Leon Neal/Getty Images News

Originally posted on November 18, 2022

Over the past few years, we have heard a great deal about the supposed advantages of cryptocurrencies as an asset class. As all those varieties of pixelated coins inched ever closer from obscure back alleys to the wide boulevards of mainstream finance, the phrase “digital gold” was often invoked by cryptoworld’s growing legions of Silicon Valley evangelists and their A-list celebrity shills (“Digital Gold”, by the way, is also the name of an excellent book by Nathaniel Popper that traces the rise of bitcoin and the blockchain technology, written some time before the speculative mania took the jump into warp speed in 2020 – well worth reading if you want to understand the origin story).

The idea that holding bitcoin or another digital currency could perform a gold-like hedge against adverse moves in the stock market took a resounding beating when the animal spirits pushing crypto and speculative tech shares to new heights both peaked around the same time – November 2021 – and went into a tandem spiral downward. Whoops. But there is a somewhat brighter corollary to the story: it turns out that, despite the best efforts of Matt Damon and Tom Brady and the like, cryptocurrencies never actually went mainstream enough to pose a contagion risk to other asset classes. Given what has happened to one of the biggest names in the sector over the past couple weeks, that really is something to give thanks for over the stuffing and cranberry sauce this year.

SBF, the New JPM (Not)

The recent fate of crypto exchange FTX (FTT-USD) and its once-illustrious founder Sam Bankman-Fried helpfully answers one question: is it possible for $32 billion to vanish into thin air in the space of two weeks? Why, yes it is! FTX was the third-largest crypto exchange in the business, and its leader, who of course was known by the cognoscenti as SBF, was not only one of the industry’s shining stars but also a prolific fundraiser and political mover and shaker (his fall from grace was very unwelcome news to a great many politicians, mostly Democrats, in Washington). FTX attracted as major investors the likes of Sequoia, one of the oldest and most respected Silicon Valley VC firms, and Temasek, the Singapore wealth management fund. Earlier this summer, when FTX intervened to bail out a handful of failing crypto players, there was talk comparing Bankman-Fried to the legendary financier J.P. Morgan, the founder of the eponymous bank who was a one-man Committee to Save the World during the Panic of 1907.

That ended abruptly just one week ago, when a run on FTX by customers stampeding for the exit revealed that the exchange had liabilities of over $9 billion against assets of just $1 billion (and the money trail chicanery is way, way more complicated than that one simple asset-liability mismatch). It turned out that when SBF was running around trying to shore up other crypto exchanges, he was most likely doing this not out of some grand altruistic impulse but in a desperate effort to paper over his own financial black hole. In the end, he wound up looking less like J.P. Morgan and more like the Knickerbocker Trust Company, the overextended lender whose troubles started that whole Panic of 1907.

Now For the Good News

Over the past several years, we have grown increasingly concerned about the aggressive attempts by its main backers to push cryptocurrencies into mainstream finance. This is not because we think the entire idea of digital currencies is worthless – far from it. The original bitcoin manifesto of Satoshi Nakamoto (who may or may not be an actual person and who may or may not be alive on the planet in the year 2022) and, even more so, the underlying blockchain technology do have some interesting aspects. The technology, in particular, can potentially perform certain financial operations in a more secure, less expensive and less intermediated manner than through traditional financial channels. And we do think that digital currencies – most likely through a mechanism operated by national central banks – will play an increasing role in the financial system in years to come.

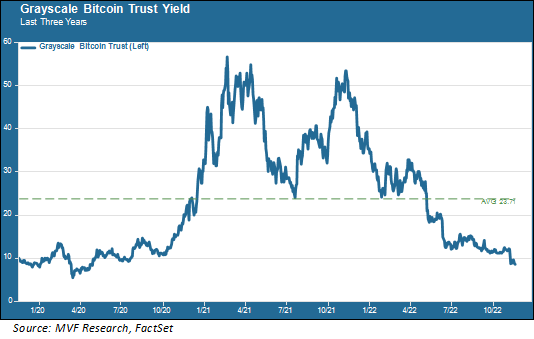

That being said, we never saw a compelling use case for bitcoin and its ilk to convince us that it was an appropriate asset class for the long-term investment portfolios under our stewardship as asset managers. Our view was increasingly challenged as more and more mainstream voices joined the chorus of crypto fandom. New vehicles emerged offering ever-easier ways to obtain exposure. Here’s one: Grayscale Bitcoin Trust (OTC:GBTC), the world’s largest crypto fund with a value (still!) of $10.5 billion.

Greyscale Bitcoin Trust Yield – Last 3 Years (Author)

Not a great look, as they say. Now, if the 2021 crypto rally had continued into this year, who knows, the asset class could have grown enough and become systemically entwined within the balance sheets of enough major players that the fall of FTX could have created a mass contagion. Within the crypto industry, the FTX debacle is being called crypto’s “Lehman moment.” When Lehman Brothers fell in 2008, it nearly brought down the entire financial system – because of all those overleveraged exposures on the balance sheets of so many major financial institutions.

But the collateral damage from FTX is limited to the likes of Grayscale – bad news for those who drank Matt Damon’s Kool-Aid about investing in crypto being a feat equivalent to climbing Mount Everest or inventing the internal combustion engine, but not much more than another head-shaking tale of greed and gullibility for the rest of us. So let’s give thanks, and please pass the cranberry sauce.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment