Scott Olson

Investment Thesis

Foot Locker, Inc. (NYSE:FL) is a company going through a transition in just about every conceivable way. FL’s business is transitioning from physical stores to e-commerce, and its physical stores are transitioning from the mall to off-mall. Their products are transitioning from mainly Nike products to more diversified products from a mix of vendors, and if that weren’t enough change, FL is transitioning to a new CEO. FL’s customers are changing too by dressing more casually and becoming more health and fitness-focused, both trends benefitting FL. Change brings uncertainty, and Wall Street does not like uncertainty. As a result, shares of FL have suffered, creating a buying opportunity for savvy investors.

Overview of Foot Locker’s Business

FL is a specialty retailer focused on selling sneakers and athletic apparel. Its mission is to fuel a shared passion for self-expression, create unrivaled experiences for its consumers, and be at the heart of the sport and sneaker communities. FL is headquartered in New York City and has stores across the United States, Canada, Europe, Australia, New Zealand, and Japan. The majority of these stores are located within shopping malls. With thousands of stores around the globe, FL’s store brands include Foot Locker, Kids Foot Locker, Champs Sports, Eastbay, atmos, WSS, Footaction, and Side Step. FL also has a growing e-commerce business, with 16.9% of sales coming digitally. Most of FL’s products come from one vendor, Nike (NKE), making up 68% of all purchases. However, management believes their customers desire multiple brands and have emphasized diversifying FL’s vendor mix.

Foot Locker’s Track Record for Growth and Profitability

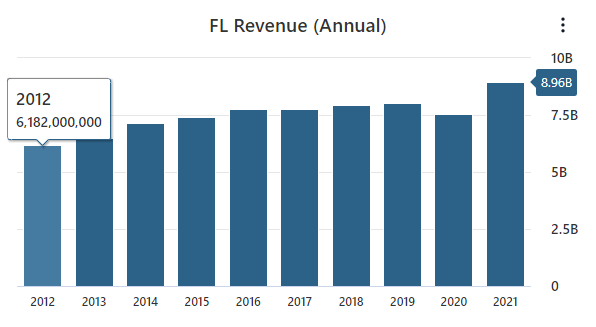

Before I dive into some of the head winds that FL is facing moving forward, I’d like to take a look at FL’s track record of growth and profitability over the last decade because I believe in investing for the long term, so I think it’s important that any potential investment have a track record of persistent earnings growth and industry leading profitability. FL’s top line growth has not been great over the last decade only growing 44% from $6.18 billion to $8.96 billion.

FL Data by Stock Analysis

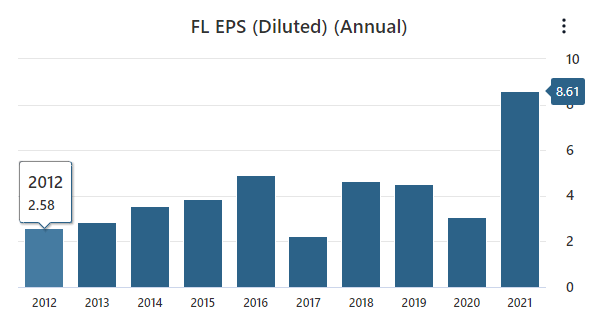

On a positive note, FL has been committed to returning capital to shareholders, over the last decade FL has bought back almost a third of the company’s outstanding shares. As a result, FL has grown EPS from $2.58 in 2012 to $8.61 in 2021, an increase of 233% over that time.

