Alfio Manciagli

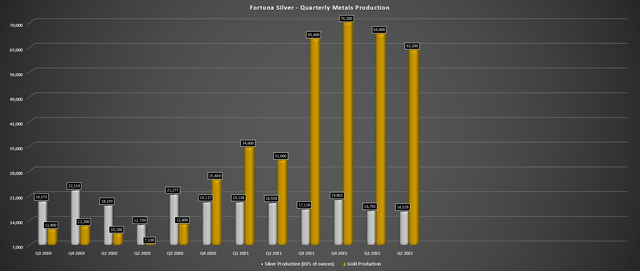

The Q2 Earnings Season for the Gold Miners Index (GDX) is just around the corner, and one of the first companies to pre-release its results was Fortuna Silver (NYSE:FSM). Overall, the company had a solid quarter, reporting a 100% increase in gold production, offset by a 13% decline in silver production. However, this was offset by weakness in metals prices, which won’t only affect margins but could also affect reserve replacement for its more price-sensitive operations. At a share price of US$2.60, FSM’s valuation is becoming more reasonable, but I continue to see more attractive bets elsewhere.

Seguela Project Construction (Company Presentation)

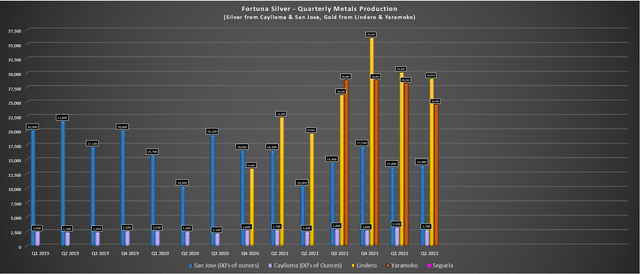

Fortuna Silver (“Fortuna”) released its Q2 production results earlier this month, reporting quarterly production of ~62,200 ounces of gold (100% increase) and ~1.65 million ounces of silver. The sharp increase in gold production was related to the acquisition of Roxgold (addition of the Yaramoko Mine) and a successful ramp-up at the company’s newly constructed mine in Argentina. The strong increase in gold production helped by ~24,500 ounces from Yaramoko was a saving grace, given that production was down sharply at San Jose on the back of lower silver grades, and production at Caylloma was down marginally to ~267,000 ounces. Let’s take a closer look below:

Fortuna Silver Mines – Quarterly Production (Company Filings, Author’s Chart)

Q2 Production Results

Digging into the production results a little closer, Lindero had another solid quarter, reporting production of ~29,000 ounces of gold, marking its third consecutive quarter with production above 25,000 ounces. This has placed the mine on track to meet its FY2022 production guidance of 115,000 to 127,000 ounces, with ~60,000 ounces produced in H1 2022 alone. Meanwhile, at Yaramoko, the company guided quite conservatively, and the asset looks like it should be able to meet the guidance mid-point of 105,000 ounces (~24,800 ounces produced in Q2, ~52,700 ounces produced year-to-date).

Fortuna – Quarterly Production by Mine (Company Filings, Author’s Chart)

Moving over to the silver assets, San Jose’s production was down 14% year-over-year to ~1.39 million ounces, attributed to lower silver grades (187 grams per tonne) and lower throughput of ~252,000 tonnes. Meanwhile, Caylloma saw lower much lower gold production and flat silver production, which should keep costs elevated at the asset with a reduced benefit from by-product credits. The good news is that while production was down at these two assets, they are not as significant of contributors following the acquisition of Roxgold and the ramp-up to commercial production at Lindero.

Weakness In Metals Prices

These decent headline numbers might leave some investors scratching their heads about the muted response from the market following the release of the results. However, while the operational results were solid and the company is tracking well against guidance, lower metals prices have more than overshadowed this. In fact, as it stands, the silver price is below Caylloma’s all-in sustaining cost [AISC] mid-point of ~$19.50/oz, and it’s only 20% above San Jose’s AISC guidance mid-point of $14.90/oz. So, on an all-in cost basis, the company’s silver portfolio is not in great shape from a margin standpoint, with its consolidated all-in costs near $17.00/oz.

