Petrovich9

About 2.5 years ago, I published my first and only article about Fuchs Petrolub (OTCPK:FUPEF), a mid-cap company from Germany. After such a long time, I would like to provide an update on the business as we are dealing with a hidden stock market gem: A company not only with a wide economic moat around its business, but also the potential to outperform over the years and decades to come.

Business Description

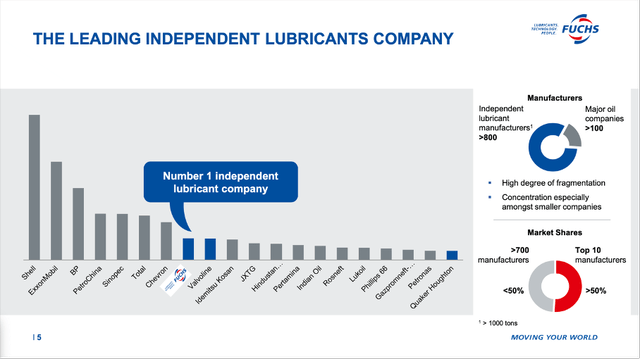

We start with a short business description as Fuchs Petrolub is probably unknown outside Germany – and even in Germany I would assume most residents never heard of this leading independent lubricant company (as it is not selling to end consumers). The independent lubricant manufacturer was founded 1931 in Mannheim, Germany and today the company has about 6,000 employees and production locations on every continent – including one in Africa. Fuchs Petrolub is among the top ten lubricant manufacturers in the world and the leading independent lubricant company with customers in many different industries – including automotive, engineering and construction, mining, and transportation as well as agriculture and food.

Fuchs Petrolub November 2022 Presentation

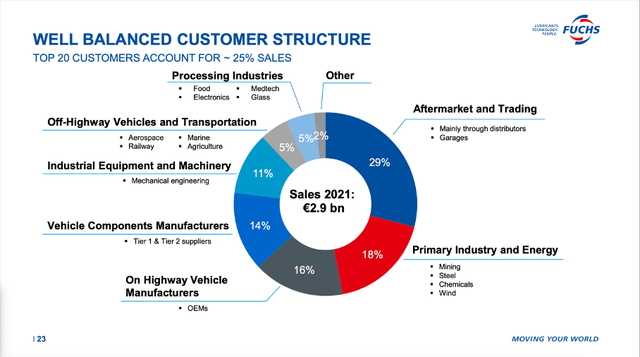

The company was established three generations ago as family-owned business and is still run by the Fuchs family. Today, Fuchs Petrolub has a full range of over 10,000 lubricants and related specialties and generated €2.9 billion in annual sales in fiscal 2021.

Fuchs Petrolub November 2022 Presentation

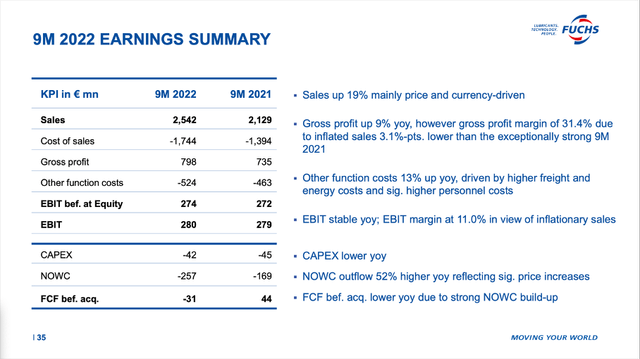

Solid Results

It is safe to say that Fuchs Petrolub is struggling a bit, but it reported solid result for the first nine months of fiscal 2022. Sales in the first nine months increased 19.4% year-over-year from €2,129 million in 9M/21 to €2,542 million in 9M/22. While this is a strong growth rate for the top line, cost of sales increased 25% and therefore EBIT could increase only slightly from €279 million in the first nine months of 2021 to €280 million in the first nine months of 2022. And diluted earnings per share also increased only slightly from €1.42 to €1.43.

Fuchs Petrolub Q3/22 Presentation

When looking at the different regions, Fuchs Petrolub could also increase sales in all three regions. Sales in the EMA region increased 18.4% YoY from €1,276 million to €1,511 million, sales in Asia-Pacific increased 10.8% YoY from €637 million to €706 million and sales in North and South America increased 40.1% YoY from €344 million to €482 million.

For fiscal 2022, Fuchs Petrolub is now expecting sales above €3.3 billion and EBIT is expected to be at previous year’s level (€363 million) and therefore at the lower end of the previous range (between €360 million and €390 million).

