Uwe Krejci/DigitalVision via Getty Images

One of the more interesting companies that I have come across in recent years is Fox Factory Holding Corp. (NASDAQ:FOXF). The enterprise engages in the production and sale of products and systems that are used in equipment like bikes, on-road vehicles, trucks, snowmobiles, commercial trucks, motorcycles, and other related products. Recently, fundamental performance for the company has been robust and shares have been performing nicely relative to the market. Long term, I suspect that this trend will continue. But at present, shares are reaching the point where they look to be more or less fairly valued. So despite the attractive performance on the fundamental side, I have decided to change my rating on the company from a ‘buy’ to a ‘hold’.

Fox Factory has ridden its course

On May 19th of this year, I wrote an article detailing the investment worthiness of Fox Factory. In that article, I called the company a quality play on vehicle components. I said that the management team of the firm had done a remarkable job growing the enterprise over the prior few years. I also said that growth was likely to continue throughout 2022 and that shares of the enterprise were looking cheaper than they were previously. Ultimately, I concluded that shares of the business were looking attractive enough to warrant a ‘buy’ rating, indicating that I felt it would likely outperform the broader market for the foreseeable future. And so far, the company has more than delivered. While the S&P 500 is up by 8.1%, shares of Fox Factory have jumped by 35.7%.

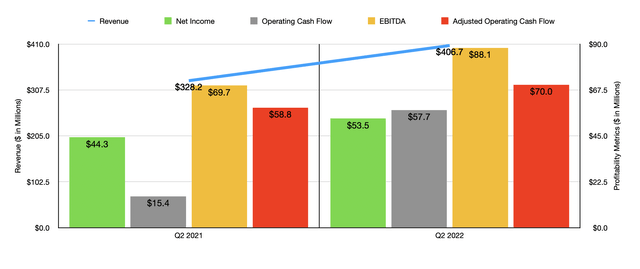

Author – SEC EDGAR Data

This increase in price was not without cause. The fact of the matter is that the fundamental performance of the company has been rather robust. When I last wrote about the firm, we only had data covering through the first quarter of its 2022 fiscal year. But now, we have data covering the second quarter as well. During that quarter, sales came in at $406.7 million. That’s 23.9% above the $328.2 million generated the same quarter one year earlier. Growth during the quarter was particularly strong under the Specialty Sports products category, with sales climbing by 28.1% year over year from $138.7 million to $177.7 million. Management attributed this to continued strong demand in the OEM channel. By comparison, the Powered Vehicle products category grew a slightly more modest 20.9%, with management attributing this rise to strong demand for its upfitting product lines.

Thanks to the strong demand across the board, sales for the first half of the year as a whole came in nicely. Revenue in the first half of the year totaled $784.7 million. That’s 28.8% above the $609.3 million generated just one year earlier. When it comes to the 2022 fiscal year as a whole, management expects revenue to total between $1.535 billion and $1.565 billion. This compares favorably to management’s prior expectations of between $1.50 billion and $1.53 billion. At the midpoint, this would translate to a 19.3% increase over the roughly $1.30 billion the company generated during its 2021 fiscal year. It would also imply an increase of 74% compared to the $890.6 million the firm generated in 2020.

