Kevin Frayer/Getty Images News

The consumer discretionary sector has been one of 2022’s worst performers. The industry has taken a hit on two fronts as high inflation increases input costs, and rising interest rates (combined with falling real wages) lower economic demand. Virtually all consumer discretionary firms have seen gross profit margins contract this year, while some have seen sales decline. The economy is at a potential transition point today where inflation may finally slow as demand falls faster. That is precisely the Federal Reserve’s aim by pursuing a tightening policy. For consumer discretionary firms, I expect that change will moderate losses in profit margins but potentially accelerate declines in sales as people reduce discretionary spending more quickly.

One interesting case example of this situation is Starbucks Corporation (NASDAQ:SBUX). SBUX was on a strong rally before 2022 as the company continued to expand into overseas markets after developing a solid brand in the U.S. This year’s events have altered its prospects as the company grapples with rising wages and labor dissatisfaction, hampering its gross margins. Like it or not, investors must realize that the lack of willing retail workers in the U.S. dramatically benefits employees’ competitive leverage at the expense of corporate profits. Starbucks is also facing some strain due to higher coffee commodity prices (though they have fallen more recently) and energy costs (freight, etc.), but the labor shortage is, by far, Starbucks’ most significant strain today.

Falling real wages and low consumer sentiment is also undoubtedly negative factor facing the retail brand. The company has continued to grow revenue over the past year, but its growth rate has fallen dramatically. SBUX trades at an extremely high “P/E” of 29x, as analysts expect the company to continue to grow EPS and sales quickly over the next decade. If macroeconomic, geopolitical, competition, or social factors reduce its growth rate further, the stock is liable to suffer a significant decline as it no longer benefits from a primarily expected future cash flow. SBUX is down around 14.6% this year but was down over 37% in May before rallying back up. With that in mind, I believe the stock is at a high probability of reversing lower or continuing higher depending on one’s assumptions.

Starbucks’ Labor Strains Are Likely To Persist

Starbucks is currently the seventh-largest consumer retail company in the United States, controlling over 40% of the coffee-chain market share – much of which is still made up of independent local brands. The corporation is also the fourteenth largest employer in the United States, giving it great exposure to economic wage pressures. Amid a large retail-centric labor shortage, Starbucks employees have tried to unionize, with many chains recently pursuing a one-day strike earlier this month. To try to delay unionization, The chain recently stated it would invest hundreds of millions of dollars in employee wages and improve operations.

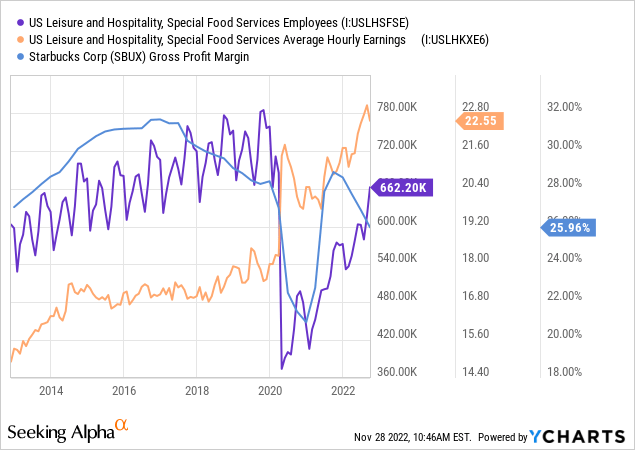

Starbucks has faced a relatively consistent decline in gross profit margins since 2017. Around the same time, average hourly earnings for “special food services” (which includes coffee services) began to rise quickly. Around the same time, this segment’s total number of employees started to level off. Mass shutdown’s in 2020 vastly accelerated this trend, causing the employee count to collapse – spurring worker shortages and soaring wages. Employee levels remain below pre-lockdown levels, so the industry’s wages continue to trend higher. See below

There is an evident negative trend in Starbuck’s gross profit margins. Its margins collapsed in early 2020 when lockdowns created massive business declines and labor layoffs. As with many things, its margins rose back last year, but not to the level before the lockdowns. Further, as labor strain continues, Starbucks’ gross margins are falling over the long run.

