metamorworks/iStock via Getty Images

KalVista once again shocks its shareholders with news regarding the termination of the KVD824 phase 2 trial. After its product candidate KVD001 failed to convince in a phase 2 study due to insufficient effectiveness a few years ago, safety concerns are the reason for the termination of the KVD824 trial. The news was very badly received by the market and, as a result, KalVista has lost more than 85% of its value since its peak following positive data on its product candidate Sebetralstat in 2021.

Since Sebetralstat is apparently the main value driver of KalVista, and the developments in the pipeline do not allow any conclusions to be drawn about the latter, I wonder whether the high decline in the market capitalization of KalVista is justified. For me, the key value driver is still in place, meaning KalVista is significantly undervalued at current levels. In the following article, I want to introduce the company, explain my investment thesis and justify the potential of the value driver Sebetralstat.

Business Of KalVista Pharmaceuticals

KalVista (NASDAQ:KALV) is a clinical-stage pharmaceutical company headquartered in Cambridge, Massachusetts, focused on developing oral therapies for the rare disease hereditary angioedema (HAE). KalVista intends to provide best-in-class therapies, both for acute on-demand and prophylaxis treatment, to fundamentally change the way HAE is treated. HAE is a rare and potentially life-threatening disease, and despite the fact that there are several approved therapies, there is a high unmet medical need to improve the quality of life and ease of disease control.

KalVista went public in 2016 through a reverse merger with Carbylan Therapeutics and raised $78.2 million at $17 per share in its first public offering in 2018.

The Pipeline Looks Bigger Than It Is

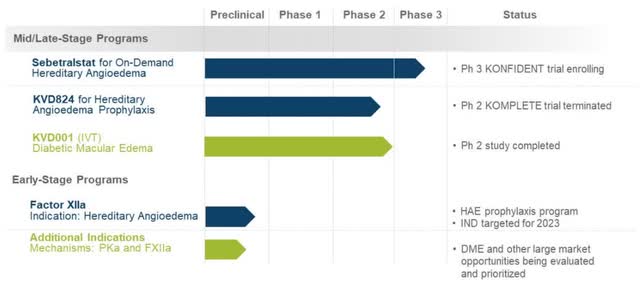

The origin of KalVista’s pipeline lies in the deep understanding of plasma kallikrein inhibitors. Prior to the change in strategy to focus on developing therapies for HAE, the molecules were also being investigated for diseases in diabetic macular edema (DME). In summary, however, KalVista’s research efforts have not been very successful in the past.

Investors should currently focus on KalVista’s lead product candidate, Sebetralstat, formerly known as KVD900, which is currently being investigated in a placebo-controlled Phase 3 trial as an on-demand therapy for HAE attacks. The results of the study are expected to be published in the second half of 2023 which, if positive, will form the foundation for a regulatory submission in the first half of 2024.

Since there is already very strong and meaningful data from the Phase 2 trial, I think it is very likely that the success can be duplicated in the Phase 3 trial. The Phase 2 study in 53 HAE patients demonstrated with statistical significance both the clinical efficacy across all primary and secondary endpoints and the overall safety profile of Sebetralstat.

The factor XIIa program clearly has great potential, but is still in preclinical development and investors should not assign a value to it at this time. In 2023, KalVista plans to file an investigational new drug application (IND) to move the program into human clinical trials.

The factor XIIa program has tremendous potential in the prophylactic treatment of HAE. It targets an enzyme that plays a key role in HAE and could block the underlying cause of HAE attacks. If successful in a proof-of-concept study, the program could be expanded in other large market opportunities in the area of inflammation and thrombosis.

Overview of Kalvista’s pipeline (Company Presentation)

KVD824 was investigated in a Phase 2 study for the prophylactic treatment of HAE. However, KalVista has terminated the study due to safety concerns, which indicate that KVD824 will no longer meet the requirements for a best-in-class oral prophylactic therapy.

In the beginning, the DME program with its product candidate KVD001 generated a great deal of interest and resulted in a collaboration with Merck (MRK). Following disappointing Phase 2 data in which the primary endpoint was missed, Merck did not extend the collaboration. However, as a dose-dependent clinical benefit on vision has been observed in certain patients, KalVista is still evaluating how to proceed with KVD001.

Financial Situation

Following the last capital raise following the publication of the Phase 2 data of Sebetralstat at a price of $36 per share, KalVista is currently in a good financial position. With $142 million in cash and a cash runaway until at least 2024, KalVista is funded across key milestones and significant value drivers. With the recently announced termination of the KVD824 Phase 2 trial, an additional $3 million in research and development costs can be saved on a quarterly basis.

