MediaProduction/iStock via Getty Images

Investment Thesis

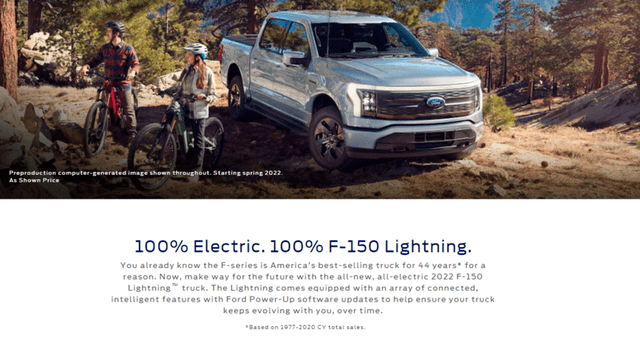

Ford Motor Company (NYSE:F) holds the interesting image of an American giant finally lumbering into the EVs market, currently dominated by the cutting-edge space-loving Tesla (TSLA). Though it may seem that Ford is late to the race, the company could be catching up in its own unique ways. Given that 75% of all vehicles sold in the US in 2021 come in the form of light trucks, Ford could have the upper hand, since its F-Series has been the best-selling truck for the 45th consecutive year. Its long-awaited release of the F-150 Lightning could be the gamechanger for Ford.

We will discuss whether Ford is still able to recover from TSLA’s lead. In the meantime, we encourage you to read our previous articles on TSLA, which would help you better understand its position and market opportunities in the EV and solar business.

Ford Is Indeed Four Years Late In The EV Race

It would be impossible to talk about the EV industry without mentioning Tesla. TSLA is the clear market leader in the EV market, with the leading market share of 69.95% in the US as of 2021 and a global market share of 14%, with Volkswagen (OTCPK:VWAGY) coming in second globally at 12%. By combining its full-stack autonomous driving software with breakthrough semiconductor chips, TSLA created its unique EV segment within the automotive industry.

In terms of manufacturing capacity, TSLA delivered 936K EVs in FY2021 and is projected to produce over 1.2M EVs in FY2022 from its two existing Gigafactories in Fremont and Shanghai ( based on 310K vehicles in FQ1’22 ). In addition, with its expanded manufacturing capacity of another 1M from Berlin and Texas Gigafactories, TSLA could potentially hit over 2M EVs by the end of 2022. In contrast, Ford delivered 27.1K EVs in FY2021, with a rather significant distance to cover, with a projected capacity of 600K EVs by 2023 and 2M by 2026. It is evident that Ford is indeed four years late into the EV game, which TSLA currently dominates. In addition, TSLA’s ambition runs deeper than any other automotive maker, given how the company had created an entire ecosystem of superchargers, solar energy production, and energy storage through its TSLA Energy segment.

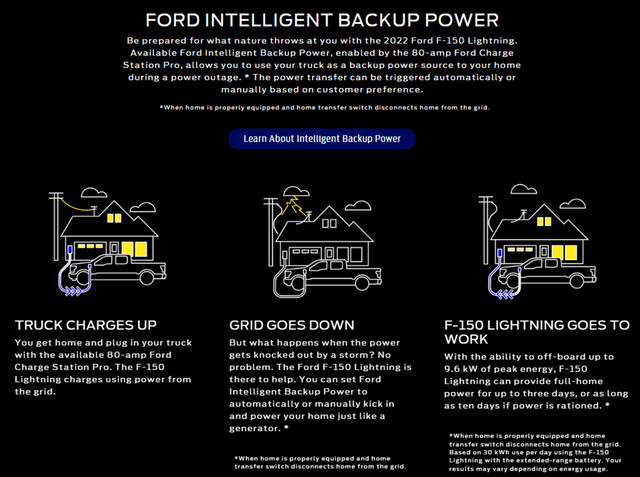

However, Ford is already learning the game by announcing its partnership with Sunrun Inc (RUN), the leading solar installation company in the US, in May 2021. Through the strategic partnership, Ford encourages its consumers to install solar panels, energy storage systems, and Ford Intelligent Backup Power, including its Ford Charge Station Pro and home integration system. The integrated system would be able to charge Ford’s F-150 Lightning electric truck slated to be delivered by FQ2’22, while also offering another backup energy source through the vehicle’s battery. Interestingly, Ford is among the first few automakers to introduce an EV that offers a bi-directional charging option. TSLA has previously been shown to be against it and voided the vehicle battery’s warranty if the owner was found to be using their vehicle “as a stationary power source.”

