AsiaVision

With the COVID pandemic seemingly done and dusted, consumer demand is on the mend, and employees are returning to the workplace – a favorable setup for unattended point-of-sale service provider Cantaloupe (NASDAQ:CTLP). In line with the post-COVID trend, revenue growth accelerated in the June quarter, with transaction volumes up double digits % YoY and EBITDA seeing similar YoY improvements. The new management team deserves a lot of credit for its progress in exercising expense discipline through the worst of the pandemic, while expansion initiatives beyond the traditional vending industry bode well for the long-term outlook.

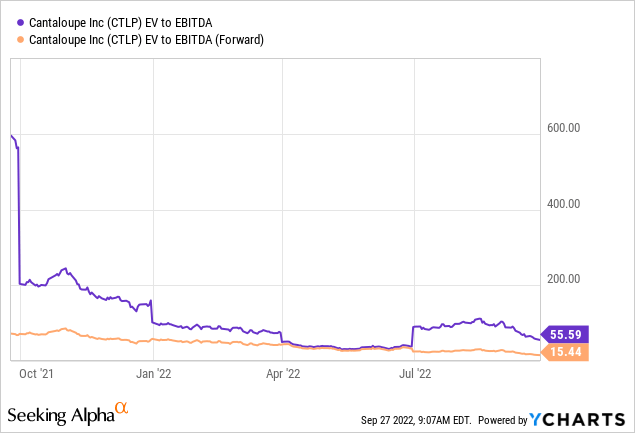

That said, at current prices, investors will need to pay a pricey EBITDA multiple for projected low to mid-teens growth. The departure of CEO Feeney is concerning as well, particularly coming on the heels of prior CFO changes and accounting issues. All in all, CTLP has plenty going for it, but the risks from another round of management reshuffling and the lofty valuation keep me on the sidelines.

The Post-COVID Growth Recovery Continues

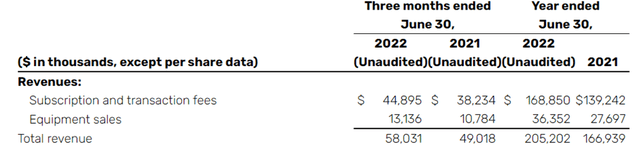

CTLP saw its June quarter revenue up ~18% to $58m (vs. +18% in the prior quarter), helped by +17% subscription and transaction revenue growth (vs. 21% in the prior quarter) and an impressive +22% growth of equipment revenue (vs. +1% last quarter) due to the EMV (Europay, Mastercard (MA), and Visa’s (V) joint security standard) upgrade cycle. For the full year, the +21% subscription and transaction revenue growth marks an important post-COVID recovery on the path to regaining management’s targeted double-digit % segment growth. Given subscription revenues carry 80%-85% gross margins, continued growth momentum here will prove accretive to future earnings.

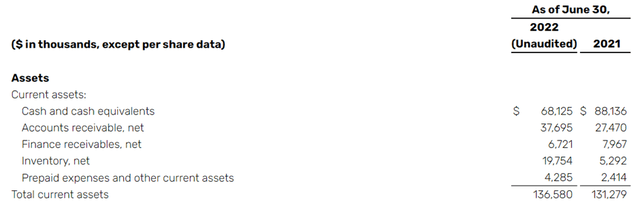

Adj EBITDA benefited from this quarter’s growth as well, at ~$2m for the quarter and $9.9m for FY22 (up from $7.6m in FY21). The solid P&L result means CTLP is equipped with ~$68m of cash and ~$15m of debt exiting FY22, translating to net cash of $0.76/share. This adds to the prior quarter’s liquidity boost – recall that management’s debt facility agreement amendments have allowed for term loan availability of ~$10m and increased its line of credit to ~$15m. Book value stands at a healthy $2.25/share.

Guidance Update Signals a Brighter Near-Term Outlook

The FY23 guidance has been pegged at +10%-15% revenue growth or $225m-$235m – while growth is down from the +23% in FY22, the YoY comparison did benefit from a low, COVID-driven base. Underlying the guidance is a +13%-17% subscription and transaction revenue growth projection (to $191m-$198m), which is set to drive adj EBITDA of $12m-$17m (well above the $9.9m in FY22). The improved profitability makes sense, in my view – CTLP was focused on building out new products to drive future growth in FY22 (as shown by the +37% YoY Technology and Product expense growth), but as these products go to market, the expense run-rate will likely moderate. As operating leverage kicks in, expect profitability to inflect higher in FY23, driving upside to the current adj EBITDA guidance numbers.

Over the mid to long-term, the newer offerings not only pose upside to the revenue growth trajectory but also the margin profile. In particular, higher subscription revenue contribution through SaaS (via SEED) and equipment subscription (via Cantaloupe One) offer higher revenue per connection and margin accretion, thus, driving improved profitability over time. Of note, however, chairman Douglas Bergeron seemed reluctant to commit to the ambitious prior targets of >30% growth and >20% operating margins on the earnings call – a worrying sign heading into the year-end investor day. Pending visibility into the long-term margin and growth profile, I would be cautious heading into the event.

Yet Another Management Reshuffle

The key negative surprise from the quarter was that effective this October, chief operating officer Ravi Venkatesan will take over as CEO, replacing outgoing CEO Sean Feeney, who joined in May 2020. Feeney’s retirement is a loss to the company – during his tenure, he refreshed the senior leadership team, successfully rebranded (from ‘USA Technologies’ previously), and improved the balance sheet. More recently, he also led several new product initiatives alongside Venkatesan, who joined as chief technology officer in 2020 and became COO earlier this year.

At first glance, Venkatesan’s reputation on the execution and product fronts makes him an ideal candidate for the next phase of the CTLP journey, in my view. That said, the latest reshuffle comes on the heels of several CFO departures in recent years and the disclosure of accounting issues that have had a material impact on reported numbers. Given the context, it would not surprise me if investors price in a discount to reflect concerns about the underlying financials, as well as the credibility of existing financial targets.

A Promising Growth Story but Risks Abound

Overall, CTLP’s Q4 results and FY23 guidance were unsurprisingly strong across the revenue and EBITDA lines. The retirement of CEO Sean Feeney was a negative surprise, though. In his place, current COO Ravi Venkatesan will assume the CEO position going forward. While new CEO Venkatesan’s strengths on the execution and product sides are positives, the latest reshuffle comes on the heels of numerous CFO changes. This pattern is worrying and could raise investor concerns about the health of the underlying financials as well as future targets.

Still, the long-term growth story is compelling – CTLP’s exposure to tech solutions in the unattended retail sector means it stands to benefit from future labor shortages and wage inflation going forward. Yet, the current valuation is pricey relative to the growth potential. Thus, I would hold off on the stock heading into the December investor day event, which should provide additional color on key initiatives and updated long-term financial targets.

Be the first to comment