MarcelC

Introduction

Imagine a mining company that produces a commodity critical to the world’s energy stability, with growing demand, no real substitutes, trading at a price below the cost of production of new marginal supply.

The company has the best assets on the cost curve, has the biggest reserves, has the best margins, is the largest producer in the world, is committed to returning value to shareholders, is already a cash flow machine at current prices, and can ramp up production quicker and at lower costs than any competitor when the prices start rising.

If the company were also trading at an attractive valuation, it would be an extremely compelling investing proposition. In this article, I will argue that Kazatomprom is indeed such a company and that now is a good moment to get long.

Before diving in, let me remark that Kazatomprom is a Kazakh company and it is not available for trading on American markets. It is listed on the Astana Stock Exchange and the London Stock Exchange (ticker: KAP).

Its main peer, Cameco (tickers: CCJ, CCO:CA), is a Canadian company trading on the NYSE and the TSX. Despite Kazatomprom being the better company, it is trading at a significant discount to Cameco, probably motivated by a combination of geopolitical factors, Russian exposure, lack of access by US investors, and poor liquidity due to the smaller float.

The Uranium Thesis

The investing thesis in both Kazatomprom and Cameco is built on the assumption that uranium is in the early innings of a new bull market.

In a separate article, I lay out in detail the reasons why a significant increase in the uranium price is not only inevitable, but probably also imminent. The reader is referred to that article for a more in-depth discussion. Here, I will only summarize it quickly.

The uranium thesis boils down to the fact that the current price is below the production cost of most new primary supply. As the uranium market is currently undersupplied, because of existing sources of secondary supply, sooner or later secondary supply has to run out, and therefore the uranium’s price has to rise in order to incentivize new production.

Add to this background: geopolitical uncertainties, logistical challenges, stricter environmental regulations, inflation, renewed interest for nuclear energy, and utilities returning en masse to the market. I therefore assign a high probability to a scenario where the new equilibrium price is well above $70 / lbs.

How to play the uranium thesis? Ideally, one would like to have high torque to any upside movement in the uranium price, while at the same time maintaining a good margin of safety in case the thesis is wrong (or it takes more than initially expected to play out). I believe that the best way is a combination of physical uranium (such as the Sprott Physical Uranium Trust) and Kazatomprom (rather than Cameco).

Why Kazatomprom over Cameco

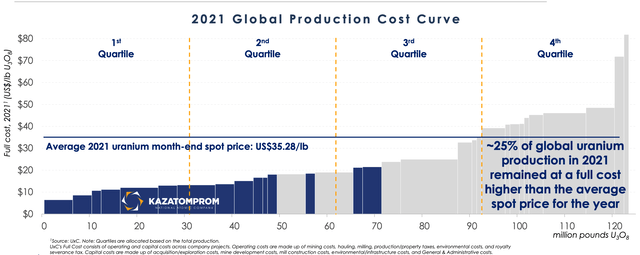

Kazatomprom is the largest world producer, responsible alone for around 25% of total primary supply. It also has the lowest costs, as evidenced by the global cost curve here below.

Global production cost curve (KAP Investors Presentation)

To give some numbers: in 2021, worldwide uranium production was equal to 48 thousand tons, of which 12 thousand tons attributable to Kazatomprom (total demand was around 68 thousand tons). The spot price averaged $32.3 / lbs, while Kazatomprom’s AISC was around $12.6 / lbs. In fact, Kazatomprom was highly profitable in 2021. Cameco, on the other hand, posted a loss, because of its higher costs. With the spot price now above $50 / lbs, Cameco will probably return to profitability this year, but clearly the margin of safety is thinner with Cameco. In addition, if the uranium price moves higher in the next few years, Kazatomprom can ramp up production faster and at lower costs than Cameco.

To summarize, on the one hand, Kazatomprom is going to be a major beneficiary compared to peers in a bull market. On the other hand, if the bull market does not materialize, Kazatomprom has limited downside. Let’s analyze each point in detail.

Kazatomprom is going to be a major beneficiary compared to peers in a bull market

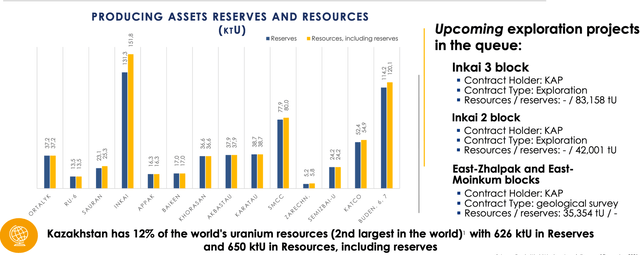

The fact is that Kazatomprom can ramp up production very quickly. This is due to the fact that all its production uses in-situ recovery. Compared to conventional mining, this technique has lower capital costs and is faster to bring online. This is a major advantage, especially considering current inflationary pressures. At the moment, Kazatomprom is maintaining market discipline, while increasing its reserves. Kazatomprom has already the largest reserves in the world (of around 351 thousand tons), all accessible via in-situ recovery.

Kazatomprom reserves and resources (Investor Presentation)

On the other hand, Cameco has certainly good assets. McArthur River, which was put under care and maintenance in 2018 and is going to be restarted this year, is the world’s largest uranium mine. Cigar Lake has some of the highest grades in the world (100 times the world’s average). However, both are conventional mines (Cameco also owns 40% of Inkai, the JV with Kazatomprom, which uses in-situ recovery). Ramping up production for a conventional mine is more technically challenging, slower and more expensive. Capex is going to consume FCF, and meanwhile Kazatomprom is going to out-produce and out-compete Cameco, as soon as the uranium price becomes attractive.

The downside is limited

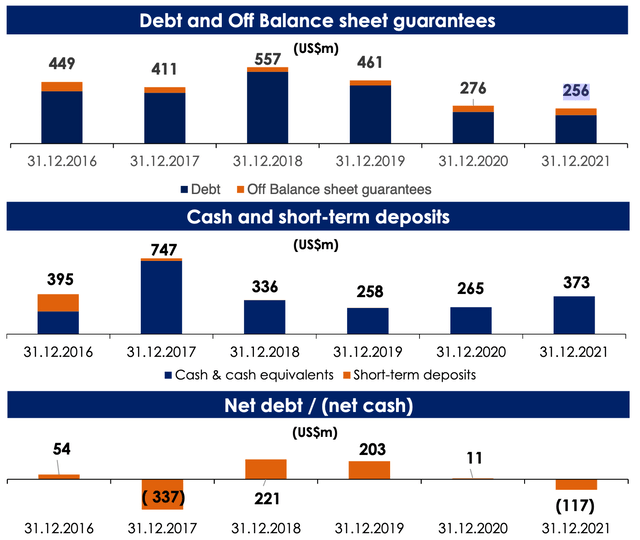

Kazatomprom is a cash-flow machine at current prices, because of its best-in-class assets and high margins. In case of a downturn in the uranium price, Kazatomprom is clearly in the best position to wait it out. On top of that, Kazatomprom is committed to return capital to shareholders via a generous dividend policy. In fact, the minimum dividend is 75% of FCF (if the ratio of net debt / adjusted EBITDA is below 1.0x; otherwise, 50% of FCF if the ratio is less than 1.5x). The company was net-cash at the end of 2021 ($256 million in debt, $373 million in cash). At the moment, investors are currently being paid a 5% or higher dividend yield, just while they wait. On the other hand, Cameco’s dividend yield is negligible and the company has been burning money the last couple of years.

Kazatomprom has a robust balance sheet (Investor Presentation)

Kazatomprom: risks to the thesis

Of course, there are also risks involved to the Kazatomprom’s thesis, so let’s go through them.

The most obvious ones are related to the jurisdiction. Kazakhstan has been making a tremendous amount of progress in recent years to transition to a market economy, but stability remains an issue. In January 2022, there were several protests. However, order was quickly restored and, during the whole time, operations continued unaffected for Kazatomprom. The country appears stable at the moment. Undoubtedly, investors have been made aware that risks remain, which is the reason for the discount compared to peers.

Another risk comes from internal politics. Kazatomprom is majority owned (85%) by a state company, the Samruk-Kazyna JSC national wealth fund, and only 15% of its shares are free floating.

Finally, Kazatomprom has exposure to Russia. For instance, it has a partnership with Rosatom, including five junior ventures through Uranium One. Part of the supply chain on which Kazatomprom relies is located in the Russian Federation. Kazatomprom’s main route for exports is through the port of St. Petersburg, which creates operational risks, as evidenced by the recent Canadian ban on imports of enriched uranium products (EUP).

However, Kazatomprom is not a Russian company, it is not listed on any Russian exchange, and there are no sanctions against either the company or Kazakhstan. Actually, Kazakh politicians were careful to distance themselves from Russia’s aggression. This is encouraging. In any case, the company continues its operations unaffected, it can pay dividends, its shares trade regularly, etc.

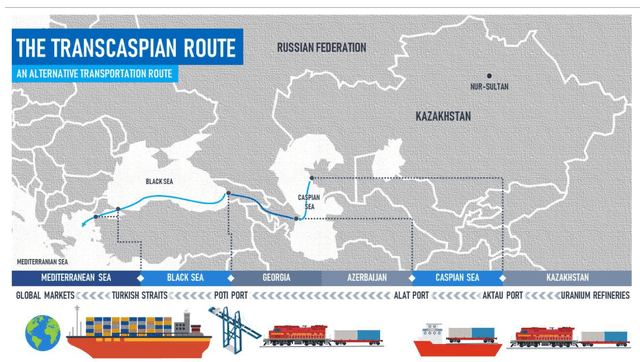

Regarding the export route through St. Petersburg, the company is not encountering any difficulty at the moment, but it is increasing capacity along the alternative trans-Caspian route. Following a question during the Q&A session of the H1 2022 earnings presentation, management has stated that the alternative route is already in place, has not yet been used this year, but it is available, and can potentially absorb all of the company’s export volumes.