Nonetheless, we are of the opinion that the brilliant combination of EVs, solar panels, energy storage systems, and bi-directional charging capabilities are the future, given the frequency and severity of natural disasters in the US in 2021. The outcome could be an absolute goldmine for Ford moving forward, if TSLA does not quickly hop on to the bi-directional charging concept.

Ford Understands The Old-School American Dream

Ford’s F-150 Lightning

It is interesting that TSLA only released sedans, in the form of Model S & 3 and crossovers, through Model X and Y. On the other hand, in 2021, Ford chose to release an SUV Mustang Mach-E built on its expertise platform, pick-up trucks. In addition, Ford will start deliveries for its F-150 Lightning, an all-electric pick-up truck, in the next few weeks.

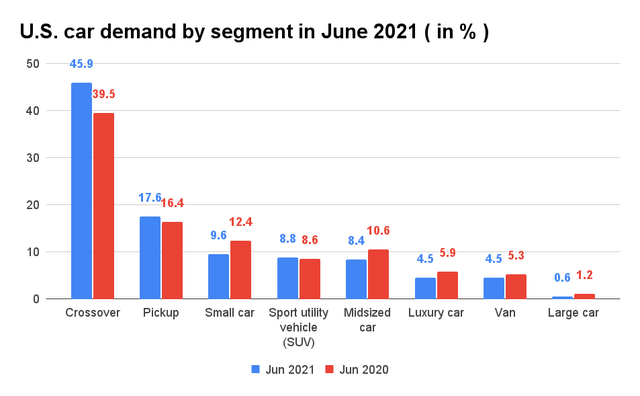

The US car demand by segment in June 2021

Now, why does this matter? In 2021, Market Beat reported that approximately 11.6M light trucks are sold in the US, accounting for 78% of all vehicles sold in the US then. It highlights the rising importance of the vehicle type as a long-term American staple. In addition, given that crossovers, SUVs, and pick-up trucks constituted the majority of the US automotive market share at 72.3% in June 2021, it made sense that Ford focuses its efforts on these popular segments, instead of competing with TSLA on the sedan segment. As a result, we expect the total market share for pick-up trucks to increase YoY when Market Beat announces new results in June 2022. Morningstar analyst David Whiston said:

Ford is turning itself around by focusing on light-truck models in the U.S., which we think is the right move given light trucks are over 75% of U.S. industry new light-vehicle sales. ( Seeking Alpha )

In the meantime, TSLA had indefinitely delayed the production date of its Cybertruck from the original 2022 timeline. The delay was initially caused by the COVID-19 pandemic, followed by 1.3M reservations for the Cybertruck. Though speculative, we believe that the delay is also caused by the fact that TSLA’s Cybertruck is already out-of-date, since it was initially introduced in late 2019. Given the competition that TSLA is set to face from Ford’s F-150 and Rivian R1T, it made sense for the company to go back to the drawing board for its next-generation trucks instead.

On the other hand, given TSLA’s indefinite delay and Ford’s breakthrough F-150 Lightning, we may expect more to choose the latter, given that the deposit for TSLA’s Cybertruck is only $100. Ford’s F-150 is already in production with the bi-directional groundbreaking features that TSLA has yet to introduce. It is a no-brainer really. Nonetheless, given the current global semiconductor chips shortages causing Ford to halt production in a few of its plants in March, we suspect the company would face the same issue for its new model, previously also reported in February 2022. With Reuters estimating 15K units of production capacity in FY2022, it is also nowhere enough to meet its current reservation of 200K for the F-150. As a result, truck enthusiasts may have to wait until 2024 to get their hands on the F-150, once Ford ramps up their production capacity to 150K annually by then. Like Nvidia (NVDA), a semiconductor chip designer, Ford’s growth and revenues seemed to be gated by supply as well.

