a decade of strong fundamental growth and share price growth. Especially in 2020/2021 the company also benefited from multiple expansions, growing far above its Median 5-year PE ratio of 34.6x and peaked at 54x earnings. The company since then, in line with the general technology market, saw its price decline sharply dropping as much as 47%. Valuation now declined well below the median PE with a 30.2 PE and a 14x EV to gross profit. The Free Cash Flow yield also offers a good opportunity based on its median of 2.72%, with a current yield of 3.35%.

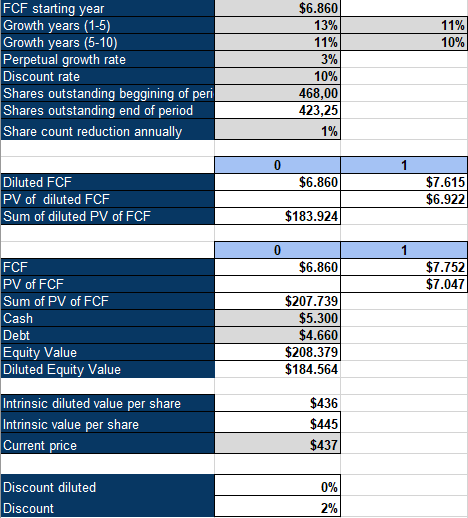

Using an inverse DCF model we get to a required Free Cash Flow growth rate of around 11-10% over the next year (factoring in buybacks) to generate a 10% return on the investment. According to Seeking Alpha’s Consensus EPS estimates analysts expect an EPS growth rate above this rate in all years after 2022. EPS isn’t free cash flow, but we can expect free cash flow to grow at least equal to this pace, considering that Adobe managed cash conversion rates above 100% every year in the last decade.

Adobe inverse DCF (Authors model)

Adobe is a buy here

Adobe is a high-quality compounder with a wide moat that is entrenched in most creative businesses and digital enterprises. The company has an attractive valuation and I consider it a buy. I currently have 3% of my portfolio in Adobe stock and I am considering adding to my position.

Be the first to comment