The trans-Caspian export route (Investor Presentation)

In conclusion, the risks just mentioned are also the main reasons why many investors prefer Cameco over Kazatomprom. However, such risks are not as big as they might at first seem, especially when taking into account the two companies’ relative valuations.

Valuation: Kazatomprom is much cheaper

At $28 / share, the market capitalization of Kazatomprom is around $7.3 billion (the EV is almost the same, since Kazatomprom had a $117 million net-cash position at the end of 2021).

The company has expressed the intention to exercise market discipline over the next couple of years, i.e. to keep production below contracted volumes. Therefore, it is guiding for a roughly flat production for 2022 – 2023 of around 10.9 – 11.5 thousand tons and sales volumes in the range 13.4 – 13.9 thousand tons (with the difference being covered via spot market purchases or existing inventory).

AISCs are estimated to be in the range $16 – 17.5 / lbs. Average realized price over H1 2022 was around $40, well below the average spot price, but this gap is expected to be filled in the coming months.

Kazatomprom is therefore trading at a 13 EV / FCF multiple and a 5.5% dividend yield. This is already reasonably cheap. Things are going to get even more interesting as Kazatomprom’s average realized price moves from $40 to $50, and hopefully even beyond, if the bull market keeps going.

Here are a few rough estimates. The first scenario is based on the current numbers, with AISC conservatively estimated at the top of the range. The second scenario is based on $60 / lbs, at which point Kazatomprom would stop the spot market purchases and start increasing production. The last one is an optimistic one, with uranium at $80 / lbs and production ramping up.

| Production (thousand tons) | AISC ($ / lbs) | Realized price ($ / lbs) | FCF ($ million) | EV / FCF | Dividend yield |

| 11 | 18 | 40 | 532 | 13.7 | 5.5 |

| 13.5 | 18 | 60 | 1247 | 5.9 | 12.7 |

| 15 | 18 | 80 | 2046 | 3.6 | 20.8 |

These are very attractive numbers!

It is very easy to convince oneself that Cameco is not nearly as attractive. Just as quick proof, even if Kazatomprom is the biggest producer and has the best margins, Cameco is actually valued more than Kazatomprom (its market capitalization is 25% higher than Kazatomprom’s, at $9.2 billion dollars).

However, Kazatomprom is by far the most profitable. This is clear by comparing virtually any financial ratio. Even looking at operational results over H1 2022, operating cash flow was around $540 million dollars for Kazatomprom, but only $270 million dollars for Cameco. Besides, looking forward, Cameco is going to incur higher expenses in the next few years, as it ramps up production at McArthur River. This is going to decrease even more FCF compared to Kazatomprom.

Clearly, the Kazatomprom’s discount is due to geopolitical factors. As a matter of fact, its share price has gone nowhere in the last year, even if the uranium price has moved up by more than 50%. In the meantime, Cameco’s share price has appreciated by 50%. I believe the discount is excessive and the geopolitical risks are exaggerated, since the world cannot go on without Kazatomprom’s volumes.

Conclusion

Kazatomprom presents a compelling investing opportunity to play the coming uranium bull market. Currently, it is suffering from a severe geopolitical discount compared to Cameco. While I do not expect the discount to go away any time soon, its valuation offers a reassuring margin of safety. In fact, Kazatomprom has been able to remain highly profitable even at the lowest point of the previous bear market, and is currently returning cash generously to shareholders. If the discount were to never go away, one could simply hold and get a good return by collecting the dividends over the years.

Turning to the risks, I don’t see any major downside coming from the uranium price in the medium term (demand is growing and spot is trading below marginal supply cost of production). The main risk is linked to the company’s unique geopolitical position. That’s why I would consider a long position in Kazatomprom together with one in physical uranium. With Kazatomprom being responsible for a quarter of world production, if there were any major uncertainty about its ability to bring its volumes to the market, the price of uranium would react by moving massively to the upside.

Finally, there are many reasons to believe that now in particular is a good time to get long. Such reasons include: a general bearish sentiment in the commodity space, the unfolding energy crisis coupled with a growing awareness that nuclear must be a long-term part of the energy mix, the fact that many uranium companies are confirming in their conference calls that utilities are aggressively returning to the market, and speculative financial players that are buying up pounds in the spot market.

Be the first to comment