Liudmila Chernetska

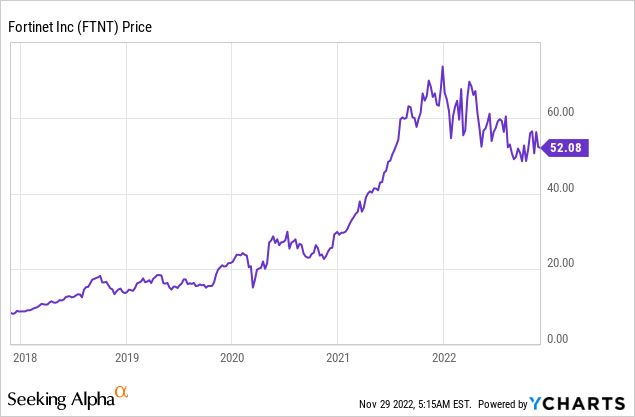

According to one study, cybersecurity attacks globally have risen by 32% year over year and there are over 1,200 attacks per week. This is no surprise given the increase in the use of technology and the rise of remote working which has widened the attack surface. Therefore it is not surprising that the cybersecurity industry was valued at $139 billion in 2021 and is forecasted to grow at a rapid 13.4% compounded annual growth rate, reaching a value of $376 billion by 2029. Fortinet is in a prime position to benefit from this growth trend as a leader in firewalls. The company has recently posted strong financial results for the third quarter of 2022, beating both top and bottom-line estimates. In this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Leading Business Model

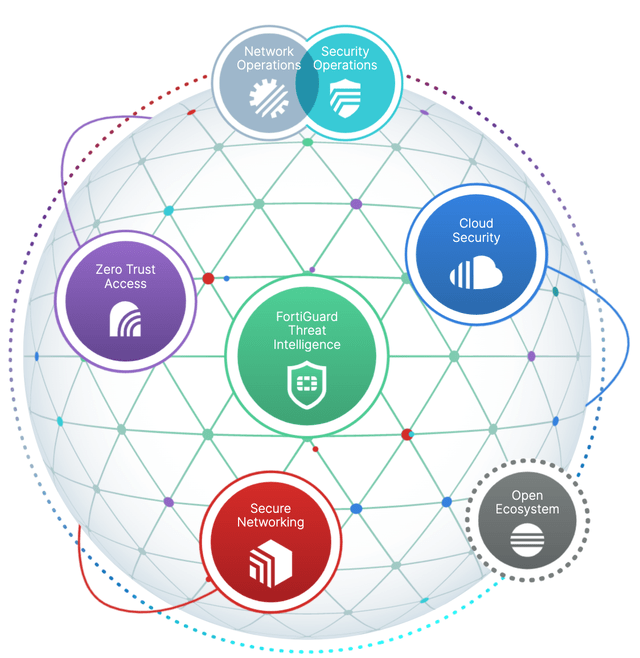

Fortinet (NASDAQ:FTNT) has created a “Security Fabric” which aims to converge multiple cybersecurity solutions into a single platform. This includes Fortinet Threat Intelligence, Cloud Security, Zero Trust Access, Network Security and more. The company competes with companies such as Check Point (CHKP) and Palo Alto Networks (PANW) in its Cloud Security Segment. While the business also competes with Zscaler (ZS) for its Zero Trust access offering. “Zero Trust” is a network access methodology that aims to give users the “least privileged access” to only the applications they need. This stops hackers from entering a company’s network via a harmless application before moving laterally to the financial applications.

Fortinet (Official website)

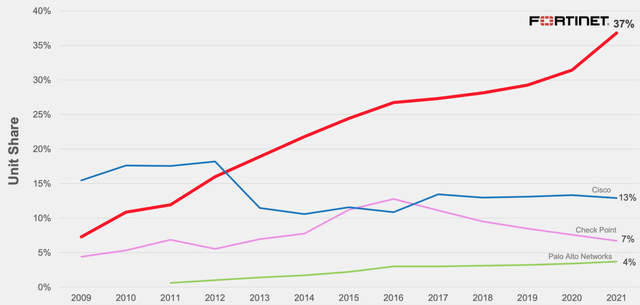

Fortinet is a Gartner leader in its Next Generation Firewall solution and won the customer choice award in 2022. In addition, the company is the market leader in firewalls with its products making up 37% of all units shipping in 2021.

