Dilok Klaisataporn

Summary

I believe Freshworks (NASDAQ:FRSH) is undervalued today, and investors can look to gain 18% over a 1-year period. FRSH provides businesses with user-centric SaaS solutions and they prioritize ease of use and customer needs in its product development. A key competitive advantage is that FRSH’s solutions are designed to be easily implemented and scaled, allowing businesses to quickly and efficiently undergo digital transformation. The COVID-19 pandemic has accelerated the need for digital transformation and made it necessary for businesses to modernize their marketing, sales, and customer service strategies.

Company overview

FRSH provides businesses of all sizes with cutting-edge, user-centric SaaS solutions. FRSH’s primary offerings consist of Freshdesk, a customer experience product, as well as Freshservice and other customer relationship management solutions.

FRSH website

Digitization is table stakes in today’s operating environment

All types of businesses need to undergo a digital transformation of their marketing, sales, and customer service strategies in order to keep up with the demands of modern consumers. In spite of the heavy expenditures invested by legacy businesses on infrastructure, they are still struggling to keep up with the rising expectations of their customers and workers. In my opinion, all businesses need to undergo digital transformations if they want to meet and even exceed the expectations of their customers and employees.

The 2020 COVID-19 pandemic has accelerated the need for modernization through digital transformation, making it necessary for many face-to-face interactions to be reimagined as digital ones. At the same time, many workers had to reevaluate their methods of communication and teamwork in order to be effective in a more dispersed and distant setting. These situations have resulted in existing businesses being compelled to go digital in order to survive in the current economic climate.

The dramatic shifts brought on by the pandemic have made it difficult for many businesses to provide even for the most fundamental requirements of their clients and workers. Because of this, it is now exceedingly difficult for businesses to satisfy customers without resorting to the technology that consumers have come to expect. Therefore, companies that were ahead of the curve in their digital transformation efforts have thrived, while those that lagged behind have struggled to catch up.

To make matters worse, businesses today have it tough because they have to focus on more than just customer satisfaction. They must also win over the organization’s own staff. It has never been more important for businesses to satisfy their customers and their workers. In the last twenty years, improvements in technology and the widespread adoption of smartphones have made it possible for virtually anyone to use a straightforward app or website to find products with little to no hassle. The expectation of getting what one wants when one wants it has spread throughout society. As a result of these modern consumer experiences, customers’ expectations of business interactions have increased, making it more challenging to keep them as customers and encourage them to make additional purchases and recommendations.

The expectation that businesses provide consistently excellent customer service also applies to the company’s relationships with its own employees. Employees who are able to place food orders via a smartphone app and receive delivery in a matter of minutes expect to have an equally straightforward experience when contacting their own company for help with an issue. In a world where an employee can order a car online and have it delivered the next day, the IT department’s week-long delay in provisioning a videoconference license can understandably irritate them.

In light of these developments, I think there is room for FRSH’s solutions in the market, and I anticipate rapid expansion for the company.

Solutions are designed to optimize ease of adoption

In my opinion, one of FRSH’s strongest points is the ease of use and accessibility of its products. The reason is straightforward: in my opinion, business software should be as user-friendly and straightforward as a mobile app, and FRSH’s offerings are exemplary illustrations of this design principle. Having used FRSH products in the past, I can attest to the company’s dedication to putting the customer first by prioritizing their needs at every stage of the product development lifecycle.

Second, the simplicity of implementation is often disregarded. Installing, configuring, using, and scaling the FRSH solution is a breeze. Companies that use Freshworks don’t need to go through the typical months-long implementation process. Instead, they can try out the service risk-free for 21 days before committing to a paid subscription on our website. Whereas major competitors may take months or even years to get started, small businesses can be up and running in a matter of hours, and large organizations will see results in a matter of weeks.

For businesses, this means they can prioritize speed without sacrificing the ability to meet unique needs, as FRSH offers a marketplace stocked with thousands of pre-built apps that can be used to tailor their Freshworks implementation. Being able to make changes with simple drag-and-drop functionality and minimal or no coding is my favorite part. This is crucial because it makes it just as simple for businesses to tailor their FRSH solution to their specific requirements after they’ve tried it out or purchased it for the first time. The lack of complex integrations between products that only an elite few users or external consultants are equipped to manage makes troubleshooting and maintenance a breeze.

