tifonimages/iStock via Getty Images

Copper has been one of the best means of hedging against rising inflation. “Dr. Copper” is historically seen as a great predictor of changes in economic demand as it has a multitude of industrial demand sources. Generally speaking, global demand for copper has been strong. However, the immense surge in copper’s value may not indicate strong economic growth today as it has in the past since its rally largely stems from ongoing worldwide supply-chain shortages.

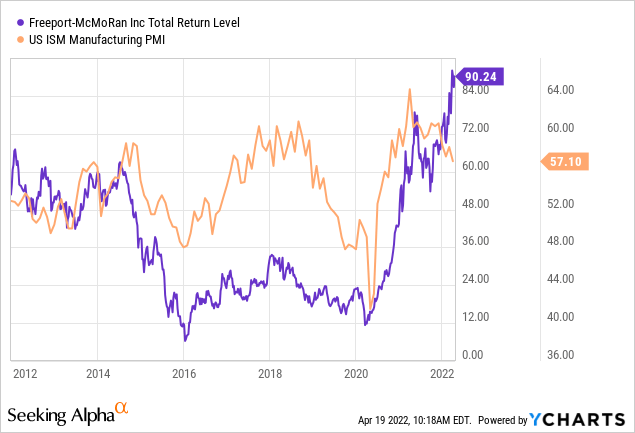

The global price of copper is currently at ~$4.7/lbs, up well over 100% from its $2.1/lbs low in 2020 and just below its all-time high of $4.8/lbs set last month. This dramatic surge in copper’s value has dramatically aided many top copper producers, such as Freeport-McMoRan (NYSE:FCX), which is currently trading at ~$50 per share, up over 8X from its $6 to $8 2020 lows. See below:

The price of copper, and the related price of Freeport-McMoRan shares, are closely correlated to the U.S. ISM manufacturing PMI index. This index is an aggregate measure of changes in demand factors derived from many industrial business surveys. In general, the PMI is a great leading indicator of real U.S. GDP growth, and often recessions occur when the index falls below 50. Today, the measure is above that level at 57; however, it is declining rapidly. Given its notorious cyclicality and the hawkish shift in U.S. monetary policy, it looks pretty likely that industrial demand levels are likely peaking or even declining.

I last wrote about this possibility related to Freeport in my January article titled “Freeport-McMoRan: Copper Demand May Fall In 2022, But Supply Could Decline Even Further”. At the time, it appeared that ultra-low copper inventory levels and global production issues heavily supported the rally in copper’s price. Additionally, it seemed that demand for copper was likely reaching peak levels, though I was not bearish on FCX since it seemed low copper supply would continue to offset declines in demand. Since then, Freeport shares have rallied an additional 17%, with added strength from the significant inflationary power of the conflict in Eastern Europe (and related sanction efforts). It seems like an excellent opportunity to look at Freeport and copper in general to reassess its investment potential.

Demand Destruction Now Offsets Weak Supply

It seems the bullish case surrounding copper is now firmly fading. While there are no indications that inflation is peaking (as many imply inflation will continue to rise), inflation undoubtedly results in demand destruction. China’s construction and manufacturing sectors, which consume around half of the world’s copper, are grinding to a halt as new home prices slide in the face of China’s extreme home vacancy rate and popping property bubble. The country’s copper inventory levels have surged as its industrial activity faltered. The recent wave of ultra-strict lockdowns in Shanghai and other cities has resulted in growing widespread unrest and cries for freedom.

These measures further amplify copper (and other metal) demand destruction across China’s construction and manufacturing sectors as truck drivers and industrial staff are stuck at home. Already, there has been an immense increase in China’s port congestion, meaning fewer goods are going into or leaving the world’s most crucial manufacturing nation. Likely, this will cause U.S. consumer prices to rise at an even faster pace as fewer goods arrive from China. However, since China imports typically immense amounts of copper, it will also cause copper demand to decline via transportation constraints and declines in construction demand (due to China’s numerous domestic economic issues).