Fortinet Firewalls (Investor presentation 2022)

Strong Third Quarter Results

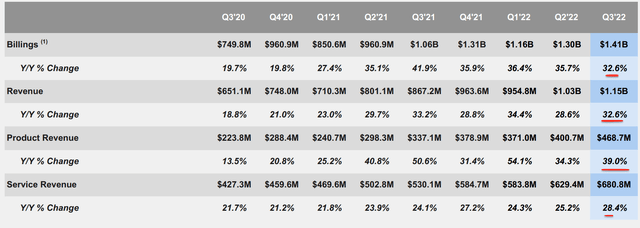

Fortinet reported solid financial results for the third quarter of 2022. Starting with Billings, which is the amount invoiced to customers and the true “top line” for SaaS companies. Billings increased by 32.6% year over year to $1.41 billion. Following on from this revenue was $1.15 billion, which increased by a rapid 32% year over year and beat analyst estimates by $25.59 million.

Fortinet stock (Q3,22 report)

Total revenue was driven by solid product revenue growth of $468.7 million which increased by 39% year over year across its Core and Enhanced Platform technology products. This is impressive growth given a tough year-over-year comparison and supply chain challenges. Service revenue also increased by a solid 28.4% year over year and 3% sequentially to $680 million.

There are three drivers which are helping to accelerate revenue growth across its product range. These include the increase in cybersecurity threats (as mentioned in the introduction), the merging of security and networking, and vendor consolidation. For a long time, the cybersecurity industry has been categorized by a variety of single-point solutions and specialist companies. This was great in the short term as each company had its own expertly honed product. However, for IT and security teams the security tech stack has become unmanageable with high operational overhead. For example, internal security will have to manage patches, updates, licenses, etc. on many different solutions.

Fortinet solves this problem with its “platform strategy” which enables customers to “converge” together both networking and security products, resulting in lower management time and lower operating costs.

A Forrester report even highlighted this and labeled Fortinet as a leader in enterprise firewalls for the first time. The report stated, “Fortinet has built a flexible and capable platform” and it “excels at performance for value”.

The company has continued to eat market share in the area of Secure SD-WAN (Wide-Area-Network) which increased bookings by 45% year over year. Management believes the company is on track to become the market share leader in this space over the next couple of years.

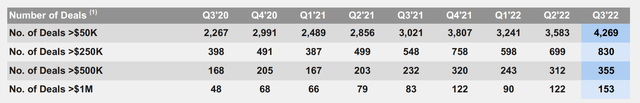

Fortinet has also been “growing upmarket” as it executes its strategy of targeting higher-order value enterprise customers. In the third quarter of 2022, the number of deals over $1 million increased by over 80% to 153 deals.

Number of Deals (Fortinet)

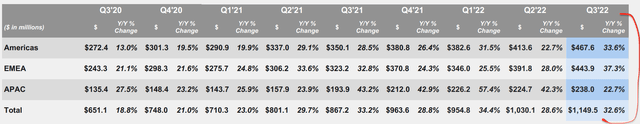

Fortinet is well diversified with the Americas making up 40.7% of revenue followed by EMEA at 38.6% and APAC at 20.75%. EMEA was surprisingly the fastest growing segment as revenue increased by 37% year over year. This was followed by the Americas with 34% revenue growth and the APAC region with 23% growth.

Revenue by Geography (Q3,22 report)

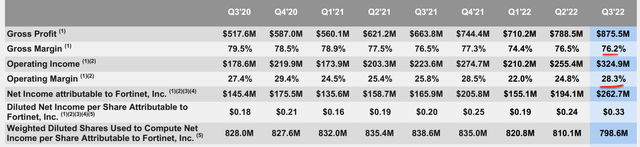

On to profitability and margins, the company reported $875.5 million, in gross profit which increased by 32% year over year at a solid 76.2% gross margin. Operating Income was $334.9 million, which increased by blistering 45% year over year. This was driven by a solid improvement in operating margin from 25.8% to 28.3%, as the company benefited from higher operating leverage and FX tailwinds.

Earnings per share were $0.29, which beat analyst expectations by $0.06.

Financials (Q3,22 report)

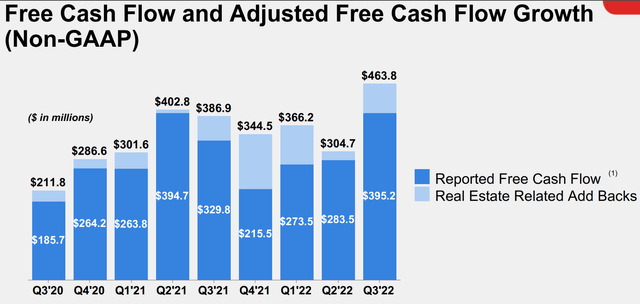

Fortinet has also reported solid growth in its cash flow which increased by 19.9% year over year to $463.8 million, including real estate add-backs.

