Abstract Aerial Art/DigitalVision via Getty Images

Fortis Inc. (NYSE:FTS) is one of the largest regulated electric utilities in North America, boasting operations in Canada, the United States, Central America, and the Caribbean. Electric utilities have long been favorites of conservative investors, particularly in somewhat choppy market environments like the one that we have today. This is because these companies tend to boast relatively stable cash flows secured by a high dividend yield. Fortis is certainly an excellent example of this, as the stock yields 3.71% at the current price. Fortis also has a very strong ambition to increase the use of renewable sources of energy across its network, which will undoubtedly appeal to those investors that have poured enormous sums of money into environmental, social, and governance funds that have proven popular over the past few years.

In my last article on Fortis, I pointed out that the company appeared to be somewhat overvalued, which is not unusual for utility companies that are highly focused on renewables. The company’s stock price has come down a bit since the last article, though, and when we combine this with the company’s reasonably impressive second quarter results, Fortis might actually make sense to purchase today.

About Fortis Inc.

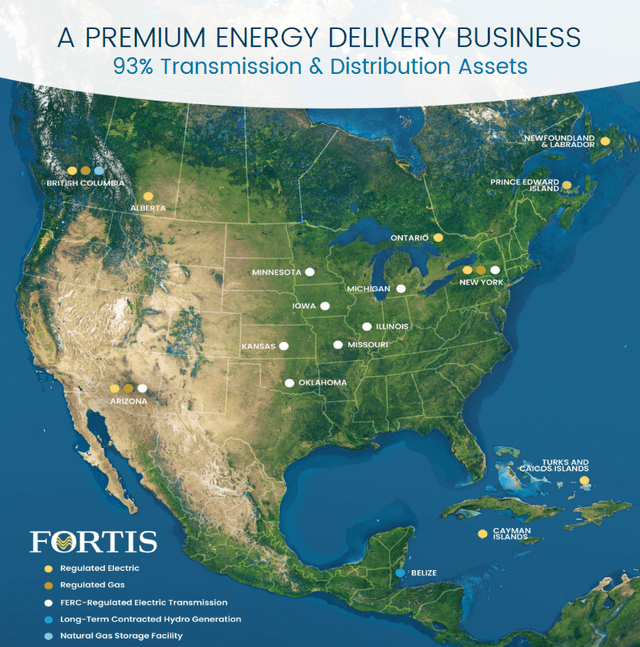

As stated in the introduction, Fortis is one of the largest regulated electric utilities in North America. The company boasts operations in Canada, the United States, Central America, and the Caribbean:

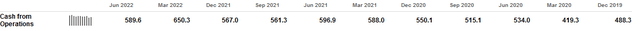

The company owns ten regulated utilities yet is surprisingly small given the breadth of its international operations. This is evident in the fact that Fortis only has about 3.4 million customers, which puts it in the same size range as many utilities that serve a single large city. This size certainly does not stop Fortis from having many of the same characteristics that traditionally attract investors to utilities. The most important of these characteristics is cash flow stability. As we can see here, Fortis has indeed posted remarkably stable operating cash flows over time, including the second quarter of 2022:

(all figures in millions of U.S. dollars)

The reason for this stability is that the company provides a product that most people consider to be a necessity for our modern way of life. After all, it is quite difficult for most people to imagine a life in which they do not have electric service in their homes. As such, most people will prioritize paying their electric bills ahead of more discretionary expenses. Thus, Fortis is quite likely to enjoy much more revenue and cash flow stability than companies in many other industries. This is exactly what we see reflected above.

Naturally, as investors we like to see growth in addition to stability. We can also see that reflected in the operating cash flow chart above as the numbers tend to increase over time. This is merely a small glimpse at what is a long history of growth. Over the past twenty years, Fortis has delivered a 12.8% average total annual return, which is nothing to be sneezed at.

