Galeanu Mihai

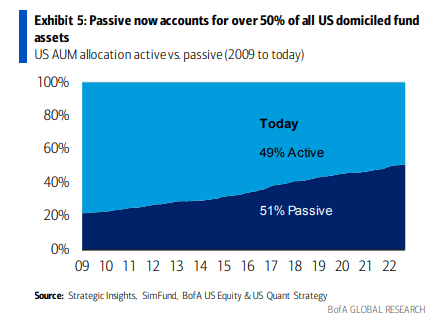

Passive now accounts for over 50% of all U.S.-domiciled fund assets, according to a recent report by BofA U.S. Equity & U.S. Quant Research. That trend is a hard beast to fight, and one asset manager has struggled in the last year with relatively poor investment performance and fund outflows.

This high-dividend stock features some green shoots, but will the turnaround continue through earnings next week? Let’s find out.

The Shift To Passive Continues

BofA Global Research

According to Bank of America Global Research, Franklin Resources (NYSE:BEN) is a global asset manager with over $1.3 trillion in AUM, over 10,000 employees globally, and a presence in six continents. BEN provides investment management services to retail, institutional, and high-net-worth clients globally with capabilities across all asset classes, including equities, fixed income, multi-asset, alternatives, and money market.

The California-based $11.7 billion market cap Capital Markets industry company within the Financials sector trades at a low 7.0 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.9% dividend yield, according to The Wall Street Journal.

The company faces headwinds, including poor investment returns in 2022 and net capital outflows. Recent M&A is also a sore spot. As an asset manager with poor performance figures compared to its competitors, there’s the risk that flows could continue out from BEN. The trend from active to passive is another macro concern.

The upside potential is there, though. Better stock market returns, which we might already be seeing, would help Franklin Resources’ revenue and there are higher margins to be had in the alternative asset space.

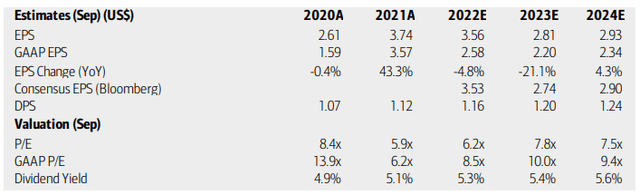

On valuation, analysts at BofA recently lowered their earnings estimates. The bank now sees EPS falling by 5% this year and a whopping 21% in 2023. Just a modest per-share profit recovery is seen in 2024. The Bloomberg consensus forecast has similar figures.

Still, the company’s dividend is expected to continue to be on the increase through the next two years. BEN’s operating and GAAP P/E ratios appear to have priced in much of the dismal near-term outlook. Hence, Seeking Alpha has a solid B+ valuation rating on the stock, but the growth rating is poor.

Franklin Resources: Earnings, Valuation, Dividend Forecasts

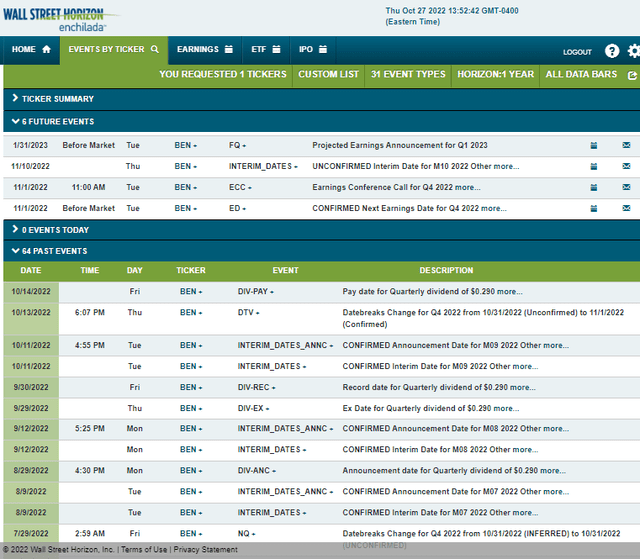

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Tuesday, Nov. 1 BMO, with a conference call later that morning. Franklin Resources will also issue a month-end assets update on Nov. 10, so that’s another volatility catalyst.

Corporate Event Calendar

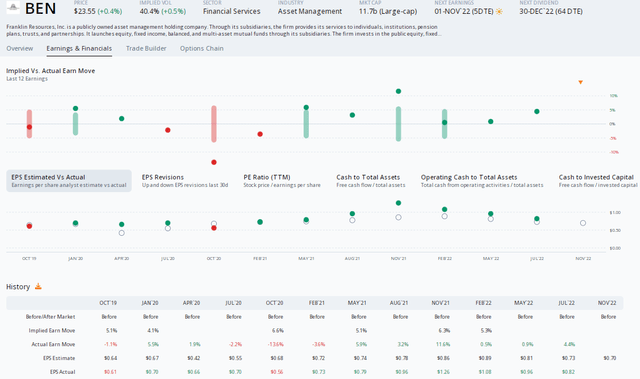

On earnings, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.70 which would be a significant drop from $1.26 in per-share profits earned in the same quarter a year ago. Since reporting last July, there have been four analyst downgrades of this coming quarter’s earnings figure, per ORATS. The bulls, though, can point to an impressive beat rate history, with BEN topping analysts’ forecasts in each of the previous seven quarters. The stock has also traded higher after the last six earnings reports.

BEN: Strong Numbers Around Past Earnings Reports

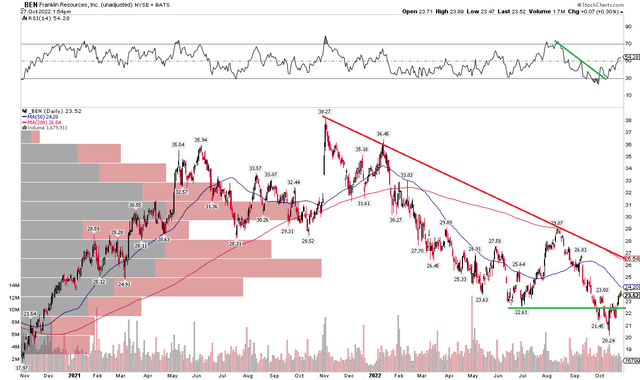

The Technical Take

BEN has a mixed chart. I see a potentially bullish false breakdown earlier this month, but the RSI momentum indicator confirmed the new low in price. The trend on the RSI, however, recently exhibited a bullish breakout, which preceded the move-up in the stock.

Bigger picture, the long-term 200-day moving average is downward sloping and marked a point of selling back in early August. I think ultimately the stock needs to get back above that trend line before traders should get long. Take note, too, of the downtrend line off the November 2021 high which has confluence with the 200dma.

BEN: Shares Show Signs Of Hope, But A Downtrend Still In Play

The Bottom Line

BEN looks decent on valuation, but very weak growth heading into next year is not a good near-term sign. Moreover, the bulls still have work to do to turn the stocks’ trend around. Overall, I am a hold on the stock until we see better signs of growth or if shares simply get washed out to the downside.

Be the first to comment