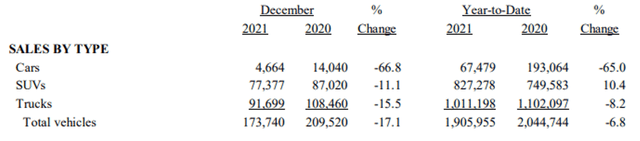

Ford’s Total Deliveries In FY2021

Nonetheless, it is important to note that though Ford delivered minimal EVs in 2021, the company compensated by delivering a total of 1.9M vehicles in the year. That is more than double the vehicles that TSLA had produced for the same year. In addition, trucks account for over 53% of Ford’s sales, which would potentially increase once the company delivers its F-150 moving forward. In addition, Ford is already on a $50B road map in fully transforming its factories worldwide through the next decade, in order to sell at least four EVs for every ten Ford automobiles by 2030. Given that Ford is also building four other factories to manufacture EVs and batteries, we expect Ford to catch up to TSLA’s dominance and manufacturing capacity by the end of the decade.

In addition, Ford is looking at the same EV advancement that TSLA is pioneering, from the monetization of full-stack software systems, EV battery systems, public and depot EV charging networks, on top of the partnership with RUN for the installation of home charging systems with the latter’s solar systems. As a result, Ford investors can rest assured that the company is already advancing its forward offense in the EV game.

So, Is Ford Stock A Buy, Sell, or Hold?

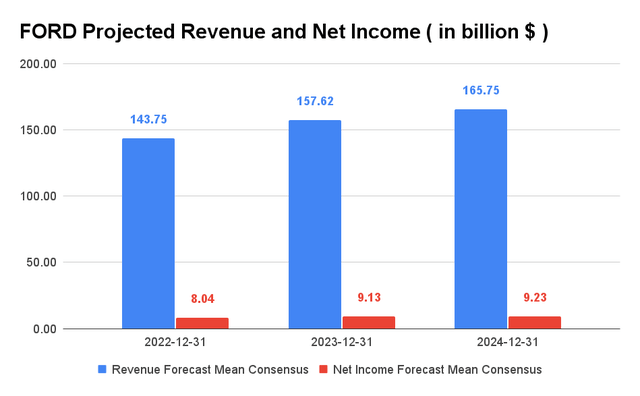

Ford Projected Revenue and Net Income

Ford is expected to report revenue growth at a CAGR of 9.5% over the next three years. For FY2022, consensus estimates that Ford will report revenues of $143.75B, representing YoY growth of 13.8%. Nonetheless, its net income is expected to normalize from FY2021’s highs of $17.93B to $8.04B in FY2022, though still representing a decent improvement from pre-pandemic levels.

Ford is currently trading at an EV/NTM Revenue of 1.15x, in line with its 3Y mean of 1.22x. Its valuation seems fair, since the company is still expected to report decent revenue growth moving forward. However, we still have to admit that Ford is undergoing massive restructuring to increase its EV production and is experiencing production delays due to the ongoing semiconductor shortages. Furthermore, given that the contract for port workers is bound for contract renewal in June 2022, we may also potentially see further disruption in the global supply chain if history repeats itself. Therefore, there might be a possibility of further retracement for the stock in the next few weeks, before recovery upon a positive catalyst, potentially the deliveries of F-150 Lightning.

Nonetheless, we still encourage investors to add in stages during this dip, given its steady historical execution since 1903 and that it is now trading at $15.39, down 40% from its 52 weeks high of $25.87. In addition, the EV market is big enough to accommodate multiple big players, early or late. In our opinion, Ford will get there, just a little slower. After all, there is no finish line here.

Therefore, we rate Ford stock as a Buy for aggressive long-term investors.

Be the first to comment