Just_Super

Investment Thesis

Fortinet’s (NASDAQ:FTNT) revenue growth rates could be set up to slow down. And if that’s the case, investors are left with a choice. Is paying up 37x next year’s non-GAAP EPS all that compelling? And I don’t know the answer to this question.

I guess it depends on whether the Fed deems it necessary to stop raising rates as quickly. But even this line of thought illustrates that Fortinet’s valuation isn’t that amazing.

To help me drive my point, here’s a quote from the earnings call that lays out everything investors need to know,

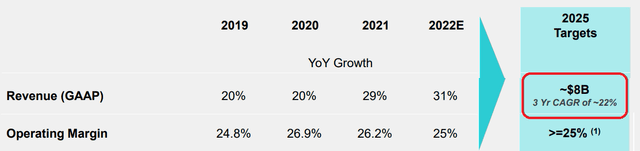

[…] we remain on track to achieve all of our medium-term financial targets from our May 2022 Analyst Day, including $10 billion in billings and $8 billion in revenue in 2025, each representing a 22% three-year CAGR from the midpoint of our 2022 guidance.

Management clearly stated that it’s going to exit 2022 growing at close to 32% CAGR and that in the next 3 years its CAGR gets down to around 22%. Even if there’s a substantial amount of conservatism baked in, we are nevertheless forced to question, what’s a fair growth rate for 2023?

What’s Happening Right Now?

Investor trepidation is now starting to creep into valuations. For a long period of time, cyber security companies were deemed to be recession-proof. Not only are investors now a lot more skeptical, but it also appears that even ”recession resistant” could now involve substantial qualifiers around it.

To get to my point, consider what Fortinet’s CEO stated on the call,

We expect fourth quarter ending backlog to be relatively consistent with the third quarter backlog as we are seeing early signs of a transition back to more normalized customer buying behaviors.

Within that paragraph, we see the news that investors didn’t want to hear, ”more normalized customer buying behavior”.

And that’s a theme that is percolating throughout enterprise tech. Tech had been seen as the trade to be in, during a recession. And within tech, cyber security was seen as a safe haven. And now? Well, perhaps this trade became a tiny bit too crowded for what it is.

That being said, to be clear, it’s absolutely not all bad news when it comes to Fortinet.

Revenue Growth Rates Remain Attractive

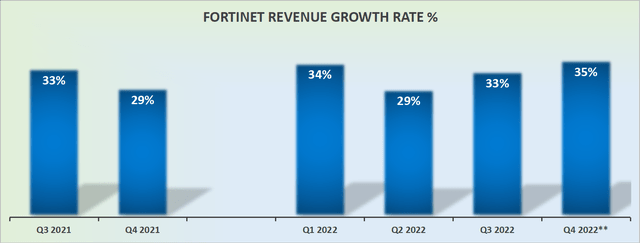

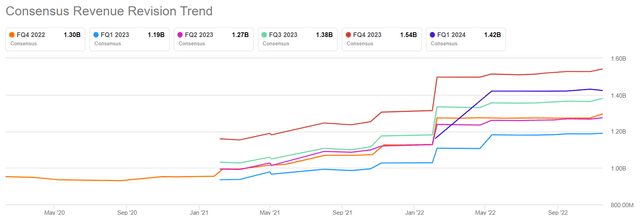

Fortinet’s revenue growth rates continue to point to a mid-30% CAGR. For a cybersecurity firm that has seen its share price mostly move down for the bulk of 2022, one has to question, whether investors may not be too negative about Fortinet’s prospects?

For their part, analysts remain positively bullish on Fortinet’s prospects. Even as cyber security and enterprise SaaS companies generally speak of the tough macro environment, Fortinet’s analysts continue to revise their revenue estimate outlook upwards.

With this in mind, let’s discuss one blemish in the bull thesis.

Capital Allocation, Needle Moving?

Consider this:

During the three and nine months ended September 30, 2022, Fortinet repurchased 10.2 million and 36.0 million shares of its common stock, respectively, at an average price of $49.15 and $55.37 per share, respectively, and for an aggregate purchase price of $500.0 million and $1.99 billion.

And now see if you see a pattern here:

- Q1 2022: $691 million (average price $61)

- Q2 2022: $800 million (average price $55)

- Q3 2022: $500 million (average price $49)

It appears to me that as the share price is moving lower, this coincides with the total amount deployed towards share repurchases coming lower. That being said, there’s still a further $530 million left for share repurchases. So it could be the case that these share repurchases could end up being accretive to long-term shareholders.

Altogether, as we look ahead to Q4 2022 this translates into the total share count ending the year down 4.2% y/y.

FTNT Stock Valuation — 37x non-GAAP EPS

The problem that investors are facing right now, is that there’s so much uncertainty over what will FTNT’s 2023 revenue growth rates normalize at? On the one hand, we have management openly stating that customer behavior is normalizing.

On the other hand, FTNT’s GAAP margins are extremely enticing. In fact, as a point of reference, Q3 2022 reported 23.1% GAAP margins, an increase of 390 basis points from 19.2% reported in the same period a year ago.

On yet the third hand, we have to highlight that the bulk of the revenue growth is coming from its Product business line. And many investors are skeptical that Product revenues will continue to be a growing TAM over the next few years.

The Bottom Line

Optically Fortinet is cheap. Why? Because it has GAAP earnings. Something that many tech companies haven’t figured out yet, how to get their business to report GAAP profits.

On the other hand, a large proportion of its growth is not coming from its Service unit, but instead from its Product business. As a point of reference, two years ago, Fortinet’s product business made up approximately 34% of its total revenues. While for its most recent quarter, its Product business makes up 41% of its total revenues.

So, it could be that soon 50% of Fortinet’s business could be coming from its Product business, with a very limited TAM.

Be the first to comment