SvetaZi/iStock via Getty Images

By: Alex Rosen

Summary

Freedom 100 Emerging Markets ETF (BATS:FRDM) tracks an index of companies in emerging markets based on economic and human freedom metrics. The fund has a complex formula using 76 variables to determine what companies should be in the portfolio.

Since inception in 2019, the fund has returned on average 6.13% per year. This does not include 2022 though, in which the fund is down 12%, even with the post Chinese Communist Party Congress rally.

Despite its claim as an emerging market fund, the top country holding is Chile with 25% of the fund’s assets, followed by Taiwan at 15% and South Korea at 15%.

Because of the complex nature of the fund’s selection strategy, especially with regard to highly subjective metrics, we rate FRDM a Sell. We think the endeavor is noble, but we prefer to make investment recommendations not on nobility, but on fundamentals.

Strategy

According to the fund prospectus, FRDM’s investment strategy is “To track the total return performance of the Life+LibertyFreedom100 Emerging Markets Index, a freedom-weighted emerging markets equity strategy using personal and economic freedom metrics as primary factors in its investment selection process.”

What that means, and this is where we start to question the fund’s investment strategy, is first they choose a basket of emerging market countries, 27 in all, and then they screen for a minimum country level market cap. Next, country selection and weights are based on composite freedom scores derived from 76 quantitative variables measuring each country’s level of protection for both personal and economic freedoms. Country level data is provided by the Fraser Institute and Cato Institute.

After this, companies with more than 20% state ownership are excluded, and then, finally, the ten largest companies in each of these countries that meet the above requirements including cap size are added to the fund.

The most glaring thing that could use further clarity is how the fund chooses the countries that qualify for their emerging market list.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Non-U.S. Equity

-

Sub-Segment: Emerging Markets

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): High

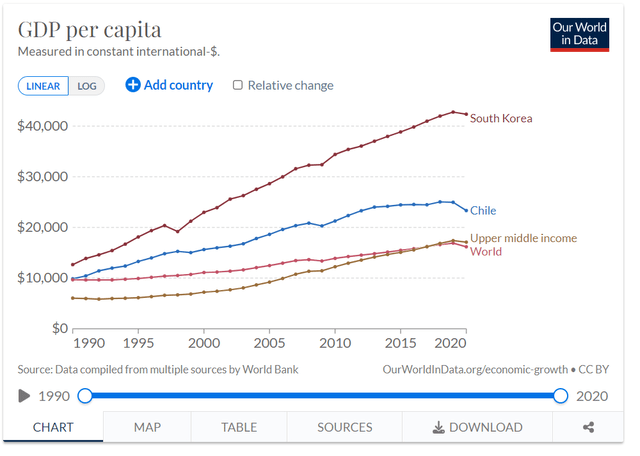

As an emerging market fund, it is no surprise that FRDM has no stake in U.S. or Western European equities. As mentioned above, the majority of the funds are in Chile, South Korea and Taiwan, three countries not typically associated with emerging markets. While the World Bank emerging market definition takes many factors into consideration, one of the key factors is a country with a per capita GDP over $12,000 per year is typically considered to have emerged. Chile’s PCGDP is around $16,000, South Korea is at $35,000, and Taiwan is around $33,000.

GDP per capita of select “Emerging Markets” (Our world in data)

It is perfectly fine to invest in countries based on a freedom index and to even exclude Western Europe, North America, and Japan, but to call it an emerging market fund is a bit of a misnomer.

The top ten holdings constitute 42% of the fund, and overall, the fund has 114 individual holdings, The top holdings include Sociedad Química y Minera de Chile (SQM) the world’s largest lithium producer (8.44%), Samsung (OTCPK:SSNLF), the South Korean giant (7.29%), and Taiwan Semiconductor Manufacturing Company Limited (TSM) (6.05%)

Strengths

FRDM has set out on a bold path. By focusing on countries and companies that deal in economic and human freedom, they are saying to the world we care about more than just making money. This is what is called socially responsible investing and it is a hot new trend.

This label goes a long way towards selling itself as not just a fund, but a lifestyle. It says I care, and I’m willing to put my money where my mouth is.

Whether this is just a marketing gimmick, or an actual strategic execution is up to each individual investor to determine. Of note though, SQM’s largest shareholders are Tianqi Lithium Corp, a Chinese lithium mining conglomerate, and Julio Ponce Lerou, the former son-in-law of Chilean dictator Augusto Pinochet.

These facts don’t make FDRM a bad investment, they simply undermine the stated purpose of the fund.

Weaknesses

The fund’s complex algorithm for choosing holdings and high turnover rate makes it vulnerable to investment creep. Companies that meet the stated objectives today may either quickly fall afoul of the investment requirements, and find themselves out of the model, or they may continue to stay in the fund due to high returns.

Funds with simple investment strategies and a small universe of holdings are easy to track and have little trouble justifying the holdings. With a fund like FRDM, the ambitious nature of the model lends itself to the slings and arrows of critiques.

Opportunities

From a marketing standpoint, FRDM has hit on investment gold. Who wouldn’t want to be attached to a fund that only invests in emerging market companies that focus on economic and personal freedom? Socially responsible investing sounds great, and FRDM has jumped on that concept with both feet running.

If FRDM can actually deliver on its stated strategy while also bringing back a nice return, then they really are selling freedom.

Threats

When it comes to investing, Warren Buffet put it best “Only buy stocks that you understand (don’t chase stocks just because everyone else is trading but you don’t know anything about)”.

The same rule applies to ETFs. Plain vanilla ETFs that are easy to understand and invest in tangible items are always a good idea. Funds that invest in a concept are much more likely to lose the plot.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

ETFs that focus on concepts or philosophies as opposed to tangible goods or sectors, require a lot more attention be paid to the strategy. You would think that a fund using 76 variables to determine what the holdings should be would really be able to drill down on its core principles, but even a cursory glance shows that FRDM is neither focused on emerging markets, nor on socially responsible companies with less than a 20% state ownership stake.

ETF Investment Opinion

Investors looking for socially responsible funds will naturally be drawn to FRDM. After all, who wouldn’t want to invest in a fund that prioritizes personal and economic freedom metrics when determining investments?

However, don’t judge a book by its cover. FRDM’s ambitious strategy still needs some fine tuning before it can actually do as advertised, and by then it may be down to a very small basket of holdings that meet the criteria.

As a result, we rate FRDM a Sell. For now, it is a fund with some work to do, but maybe it will get it right eventually.

Be the first to comment