Vadim Zhakupov/iStock via Getty Images

I have been in and out of FreightCar America (NASDAQ:RAIL) since 2020, and I have to say this is a stock to love and hate at the same time, for many reasons. Today, I’m going to be looking at the company’s recent earnings results and bring up everything that I think can be tagged as highlights.

A quick company snapshot for the youngsters

Before I dive into the company’s Q3 2022 results, let me provide some brief information about FreightCar America. The company is earning its income by the production and lease of different types of rail cars, including, among others, covered hopper cars, bulk commodity cars, coal cars and by converting existing cars for other purposes. The company has ceased production in two former sites in the U.S. and now, most of their cars are produced in Mexico and China.

Highlight #1: Nice boost in revenues, improving gross profit margins

For the three months ended in September 2022, the company generated revenues of $85 million from cars and parts sales, while revenues generated from the same segments in the third quarter of 2021 reached $57.5 million. In other words, we saw a 48% increase in revenues, on a YoY basis. On a sequential basis, the picture is almost identical. Zooming a little bit out, we can see that the company reported cars and parts revenues of $233 million, for the first 9 months of 2022, while the respective figure in the first 9 months of the previous year was $118 million, signifying an increase of almost 100%. From a car count perspective, the company delivered 783 railcars in Q3 2022, an increase of 55% on a YoY basis.

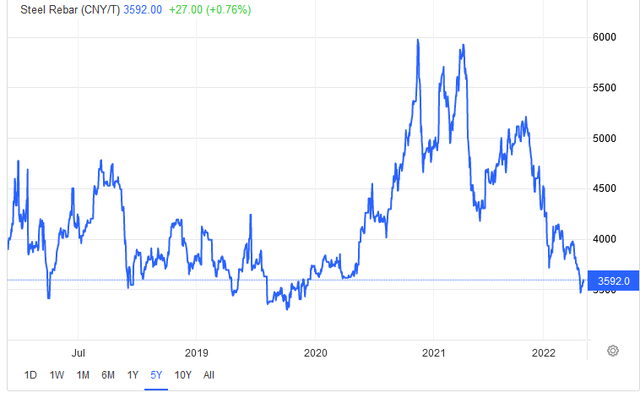

In addition, despite rising inflation in the recent months, the company’s gross margins improved. This was expected, as steel prices, which hit new highs in the past months, started declining rapidly. In fact, before the slump, steel prices had reached such levels, that old rail car scrapping became quite a profitable endeavor.

Steel Prices in Chinese Yuan (Trading Economics)

This shift in rail car owner behavior benefited rail car manufacturers, as rail car stock got reduced. However, the high steel prices narrowed down profit margins significantly. Consequently, the reduction in rail car raw materials eased the pressure on the company’s gross profit margins. More specifically, FreightCar America, for the three months ended in September 2022, reported a gross margin of 5.3%, while in the respective quarter of 2021, the company’s gross margin was just 2.6%. According to the company’s President and CEO, Jim Meyer:

” …our third-quarter financial results were muted by deliveries of lower-margin railcar orders that were accepted earlier in the year and at the bottom of the cycle as well as elevated freight cost. These items put downward pressure on our profitability and made a debt to our gross margin, which had been double digits during the prior two quarters. We expect these legacy orders to be completed before year-end and for our margin profile to strengthen beginning in the fourth quarter.”

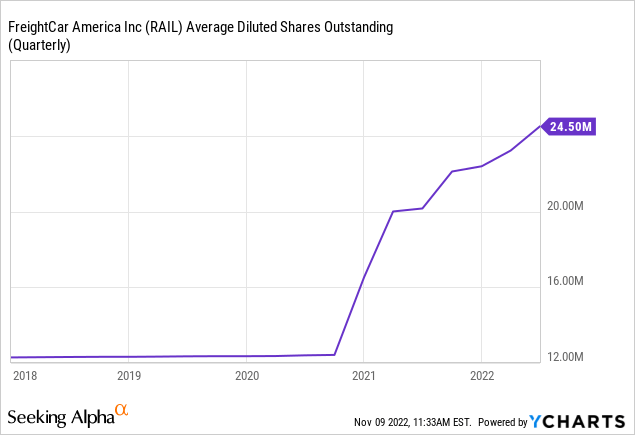

Highlight #2: FreightCar America is a serial diluter, but for how long?

