Mario Tama

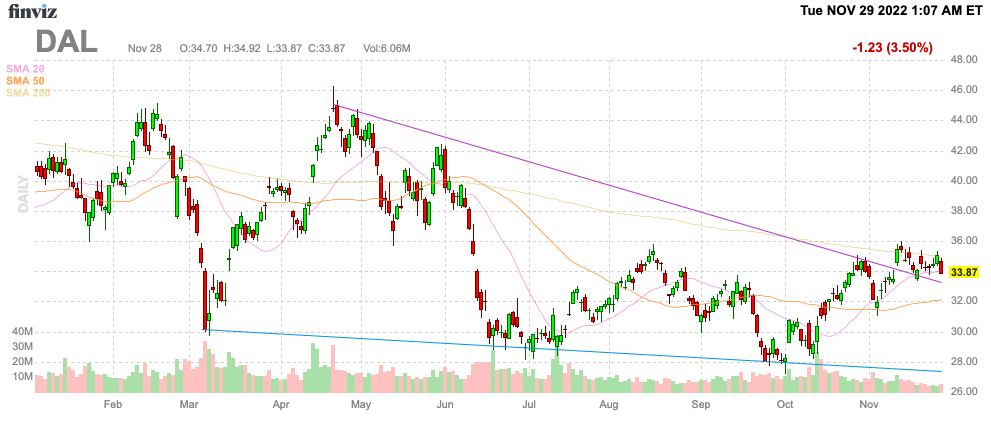

After a strong Thanksgiving holiday, investors should have no doubt about the rebound in airlines and specifically Delta Air Lines (NYSE:DAL). The company has produced a remarkable rebound in profits, yet the stock is still valued as if a profitable rebound remains in doubt. My investment thesis remains ultra-Bullish on the airline stock with an expectation for a full profit rebound for a stock that was once considered cheap at $60 and now trades below $35.

Source: FinViz

Big Q4 Ahead

Over a month following a big Q3’22 earnings report, Delta Air Lines still trades around $34. The stock has rallied some with the market, but investors don’t appear to understand the big profit machine already in full force.

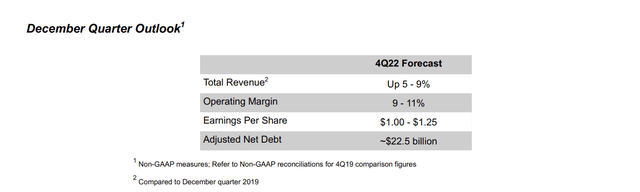

Delta Air Lines doesn’t need traffic to rebound sometime next summer, the airline is on pace to produce a $4+ EPS over the final 3 quarters of 2022. The company guided to a Q4’22 EPS of $1.00 to $1.25 with consensus estimates up at $1.19 following the airline earning $2.95 in the prior 2 quarters.

Source: Delta Air Lines Q3’22 earnings release

The airline is set to earn these massive profits despite a period where oil surged above $100 and capacity at Delta still remains 17% below 2019 levels. The operating environment wasn’t perfect, yet the airline is already generating massive profits.

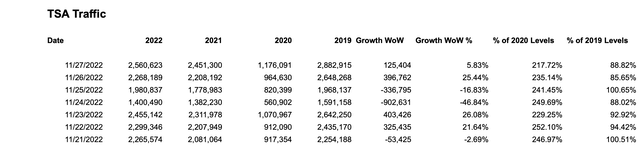

The Thanksgiving holiday traffic failed to top 2019 levels partly due to capacity and storms in the New York area. Traffic still remained strong with TSA showing throughput of ~2.5 million passengers on both Wednesday (Nov. 23) and Sunday (Nov. 27) in line with original forecasts.

Too many people debate whether air travel is going to dip next year not realizing traffic hasn’t fully recovered to normalized levels yet. Delta isn’t anywhere close to back to full capacity while generating these massive profits.

According to CEO Ed Bastian on the Q3’22 earnings call, air travel still has another major leg higher:

And while consumer spend on experiences is growing, the airline industry revenues are still $20 billion to $30 billion below the historical trend against GDP, highlighting the significant opportunity still ahead.

Those revenue figures are close to 50% of any legacy airline with revenues heading towards $50 billion levels. The market appears to have forgotten 3 years will have passed from the comparable 2019 period by the time 2023 arrives.

Big 2024 Targets

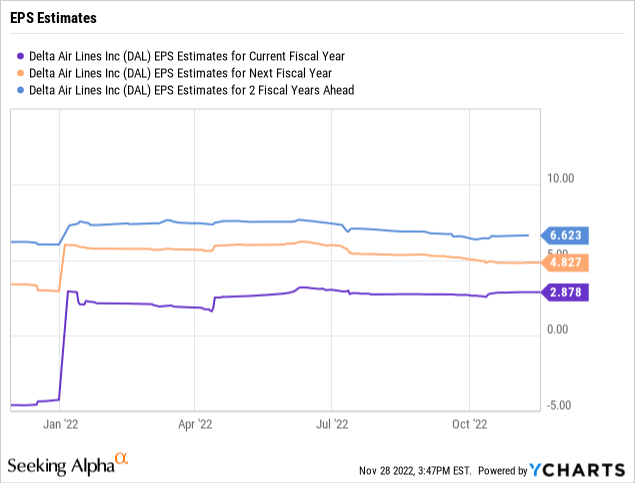

Delta continues to promote the 2024 financial targets of a $7 EPS along with $4 billion in free cash flow. The stock trades at $34 with a market cap of only $22 billion.

Somehow Delta trades at a fraction of 2024 financial targets that don’t appear in question. Though, analysts only forecast a 2024 EPS targets of $6.62.

As detailed above, Delta is already generating what amounts to ~$4.50 in annual profits starting with the Q2’22 results. The airline only needs to boost profits by 50% from those levels to reach the 2024 targets and Delta has flown a capacity of ~20% below 2019 levels in a period where capacity should’ve grown 5% to 10%.

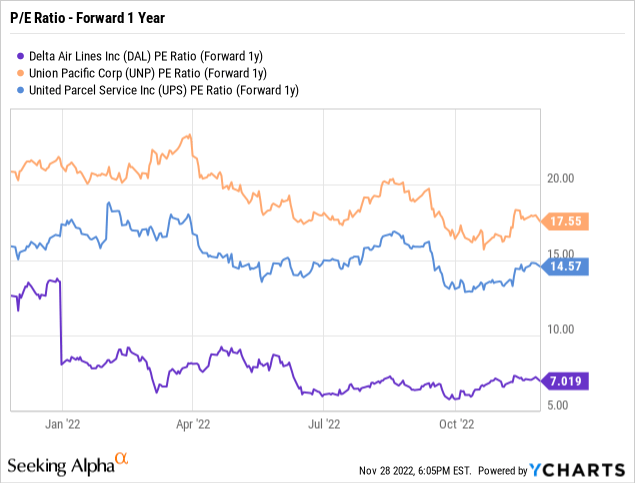

After Delta has survived the last couple of years with flying colors, the market should be more willing to pay up for the stock. Yet, Delta still trade at a massive discount to the forward P/E multiples of other industrial transport stocks such as Union Pacific (UNP) and United Parcel Service (UPS).

By 2024, Delta will have the margins and FCFs to warrant a similar P/E multiple. The airline sector has faced this long-standing problem of being valued at a lower multiple, but investors need to understand this scenario will eventually correct.

Takeaway

The key investor takeaway is that Delta Air Lines isn’t a turkey. The airline is already producing massive profits and the market doesn’t appear aware of the scenario. The stock is a gift here trading below 5x 2024 EPS targets.

Be the first to comment