Diego Thomazini

By Robert Eisenbeis, Ph.D.

The FOMC will be meeting November 1–2, but there will be no projection materials to inform the public if there are significant changes in the Committee’s outlook. Thus, the Beige Book and a first reading on Q3 GDP will be the major sources of current information on the state of the economy and key industry segments across the country. Just released on October 19, the Beige Book covers information collected through October 7, which was too soon to include the impacts of Hurricane Ian. Even these data will be nearly a month old by the time of the meeting. As we parse the information in the Beige Book, we need to keep in mind that four of the 12 districts – San Francisco, Dallas, New York, and Atlanta – account for a significant portion of the country’s output because one state in each of those districts is so large in terms of GDP. The four states – California, Texas, New York, and Florida – together account for 36% of the country’s GDP, so the Beige Book entries for the four districts containing those states provide key pieces of information on how the economy is faring.

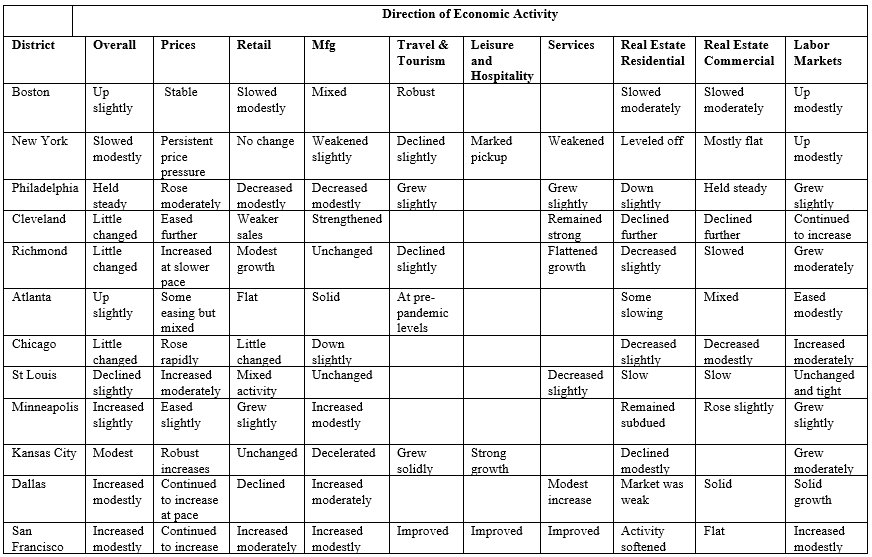

The table below provides the terms used in the Beige Book to describe the overall changes in the economy since the last Beige Book. San Francisco, Dallas, and Atlanta all showed slight increases in activity while New York indicated a modest slowing. Other districts that showed some slight increases were Boston, Minneapolis, and Kansas City. Three districts indicated little change – Cleveland, Richmond, and Chicago – while St. Louis declined slightly and Philadelphia held steady. The picture that emerges is that the economy clearly is not in recession, but neither is it growing significantly. This conclusion is bolstered by recent corporate earning reports of declining sales and earnings.

While these overall assessments are informative, the devil is in the details. The table highlights some of the key common sectors and what is happening in terms of how the previous rate hikes may be impacting the economy. In some instances, not all districts discussed some of the indicated areas, and in other cases a limited number of areas were mentioned, for instance agriculture and energy.

All the districts commented on prices, indicating some continued upward pressure. At the same time, virtually all the districts reported continued and/or modest growth in the labor market while at the same time noting that the market remained tight. Where some differences showed up were in some of the other categories, such as real estate and manufacturing. For example, all the districts reported slowing and weak retail real estate markets, and 9 of the 11 districts that reported on commercial real estate noted slowing or, at best, flat markets. Cleveland, Atlanta, Minneapolis, and San Francisco reported some improvement in manufacturing, while New York, Philadelphia, Chicago, Kansas City, and Dallas noted deceleration and declines. Tourism was mixed, with New York and Richmond citing declines, while Kansas City, Philadelphia, and San Francisco reported improvement while Boston noted robust activity.

The overall picture that emerges is that prices are still a problem, labor markets remain tight, and the districts show little sign of a recession. The most common observation was on weakening real estate markets, which is not surprising given the general increase in mortgage rates. Clearly, the stage is set for at least one more 75-basis point increase in the target range for federal funds, but the key question that may emerge from Chairman Powell’s post-meeting press conference concerning the future path for rates will be how inclined would the Committee be to slow the pace and size of future rate increases.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment