Philiphotographer/iStock Unreleased via Getty Images

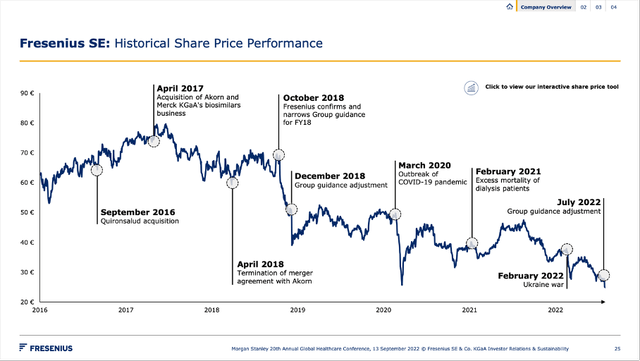

Fresenius SE (OTCPK:FSNUF) is another company that has just been a disappointment in the last few years. I have been bullish about Fresenius for quite some time, but the stock has been going lower and lower. Fresenius is even documenting the catastrophe the stock has been over the last 5.5 years – when the stock declined 75% from about €80 to slightly above €20 right now.

Fresenius SE Roadshow Presentation

Fresenius is now trading at 11-year lows. In December 2021, I published my last article about Fresenius and called it a buying opportunity once again. Back then, the stock was trading for €34 and now it is trading only for €22. And it is easy to criticize my bullish view on Fresenius as I have been wrong about Fresenius in the past. But the way I see it, I have only been wrong about the stock and people’s sentiment – I have not necessary been wrong about the company.

Fresenius Medical Care and Fresenius Kabi

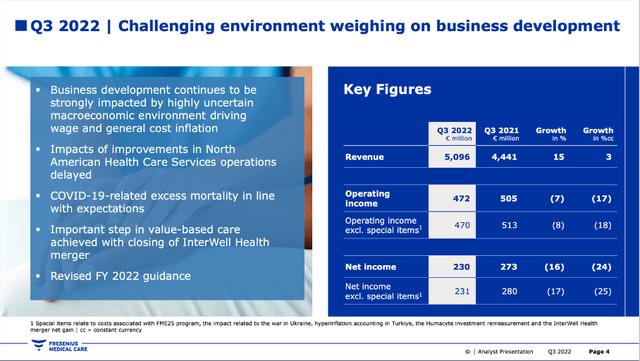

The current problem child is Fresenius Medical Care (FMS), which reported terrible third quarter results once again. And as Fresenius SE is holding 32% of the outstanding shares of Fresenius Medical Care, this has a huge impact on Fresenius SE. Fresenius Medical Care could report revenue growing from €4,441 million to €5,096 million – resulting in 14.7% year-over-year growth (3% growth in constant currency). However, net income declined again: In Q3/22, net income declined from €273 million in the same quarter last year to €230 million – resulting in 16% reported decline and 24% decline in constant currency.

Fresenius Medical Care Q3/22 Presentation

The reasons for this horrible performance were macroeconomic challenges (supply chain disruptions and cost inflation) and especially a challenging labor market (which has shifted in favor of employees) is leading to huge difficulties for Fresenius Medical Care to find suitable employees for acceptable salaries (due to wage inflation). Additionally, dialysis patients were affected severely by COVID-19 due to age and exhibited excess mortality. Fresenius SE also talked about Fresenius Medical Care during its second quarter earnings call:

Fresenius Medical Care’s financial performance in Q2/22 was significantly impacted by worsened labor shortages and related meaningfully increased wage inflation in the U.S. The further deterioration of the macro-economic environment resulted in accelerated non-wage inflation, particularly higher supply chain costs.

Fresenius now expects significantly more pronounced headwinds in 2022 from supply chain disruptions and cost inflation, including energy prices. Furthermore, Fresenius expects significant negative effects from ongoing labor shortages and associated wage inflation, especially at Fresenius Medical Care in the U.S.

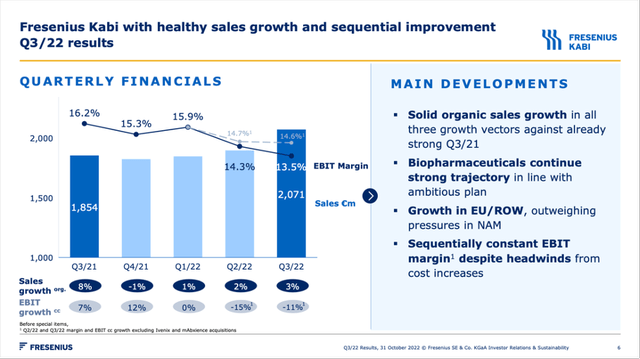

Fresenius Kabi is the second important segment that is struggling. However, in the third quarter of fiscal 2022 the segment reported solid results. While EBIT margin is continuing to decline (now 13.5% compared to 14.3% in the previous quarter), sales increased 11.7% year-over-year from €1,854 million to €2,071 million. And especially biosimilars are growing with a high pace.