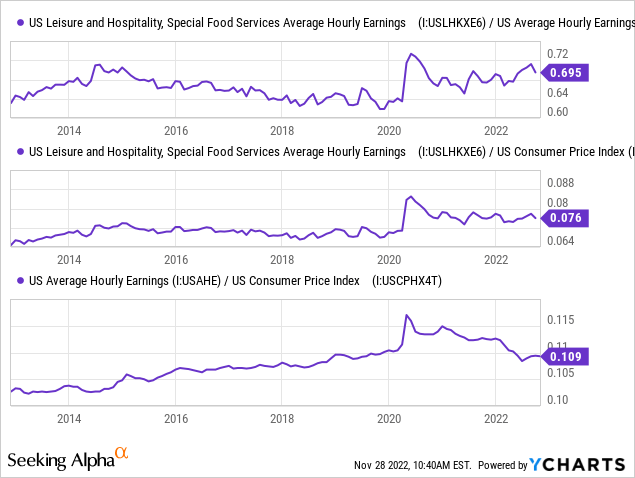

Notably, special food service is one of the only labor segments that is seeing wages rise at the same pace of inflation, thus keeping gains from the initial “wage stimulus spike” in 2020. Average hourly earnings for all employees are now below pre-lockdown levels compared to the consumer price index. See below:

This data indicates that rising wages may persist in the special food services segment, even if inflation slows or wages for other employees slow. Much of that stems from the fact that there are fewer employees in the sector than there were before the lockdowns, while demand for special food services is generally higher. Starbucks has specifically seen U.S. same-store sales rise 11% over the past year, driven almost entirely by more significant volumes and not higher sales prices. However, operating income in Starbucks’ North American segment declined due to a sharp 3.2% fall in its operating margins.

Starbucks is facing falling margins in its U.S. and international segments. Europe is also challenged by significant labor shortages that are specifically impactful to “food accommodation services,” not unlike the U.S. Around most developed countries, labor shortages are specifically substantial for lower-wage service jobs. Many people appear less inclined toward these jobs, particularly after experiencing mass layoffs during the 2020 lockdowns.

Demographic factors may also be at play as the “millennial” generation” (~26-40) is larger than the “generation z” group (12-26). This is because the larger “baby boomer” group tended to birth the equally larger “millennial” group, creating two bumps in the U.S. population pyramid for 25 to 35 year-olds and 55 to 65 year-olds. There is also a sharp decline “inverted pyramid” going toward the < 20-year-old group. This pattern generally holds for western Europe and the UK and is highly exaggerated in China (due to their older one-child policy).

When the “millennial bubble” was situated for 15-25-year-olds, Starbucks benefited from an ample supply of new entrants to the workforce. Now that the “millennial bubble” is reaching mature age ranges, many are moving into more established roles, but there is an insufficient supply of replacements since there are fewer 15-25 years than there were a decade ago. As such, it should be no surprise that shortages are growing, and wages are rising above-trend for “entry-level” part-time jobs. This situation will worsen over the coming decade due to population pyramid inversion.

Are Starbucks’ China Plans Doable?

Starbucks grew its North American store count by only 3% this year and likely had minimal growth potential in the U.S. since the market is somewhat oversaturated after decades of tremendous growth. Outside of the few remaining underserved regions, the continued growth of the number of U.S. coffee chains would likely increase price competition and exacerbate labor shortages at the expense of profit margins, as seen this year.

Comparatively, Starbucks grew its international store count at a faster pace of 8%, despite significant headwinds in China. There are now nearly as many international Starbucks stores as North American ones, though its international income and sales are around 70-80% lower. Starbucks suffered relatively large declines in its international market due to an 11% unfavorable currency impact and a 5% decline in same-store sales due to China’s extreme lockdown policy. While many have speculated that China’s “zero-COVID” policy will end, they have only worsened in recent weeks.

The most recent wave of lockdowns triggered massive anti-lockdown protests across China. Historically, the heavy-handed Chinese government does not bend to the will of its people, and information from the country remains opaque, so it is unclear what will come of these protests. In the immediate term, unrest in China is likely a net negative for Starbucks’ hopes in the nation as it will likely result in lower same-store sales and closures. Of course, if lockdowns are lifted, then it would benefit Starbucks’ situation in the region.

Notably, Starbucks is valued under the assumption that the company will achieve substantial revenue and income growth from expansion into China. It is certainly possible that the company will accomplish this feat, but investors may benefit from being realistic about its possibility. China is an authoritarian country with an undeniably poor human rights record. The country’s regime has also made numerous anti-business moves as Xi Jinping acts to consolidate power more quickly. This year’s events have made it clear that Starbucks is playing with fire by trying to expand into this region.

Starbucks also faces significant competition in China from Luckin Coffee (OTCPK:LKNCY). Luckin now has more stores than Starbucks in mainland China and has achieved much higher revenue growth despite lockdown headwinds. Luckin’s metrics are not necessarily reliable as the firm was charged with accounting fraud two years ago and was delisted. That said, numerous competitors in the growing Chinese coffee market could upset Starbucks’ potential. All corporations doing business in China, particularly foreign firms, operate at the leisure of the CCP and could lose if domestic competitors are given preferential treatment. Other western companies expanding into China, such as Disney, are often forced to show support for the CCP (and turn a blind eye to its doings), exposing all companies in China to geopolitical and brand trust risks.

The Bottom Line

Starbucks faces numerous headwinds today that I believe will upset its earnings growth in the long term and continue to strain its income over the coming year. In my opinion, there is strong evidence to suggest Starbucks will continue to see gross margins fall over the coming years due to acute and long-term labor pressures in the U.S. (and most of the western world). Unionization could accelerate this trend significantly, but it appears to be likely as long as entry-level part-time workers are in short supply (driven by demographic factors).

Much of Starbucks’ valuation stems from its growth potential. If we were to assume the company was to maintain its EPS with inflation, it would likely trade at a “P/E” more similar to that of the S&P 500, or around 15-20X – or a share price of approximately $50-$70. In my view, it is highly doubtful that Starbucks will double its sales over the next decade, as anticipated by most other analysts. Starbucks’ growth depends on its Chinese expansion plan, which to me, seems very risky in light of the increasingly precarious situation in the country and its draconian leadership. Due to its one-child policy, China faces a much more steep inverted demographic pyramid and has few young people to fill jobs once more extensive the 25 to 35-year-old cohort finds new employment. In my view, that situation gives China a high probability of entry-level labor shortages over the coming five years (and beyond).

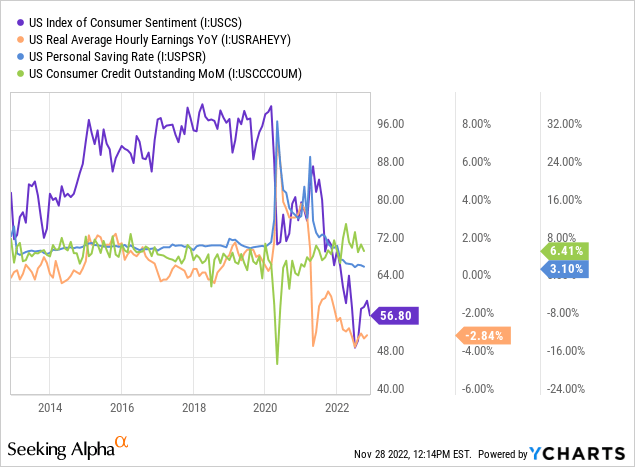

Finally, the U.S. and global economies are slowing. U.S. consumer sentiment is extremely low amid falling real wages and ultra-low personal savings levels. Until recently, falling spending capacity was offset by rising consumer credit. However, consumer credit is now starting to slow, indicating an impending sharp decline in discretionary spending. See below:

In my view, this data makes it abundantly clear that many people in the U.S. will be looking to reduce discretionary spending in 2023. Switching from the “Starbucks habit” to DIY coffee is one of the easiest ways many people could save $50-$200 per month. Considering Starbucks prices have risen to offset rising wages, its “luxury” market position has grown – increasing exposure to economic consumption declines.

For now, a negative shift in consumer spending is a potential negative factor for Starbucks in 2023. I expect this change to negatively affect earnings next year, and it may be persistent if people make permanent habit changes. Of course, even if Starbucks does not suffer a decline in U.S. same-store sales, I believe the stock is considerably overvalued due to my low expected long-term growth outlook. That said, a sharp decline in same-store sales next year would undoubtedly be a solid negative catalyst for the stock.

Overall, I am bearish on SBUX and believe the stock will likely decline in value over the coming year. With very low short interest, no short borrowing costs, and historically low implied volatility, I also believe it is an excellent short target. Options may be particularly suitable due to their abnormally low implied volatility. In my view, its technical position after retracing significantly over the past six months is also attractive. That said, the most considerable immediate risk to betting against the stock is an end to lockdowns in China. While I have doubts, this may occur over the coming weeks, given the growing protests in the country.

Be the first to comment