In my opinion, investors should not fear dilution, as current prices do not reflect the value of Sebetralstat in any way. Nevertheless, I would like to mention that KalVista has access to an ATM with Cantor Fitzgerald, and can issue shares in the amount of $100 million. However, I expect a funding effort with the publication of Phase 3 topline data in the second half of 2023.

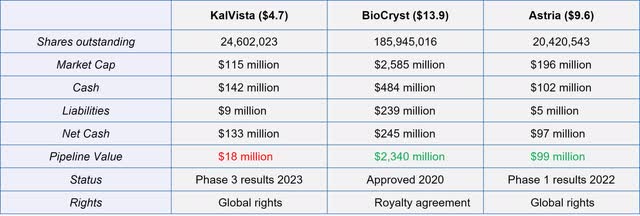

At current prices, KalVista has a negative pipeline value of approximately $18 million. Consequently, despite the good Phase 2 trial results and the independence to KVD824, investors do not believe that Sebetralstat will be successful.

KalVista is currently very attractively valued (Author’s Chart)

Investment Thesis

An investor should always be clear on the reasons for investing in a company. Therefore, I will present my reasons why I believe KalVista is an attractive investment at current prices.

KalVista currently has a negative pipeline value even though its lead product candidate is being investigated in a Phase 3 trial in an attractive orphan indication with high unmet medical need. In my opinion, an investment in KalVista given a negative pipeline value is a good opportunity to speculate on a data run in the second half of 2023. The HAE market is very attractive and KalVista has the opportunity to take market share from the established players with a differentiated and more convenient mechanism of action.

Personally, I expect KalVista to reach a positive pipeline value of at least $200 million before data readout, which equates to at least $10 per share. Although much higher prices are certainly possible with positive data, I would like to limit my investment thesis to the data run at this time and reduce risk prior to the data release. The release of the data represents a binary event and carries tremendous risk.

Even though the peer comparison below does not allow a complete comparison, one can still conclude that KalVista is undervalued based on current share prices. BioCryst (BCRX), with its approved oral drug for the prophylactic treatment of HAE, is a good example of KalVista’s potential pathway with positive data. Even Astria (ATXS), which still owes proof-of-concept, currently has a higher pipeline valuation than KalVista. However, it should be noted that Astria is about to publish Phase 2 data, while KalVista has no catalysts scheduled for the next 12 months.

Comparison of companies with oral HAE therapies. (Author’s Chart)

Market Outlook In HAE And Potential of Sebetralstat

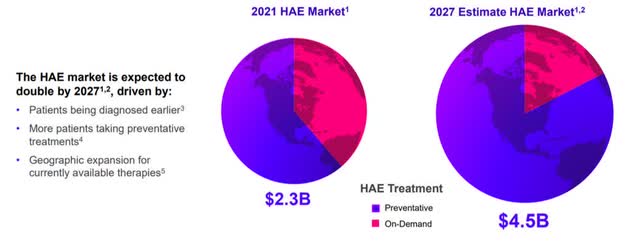

Having made my investment thesis clear, I want to justify why I attribute substantial value to Sebetralstat. The current standard of care provides both on-demand and preventive treatments. Overall, 6000-8000 patients are affected in the US and up to 15,000 patients in Europe, which translates into up to 100,000 annual attacks in the US and 150,000 in Europe. According to forecasts, the HAE market will show tremendous growth in the coming years, reaching 4.5 billion in 2027. The market will focus more and more on the prophylactic treatment, nevertheless patients will always need a back-up solution in case of an attack.

Global HAE Treatment Market is Substantial and Growing (Astria Company Presentation)

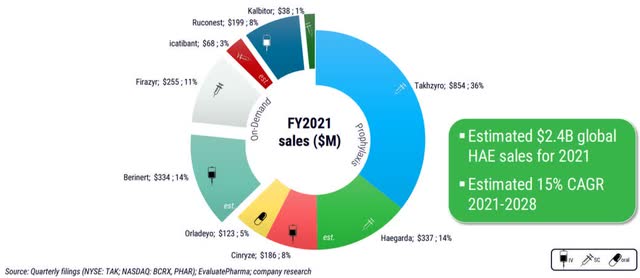

Currently, there are a number of approved products for HAE patients. The largest player in the HAE market is Takeda (TAK) with its product Takhzyro, which is administered subcutaneously every two weeks for prophylactic treatment. For on-demand treatment of HAE, Takeda offers Firazyr and Kalbitor as subcutaneous injections, generating in total approximately 50% of sales in the HAE market.