FreightCar America is currently firing on all cylinders, with three production lines working full time and a fourth getting ready to start production in 2023. While all these events are good for growth, they all require large sums of cash. And guess what the company does to support their expansion: They issue common shares, thus, taking away from investors’ stake.

As we can see in the chart listed above, they do so in quite an aggressive pace. At the end of 2020, the company had an average of just above 12 million shares outstanding, while today, two years later, the amount of outstanding shares has doubled. In my last article about the company, I had written that they had calculated liquidity needs of $90 million and that they would finance those, using a combination of a new senior term loan and the issuing of the company’s 23% of outstanding common stock. But will they ever stop at some point?

Yes, when they swing into profitability. In this quarter, the company reported a net loss of $5.4 million, while in Q3 2021, the adjusted net loss reached $15 million. As profit margins improve and demand for new railcars increases, we could see a picture of operating profitability next year. In fact, operating income is slightly positive, on a TTM basis, being just north of $0.5 million. There’s no way to accurately predict if the current market fundamentals will continue linearly into 2023. However, the existence of new rail car orders and declining raw material costs, together with outsourced production facilities may do the trick sooner, rather than later. I could actually see it coming, if it wasn’t for Highlight #3.

Highlight #3: A financing deal Tony Soprano would’ve been proud of

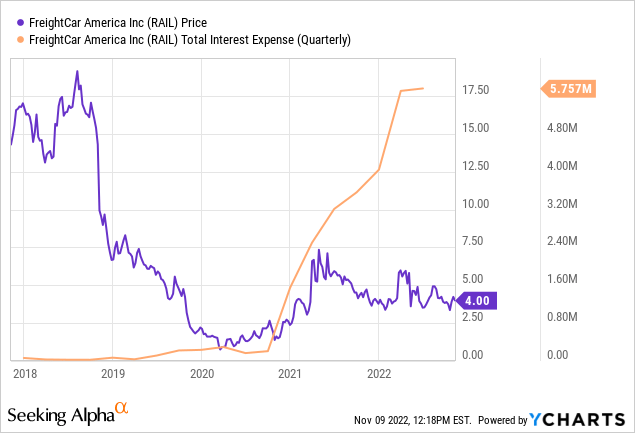

Two years ago, the company entered into a $40 million credit agreement with CO Finance LVS VI, at an interest rate, which at the end of Q3 2022, was 15.5%. I mean, when I bought my car, the car agent told me that financing costs were at 8%, and I thought he was about to offer me a pizza Napolitana. Here, it is almost twice this rate.

Additionally, in 2021, the company amended the 2020 credit agreement, adding another $16 million, at an interest rate of 16.2%. The lenders, knowing that financing FreightCar America would bear high risk, included a warrant offering clause into the deal, in the event of the company not repaying the additional loan by March 2022. Due to this clause, the company issued the warrants, with a ten-year term, which are now exercisable for 1.45 million common shares. The company has been going on and on, amending their credit agreements and adding to the warrant deals, which, now, have reached to 31% of their outstanding shares count.

Now, this is not a clear debt picture. The company is paying monstrous interest rates on their debt, reaching $5.8 million, as it is shown in the graph listed below. At the same time, investors’ returns have suffered.

Conclusions

I used to believe in FreightCar America, due to their right steps towards cost reduction. However, despite the large new rail car deliveries, the increasing of gross margins and the road towards profitability, the company’s growth plans mean that dilution will continue at a hard pace. In addition, interest expense has been increasing rapidly and currently inhibits the pace towards profitability. While this is definitely not a lost cause, I can’t see how an investment in FreightCar America could outperform the market, in these conditions. If they manage to refinance their existing debt, things could change rapidly to the best.

Be the first to comment