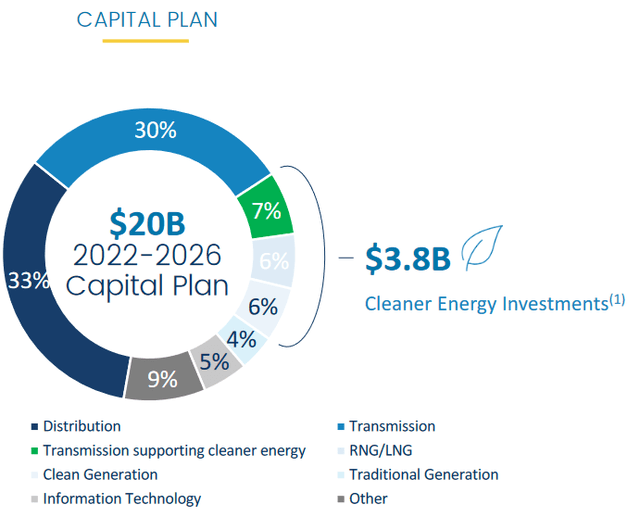

Fortunately, Fortis is likely to continue to deliver growth going forward. The primary way that it will be doing this is by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return (usually about 10%). As this rate of return is a percentage, any increase in the size of the rate base allows Fortis to increase its prices in order to earn that rate of return. The usual way in which a company increases its rate base is by investing money into upgrading, modernizing, or even expanding its utility infrastructure. Fortis is planning to do exactly this by spending approximately $20 billion over the 2022 to 2026 period:

This can be expected to increase the company’s rate base at a 6% compound annual growth rate over the period. This does not mean that the company’s earnings or earnings per share will grow at exactly that rate, however. This is because Fortis will need to finance these capital investments, which may include the issuance of common stock that will dilute some of the net income growth. Fortis has not provided any earnings per share growth guidance for the period, however its dividend has growth at a 6% compound annual growth rate over the past 48 years, which is in line with the projected rate base growth out to 2026. It thus seems likely that the company’s earnings per share will grow at slightly less than 6% but that is by no means certain.

As I noted in the introduction, Fortis is heavily focused on the development and deployment of renewable sources of power to generate the electricity that it sells to its customers. We can certainly see that reflected above as Fortis has dedicated $3.8 billion of its spending to the construction of renewable facilities. This is part of the company’s plans to reduce its greenhouse gas emissions by 75% by 2035 compared to 2019 levels and achieve net-zero carbon emissions by 2050. This is a fairly aggressive goal, but admittedly it is not the most ambitious in the utility sector.

As might be expected, one of the methods that Fortis intends to use to achieve this goal is retiring its old coal-fired power plants since these produce substantially more pollution than any other form of electricity generation. The company will be replacing much of this retired capacity with wind and solar power, which is hardly surprising. In 2021, Fortis added 450 megawatts of wind and solar power supplemented with thirty megawatts of battery storage to its network. While this is certain to appeal to environmentalists, Fortis has yet to retire all of its coal-fired power plants. The company will not achieve this until 2032, which actually damages its environmental credibility a bit since it will be one of the only electric utilities still planning to use coal after 2030.

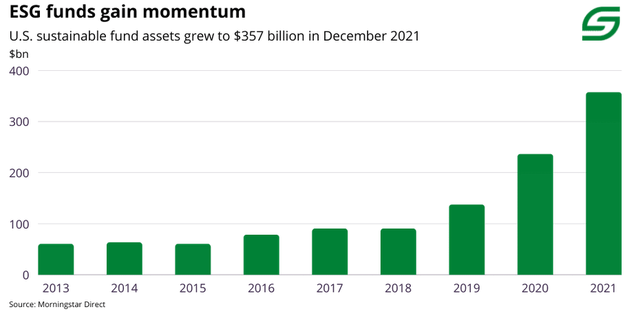

With that said though, the fact that Fortis is making a big deal out of its environmental credentials may attract the attention of the managers of the various environmental, social, and governance funds that have arisen over the past few years. The reason why this could be important is the sheer size of these funds. According to Morningstar, American environmental, social, and governance funds commanded $357 billion at the end of 2021:

Sustainfi.com/Data from Morningstar Direct

However, these funds command substantially more assets globally, European environmental, social, and governance funds commanded $2.231 trillion at the end of 2021. Clearly, these funds are large enough to be able to move the stock prices of large multinationals if the fund managers become interested (or disinterested). Fortis only has a market capitalization of $21.60 billion as of the time of writing so clearly these funds could have a very significant impact on Fortis’ stock price. Perhaps more importantly, interest from the managers of these funds could essentially put a floor under the price and prevent it from declining too far in the event of a market downturn. Any conservative investor, such as the type that typically invests in utility stocks, should be able to appreciate this.

Financial Considerations

It is always important that we look at the way that a company finances itself before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is usually accomplished by issuing new debt and using the proceeds to pay off the maturing debt since very few companies have sufficient cash on hand to pay off their debt as it matures. This can cause the company’s interest costs to increase after the rollover depending on the conditions in the market. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows could push a company into financial distress if it has too much debt. Although utilities tend to have remarkably stable cash flows, bankruptcies are not unheard of in the sector so this is still a risk that we should not ignore.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. The ratio also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of June 30, 2022, Fortis had $20.7476 billion in net debt compared to $16.9815 billion in total shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.22. Here is how that compares to a few of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| Fortis, Inc. | 1.22 |

| DTE Energy (DTE) | 2.23 |

| Eversource Energy (ES) | 1.41 |

| Exelon (EXC) | 1.60 |

| Entergy (ETR) | 2.18 |

As we can clearly see here, Fortis has a significantly lower debt load than many of its peers. This is very nice to see since it is a clear sign that the company is not over-reliant on debt to support its operations. This should also mean that the company should be somewhat less risky than its peers in this respect.

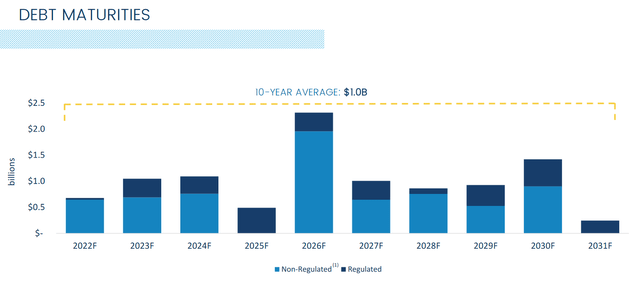

Another one of the nice things about the company’s debt is that the maturities are fairly well staggered. We can see this here:

As we can see, the company only has a relatively limited amount of debt maturing in any given year. This is nice because it limits the company’s risks. This is because it only has to refinance a relatively limited amount of debt every year. It is always somewhat easier to rollover a small amount of debt than a larger amount. In addition to this, we already discussed the interest rate risk involved in rollovers. If Fortis had to rollover a substantial amount of debt in a year than interest rates are high then this could have a significant adverse effect on the company’s financial performance. However, given the fact that the company will only be rolling over a small amount of debt in any given year, we should be looking at a situation in which some debts are rolled over in low interest rate years and some debts in high interest rate years, balancing the company’s interest expenses over time.

Dividend Analysis

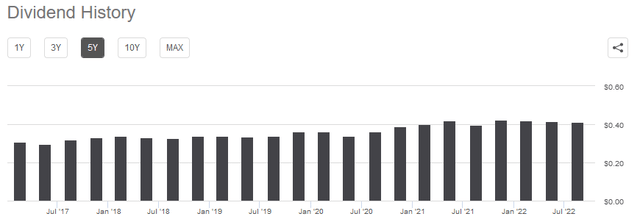

One of the reasons to be attracted to Fortis is the relatively high yield that the company pays out. As stated in the introduction, Fortis has a 3.71% yield at the current price, which is substantially higher than the 1.48% yield of the S&P 500 index (SPY). Perhaps even better, Fortis has a long track record of raising its dividend on an annual basis:

In fact, Fortis has grown its dividend at a 6% compound annual growth rate for 48 years! At this point, there may be some readers that look at the chart above and state that the dividend tends to fluctuate as opposed to growing. That is due to the fact that Fortis is a Canadian company and pays its dividends in Canadian dollars but the chart depicts the dividend paid by the American-traded shares. Thus, the fluctuations are caused by the value of the Canadian dollar changing against the U.S. dollar. We can still see though that the long-term trend is for dividend growth.

