PonyWang/E+ via Getty Images

Since our initial publication, FormFactor (NASDAQ:FORM) delivered a negative return compared to Technoprobe. Looking in detail at the numbers, despite a challenging macro environment, since the first day of trading, the Italian company posted a stock price appreciation of more than 22%, whereas FormFactor stood at a minus 9%.

Mare Evidence Lab’s previous publication

Today, we are going back to do our task and we are going to analyze FormFactor’s three-month accounts and the latest company’s development.

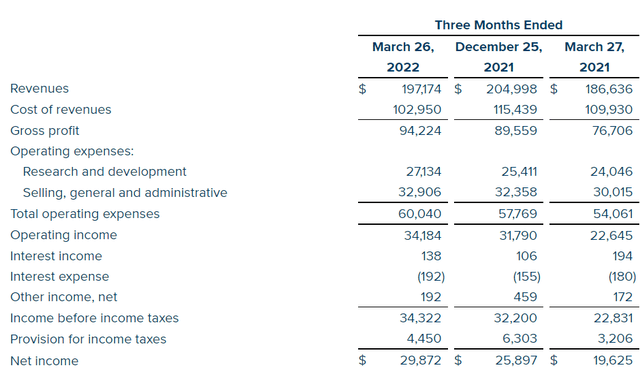

Q1 Results

Mike Slessor FormFactor’s explained that the company “posted strong results in the first quarter, delivering the second-highest quarterly revenue in Company history and exceeding the non-GAAP gross margin and operating margin levels”, he also add “these results demonstrate the resilience and agility of our team and operational model, and demonstrate progress towards our target financial model that delivers two dollars of non-GAAP earnings per share on eight-hundred-fifty-million dollars of revenue.” Aside from the management consideration, looking at Wall Street analyst estimates, FormFactor beat the expectation. Top line sales posted a plus 5.7% compared to Q1 2021 surpassing the consensus by 1.5%. Cross-checking its sub-sectors, revenue increased for the solid demand by the Foundry & Logic and Systems, whereas we see not a great performance for the DRAM and Flash products. The company delivered an adj. EPS of 49 cents beating the consensus estimates by almost 26%. Also, the net income delivered 15% on a sequential basis and a plus 50% year over year.

FormFactor results snap

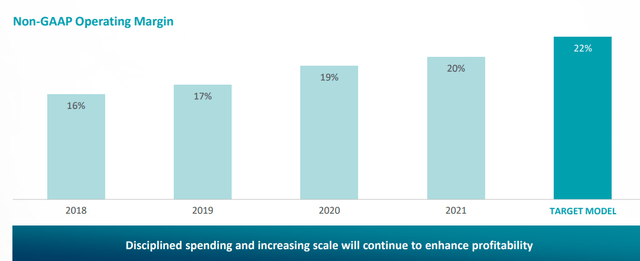

Looking deeper into the company’s financials, we see a positive development of organic cash flow from operation. Also on a non-GAAP basis, gross margin increased by 4 bps year over year arriving at 49%. To support FormFactor growth, operating expenses increased by 11.7% but operating income stood at $44.7 million with an increase of 19% compared to Q1 2021. FormFactor aims to deliver higher margin thanks to the operating leverage and its scale effects.

FormFactor operating margin as %

Other positive development and Conclusion

At the end of May, FormFactor’s board of directors announced a new share repurchase program. The buyback is up for a max of $75 million of common stock with an expiration day of May 2024. However, the buyback’s primary scope is to offset dilution from SBC (stock-based compensation). Businesswise, the company is constantly developing partnerships thanks to its product portfolio. FormFactor signed with SEEQC, a Digital Quantum Computing company, a new agreement for an integrated solution that will speed up “cryogenic test cycles by more than two times“.

Very positive and it is worth highlighting the client comment: “with FormFactor’s probe socket solution, we have been able to eliminate wire-bonding for qubits, SFQ circuits, and multi-chip modules for faster device characterization to identify the known-good die for final quantum testing. This has streamlined and improved our device characterization process especially in providing fast feedback to our foundry fabricating superconducting integrated circuits and multi-chip modules.”

It is not the first time that we anticipated the sector trends, and we see positive development not only in the quantum space but also thanks to the 5G technologies. However, our internal team still expects an in-line return from FormFactor in the upcoming months. The outlook was confirmed and it’s in line with our previous estimate, so once again we assign a hold rating, and we reiterate the preference for Technoprobe.

If you are interested in our latest coverage on European semis, please have a look at our recently published articles:

- STMicroelectronics: Doubles Profits And Beats Expectations

- Infineon: Maintain Outperform

Be the first to comment