Jan Hetfleisch

Q3 recap and thesis

Ford Motor (NYSE:F) recently released its 2022 Q3 earnings results. After reporting a mixed quarter in Q2 (more on this later), F reported quite strong results in Q3. Its Non-GAAP EPS came in at $0.30, in line with consensus estimates. And its revenue from automotive came in at $37.2B, translating into a robust annual growth of 12.0% and beating consensus estimates by $90M.

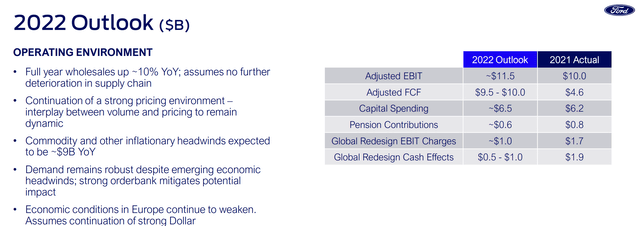

Looking forward, it also lifted its 2022 full-year outlook. It raised its adjusted EBIT guidance to $11.5B, representing a ~15% growth YoY. For its free cash flow (“FCF”), its new guidance is now between $9.5B and $10B, almost doubling its previous outlook of $5.5B to $6.5B. The main drivers of its optimism include the strength of its automotive operations and the restructured business models.

Of course, some headwinds are inevitable in the near term. And we will discuss two of them in particular in a later section: the recent 3k layoff and also the Argo AI shutdown. However, I see a healthy long-term growth curve ahead. And yet its current PE is in the single digit (only ~7x). For accounts that can sit out these short-term volatilities, the margin of safety is wide to ignore.

And in the remainder of this article, we will use our son’s UTMA account holdings to further illustrate our thinking. You will see why I’ll be happy to add more shares for this account at a price near or below $13 (translating into an FW PE of around 6.5x).

Source: author based on Seeking Alpha data.

UTMA account

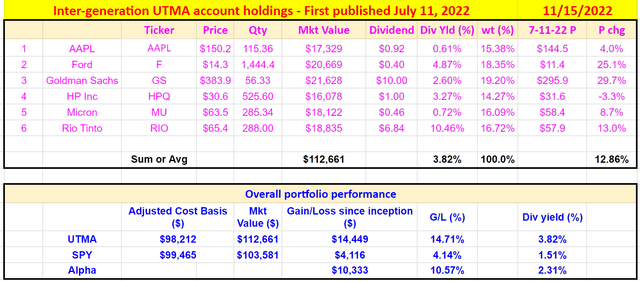

Readers familiar with our writings know that we have a young kid. And we have funded a small Uniform Transfers To Minors (“UTMA”) account for him. The basics of the UTMA account have been detailed in our recent article. The account is with Fidelity (and its webpage provides a good 101 into UTMA accounts). Key motivations for us included: providing some seed funds for our son and also the tax advantages these account offer. Our current holdings are listed below. A few notes:

- Due to the relatively small size of our account and the long-time horizon, we hold an even more concentrated portfolio than our other accounts. You should tailor your diversification and exposure accordingly.

- For performance tracing purposes, I used the prices on July 11, 2022 (the date I first published this portfolio) on SA as the entry price. So, it’s easier for readers to verify and track its performance.

- Our actual portfolio size is substantially smaller. The $100k starting size used here is just to simplify the math.

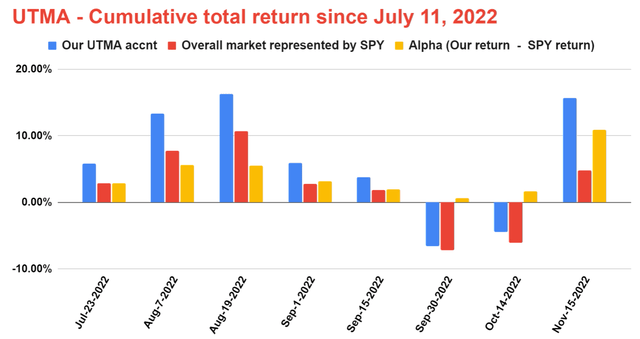

As can be seen from the two charts below, F is the second-largest holding in our UTMA portfolio, representing 18.3% of our total assets. It is also the second best-performing holding since July 11, with a 25.1% price appreciation.

Overall, the UTMA account has consistently outperformed the overall market (represented by SPY) since July amid extreme market turbulence, despite (probably because of) the fact that it only holds a total of 6 stocks. It is currently outperforming SPY by a large margin of 10.6% as of Nov 15 (we update the account monthly in the mid of each month). Note our picks yield much higher (3.82%) than SPY (about 1.51%), and the returns reported here were adjusted for dividend yields.

And next, you will see why I’ll be happy to add even more F shares to this account at a price near or below $13 given the Q3 results.

Source: Author, our Son’s UTMA current holdings Source: Author, UTMA cumulative return since July 11 vs. SPY returns.