Users are able to rely on our software for routine tasks, roll it out to more departments, buy more features from FRSH, and advocate for it within their own companies because of how quickly they can get up and running. It’s a win-win for FRSH as well, since more people using our software means more useful insights and automation tools, which in turn benefits FRSH.

It is not expensive to use FRSH

SMEs are FRSH’s primary target, and the cost is one of the main areas of attention for these companies (source: FRSH S-1 pg. 101). Overall, I think FRSH has done a good job of bringing the TCO down to a level where their product is reasonably priced.

FRSH’s software has the features of cutting-edge technologies like AI, ML, and workflow automation, but it’s available for trial and purchase in a convenient package. I reasoned that one of the main draws of FRSH is that they use self-service software, which lowers TCO and makes switching to their platform relatively inexpensive. In other words, implementing FRSH doesn’t call for a slew of expensive consultants and IT resources, and those savings can be given to end users. Pre-built applications available in the FRSH marketplace are typically used to address custom business requirements, as opposed to expensive professional services necessary for enterprise-level solutions that require extensive customization.

In addition, the company has lowered its maintenance costs by standardizing on a single platform for all of its products and providing customers with a self-service library that solves numerous frequent issues. In addition, FRSH’s subscription pricing model allows businesses to reap the benefits of the solution during trial and adoption, leading to users who evangelize within their organizations as a result of seeing the value of FRSH’s products immediately.

FRSH works for all organization types

Although FRSH’s main target market is SMEs, the company’s offerings would be useful even for major corporations. Investors should know that SMEs implementing FRSH have a good chance of expanding into large businesses. If FRSH keeps up with technological advances and maintains the quality of their product, it may become the standard for up-and-coming multi-billion dollar businesses.

Companies of all sizes and in many different sectors and countries find value in Freshworks’ offerings. Their software is reasonably priced, making it a good option for startups without the capital to invest in more expensive, established SaaS options. In particular, their products help SMEs close the technology gap between themselves and larger, better-funded enterprises that have already implemented or are in the process of implementing digital transformation solutions. As a whole, I believe FRSH’s software is attractive to companies of all sizes whose workers require efficient, cutting-edge resources in order to effectively compete in a dynamic market.

Valuation

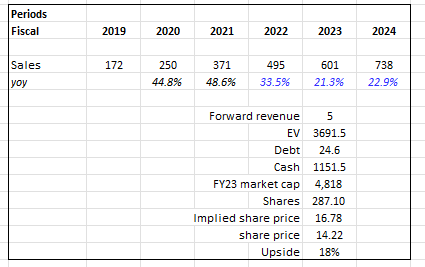

My model suggests that FRSH is undervalued. At this valuation, investors are probably looking at an 18% return over a 1-year period.

Looking at the consensus estimates, they are projecting a high growth rate, in the range of ~20+%, which I think is fairly reasonable given this is a new industry and there are plenty of opportunities to capture. Also, if we look at FRSH’s performance historically, they have been growing at a high rate, so that gives some comfort that they can execute well. The only thing to worry about is how fast can they grow. I do not have a precise answer to that but growing at 20+% when historically they are growing at 40% seems very plausible.

Anyway, at 5x forward revenue (where it is trading today), FRSH is worth $4.8 billion in FY23, or $16.78.

Own calculations

Risk

Not rocket science

While I have listed numerous benefits of FRSH above, this is not rocket science. It is not difficult to replicate FRSH’s offerings. This is demonstrated by FRSH’s rapid expansion of its products into various verticals. I expect more competition to enter as long as the industry remains profitable.

Inbound sales strategy puts FRSH at the mercy of SEO

Because FRSH’s go-to-market strategy is heavily reliant on SEO like Google (GOOGL), they will always be at the mercy of GOOGL’s algorithm. This may not seem like a big threat, but if things go bad (i.e., FRSH loses its competitive edge significantly), they may not have the financial resources to continue bidding for ad space in order to grow. Unfortunately, this has resulted in a vicious cycle.

Conclusion

I believe FRSH is undervalued today. The COVID-19 pandemic has highlighted the importance of digital transformation, and FRSH’s solutions are well-positioned to help businesses adapt to the changing landscape.

Be the first to comment