eyegelb/iStock via Getty Images

The Q4 Earnings Season for the Gold Miners Index (GDX) has finally come to a close, and one of the most recent companies to report its results was Fortuna Silver (NYSE:FSM). The company posted strong growth in 2021 with record gold production helped by nearly a full year of contribution from Lindero. Still, the growth was not entirely organic, with some help from the Roxgold acquisition. Unfortunately, while production was up and will grow further, costs also increased sharply, and Yaramoko has a less attractive outlook post-2021. So, while I do see some upside from current levels, I still don’t see enough of a margin of safety here to invest at ~US$4.00 per share.

Lindero Operations (Company Presentation)

Last month, Fortuna Silver released its Q4 and FY2021 results, reporting gold production of ~207,200 ounces and silver production of ~7.5 million ounces. This represented a more than 200% increase in gold production year-over-year, driven by a ramp-up at the company’s new Lindero Mine in Argentina and an additional contribution from the newly acquired Yaramoko Mine in Burkina Faso. However, while production soared, costs were up sharply as well. Let’s take a closer look below:

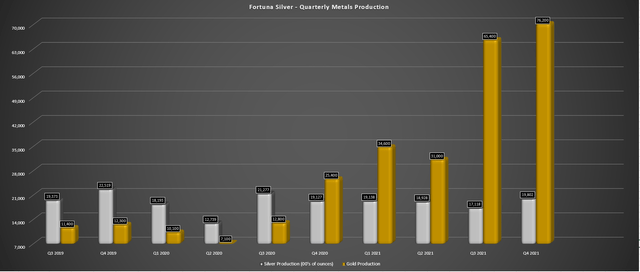

Fortuna Silver – Quarterly Metals Production (Company Filings, Author’s Chart)

If we look at the chart above, we can see that Fortuna saw a massive increase in production in Q4, reporting consolidated production of ~76,200 ounces of gold and ~1.98 million ounces of silver. This represented a 200% increase in gold production on a year-over-year basis and helped push annual gold-equivalent ounce [GEO] production above the 200,000-ounce mark for the year. Meanwhile, silver production was up slightly to ~1.98 million ounces, helped by slightly higher silver grades and recovery rates at San Jose vs. Q4 2020 (219 grams per tonne of silver vs. 206 grams per tonne).

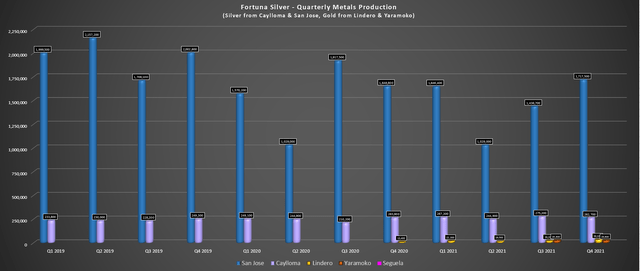

Fortuna Silver – Quarterly Metals Production (Company Filings, Author’s Chart)

Looking at the production from a mine-by-mine standpoint, we can see that Fortuna is now much more diversified, with four mines in its portfolio vs. just two in mid-2020. This was helped by the delayed and over-budget Lindero Mine finally making its way into commercial production and ramping up to capacity and adding the Yaramoko Mine in the Roxgold acquisition. As the chart above shows, Lindero contributed a new record of ~36,000 ounces of gold in Q4, while Yaramoko struggled a little due to the delay in mining several high-grade stopes and grade variability in the 55 Zone.

Based on Roxgold’s average production profile at Yaramoko of ~125,000 ounces per annum at industry-leading costs plus a high-grade development asset in Seguela, I thought this was a reasonable acquisition, though the price looked a tad high, partially offset by the fact that Fortuna was using expensive currency (high share price) to complete the acquisition. However, following Yaramoko’s disappointing performance in FY2021 and the updated outlook, the price paid is looking much less attractive today.