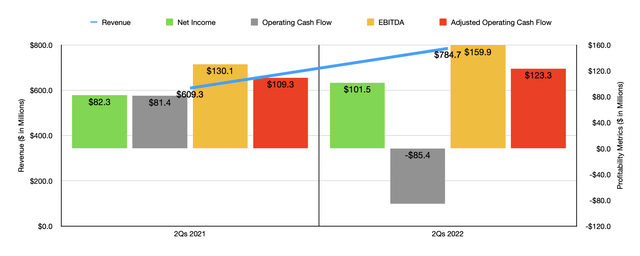

Author – SEC EDGAR Data

On the bottom line, performance in the latest quarter remained strong. Net income of $53.5 million translated to a year-over-year increase of 20.8% compared to last year’s $44.3 million. Operating cash flow fared even better, skyrocketing from $15.4 million to $57.7 million. If, however, we were to adjust for changes in working capital, it would have risen more modestly from $58.8 million to $70 million. Meanwhile, EBITDA for the firm increased from $69.7 million to $88.1 million. This second quarter has been instrumental in helping to increase profitability for the first half of the 2022 fiscal year as a whole. Net income of $101.5 million came in stronger than the $82.3 million generated in the first half of 2021. Operating cash flow did still worsen considerably, declining from $81.4 million to negative $85.4 million. But if we adjust for changes in working capital, it would have risen from $109.3 million to $123.3 million. Meanwhile, EBITDA for the company rose from $130.1 million to $159.9 million.

When it comes to profitability for the 2022 fiscal year as a whole, management still expects earnings per share of between $5 and $5.30. Based on the company’s current share count, this translates to net income of $217.7 million. This compares to the $163.8 million generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at a similar rate, then we should anticipate adjusted operating cash flow of $273.7 million and EBITDA of $316.1 million. To put this in perspective, these metrics totaled $207.4 million and $263.9 million, respectively, in the 2021 fiscal year.

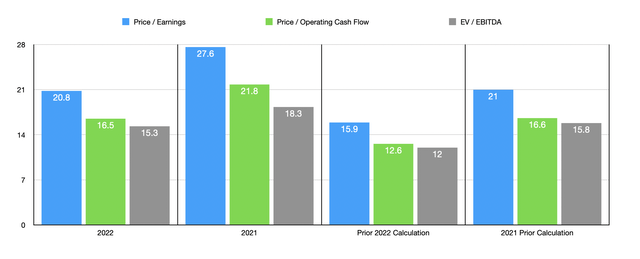

Author – SEC EDGAR Data

This data makes it very easy to value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 20.8. This is down from the 27.6 reading that we get using 2021 results. The price to adjusted operating cash flow multiple should be 16.5. That stacks up against the 21.8 reading we get using 2021 results. Meanwhile, the EV to EBITDA multiple should be 15.3. That compares to the 18.3 reading that we get using last year’s figures. As part of my analysis, I also looked at how shares were priced when I last wrote about the firm. Clearly, the stock has gotten a bit pricier. And also as part of my analysis, I compared the company to the five firms that I compared it to in my last article, only four of which had positive financial performance. On a price-to-earnings basis, these companies ranged from a low of 4.3 to a high of 43.8. And on a price to operating cash flow basis, they ranged from 15.6 to 32.3. In both cases, three of the five firms were cheaper than Fox Factory. Meanwhile, using the EV to EBITDA approach, the range was from 5.6 to 15.2. In this scenario, our prospect was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fox Factory Holding Corp | 27.6 | 21.8 | 18.3 |

| Luminar Technologies (LAZR) | N/A | N/A | N/A |

| Dorman Products (DORM) | 22.8 | 32.3 | 14.9 |

| LCI Industries (LCII) | 6.7 | 15.6 | 5.6 |

| Adient (ADNT) | 4.3 | 15.6 | 10.5 |

| Visteon Corporation (VC) | 43.8 | 16.3 | 15.2 |

Takeaway

Based on the data provided, it seems to me as though Fox Factory still remains a quality operator and I fully believe in its long-term potential. Having said that, shares of the enterprise are more expensive than they were previously and, while revenue is forecasted to grow at a more rapid pace than previously anticipated, earnings per share have not been revised higher. This is a slight negative in and of itself. When you also consider where shares are priced compared to similar firms, the stock no longer looks like it offers attractive upside. So for all of these reasons, I have decided to lower my rating on the firm from a ‘buy’ to a ‘hold’, reflecting my new belief that it will likely perform along the lines of what the broader market will for the foreseeable future.

Be the first to comment