An increasing dividend is something that is always nice to see, particularly during inflationary times like we find ourselves in today. This is because inflation is steadily reducing the number of goods and services that can be purchased with the dividend that the company pays out. This can make it feel as if an investor is getting poorer and poorer. The fact that the company keeps giving you a greater amount of money every years helps to offset this effect and helps maintain the purchasing power of the dividend. As is always the case though, it is critical that we analyze the company’s ability to maintain the dividend. This is because we do not want to be in a situation in which the company is forced to reverse course and cut its payout since that would reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the amount of cash that is generated by a company’s ordinary operations and is left over after the company pays all its bills and makes all necessary capital investments. This is the money that is available to do things such as reducing debt, buying back stock, or paying a dividend. However, in the second quarter of 2022, Fortis had a negative levered free cash flow of $416.3 million. This is not nearly enough to pay any dividend, let alone the $139.8 million that the firm actually paid out.

However, it is not unusual for utilities like Fortis to pay for their capital expenditures via the issuance of debt and equity while paying their dividends out of operating cash flow. This is largely due to the incredibly high cost of building and maintaining utility-grade infrastructure over a wide geographic area. In the second quarter, Fortis reported an operating cash flow of $589.6 million. That is more than enough to cover the $139.8 million that the company paid out in dividends with a significant amount left over to cover other expenses. Overall, this dividend appears to be quite secure and investors should not have to worry much about a cut.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Fortis, we can value it using the price-to-earnings growth ratio. This is a modified form of the more familiar price-to-earnings ratio that takes the company’s earnings per share growth into account. A ratio of less than 1.0 is a sign that the stock may be undervalued and vice versa, however very few companies have such a low ratio in today’s overheated market. This is particularly true in the relatively low-growth utility sector. Thus, it makes sense to compare the proposed investment to its peer group in order to see which company offers the most attractive relative valuation.

According to Zacks Investment Research, Fortis will grow its earnings per share at a 5.43% rate over the next three to five years. This estimate is generally in line with the growth discussion that we had earlier so it seems to be a good estimate. This gives the stock a price-to-earnings growth ratio of 3.88 at the current price, which is actually about the same as what the stock had the last time that we looked at the company. This is despite the fact that Fortis has come down in price since then as the earnings per share growth estimate has also come down a bit. Here is how that compares to the company’s peers:

| Company | PEG Ratio |

| Fortis, Inc. | 3.88 |

| DTE Energy | 3.69 |

| Eversource Energy | 3.56 |

| Exelon | 2.77 |

| Entergy | 2.77 |

Admittedly, Fortis still looks a bit expensive here but it is not drastically out of line with DTE Energy or Eversource Energy. It may still make some sense to wait and see if the stock comes down a bit more in price before buying in. However, this does provide some support for our thesis with respect to the interest and impact that environmental, social, and governance funds could have on the stock price. That would be great if you already own the stock but as just stated, it may be prudent to wait for a better entry point.

Conclusion

In conclusion, Fortis is one of the few electric utilities that operates in multiple countries. The company has a surprisingly small customer base given its breadth but the cash flows certainly show the stability that we like to see. Fortis also boasts a very strong balance sheet and an above-average dividend yield. The only downside here is that it may be on the expensive side but it is admittedly not drastically out of line with some of its peers. Overall, I would wait for a better entry point, but it may be worth watching this one and I would not blame anyone for dollar-cost-averaging into the stock at the current price level.

Be the first to comment