Fresenius SE Q3/22 Presentation

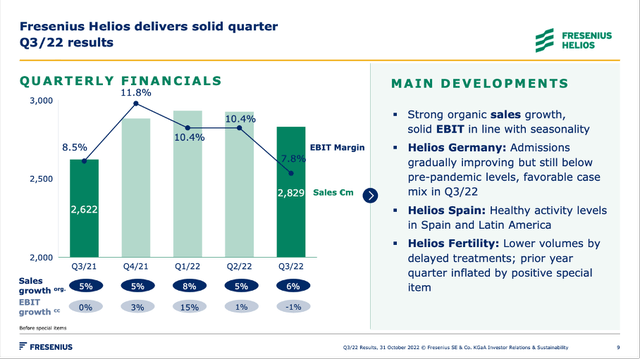

Fresenius Helios Is Improving

While Fresenius Medical Care and Fresenius Kabi are struggling, Fresenius Helios is improving again (it was also struggling in the last two years due to the negative effects of the COVID-19 pandemic). In the third quarter of fiscal 2022, numbers continued to improve, and Fresenius Helios generated €2,829 million in sales (7.9% growth compared to the same quarter last year). In the first three quarters of 2022, revenue increased from €8,009 million to €8,685 million – resulting in 8.4% year-over-year growth. And net income for the segment also increased 5.8% to €530 in the first three quarters.

For Helios Germany, management is seeing positive admissions trends. And although admission levels are still below pre-pandemic levels, admissions are gradually improving.

Fresenius SE Q3/22 Presentation

And aside from Helios Germany and Helios Spain, there is now a third sub-segment: Fresenius Fertility, which offers a wide spectrum of services in the field of fertility treatments. In the third quarter, sales for this sub-segment were €62 million resulting in 55% year-over-year growth. And the segment is expected to grow due to acquisitions in the foreseeable future.

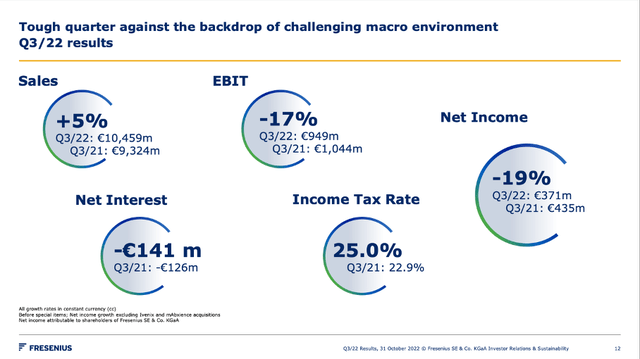

Half-Year Results

When combining the four different segments – we did not take a closer look at Fresenius Vamed – the company reported mediocre results once again. In the third quarter of fiscal 2022, sales increased 12.2% year-over-year to €10,459 million. In constant currency, sales increased 5% year-over-year. EBIT declined from €1,044 million in Q3/21 to €949 million in Q3/22 and in constant currency the decline was 17%. And finally, diluted earnings per ordinary share declined from €0.74 in Q3/21 to €0.57 in Q3/22 – resulting in 22% year-over-year decline.

Fresenius SE Q3/22 Presentation

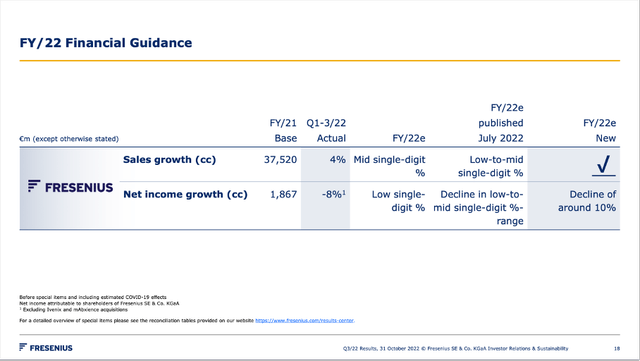

And Fresenius lowered the guidance for fiscal 2022 once again. Sales are still expected to decline in the low-to-mid single digits (similar to the guidance given three months ago.) However, net income is now expected to decline 10% in fiscal 2022 (compared to a low-to-mid single digit decline expected before).