Overall, the HAE market is very competitive and new product candidates are attracting very high interest. For example, in 2015, Shire (now Takeda) bought Dyax and its product candidate Takhzyro for $5.9 billion after robust Phase 1b data.

HAE is a Meaningful and Growing Global Market (Pharvaris Company Presentation)

Despite the large number of approved therapies, the HAE market continues to have a high unmet medical need. Except for the oral prophyhlactic drug Orladeyo, all therapies are administered by injection, which is generally less convenient for patients and reduces patient compliance. Injections present a hurdle for patients because, despite their effectiveness, they can cause pain at the injection site, are time-consuming to administer, and are difficult to store.

All approved on-demand options have significant shortcomings. Early treatment improves outcomes but undertreatment and late treatment are common. Source: KalVista

The barrier of using injections is also shown by studies. These show that less than 40% of all treated attacks are dosed within the first hour, and up to 45% of attacks weren’t treated at all. These numbers prove that patients want new medicines that deliver on all fronts.

People Living with HAE Desire HAE Therapy that can Deliver on ALL Fronts (Pharvaris Company Presentation)

KalVista believes that its oral product candidate, Sebetralstat, has the potential to change the treatment paradigm for this disease. People living with HAE actively seek new products that demonstrate improvements in efficacy, safety and tolerability, and convenience. In addition, research with patient physicians and payers indicate that the drug profile of Sebetralstat could meet these requirements in case of positive study results. As a result, 93% of all patients said they could imagine switching to the oral product candidate Sebetralstat if approved.

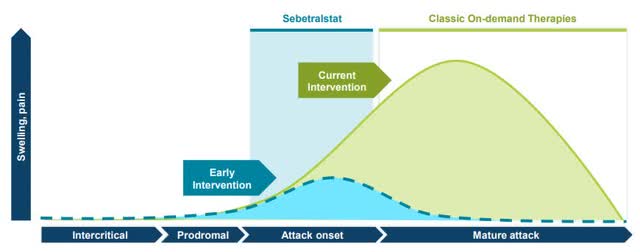

The benefits of Sebetralstat arise mainly from the fact that the drug is taken earlier due to the lower barriers. Patients should take the drug at the first sign of symptoms. Combined with the rapid uptake of the drug, Sebetralstat has the potential to stop the development of an attack at an early stage while symptoms are still mild and swelling is not severe. Early treatment of attacks leads to better overall disease management and prevention of attacks reaching the critical stage of significant swelling and discomfort.

We therefore believe that a safe, oral on-demand treatment has the potential to become a preferred alternative for patients currently using injectable treatments. Source: KalVista

Changing the Paradigm for On-Demand Treatment (Company Presentation)

Risks

In my opinion, I have made my investment thesis very clear in the article. For me, KalVista is currently an investment with an appealing risk-reward ratio. Nonetheless, in this section I would like to specifically address potential risks.

Although I currently think it is unlikely, safety concerns could also arise with Sebetralstat in the Phase 3 trial (see KVD824). I should mention that Sebetralstat has completed a Phase 2 study and management has reiterated that no safety concerns have been observed to date. Nevertheless, the biggest risk in my investment case results from the ongoing phase 3 trial.

Developments in the HAE market in general need to be monitored. For example, other competitors could succeed with their product candidates. For example, Pharvaris (PHVS) has a phase 2 readout for the on-demand treatment of HAE coming up in the fourth quarter. These competitors could grab important market shares from KalVista in the future. However, market success does not play a role in my investment thesis.

I don’t think dilution is very likely prior to the publication of the Phase 3 trial, which is a significant milestone and proves the value of the asset.

As my investment thesis suggests to reduce the risk before the publication of the final phase 3 data, I do not want to discuss the potential risks following the data readout at the moment.

Summary

After the termination of the trial with KVD824 for prophylactic treatment of HAE, KalVista was legitimately slammed by the market. Nevertheless, I consider the reaction to be exaggerated and do not believe that the market will continue to attribute a negative value to the lead product candidate Sebetralstat. Especially considering the fact that institutional investors have invested more than $220 million at prices of $36 per share following positive phase 2 data of Sebetralstat confirms me in my assessment.

The next mayor milestone is the topline data readout in the second half of 2023. KalVista is funded beyond this milestone into 2024, meaning that no dilution is to be feared in advance. I expect an adjustment of the undervaluation already in the run-up to the data release, which is supported by the peer comparison.

In my opinion, an immediate investment is not mandatory, as there are no immediate catalysts. Long-term investors can already grab a starter position now. Nevertheless, all investors should at least have the stock on the watch list when the data run could start in Q2 2023 and KalVista intensifies its public relations work.

Be the first to comment