“Pesky Kids!!”

FG Trade Latin/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

We Can Keep This One Snappy

Amid the slew of earnings reports today after the bell, we had too-hot-to-handle (Snowflake – (SNOW), woe-is-me-we-will-do-better-honestly NVIDIA – (NVDA)), awesome-quarter-look-past-the-ARR-which-is-not-a-thing-anyway (Splunk – (SPLK)) and, er, some other company. Who was it now? Wasn’t IBM. Wasn’t Oracle (ORCL). But it was someone like that. Man, been a long day. Ah! Salesforce (NYSE:CRM). That’s it. CRM reported. Looked a lot like Oracle but it was Salesforce.

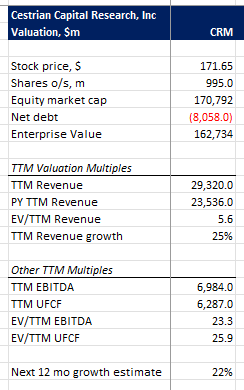

Today you can buy the OG cloud player for just 5.6x TTM revenue or 26x TTM unlevered pretax FCF, which is an old-guy multiple for an old-guy company. Even founder-co-CEO-Chairman Marc Benioff is getting bored and has to keep giving himself different “not CEO” job titles to give the impression that something exciting is happening at the company. Too big to have the needle moved by acquisitions and too old to grow at a banzai rate, CRM has settled into its comfy chair at the country club and is content to sit with its old-guy buddies and swap tall tales about the old days.

In our Growth Investor Pro service we were at Hold going in on CRM. We’re still at Hold. If the market lifts, the USS Benioff will float with it, but absent any external catalyst the business is maturing and looking rather dull. Growth and margins down, deferred revenue down, valuation is unchallenging but then the prospects are unexciting. Meh.

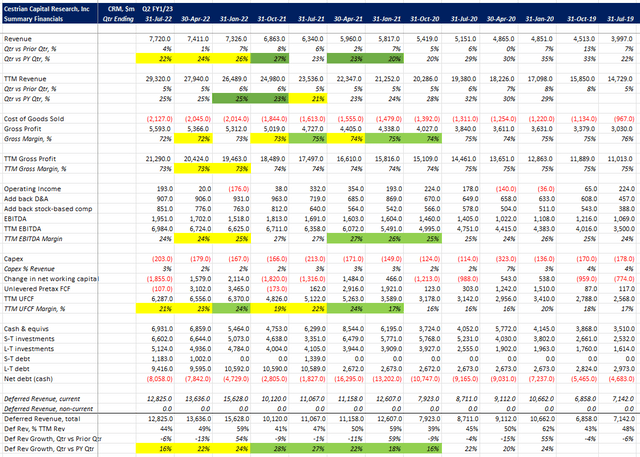

Salesforce Financials I (Company SEC filings, Cestrian Analysis, YCharts.com)

Here’s the valuation:

CRM Valuation (Company SEC filings, Cestrian Analysis, YCharts.com)

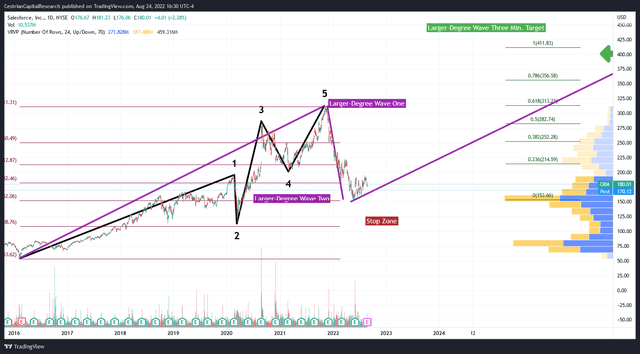

Where things get more interesting is the stock chart. The hard selloff in the name since last year means that there’s solid upside ahead on technical grounds. We think the stock is at the lows in a larger degree Wave 2, and it is, that means a Wave 3 comes next, which can run to the 100% extension of Wave 1 or better. Or in normal speak, a $400+ stock price isn’t out of the question if you’re patient. We’ve included the chart below and you can open a full page version, here.

CRM Chart (TradingView, Cestrian Analysis)

Hold rating on fundamentals, but as you can see it would justify accumulation on technicals if you were so minded.

Cestrian Capital Research, Inc – 24 August 2022

Be the first to comment