Art Wager/iStock Unreleased via Getty Images

Formula One logo (Liberty Media Corp. Investor presentation 17 Nov 2022)

Investment thesis

We seldom produce articles with a sell stance.

Formula One Group (NASDAQ:FWONA), which is part of the Liberty Media Corporation, was one of them this year. In our article of 9th June, we pointed out that the group had good cash-generating capabilities but it was not clear how this would benefit the minority shareholders.

Since our sell stance, the share price has basically been trading flat as it is down just 3.5%, and over a one-year period is down just 1.84%.

FWONA – 1 year share price (SA)

We revisit the investment thesis after FWONA published the Q3 results.

Third Quarter 2022 Financial results

Being an avid Formula One fan, it was good to see it return to normal operation with racetracks packed with spectators in 2022.

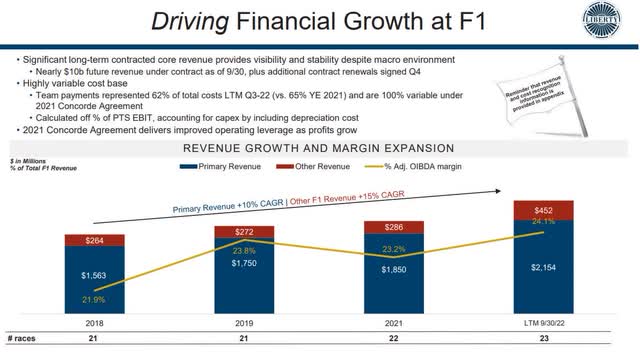

The revenue, which was $1,819 million from the first nine months this year has grown well since 2018, and based on figures from Q3 of this year it is now 42% higher than the pre-covid levels. That is a compounded annual growth rate of 10.66%. This is very good bearing in mind the difficulties they had in even arranging any sports activities during the pandemic.

Formula One Group’s revenue growth (Liberty Media Corp.)

Since the business is not capital intensive, their ability to generate a good levered free cash flow is there. Over the last 5 years, excluding 2020, they generated an LFCF of 67%.

Earnings of Formula One Group in the first nine months were $184 million. The last quarter of the year should have fewer earnings since the F1 calendar ended on the 20th of November. If we use simple pro-rated earnings for the two first months of this quarter, we can add another $40 million to this to get to what we estimate the FY 2022 earnings will become.

We then come to $224 million.

With 233.8 million outstanding shares from its 3 classes of shares, we get an EPS of $0.95

In view of the share price being $55.07 we get a P/E of 58.6

It is hard to see that as “good value” as it is more than double that of the S&P500 index’s current P/E of 20.6

We pointed out our displeasure about intergroup dealings in our last article. The reason is that it is hard to determine if both parties in such dealings are getting a fair deal.

Liberty Media Corporation lends money to the various companies in the group through the issuance of convertible notes or exchangeable debentures. This means they can convert their debt into shares in the companies if this is favorable to them.

In Q3 of 2022, Formula One Group bought back $64 million of their 1.375% cash convertible notes that were due in September. The payment went to Liberty Sirius XM Group and not Liberty Media Corporation.

When we look at Formula One Group’s balance sheet, we can see that they hold a very large amount of cash of $2,119 million plus another $90 million in liquid investments.

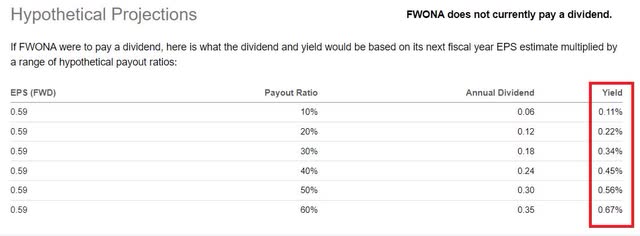

FWONA does not pay a dividend, and it is unclear if they plan to ever pay some of that cash out as a dividend to all shareholders. Even if they did, the yield would not be large. Here is a hypothetical projection based on various payout ratios:

FWONA hypothetical dividends (SA)

Business development

Traditionally, Formula One had its main interest in Europe. After all, the teams were all based there and so were most of their drivers, with the exceptions of some South American, Australian, and Japanese drivers.

Formula One obviously want to change this and they are taking steps to garner a lot more interest from the United States and Asia. The African continent will be next, with plans on returning to race in South Africa.

There will be as many as 3 races in the U.S. next year, as Las Vegas will be added to the calendar. It should be a good show, for sure. This leads me to my own personal observation of the sport and that is the fact that it is becoming more and more of a show, or circus as some describe it, than a sport for hardcore motorsport enthusiasts.

Formula One is coming to Las Vegas (Liberty Media Corp. Investor presentation 17 Nov. 2022)

The reason for this is easy to understand. Unfortunately, Formula One has become too expensive, despite their good attempts to reign in the costs. To pay for all this, money has to be generated from an increasing pool of fans. Some of those come for the show and have limited interest in the actual sport.

Why hold as many as 3 races in the U.S. and no race in China or India?

Formula One had originally penciled in for a return to Shanghai in 2023, but they have just announced that the 2023 Chinese Grand Prix will not take place due to the ongoing difficulties presented by the COVID-19 situation. It is somewhat premature, in my opinion, as we do see that the Chinese government now starting to change from a “zero-covid” policy to a more flexible approach. Nevertheless, it will return as China is a big and important market.

India built a good racetrack but failed to renew the license to continue races there. As a result, Formula One only raced there between 2011 and 2013.

Formula One Group is a tracking stock

All these stocks under the umbrella of Liberty Media Corporation, such as Formula 1 Group, Braves, and Sirius XM Group are tracking stocks.

What is a tracking stock?

From Investopedia we learned this:

A tracking stock is a special equity offering issued by a parent company that tracks the financial performance of a particular division. Tracking stocks will trade in the open market separately from the parent company’s stock.”

It allows the parent company to isolate the financial performance of a subsidiary. Tracking stocks carry the same risk as any other stock but it usually does not include shareholder voting rights. This, in itself, is not a problem for most minority shareholders; however, it may instill a corporate culture that could be less beneficiary to all the shareholders and favor the parent company.

Conclusion

As investors, we put our capital at risk whenever we allocate it. Some risks are obviously larger than others. Our job is to assess this risk and weigh opportunities up against alternatives.

Over many years, equities have benefited from TINA. There Is No Alternative. With fixed income, and what is described as risk-free investments such as treasury notes, now delivering roughly 250 to 300 basis points higher yield than in the past, the ERP, which is the equity risk premium, often shrinks to unacceptable levels.

We also need to consider that certain returns are more predictable than others. A distribution stream from a 6 to 8% dividend can often be predicted with some degree of certainty.

Since we cannot expect FWONA to pay dividends in the near future, we as investors would then have to rely solely on an increase in the share price. The company has no control over what the stock market is doing. They are only observers, just like you and we are. Therefore, it is pure speculation.

To exacerbate the situation, FWONA is not good value at a P/E of 58.6.

As such, we would remain our sell stance.

Formula One drivers of 2022 season (Liberty Media Corp. Investor presentation 17 Nov. 2022)

We still love the sport.

Be the first to comment