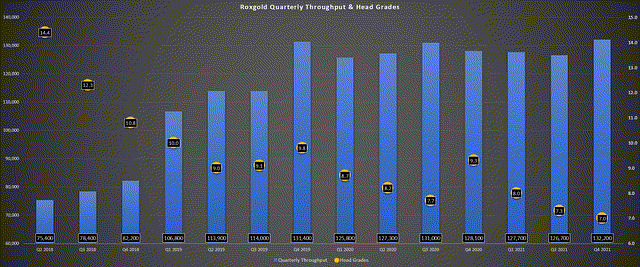

The reason is that Fortuna paid more than 1.1x P/NAV for Roxgold at a time when the average West African producer was trading for less than 0.80x P/NAV. The premium might have made sense if Yaramoko was set to maintain its solid production profile of ~125,000 ounces at sub $950/oz costs. However, as the chart below shows, grades have been steadily declining since FY2019, and they should dip towards 6.5 grams per tonne gold in FY2022. This will make it difficult to support a 110,000-ounce+ per year operation, leading to higher costs than the asset enjoyed previously.

Yaramoko – Quarterly Throughput/Grades (Company Filings, Author’s Chart)

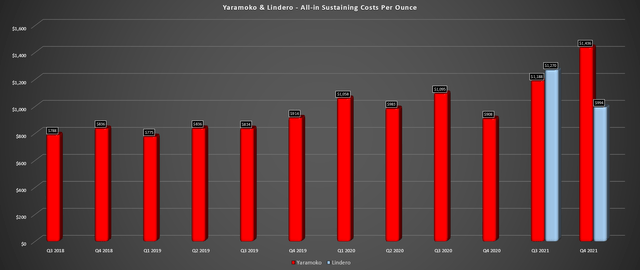

This combination of lower than planned grades in Q4 led to the production of just ~28,800 ounces in Q4, and all-in sustaining costs soared to $1,436/oz, the highest I’ve ever seen since tracking the asset for years. While this was partially due to the deferred access to higher grades that will be resequenced into this year’s production, it’s quite clear from the Technical Report that production is declining. The results are shown below, which suggest production could be halved from pre-acquisition levels in 2024, based on estimated production of ~60,000 ounces at costs of $1,457/oz.

So, while Yaramoko may have boosted Fortuna’s production in the back half of the year, costs are trending in the wrong direction and are expected to remain elevated in FY2022 ($1,475/oz guidance mid-point). Meanwhile, costs at San Jose jumped more than 23% year-over-year to $14.56 per silver-equivalent ounce [SEO], and Caylloma’s costs also increased at a single-digit pace, coming in at $18.94/oz per SEO. This was despite much higher production year-over-year, with production cash costs jumping to $88.41/tonne.

Yaramoko & Lindero – All-in Sustaining Costs Per Ounce (Company Filings, Author’s Chart)

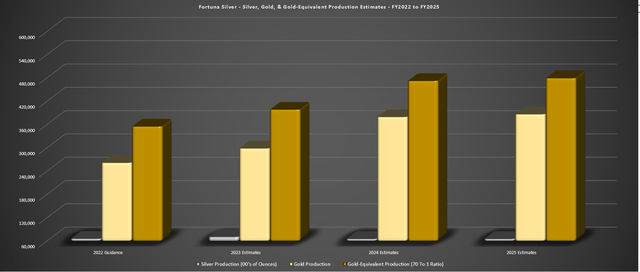

To summarize, while the bulls seem to have tunnel-vision on the growth story here coming from Seguela, an asset capable of ~150,000 ounces per annum at sub $900/oz costs, they are ignoring rising costs at nearly every operation. They’re also ignoring the fact that the weaker outlook from Yaramoko beginning in 2024 will “steal” some of the growth that Seguela will be contributing as it provides a full year of contribution in 2024.

So, while there is clear growth from FY2021 to FY2025, this is not what I would consider high-quality growth, where production increases while margins decline sharply. Currently, there are a few examples of high-quality growth stories out there, with examples being Karora (OTCQX:KRRGF), K92 Mining (OTCQX:KNTNF), and Alamos Gold (AGI). Obviously, K92 Mining and Karora have enjoyed significant runs, but Alamos has not and should see 50% growth looking out to 2025 with a simultaneous $350/oz decline in costs and a boost to its jurisdictional profile. This is the type of growth that I am much more interested in personally.