F: expected return at $13 entry

The consensus estimates projection for its FW EPS is about $2. And an entry price of $13 or below means a forward PE of 6.5x, if you recall from an earlier chart, its average PE has been about 7.6x. Therefore, a $13 entry price provides a wide margin of safety of ~15% to weather short-term volatilities. In the long term, as detailed in our earlier article:

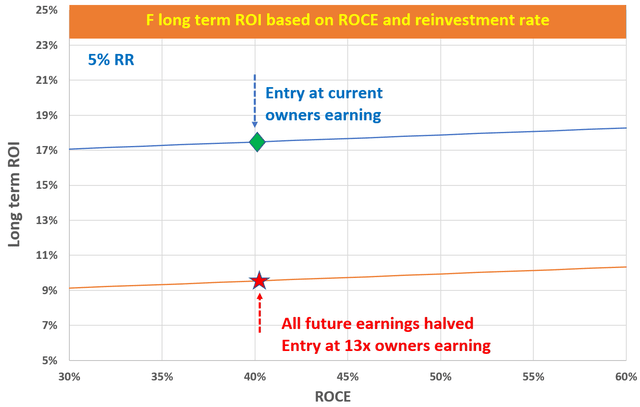

The ROI (return on investment) in the long run is simply a function of two things: A) the price paid to buy the business and B) the long-term growth rate of the business. More specifically, part A determines the owner’s earning yield (“OEY”). And Part B, the long-term growth rate, is governed by ROCE (return on capital employed) and the Reinvestment Rate.

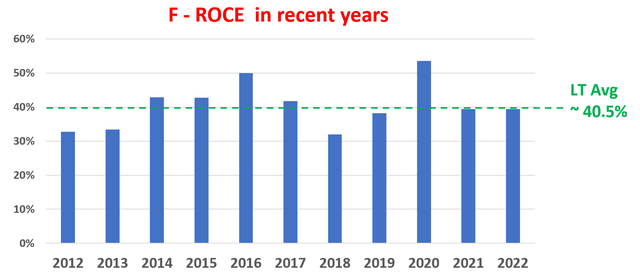

And a 6.5x PE already provides an OEY of around 15.4% to start with (part A). For Part B, F’s ROCE has been averaging 40.5% as seen from the chart below. Assuming a moderate 5% reinvestment rate (“RR”), the real long-term growth rate would be about 2% (40.5% ROCE * 5% RR = 2% long-term growth rate). The nominal growth rate would be higher if we add an inflation adjustment. And the ROI at a 6.5x PE would be already more than 17% even without the inflation adjustment (as highlighted by the blue line and green diamond in the second chart).

As a thought experiment to illustrate how wide the margin of safety is, imagine F loses half of its earnings (as illustrated by the red line in the second chart). Now the entry PE would double to 13x, and the OEY will half to 7.7%. Combining the contribution from the growth rate (2% real or 5% if adding a 3% inflation escalator), the investment would still provide a long-term return in the range of 9.7% to 12.7%.

Source: author based on Seeking Alpha data. Source: author based on Seeking Alpha data.

Risks and final thoughts

F faces all the macroeconomic risks as the rest of the economy (inflation, labor cost, raw material cost, and the possibility of a recession). Here I will just focus on two risks more specific to F: the recent 3k layoff and Argo AI shutdown. In a recent announcement, F confirmed the layoff of 3,000 jobs as part of its plan to move away from ICE (internal combustion engine) cars to EVs (electric vehicles) and AVs (autonomous vehicles). F indeed has a chance to be a leader in the EV and AV space, but the competition will be fierce and the path full of potholes. As a notable example, F had to record a $2.7 billion impairment in Q2 on its investment in Argo AI (and recall that it has also recently booked a $2.4 billion loss on its Rivian investment). As of this writing, it is expected that Argo AI will be shut down, and it remains unclear how the pieces of this self-driving pilot program will be picked up by F and Volkswagen.

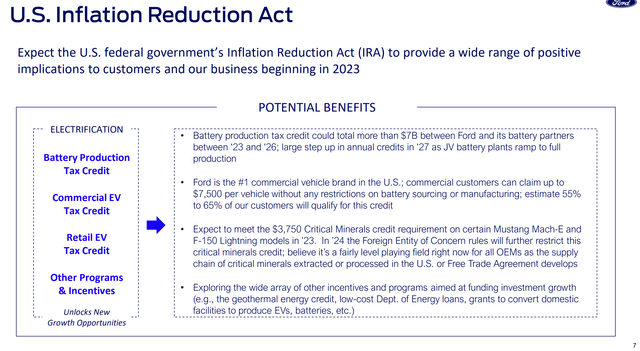

All told, the gap between F’s upside potential and its current valuation is too wide to ignore despite the uncertainties in the near future. But for accounts like our UTMA that can sit out these short-term issues, it offers outsized annual return potential in the upper teens. And note that my above analyses assumed a 5% reinvestment rate, which is very much on the conservative side the way I see things. For example, I expect the US Inflation Reduction Act (“IRA”) to provide a wide range of positive implications to the business beginning in 2023. The credits and subsidies offered in this act would effectively drive up its reinvestment rates and further boost its long-term growth potential.

Be the first to comment