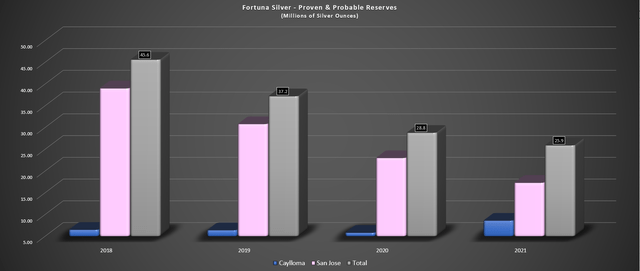

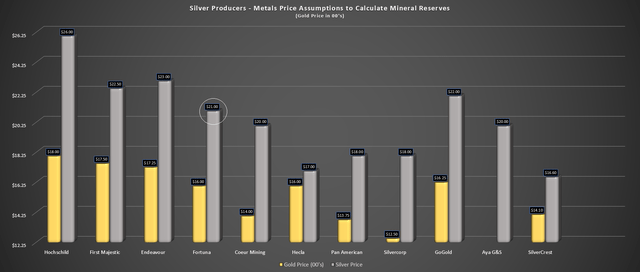

Some investors might argue that this is short-sighted and that the silver price is going much higher, meaning that worrying about margins on an all-in-cost basis is a little unfair. I would agree that placing a large emphasis on a single quarter is not that useful, but there is a bigger issue that’s resulting from weaker metals prices. This is the fact that even while increasing its silver price assumption from $17.00/oz to $21.00/oz from 2019 to 2021, San Jose’s silver reserves have declined from ~37 million ounces to 17.3 million ounces. This means that even in a rising metals price environment, the trend in reserve replacement has been horrid.

Fortuna Silver – P&P Silver Reserves (2018-2021) (Company Filings, Author’s Chart)

Now, the silver price is going in the wrong direction, a headwind to reserve replacement at an asset where the mine life is already relatively short. At the same time, inflationary pressures are present in labor, consumables, and materials, which could potentially affect the 2021 cut-off grade of $62.00/tonne to $67.80/tonne in the 2021 results (109 to 120 grams per tonne silver-equivalent). This is not ideal and makes me even less optimistic about reserve growth at San Jose in the Q1 202 report.

According to the report, these assumptions were as of June 30th, 2021, with what could be higher mining costs and processing costs after adjusting for inflationary pressures. While there are resources backing up these reserves, they are not much above the cut-off grade, with a silver-equivalent grade of ~145 grams per tonne silver-equivalent at a 75 to 1 ratio gold/silver ratio.

Unfortunately, Yaramoko is using relatively high prices too compared to the industry average and also has a short mine life, with a gold price assumption of $1,600/oz for underground reserves. So, it could be difficult to grow reserves at this asset as well unless the company wants to pull its gold price assumption higher to $1,650/oz – $1,700/oz to allow for easier conversion of resources. For now, the mine life at Yaramoko sits at barely five years, with less than 1.8 million tonnes of material in reserves, including depletion since the most recent Technical Report.

To be clear, I am not negative about precious metals prices, and I am not predicting that they will head lower. However, while conservative operators like Newmont (NEM) have a huge gap between the prices used to construct their mine plans ($1,200/oz) and the current gold price, this is not the case for weaker operators like Fortuna. So, Newmont is not sweating about the recent pullback in metals prices and will not struggle with reserve conversion or have to adapt its mine plans if metals price weakness continues. However, in Fortuna’s case, it has two operations with short mine lives, and the weakness in metals prices combined with inflationary pressures is an impediment to growing reserves.

To summarize, the margin outlook will not be pretty for Fortuna in its Q2/Q3 results, but I am less worried about a quarter or two of margin compression. However, the bigger negative is the effect this could have on its mine lives, which may lead to reserve deletion at San Jose or Caylloma if metals prices weaken even further. This is not a risk present among most gold producers and the larger operators, and this is one risk that investors should be aware of with us now just seven months out from the Q1 2022 updated Reserve & Resource estimates. So, is sentiment bad enough yet that we’ve seen a bottom, and this might be priced into the stock?

The Capitulation Phase?