Financial Results

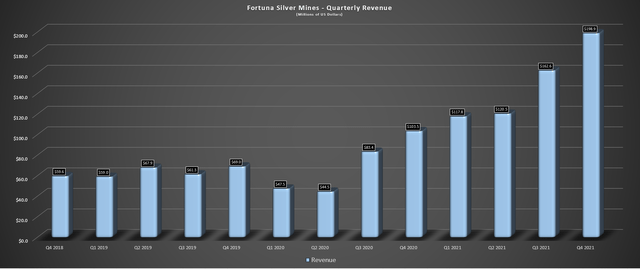

Moving over to the financial results, we can see that Fortuna saw a sharp increase in revenue, with Q4 revenue hitting a record of $198.9 million. This figure was up 92% year-over-year, or just over 30% on a per-share basis after adjusting for more than 57% share dilution in the period (~296 million fully diluted shares vs. ~187 million fully diluted shares). Due to the help of a strong Q4, annual revenue also hit a new high of ~$600 million, while adjusted EBITDA soared to ~$281 million.

Fortuna Silver – Quarterly Revenue (Company Filings, Author’s Chart)

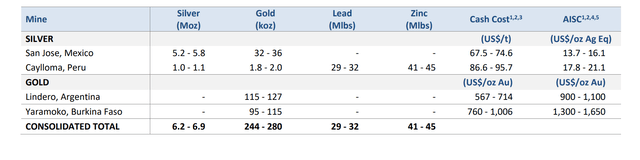

If we look ahead to FY2022, Fortuna’s guidance calls for an increase in gold production, but this is partially offset by much higher costs and lower silver production, as I’ve discussed previously. This includes all-in sustaining costs of $1,000/oz at Lindero based on the mid-point (just above Q4 levels) and a sharp rise in costs at Yaramoko ($1,475/oz mid-point). Meanwhile, at the company’s silver operations in Mexico and Peru, costs are expected to rise to $14.90 per SEO at San Jose and $19.45 per SEO at Caylloma.

Fortuna Silver – 2022 Guidance (Company Presentation)

Assuming these mid-points aren’t beat, this would translate to single-digit cost increases at both assets after lapping sharp increases in last year’s costs. If we adjust these on a gold-equivalent basis, given that Fortuna is more of a gold producer now that it has Lindero and Yaramoko, this translates to an estimated AISC of ~$1,118/oz (San Jose) and ~$1,459/oz (Caylloma). So, while Lindero is a below-cost operation, San Jose has industry average costs, and Caylloma/Yaramoko’s costs are miles above the industry average. Worse, there is limited visibility into production post-2026 at San Jose and Yaramoko, given their short mine lives.

Valuation & Technical Picture

Based on an estimated ~298 million fully diluted shares at year-end and a current share price of US$3.97, Fortuna has a market cap of ~$1.18 billion and an enterprise value of ~$1.23 billion. If we compare this figure to an estimated After-Tax NPV (5%) of the company’s mining assets/development projects of ~$1.66 billion, the stock might appear very undervalued. However, after subtracting out a conservative figure of $200 million in corporate G&A, the value drops to ~$1.52 billion, or ~$1.47 billion after subtracting out net debt.

If we compare the market cap of ~$1.18 billion with a net asset value of ~$1.47 billion, there is upside here. However, this assumes that one believes Fortuna should command a valuation of 1.0x P/NPV (5%). If Fortuna were a silver producer, this would be a low estimate for fair value. Unfortunately, while Fortuna Silver did diversify itself by completing the Roxgold acquisition, it also stripped itself of the premium valuation that silver producers typically command relative to gold producers. The above net asset value includes Seguela and some minor value ascribed to Boussara.