FL Data by Stock Analysis

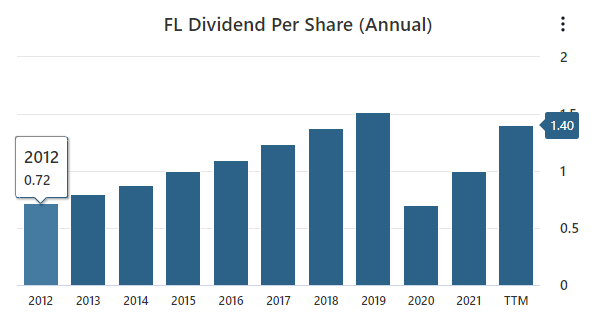

Management has consistently increased the dividend as well over the past 10 years, only briefly decreasing the dividend during the pandemic. Now that the pandemic is seemingly other, management is rapidly growing the dividend once again from $0.72 in 2012 to $1.40 over the trailing 12 months, almost a 100% gain over that period.

FL Data by Stock Analysis

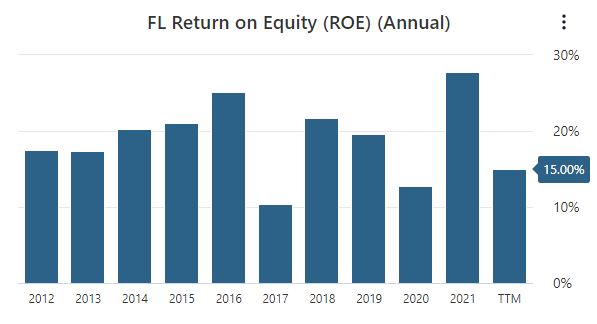

FL has also been impressive in terms of profitability over the last decade averaging a ROE of 19.35% over that period with just two years under a 15% ROE, one of those years during the pandemic in 2020. However, over the trailing twelve months FL has not been more profitable than the sector median with an ROE of 14.91% compared to a sector median ROE of 14.93%.

FL Data by Stock Analysis

These results are a mixed bag for me regarding FL’s track record of growth and profitability. Of course, stock prices are based on future performance and the market’s perception of those results. However, I like to invest for the long term, and I expect my investments to at least double their revenue and earnings over a 10-year period. I also invest in companies trading at a discount to their long-term average P/E multiple. That way, I have two ways to win. First, as the company continues to earn more, the price will eventually go up. Second, as the P/E multiple expands to the long-term average P/E multiple, the price will also go up.

Companies don’t grow forever. Eventually, they get so big they run out of growth opportunities, but before growth gets to 0%, growth slows to 2-3% per year. That’s why I look for companies with a solid track record for growth and profitability because how can I expect the company to double earnings in the next ten years if it couldn’t grow at that rate in the past ten years? This is purely a way to screen investments, as some context is always needed. There are times when companies have slow growth for an extended period and find a way to turn around the business. Let’s look at a few potential growth drivers for FL moving forward.

FL Outlook Moving Forward

Since most of FL’s sales are from physical stores and roughly 76% of FL’s stores are located in Malls, FL’s future largely depends on foot traffic within Malls. Unfortunately, the rise of e-commerce has devastated Malls over the past several years. Consumers can shop various stores and brands from the comfort of their homes, where they used to travel to a mall. The pandemic also put a lot of pressure on Malls forcing many of them to close their doors. A recent study by Coresight Research estimated that 25% of U.S. malls will close during the next five years, equivalent to 250 malls.

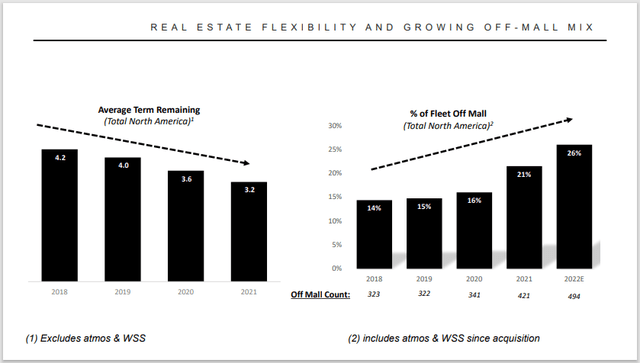

With so many malls expected to close in the coming years, there’s a lot of pressure on FL to move out of the malls and shift to e-commerce. FL has made progress with this off-mall initiative, increasing its off-mall store count from 323 off-mall stores in 2018 to 494 off-mall stores today. FL has also shrunk the average term length of its mall leases from 4.2 years remaining in 2018 to 3.2 years remaining last year. The off-mall initiative is excellent, but I see this as a defensive move, something FL has to do to maintain revenue and earnings rather than grow them.