Change: Risks and Opportunities

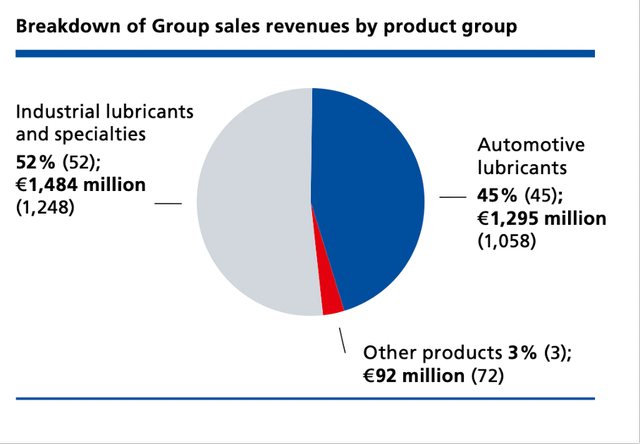

Fuchs Petrolub is still extremely dependent on the automotive industry and about 45% of the company sales are stemming from automotive lubricants (the top 20 customers also account for 25% of sales).

Fuchs Petrolub Annual Report 2021

This dependence on the automotive market might be a problem for Fuchs Petrolub, but it doesn’t have to be. The automotive industry is undergoing structural changes as the world is slowly trying to get away from internal combustion engine and moving towards electric cars. This is a challenge for Fuchs Petrolub, but it does not have to be a problem as long as the company is adapting to the new reality.

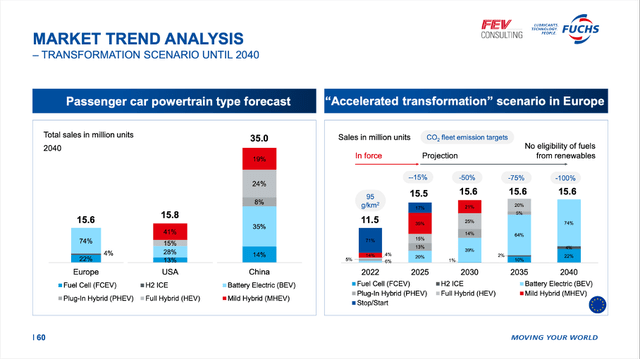

The shift from ICE to EV is not really a threat for the business – the world shifting from private transportation to public transportation would be a threat as it would reduce the number of cars and the number of new cars sold. Or if people were suddenly using their existing cars less. But estimates are not really projecting less cars in 2040 – instead the number is expected to increase. In the United States the number of annual sold cars is expected to increase from 15 million in 2021 to 15.8 million in 2040. In Europe the number is expected to increase from 13 million to 16 million and in China expectations are 35 million sold cars in 2040 (compared to 21 million in 2021).

Fuchs Petrolub Investor Presentation November 2022

And when looking at the number of total cars, Fuchs Petrolub is expecting the number to grow in the United States and especially in China. And with more cars on the road the demand for lubricants will rise as many lubricants and fluids in a car need to be changed regularly.

The world will also move very slowly away from ICE and towards EV. And ICE will play a much bigger role in 10 or 20 years from now than many are expecting right now. However, Fuchs Petrolub will also profit from the shift towards electronic vehicles as EV will create a high demand for high-quality lubricants and very specialized applications. Requirements are also much higher than EV makers thought a few years ago, which is in favor of companies like Fuchs Petrolub that offer these high-quality lubricants.

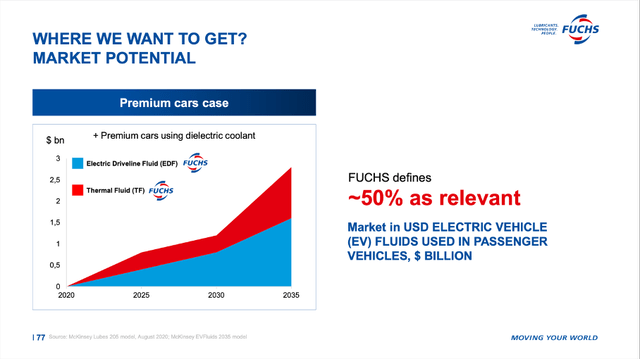

And the market size for electric driveline fluids and thermal fluids (necessary to cool components like the battery) is expected to reach $3 billion in 2035 and Fuchs Petrolub is well positioned with over 100 projects for this new market (information according to Capital Markets Day 2022). And management assumes at least 50% of that new market is accessible for Fuchs Petrolub with the new lubricants and fluids the company is developing.

Fuchs Petrolub Investor Presentation November 2022

In the last 20 years the overall market for lubricants almost stagnated and increased only from 36 million tons in 2000 to 37.6 million tons in 2021. But different studies are expecting the global lubricant market to grow in the low single digits in the years until 2030 – growth expectations are between a CAGR of 3.57% and a CAGR of 3.7%.