At the same time, social and economic pressures on key copper-producing nations are threatening Freeport’s operational foothold. Growing global food shortages have resulted in protests and financial crises in Sri Lanka, Kazakhstan, and now Peru – a leading global copper producer. Peru’s government has looked to increase taxes of the “windfall profit” variety in its copper mining sector in response to the situation. Freeport would take a hit in this situation as it has significant operations in Peru. At this rate, I would not be surprised to see inflation and food-related protests spread to some of Freeport’s other production areas, such as Chile and Indonesia. Fortunately, 40% of Freeport’s copper reserves are in North America (with the other 60% split evenly between Indonesia and South America), which is historically less likely to experience widespread labor unrest.

The potential labor unrest facing Freeport is not nearly as significant as that of South Africa-focused Sibanye-Stillwater (SBSW), which is facing large union revolts. That said, as global food prices rise to extreme levels, I believe significantly few developing nations will easily avoid similar domestic strife. As energy and food become scarce, production and labor costs surge, or it becomes impossible to find workers. If production costs rise faster than copper prices, Freeport’s profit margins could dive. In my view, this trend is a crucial risk factor facing the firm, combined with massive economic slowdowns in China and slight declines in U.S. and European economic demand, which may soon negatively impact Freeport’s profits.

What Is Freeport-McMoRan Worth Today?

On the one hand, Goldman Sachs is predicting that some essential copper inventories will soon reach zero, which may result in an extreme increase in copper’s price. On the other, demand is seemingly waning, and it seems any increases in copper’s price will cause demand for the metal to fall even faster. Thus, while I would not be surprised to see a final sizeable upward move in the price of copper, such a rally would likely be short-lived and be quickly followed by a large crash in global demand.

As it relates to FCX, strong Q2-Q3 EPS seems likely but may be quickly followed by significant declines in profitability as demand stalls entirely. In general, this is accounted for in the consensus EPS estimate for FCX, implying a $0.98 Q2 EPS, followed by $1.04 and another $0.98 in Q3-Q4. However, quarterly EPS estimates for 2023 range much lower, around $0.45 to $0.60. Given new operating investments, Freeport is looking to boost its copper and gold production by 2023. Still, I imagine this increase in supply may occur just as demand is withdrawing – a common occurrence in “super cyclical” commodities like copper.

Putting it all together, it appears that global inflation is no longer supporting Freeport’s profitability. To me, it seems that inflation will now primarily increase Freeport’s operating and CapEx costs and not necessarily boost the price of copper since it is already too expensive for many consumers. Even if copper remains at elevated levels or continues to rise, operating cost pressures will surmount those potential gains. It is difficult to say how this will impact Freeport’s EPS; however, I highly doubt the company will permanently sustain a $3+ annual EPS as most other analysts are predicting. If so, FCX would have a decent long-term forward “P/E” of 12-16X, which is slightly on the historical high-end for cyclical mining stocks. In my view, it is more likely that we see Freeport’s annual EPS decline back to the yearly $1-$2 levels by 2023 as rising operational costs eat into margins.

Even if my generally bearish outlook for copper miners (not necessarily copper itself) does not pan out, Freeport is a bit expensive at its current valuation and may decline regardless of changes to its earnings outlook. Freeport’s earnings could slip even further if copper pulls back, as I suspect. Still, with China’s demand collapsing under inflationary pressures and western nations showing signs of following suit, it looks pretty likely that copper’s demand has already peaked. Supply remains weak and may continue to weaken due to global supply-chain troubles, but given Freeport’s high labor and energy expenses, these do not bode well for the firm’s profit margins.

Overall, I am now bearish on FCX though I would not short the stock as there are far better short opportunities today. We may see one final “blow-off top” in copper and the inflationary complex in general, as it does appear likely that key copper storage sites, such as the London Metal Exchange, run out of stocks. Still, this factor has little to do with copper’s economic fundamentals and more to do with seemingly growing human error and related market instabilities – nickel’s recent explosion and crash being a notable example. From a macro perspective, it seems that inflation is no longer a bullish factor for many commodity producers as it is now a key driver of economic, social, and political instability throughout the world – a mix of threats that is likely bearish for all companies. With this in mind, critical producers like Freeport may not be great bets. That said, copper may still be a decent bullish bet since it is not exposed to the “rising overhead” issue and can be traded via ETF (CPER).

Be the first to comment