Atstock Productions/iStock via Getty Images

Seagen Inc. (NASDAQ:SGEN) delivered two shocks to its investors this year. In early February, the company provided full-year guidance that was well below the consensus, and in May, CEO Clay Siegall took a leave of absence amidst an alleged recent incident of domestic violence at his home, and a week later, he resigned. The stock plunged to around $120 per share in February and touched $105 in May, but it is just below $180 per share as I write this article, thanks to the rumors that Merck & Co (NYSE:MRK) has approached Seagen to make some sort of a deal – from a potential partnership to an outright buyout.

While I would not be a buyer at current levels on a standalone basis, Seagen is a great company with a strong revenue base and great long-term growth prospects, and I think that Merck would be getting a great business and technology platform if it acquires Seagen.

Seagen has grown revenues substantially over the last 10 years, from just over $200 million in 2012 to $1.57 billion in 2021, and it has expanded its product offering and pipeline during this period. The outlook looks good with the 2027 and 2031 revenue estimates of $6.9 billion and $10.2 billion, respectively.

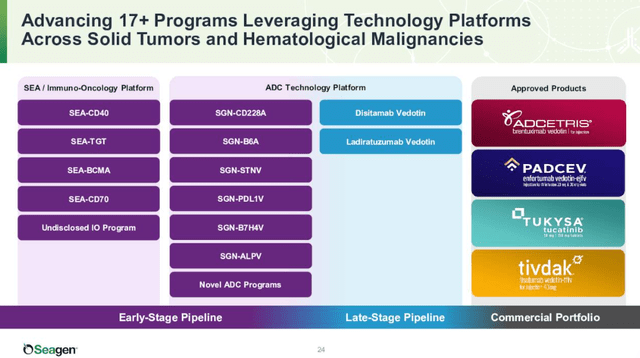

Adcetris is the foundation of the commercial business to which Seagen in recent years added Padcev, Tukysa, and Tivdak, and the company has a broad development program for these products with the potential for significant expansion of the addressable market.

And behind these four products, there is a pipeline of more than 17 programs, although only two other programs are in late-stage development.

Seagen would be a great fit for Merck because there is little overlap between the two businesses and the acquisition would significantly expand Merck’s oncology footprint, add Seagen’s technology platform and oncology expertise, and it would also help diversify it from its heavy dependence on Keytruda.

And given the limited overlap, the deal should go through without major problems, though there is the potential for increased regulatory scrutiny due to the size of the deal and this risk cannot be eliminated. The most recent examples of large deals going through are AstraZeneca (AZN) buying Alexion, AbbVie (ABBV) acquiring Allergan, and Bristol-Myers Squibb (BMY) acquiring Celgene.

The two companies already have a relationship – in 2020, Merck and Seagen entered into a collaboration to develop ladiratuzumab vedotin as monotherapy and in combination with Merck’s Keytruda for the treatment of breast cancer and other LIV-1-expressing solid tumors. Seagen received $600 million upfront and Merck made a $1 billion equity investment at a price of $200 per share.

But what is a fair price for Seagen?

The unaffected share price is approximately $145 per share, and for larger deals, premiums are usually in the 35% to 70% range (see the analysis in Alexion’s SEC filings following the AstraZeneca buyout). This puts the potential deal price in a $195 to $245 range. The low end offers modest upside from current levels (less than 10%), while the upside to $245 is still quite significant at around 35%.

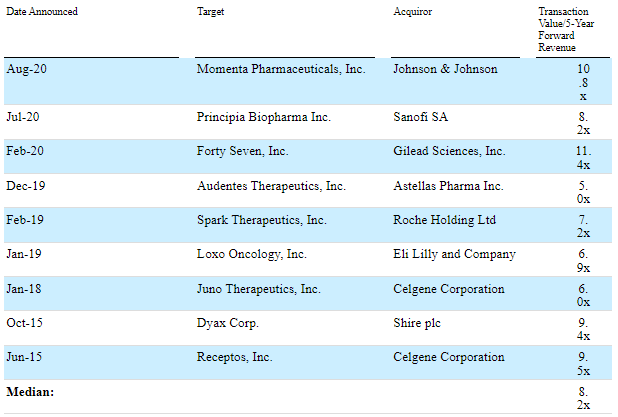

5-year forward revenue multiple is another precedent used by investment bankers to assess the value of the to-be-acquired company. The current consensus estimate for 2027 is $6.9 billion and the median multiple is 8.2 according to Centerview Partners (Acceleron Pharma SEC filings), resulting in a potential buyout price of almost $300 per share.

Acceleron Pharma SEC filings

However, it is unlikely that Seagen will get the median multiple because most of the companies that were acquired were less mature – either in late-stage development or with products that were recently approved. Less mature companies get higher 5-year multiples because they have more significant sales growth potential beyond the fifth year.

As a more mature company, Seagen would likely get a lower multiple – probably around 5 (approximately what AstraZeneca paid for Alexion) or 6 and this would put the potential deal value in the $185 to $225 per share range.

However, the premium range to the unaffected share price is a more reliable tool because we do not know what Seagen’s internal projections are, or the projections of investment bankers involved in the deal. But the ranges are not too different with mid-points of $220 and $205, respectively.

The desperation of the seller usually results in lower premiums, but to me, it does not look like Seagen is desperate. And Merck does not look like a desperate buyer to pay larger premiums. Merck did not mind paying $200 per share for 5 million shares in September 2020, but the situation is not the same today and a small equity stake to get a partnership deal done is not the same as acquiring the whole company.

Wells Fargo’s analyst Mohit Bansal believes the deal value will be in the $200 to $220 range, and that it could be as much as $250 per share.

With the available estimates and prior deal values, I tend to agree and believe the deal value would likely be up to $220 per share, a place where both parties are not likely to be happy with the deal, but that is how deals are usually made – neither party is entirely happy with the deal it is getting, but still wants to make the deal.

Of course, a deal will not be made solely based on average multiples or premiums and there are other considerations, but deviations for larger companies are not as significant as for smaller ones.

There is also the question of whether other suitors will come along and make a bid, and this could push up the buyout price. But there are not many companies that could put in a competitive bid, and there are no indications or rumors of multiple suitors being involved. At least not yet.

Conclusion

Seagen would be a great fit for Merck. If a deal happens, I think the acquisition price will likely be in the $200 to $220 range.

So, what is the risk-reward here? If a deal goes through, the upside is 10% to 20%, though, in the near-term, it could be just 5% to 10% as the market could discount potential regulatory scrutiny. And if it is reported that a deal fell through, the stock would probably go back to the mid-140s or mid-130s, or approximately 20-25%.

I do not have a position in either company and do not plan to initiate a position, but would be happy if a deal goes through as it would be a great catalyst for the biotech industry which has delivered terrible performance since the February 2021 top. It would result in a significant inflow of cash to many ailing biotech hedge funds, especially the largest one – Baker Bros, which has a substantial stake in Seagen and would receive between $9.5 billion and $10.3 billion if a deal goes through between $200 and $220 per share. A lot of the money from this potential transaction would likely flow back into other names and would lift investor sentiment.

Be the first to comment