Fresenius SE Q3/22 Presentation

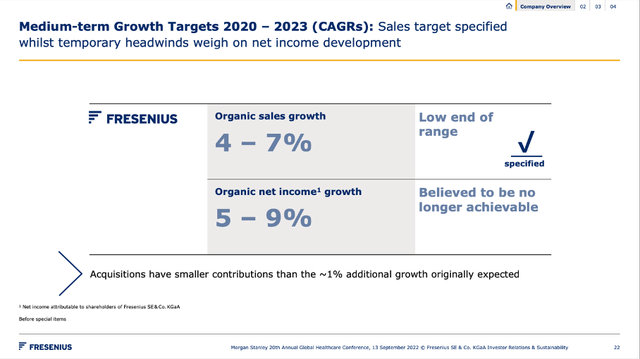

And already during the second quarter results presentation, the company had to admit it is not able to achieve its medium-term growth targets for the years 2020 till 2023. While management is still confident it can achieve the lower end of organic sales growth, the company will not be able to meet its organic net income growth target.

Fresenius SE Roadshow Presentation

The Bigger Picture

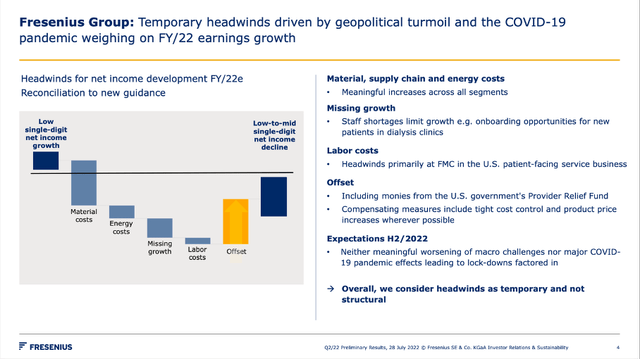

Fresenius is clearly struggling right now (and has been struggling in the last few years). But as Fresenius is pointing out, the headwinds are temporary and especially driven by geopolitical turmoil as well as the COVID-19 pandemic – and both will pass.

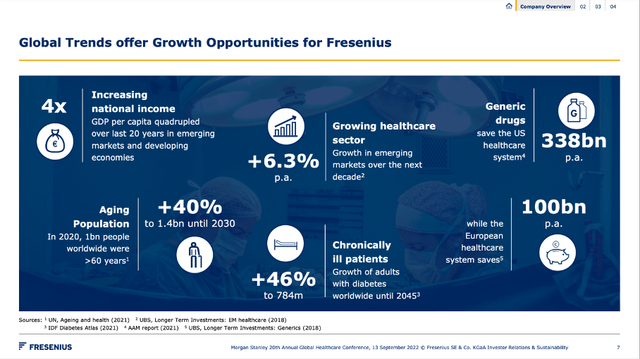

Fresenius SE Roadshow Presentation

And over the long run, Fresenius should be profiting from several tailwinds. These include an aging population as the number of people above 60 is expected to grow to 1.4 billion in 2030 (compared to about 1 billion in 2020). Additionally, the healthcare sector in emerging markets is expected to grow with a high pace and the number of chronically ill patients is also expected to increase about 50% in the next 20-25 years.

Fresenius SE Roadshow Presentation

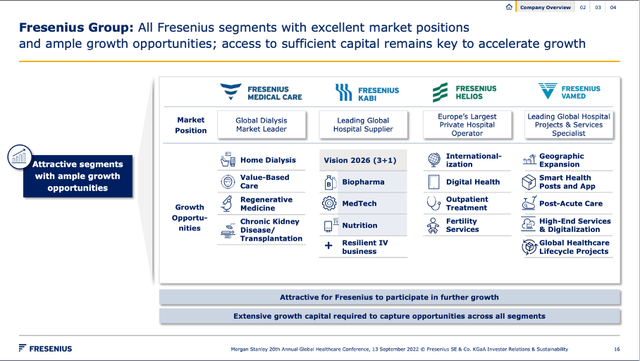

Fresenius Medical Care will profit from the increasing number of patients that will need dialysis. And Fresenius Medical Care will focus on home dialysis, which could be a growing market for the company. Fresenius Kabi will probably profit from the growing healthcare spending in emerging markets and especially the market for biosimilars is a huge growth opportunity for Fresenius. Generic drugs are a huge opportunity for the U.S. healthcare system to save money and the market for biosimilars is expected to grow 27% annually in the years until 2028.

Fresenius SE Roadshow Presentation

Fresenius has been struggling for several years now, nevertheless, I see these struggles as rather temporary headwinds and not structural challenges for the business model of Fresenius.