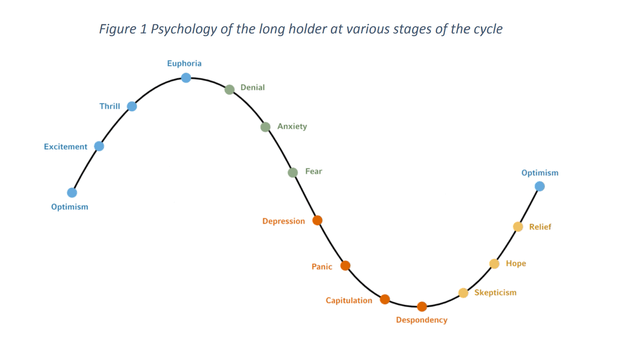

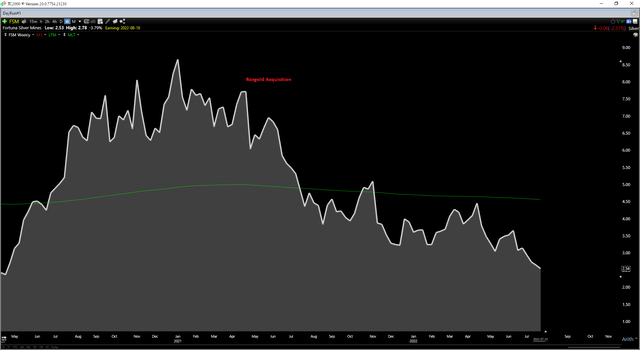

Following the acquisition of Roxgold (OTCQX:ROGFF), I noted that the best course of action was to sell the stock immediately, given that there is never going to be better news for a company or a more attractive liquidity event than when it’s receiving an offer to be acquired. Besides, Fortuna’s share price was likely to remain under considerable pressure. This is because it was just coming off the euphoric stage, enjoying a 500% return in less than 12 months. In addition, it was paying a premium to net asset value for a Tier-3 jurisdiction producer (Roxgold), which made for a dangerous cocktail combined with an extended chart that has suddenly broken its 200-day moving average on heavy volume.

Since then, Fortuna is down 65%, and all of the profits that would have been gained from the Roxgold acquisition have evaporated; a painful lesson that a bird in the hand is worth two in the bush. After relentless selling pressure and constant denial from investors that the stock could possibly be worth less than US$4.50, some good news has finally arrived. This news has come in the form of sentiment, which appears to be worsening, suggesting that some investors may be beginning to throw in the towel and look for greener pastures or a different sector altogether.

Analysis of Fortuna Silver (Twitter.com)

As of earlier this year, we were seeing fantastical targets from some analysts, with one suggesting that Fortuna had an upside case to $21.00 by 2024. This target was just a little bit ambitious, given that it would have left FSM trading at 6.0x net asset value, more than triple the multiple of Kirkland Lake Gold in 2017/2018, a Tier-1 jurisdiction producer with sub $600/oz all-in sustaining costs. However, with the stock continuing to see a lifeless share-price performance since then, some investors in the denial phase and anxiety phase might finally be tempering their expectations and, in some cases, lightening up or exiting their positions.

Fortuna Silver Mines – Weekly Chart (TC2000.com)

Looking at the chart above, the key element of reaching the best reward/risk phases (capitulation & despondency) is not only a sharp correction through price but also through time, which helps to wear down investors. After a 74% decline and a 17-month correction, we appear to be satisfying these conditions from a price and time standpoint, suggesting that the worst might be over. That said, we have not seen a major spike in volume to suggest capitulation, and the last leg of this decline has not been that violent, which would suggest that investors are finally giving up. So, while I am open to being wrong that we’ve already seen the low, I would not be surprised by a final lower low before this correction is over (below $2.50 per share).

While it’s encouraging to see that interest might be waning in Fortuna Silver, at least based on comment activity on recent articles, the key consideration to make when bottom-fishing for small-cap names is valuation. After a 74% decline, some investors might argue that FSM is massively undervalued. While I would agree that the stock is undervalued, I’m not sure it’s massively undervalued when we factor in negative developments since its previous peak. These are as follows:

- San Jose permitting uncertainty

- a less attractive mine plan at Yaramoko

- a more than 45% increase in shares outstanding (Roxgold acquisition)

- multiple compression after transitioning from a silver miner to a gold miner

- a continued negative trend in reserve replacement at San Jose

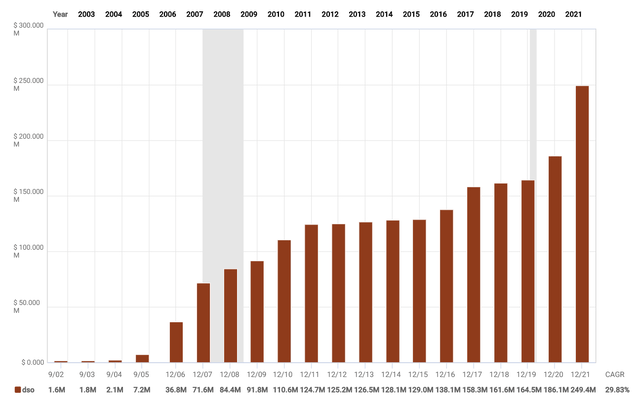

Fortuna Silver – Share Count Growth (FASTGraphs.com)

Based on these developments, I believe it’s more appropriate to use a 10% discount rate for its San Jose Mine NPV and use a more conservative figure for Yaramoko’s net asset value. In addition, I believe the more appropriate P/NAV multiple for the company is 0.90x P/NAV, given that Fortuna is no longer a silver producer, and the current silver price is actually below its reserve price assumptions for its mine plans (reserve calculations) at $18.50/oz vs. $21.00/oz. In my view, this will make it even harder to replace reserves at San Jose, especially with a likely cut-off grade increase to offset the impact of inflationary pressures – a potential double whammy. After taking these considerations into account, let’s dig into the valuation:

Silver Price – Metals Price Assumptions to Calculate Reserves (2021) (Company Filings. Author’s Chart)

To be fair and balanced, I would be remiss not to point out the one key positive. This is that Seguela remains on budget and schedule according to the company. In addition, the project continues to see positive exploration results, and this truly is a world-class project, at least among the sub-250,000-ounce per annum assets. However, suppose we adjust for inflationary pressures on capex ($180 million vs. $142 million Roxgold estimate) and operating costs. In that case, I believe a more conservative After-Tax NPV (5%) figure to be ~$380 million ($1,700/oz gold).