Wide Economic Moat

Fuchs Petrolub also has a wide economic moat around its business. This competitive advantage is based on switching costs, that arise from the products Fuchs Petrolub is selling. The lubricants Fuchs Petrolub is selling fulfill different, but essential functions. They ensure the efficient operation and preservation of moving parts. This includes reducing friction and wear in moving systems, separating surfaces, protecting from wear, cooling machinery and equipment as well as protecting surfaces from corrosion.

These lubricants are fulfilling extremely important functions and have a huge impact on the end product. And while these lubricants are extremely important for the quality and durability of the product, they only make up for a small fraction of the overall costs of a product (a car for example). We have a product with a high benefit/cost ratio when we have a mismatch between the costs (which are very low) and the effect on the end product (very high). In this case, switching costs are extremely effective.

In my last article I wrote:

When a car manufacturer is using Fuchs Petrolub because of its quality and can save a few dollars (or euros) by using the lubricant of another producer, management won’t take the risk of producing a low-quality car that is failing after a few thousand miles because of using the wrong lubricant for saving a few dollars in the production process. These are high economic risk costs for the company, because car manufacturers like Daimler (OTCPK:MBGAF) or BMW (OTCPK:BMWYY) probably would see sales decline if the cars are suddenly not as good as before because of using the wrong lubricant. And as the lubricants are only responsible for a small fraction of the overall costs, Fuchs Petrolub can easily increase its prices in the low single digits without losing any customers (resulting in pricing power for Fuchs Petrolub). The company is also producing an indispensable product that can be found in every machine and in every place with friction, but the product (lubricants) is rather invisible, and customers of Fuchs Petrolub might not even think about it when talking about cost reduction.

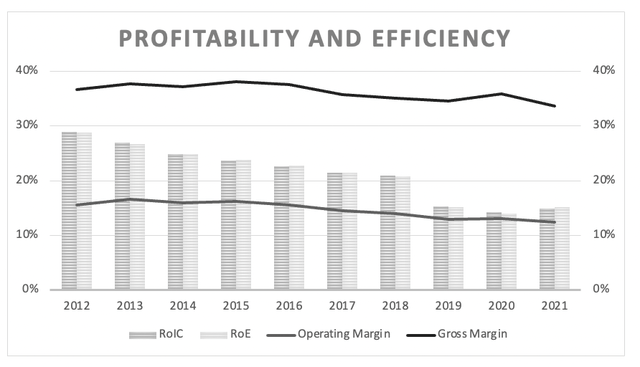

The economic moat is also visible by looking at some performance metrics. We can start by looking at the margins Fuchs Petrolub is reporting. On the one hand, gross margin is rather stable, which is indicating pricing power. Operating margin can also be seen as rather stable although the margin has been declining a bit in the last few years.

Fuchs Petrolub – Gross margin, operating margin, RoIC, RoE (Author’s work)

Return on invested capital also declined during the last decade, however RoIC was above 14% in every single year and Fuchs Petrolub has an average RoIC of 21.37% during the last ten years. These are impressive metrics and clearly indicate a wide economic moat around the business.

Dividend and Share Buybacks

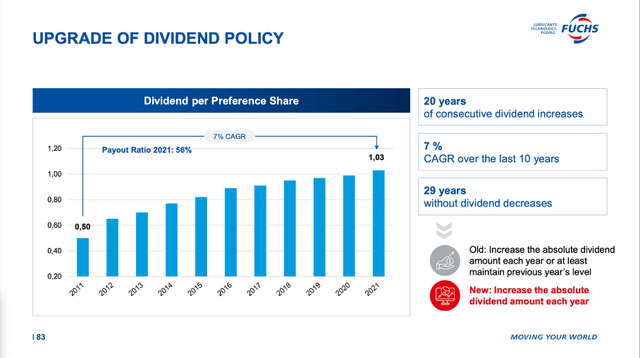

Fuchs Petrolub is also interesting for its dividend as it is one of the few German companies with a long history of consecutive dividend increases. Not only can Fuchs Petrolub report a streak of 29 years without a dividend decrease, but it is also looking at 20 years of consecutive dividend increases. And while many German companies are stable dividend payers, the number of dividend aristocrats is very limited (Fresenius SE (OTCPK:FSNUF) would be an exception).

