Slaven Vlasic

Times have not been particularly pleasant for shareholders in Freshpet (NASDAQ:FRPT). Although the company, which focuses on providing dog food, cat food, and dog treats, as well as other related offerings, to its customers, has shown signs of continued top line expansion, shares have plummeted in recent months. This decline was driven by a worsening bottom line and by the fact that shares of the enterprise have been incredibly pricey. Long term, I have no doubt that the company will continue to expand nicely. But this does not make it a solid prospect for sensible investors. Although shares have plummeted recently, the stock probably does deserve some additional downside from here. Because of that, I’ve decided to keep my ‘sell’ rating on the company for the moment.

Mixed results have been painful

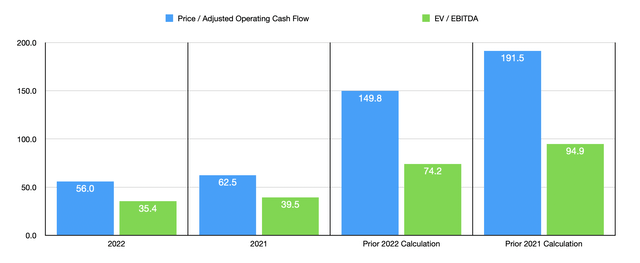

Back in February of this year, I wrote an article about Freshpet that took a very pessimistic view of the company’s valuation. I acknowledged in that article that the company had done incredibly well to grow its top line and its cash flows over the prior few years. I also said that I believed this upside would continue for the foreseeable future. But back then, shares were priced at remarkably high levels, with price to adjusted operating cash flow multiples approaching 150 and EV to EBITDA multiples well in excess of 70. Given these figures, I ended up rating the company a ‘sell’, reflecting my belief that it would likely underperform the broader market for the foreseeable future. Since then, my call has proven to be accurate. While the S&P 500 has dropped by 6.3%, shares of Freshpet have plummeted by 51.2%.

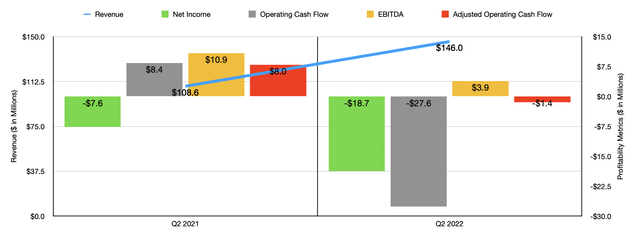

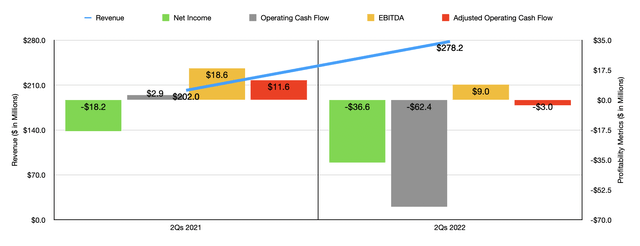

This drop in share price came even as the company’s revenue continued to come in strong. To see what I mean, we need to only look at data covering the second quarter of the firm’s 2022 fiscal year. This is the only quarter for which we now have data that we did not have data previously. During that time, revenue came in at $146 million. That represents an increase of 34.4% over the $108.6 million the company generated the same time one year earlier. This surge in revenue was driven mostly by price and product mix, which contributed $20.3 million of the $37.4 million increase in sales. Accounting for $17.1 million of the increase, meanwhile, was a rise in volume, including the refilling of the company’s trade inventory. Naturally, as you can see in the chart below, this strong quarter helped the entirety of the first half of the firm’s 2022 fiscal year, with revenue rising from $202 million last year to $278.2 million this year.

Although it’s great to see revenue rise like this, it’s also worth noting that profitability has taken a beating. In the second quarter of this year, the business generated a net loss of $18.7 million. That’s significantly greater than the $7.6 million loss achieved the same time one year earlier. It is true that management increased prices in order to help offset inflationary pressures. But what definitely looks like a sign of weakness, this increase was not enough to offset higher expenses. In the latest quarter, for instance, the company’s gross profit margin was 35%. That compares to the 39.7% seen just one year earlier. This change was due in large part to higher expenses, particularly ingredient cost and labor inflation, as well as rising costs related to quality issues. The decline in net income the company experienced also impacted other profitability metrics for the quarter. Operating cash flow went from $8.4 million to negative $27.6 million. If we adjust for changes in working capital, it would have gone from $8 million to negative $1.4 million. Meanwhile, EBITDA for the company also worsened, declining from $10.9 million to $3.9 million. And as was the case with revenue, the impact on the bottom line also had a significant impact on how the company’s results have looked for the first half of the 2022 fiscal year as a whole.

Although the current fiscal year is proving to be rather difficult, management does still have high expectations for the enterprise. Sales for the year are forecasted to come in at around $575 million. That would be roughly 35% higher than what the company generated in 2021. Even EBITDA is forecasted to improve, coming in at no less than $48 million for the year. That’s up 12% compared to what the company generated during its 2021 fiscal year. No guidance was given when it came to other profitability metrics. But if we were to assume that adjusted operating cash flow should rise at the same rate that EBITDA should, then we should anticipate a reading this year of roughly $34.8 million.

Using these figures, we can calculate that the company is trading at a forward price to adjusted operating cash flow multiple of 56. This is down from the 62.5 reading that we get using data from last year. Meanwhile, the EV to EBITDA multiple should decline from the 39.5 that we get using data from last year to $35.4 million the same time this year. As the chart above illustrates, these numbers are also significantly lower than how the company was priced when I last wrote about it. Also as part of my analysis, I compared the company with four similar firms. On a price to operating cash flow basis, these companies ranged from a low of 15 to a high of 106.3. And when it comes to the EV to EBITDA approach, the range was from 9.1 to 1,023.8. In both cases, Freshpet was more expensive than three of the four companies.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Freshpet | 56.0 | 35.4 |

| Chewy (CHWY) | 106.3 | 1,023.8 |

| PetMed Express (PETS) | 17.0 | 12.7 |

| Petco Health and Wellness Co. (WOOF) | 15.0 | 13.1 |

| Central Garden & Pet Company (CENT) | 22.9 | 9.1 |

Takeaway

All the data right now suggests to me that Freshpet will continue to grow for the foreseeable future. The company’s business model is logical and has the potential to capture strong upside. Having said that, fundamentals are important and the fundamentals we are seeing right now suggest that the stock is drastically overpriced. Because of these factors, I do still think a ‘sell’ rating is appropriate for the company at this time.

Be the first to comment