Given the exploration success and regional upside on the property, I think it’s more than reasonable to add $100 million in exploration upside, translating to a total value for Seguela of $480 million. Still, I think the estimates of $800+ million in value for this project are a little ambitious, especially after the negative revision in upfront capital costs (a 22% increase from the initial estimate at $173 million vs. $142 million) that has led to a slight degradation in the base case NPV (5%).

Valuation

Based on an estimated ~296 million fully diluted shares at year-end and a share price of US$2.60, Fortuna trades at a market cap of ~$770 million. With $480 million assigned to Seguela, this already makes up 62% of the stock’s market cap or just over half of its enterprise value (~$860 million). This might make Fortuna seem deeply undervalued, given that it has four other operating mines. The problem is that three of these mines aren’t all that impressive. For starters, Caylloma has high costs ($19.50 per ounce of silver). Meanwhile, Yaramoko has very high costs and a short mine life in its updated mine plan. Finally, San Jose has uncertainty due to permitting issues, its mine life is short, and reserve replacement has been pitiful.

Fortunately, Lindero is a significant contributor, and I see a fair value for this asset of $480 million, giving Fortuna a total NPV (5%) across its mining assets and exploration assets of $1.49 billion. If we divide this figure by 296 million shares (year-end estimate), this translates to a fair value of $5.03 per share. However, this calculation completely excludes net debt, and it excludes corporate G&A, which was $16 million in Q1 alone. Finally, it also assumes that a company with short mine lives at two assets that operate mines in Peru (Tier-2 jurisdiction), Mexico (Tier-2 jurisdiction), Argentina (Tier-2 jurisdiction), and West Africa (Tier-1 jurisdiction) should command a P/NAV multiple of 1.0.

I couldn’t disagree more with assigning a P/NAV multiple of 0.90, and I think 0.90x P/NAV is more than fair. After adding in these inputs, the conservative fair value for Fortuna drops to US$3.45 per share, with an upside case of US$3.77 per share, adding an additional $100 million in exploration upside. The mid-point of these two price targets is equal to US$3.61, representing a 39% upside from current levels. However, when it comes to small-cap producers with high metals price sensitivity (Yaramoko, Caylloma), I want at least a 35% discount to fair value to justify entering a new position. This would require a pullback to US$2.35, a figure 10% below the current share price.

Fortuna Silver Operations (Company Video)

I may be too conservative in my assumptions, and it may turn out to be an opportunity cost by being too rigid when it comes to where I believe Fortuna can be bought from an investment standpoint. However, I think it’s important to change when the facts change (which is why I noted to avoid the stock at US$4.30 in March), and with the metals price weakness being a negative development for Fortuna’s more price-sensitive operations and the Yaramoko mine plan being underwhelming, I think it’s best to err on the conservative side.

Besides, there are companies in safer jurisdictions with higher margins also trading at massive discounts to their net asset value. In a bear market, the goal should be to buy the best companies. This is because mediocre companies often find themselves on the sale rack after missing guidance or seeing massive cost overruns, as Fortuna did on its Lindero Project before its Roxgold acquisition. However, the best companies rarely fall to fire-sale prices, except for during violent bear markets. So, when one is getting the pick of the litter in a bear market, there’s no reason to buy the proverbial runt.

Summary

Fortuna Silver is becoming more reasonably valued after its sharp decline since last year, and the company continues to put out solid operational results and is enjoying exploration success at Seguela. Meanwhile, sentiment in FSM appears to have shifted from denial to near-panic, with the stock down 74% and grinding lower to break the spirits of long-term investors. That said, I still don’t see enough of a margin of safety from a valuation standpoint when applying conservative assumptions, which I believe must be utilized in a volatile metals price environment.

For investors who suffer from fear of missing out and must own Fortuna, the odds have finally tilted in their favor, and I think we have seen the worst of this correction, with limited downside from current levels. However, for those investors that are willing to wait for the best possible prices and don’t mind missing the occasional deal by being too picky, I continue to see being patient as the best course of action. For now, I remain on the sidelines, continuing to focus on what I believe to be much higher-quality names with more attractive margin profiles.

Be the first to comment