Fortuna’s Gold Assets – Estimated 2024 AISC vs. Peer Estimates (2022) (Company Filings, Author’s Chart)

Meanwhile, from a cost standpoint, the recent Yaramoko study suggests life of mine all-in sustaining costs of ~$1,380/oz, and FY2024 costs are expected to come in closer to $1,460/oz. This has pushed the estimated consolidated AISC on Fortuna’s gold-only business (Lindero, Yaramoko, Seguela) to ~$1,040/oz in FY2024, per my estimates, suggesting that its costs will only be slightly below the industry average. After adding in higher than industry average costs at San Jose and Caylloma combined, Fortuna is basically an average-cost producer in much less attractive jurisdictions.

Fortuna Silver – Forward Production Estimates (Author’s Chart & Estimates)

Looking ahead to FY2024, I estimate that ~80% of GEO production will come from gold, which is a significant decline from pre-Lindero and pre-Roxgold when the bulk of revenue came from silver. So, if we look at Fortuna as “Fortuna Gold Mines” which is the reality going forward, I think it’s a stretch to suggest that the company deserves a 1.0x P/NPV multiple. This is because I don’t know of any mid-tier gold producers with a jurisdictional profile that includes Argentina, Mexico, and West Africa with industry-average costs trading at a premium valuation. This is especially true when two assets have a poor track record of replacing reserves (San Jose/Yaramoko).

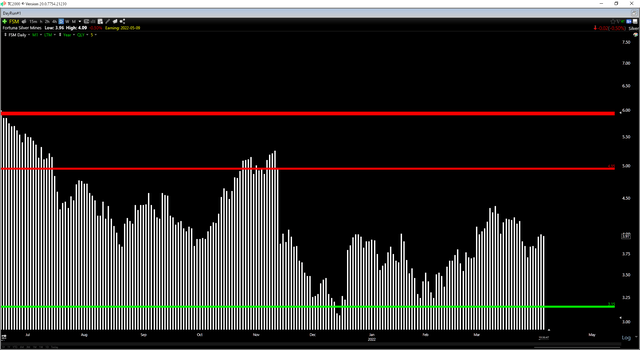

Assuming a more conservative multiple of 0.90x P/NPV on Fortuna’s mining assets and ascribing value for Boussara, which may head into production later this decade, I see a fair value for Fortuna of ~US$4.60. While this points to some upside from current levels, it’s not enough upside to make me interested at $4.00, given that I want at least a 30% discount to conservative fair value to justify entering new positions. So, while I see some upside from here, I think investors need to be careful listening to the nonsensical posts suggesting Fortuna belongs at $12.00 – $20.00 per share.

If Fortuna were to trade at $20.00 per share, the stock would trade at more than 4.0x P/NAV, quadruple the P/NAV multiple that diversified producers in much better jurisdictions with much better track records currently command, such as Newmont (NEM) and Agnico Eagle (AEM). Even at $5.70 per share, the stock would trade at a premium multiple to Agnico Eagle. I don’t recall the last time I saw a Tier-2/Tier-3 jurisdiction producer with less than one-sixth of the production profile commanding a higher valuation than a Tier-1 jurisdiction producer when both have metals exposure.

Based on my requirement for a 30% discount to fair value, Fortuna would need to trade below US$3.20 to bake in a meaningful margin of safety, and this lines up with a key support zone at US$3.15. Obviously, there’s no guarantee that the stock will decline this far, and it may not if gold remains above $1,850/oz. However, I enter positions based on where I see the most value and the most margin of safety combined with a quality ranking. With Fortuna having less favorable jurisdictions than its peers, similar margins, and a bleaker outlook at Yaramoko, a key asset in the Roxgold acquisition, I think there are more attractive bets elsewhere in the sector.

Fortuna Silver – Gold Pour (Company Filings, Author’s Chart)

Fortuna Silver is not a bad company by any means. Still, my previous outlook for growth has dampened considerably with Yaramoko being cut down to a ~60,000-ounce per annum operation in FY2024 at the time as Seguela will hit commercial production. So, the industry-leading growth profile that I previously saw is off the table. Meanwhile, though production has grown, the premium multiple has been stripped with a shift to a gold focus, regardless of whether this is justified or not. Given this less attractive outlook, I remain focused elsewhere, but I would become more interested in the stock if it dipped below US$3.30.

Be the first to comment