Free Cash Flow (Q3,22 report)

The company has a solid balance sheet with cash, short-term investments, and marketable securities of $1.81 billion. In addition, the company has ~$989 million in long-term debt.

Advanced Valuation

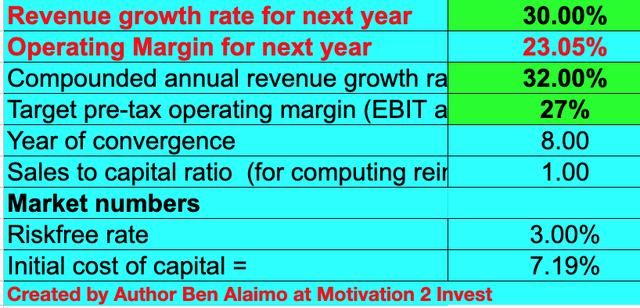

In order to value Fortinet I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 30% revenue growth for next year, which is lower than the 34% guidance for the full year of 2022. In addition, I have forecasted 32% revenue growth per year over the next 2 to 5 years in order to be conservative.

Fortinet stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted the net income. In addition, I have forecasted the company to continue to increase its operating margin to 27% over the next 8 years, as it continues to benefit from strong operating leverage.

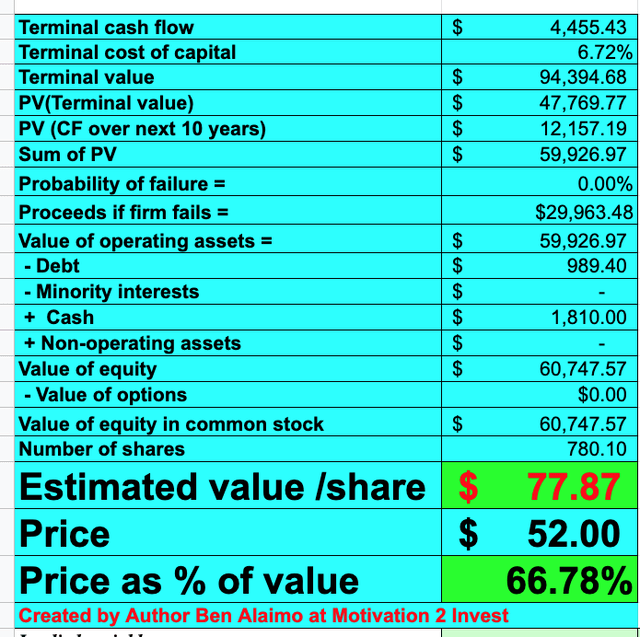

Fortinet stock valuation 2 (Created by author at Motivation 2 invest)

Given these factors I get a fair value of $52 per share, the stock is trading at $77.87 per share at the time of writing and is thus 33% undervalued.

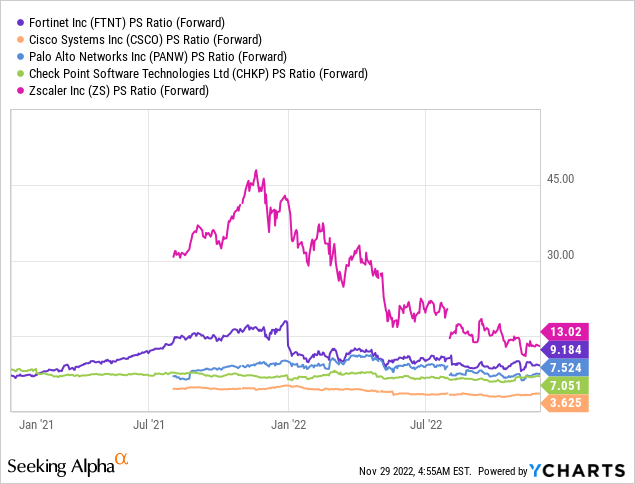

As an extra data point, Fortinet trades at a Price to Sales ratio = 10 which fairly valued relative to historic multiples. It should be noted that Fortinet trades at a slightly higher PS multiple than industry Peers but the company does have strong profit margins which aren’t factored in via the PS metric.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment is squeezing the margins of many businesses and analysts are even forecasting a recession. Therefore I expect longer sales cycles and delayed spending although the cybersecurity industry does look to be relatively immune from many of the major headwinds.

Final Thoughts

Fortinet is a solid technology innovator and has a diversified business model. The company has highlighted the problems in the market with multiple vendors and aims to help the industry consolidate. It is growing strong across all product lines and the stock is undervalued intrinsically.

Be the first to comment