Dividend

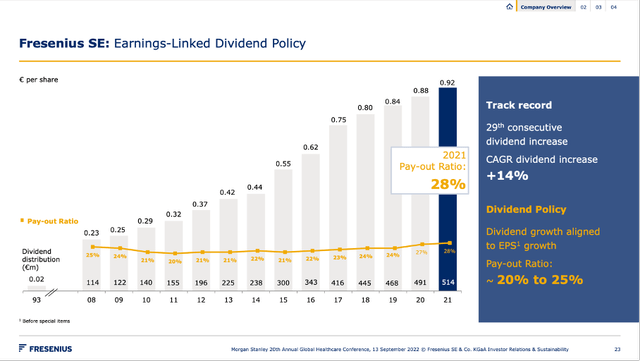

Fresenius was always interesting for its dividend as it is the only German dividend aristocrat. The company has now a track record of 29 consecutive dividend increases, which is rather an outlier in Germany. But in the past, Fresenius mostly had a rather mediocre dividend yield making it not so interesting for investors that were searching for a passive income. Now the stock has a dividend yield of 4.15% which is quite appealing.

Fresenius SE Roadshow Presentation

Part of Fresenius’ dividend policy is to pay out between 20% and 25% of its earnings per share and right now, Fresenius has the highest payout ratio of the last 13 years and the payout ratio for fiscal 2021 was 28% and clearly above the company’s target range. Still, it is no reason to worry as a payout ratio of 28% is rather low. But we should be prepared for rather low dividend increases as management probably wants to get its payout ratio in line again.

Balance Sheet: A Bit Overleveraged

A huge problem remains for Fresenius – its balance sheet. I already pointed this out in previous articles and although the balance sheet improved a little bit, Fresenius’ debt levels are too high. On September 30, 2022, Fresenius had €28,607 million in total debt on its balance sheet and while we get an acceptable debt-equity ratio of 0.84 when comparing the amount to the total equity of €34,156 million, this is distracting from the problem of operating income being too low to repay the debt quickly.

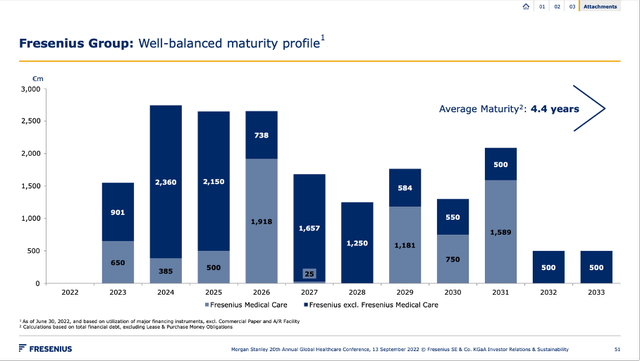

EBIT in fiscal 2021 was €4,252 million and therefore it would take about 6.7 years to repay the outstanding debt and that is a longer timeframe than I am usually willing to accept. Of course, we can include €2,128 million in cash and cash equivalents into the equation, but the debt levels are still too high. Fresenius is talking about a well-balanced maturity profile, but I would be rather skeptical.

Fresenius SE Roadshow Presentation

In the years 2024 till 2026, the company must pay back about €2.5 billion in debt each year, which is achievable, but management is not allowed to slip up. Of course, we don’t know how interest rates will be in the years to come, but if Fresenius must refinance at current rates, it could generate a problem for Fresenius.

Intrinsic Value Calculation

While the balance sheet is far from perfect, the stock is trading for unreasonable low valuation multiples. The high debt levels and amounts of goodwill might actually be one of the reasons why investors are punishing Fresenius with such a low valuation multiple. According to the company’s guidance we can expect earnings per share in fiscal 2022 to be around €3.00, which is resulting in a P/E ratio of 7.8 for Fresenius. For a stable business and dividend aristocrat this seems extremely cheap.

Fresenius is reporting a free cash flow after acquisitions (which can make sense) and after dividends (which I almost never use). In fiscal 2021, the reported free cash flow was €1,193 but, in my opinion, we should add the dividends paid (€1,068 million in fiscal 2021) resulting in a free cash flow of €2,261 million which we can take as basis for our calculation.

In our calculation, we take a free cash flow of €0 for fiscal 2022 to reflect an extremely challenging year. In fiscal 2023, we take €2,261 million as basis and even if we assume 0% growth for the years to come the intrinsic value for Fresenius SE would be €36.70. And when being moderate, assume 3% growth for the years to come and till perpetuity (a goal that seems achievable for Fresenius), we get an intrinsic value of €52.44. Both calculations assume 560 million outstanding shares as well as a discount rate of 10%.

Conclusion

In my opinion, Fresenius SE is deeply undervalued and every risk we mentioned here seems more than priced in at this point. The high debt levels should certainly make us cautious, but the risk-reward ratio seems in our favor.

Be the first to comment