Fuchs Petrolub Investor Presentation November 2022

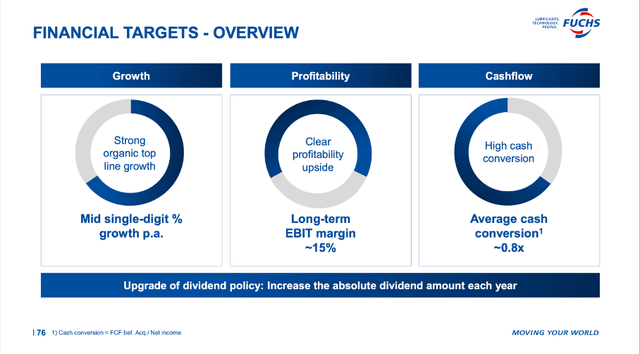

For fiscal 2021, the company paid an annual dividend of €1.03 (usually distributed to shareholders in May of the following year) and in the last ten years, the dividend was increased with a solid CAGR of 7%. With a payout ratio of 56% in fiscal 2021, we also should not worry about the dividend safety. And recently, the company upgraded its dividend policy: While it was previous policy to either increase the dividend amount each year or at least maintain previous year’s level, the company is now aiming for increasing its dividend amount each year.

Fuchs Petrolub Investor Presentation November 2022

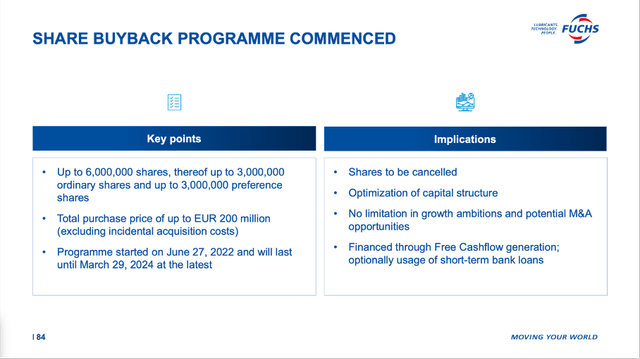

Aside from upgrading its dividend policy, the company also started a share buyback program – a rather untypical move for Fuchs Petrolub as share repurchase programs have not been part of the company’s strategy in the previous years. Starting in June 2022, the company will repurchase up to 6 million shares (3 million ordinary shares and 3 million preference shares). The share repurchase program will last until March 2024 and the repurchased shares will be cancelled.

Intrinsic Value Calculation

And in my opinion, the share buyback program is a smart move as the stock seems to be undervalued. When using fiscal 2021 earnings per share (and we can expect result for fiscal 2022 to be similar), the stock is trading for 15.8 times earnings right now. And while this is not an extreme bargain, it seems like a reasonable valuation multiple for a business with a wide economic moat.

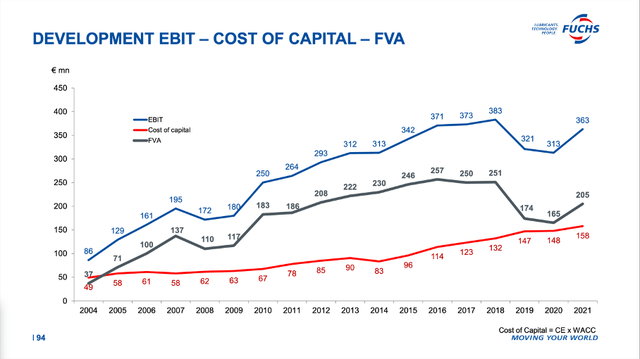

For 2023 we assume $0 in free cash flow to account for the potential of an extreme recession. When looking at the performance during the Great Financial Crisis, we see EBIT as well as FVA (Fuchs Value Added, the company’s own performance metric) declining. But the decline was rather moderate and in 2010 EBIT as well as FVA could exceed pre-crisis levels. For 2024, we assume a free cash flow around €150 million in 2024 as the recovery might take some time.

Fuchs Petrolub Investor Presentation November 2022

For 2025, we take the company’s target of €500 million in EBIT, which will lead to a net income around €350 million (maybe even a bit higher). And when also taking the average cash conversion target of 0.8x (FCF before acquisition / net income) we can expect a free cash flow of €280 million. For the years following 2025 we assume 6% growth – a growth rate we also expect till perpetuity.

Fuchs Petrolub Investor Presentation November 2022

When calculating with these assumptions (and 139 million outstanding shares as well as 10% discount rate), we get an intrinsic value of €42.51 for Fuchs Petrolub and as the stock is trading around €29 right now, the stock is clearly undervalued. I would buy the ordinary share as the one cent higher dividend for the preferred share is not reason enough to pay a premium around 15%).

And when looking at the 10-year revenue CAGR between 2012 and 2021, we see numbers between 5.01% and 8.12% and therefore mid-single digit growth as long-term financial target seems realistic for Fuchs Petrolub. And when looking at the bottom line, we see even higher growth rates – aside from the last decade when Fuchs Petrolub was struggling a bit.

|

Since 2010 |

Since 2005 |

Since 2000 |

Since 1990 |

|

|---|---|---|---|---|

|

EPS CAGR |

3.86% |

9.44% |

14.30% |

11.08% |

All in all, 6% bottom line growth seems like a realistic and achievable target for Fuchs Petrolub and there is also the potential for higher growth rates in the years to come.

Be the first to comment