FL Data from FL 2Q 2022 Earning Release

FL’s strategy to move stores off the mall includes opening new Community and Power Foot Locker Stores. Community Stores provide customers with community spaces focused on creating trust with local consumers to create a better shopping experience. Power Stores are larger stores with dedicated activation spaces that are used for regularly scheduled events for sneaker fans.

Last quarter FL opened or converted 25 new Foot Locker Community and Power Stores which nets FL at 100 of these stores. With a goal of opening 300 Community and Power Stores by 2024, it’s clear that FL wants to create more customer engagement with these stores. I feel this is important for the future of brick-and-mortar stores. You must bring a more personal experience with physical stores since the internet has mastered the impersonal shopping experience. Management has been bullish on these Community and Power Stores, COO Franklin Bracken stated on the latest earnings call,

Our community and Power stores continue to deliver sales above their plan and outperform their regional benchmarks in the fleet, giving us ongoing conviction in our rollout of the formats.

It remains to be seen whether these Community and Power Stores will be a driver of earnings growth or if FL can move into new, high-foot traffic locations faster than the malls that house FL’s current stores will close their doors for good.

Another concern for FL is Nike. NKE is by far FL’s largest vendor making up 68% of all purchases. This is a scary spot for FL because NKE has been dramatically reducing the number of retailers they do business with to promote better their own stores and online sales in a direct-to-consumer push. So far, FL has been spared, and NKE has been criticized for this move. But if NKE decides to go all in on its DTC strategy, then FL could lose 68% of its business. As one of NKE’s top retailers, I doubt this will happen, but FL needs to find the right balance of keeping the NKE relationship and diversifying away from it. This will be a problem for new CEO Mary Dillon to figure out.

New CEO at FL

In August, FL announced that former Ulta Beauty (ULTA) CEO, Mary Dillon, would take over as the new President and Chief Executive Officer at FL. The news excited the market, and shares of FL rose 19%. Dillon served as CEO of ULTA for eight years before joining FL and established an impressive track record by tripling ULTA’s stock price and doubling the number of stores in its network. Part of Dillon’s strategy while at ULTA was to increase its e-commerce business. Since ULTA is in the cosmetics industry, increasing digital sales is not easy because consumers generally want to try makeup and other beauty products before they buy. One of the tools ULTA implemented to drive e-commerce growth is a feature on the Ulta Beauty app called “Glam Lab,” which allows users to virtually try on different makeup colors before they buy.

Critical initiatives for FL are to continue moving stores out of malls, increase e-commerce sales, and diversify its vendor mix. Dillon has a lot of experience with growing store count and expanding e-commerce for a specialty retailer. Another key initiative for FL will be fostering the sneaker community within its stores, and Dillon also has experience with this initiative. She has done an exceptional job making ULTA stores the premier beauty destination. ULTA stores are full of knowledgeable associates who help educate customers about new products and help customers try products on. In addition, every store offers a full-service salon so customers can purchase services and products in-store, which I believe is essential for brick-and-mortar retailers. ULTA stores are more than a store but communal places for beauty products enthusiasts. Look for Dillon to try to implement the same experiences for the sneaker community inside FL stores.

FL – Valuation

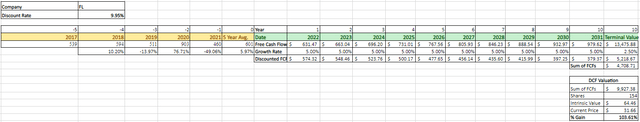

We will run a discounted cash flow analysis to find FL’s intrinsic value. We’ll begin the DCF by taking the average of the FL’s free cash flows over the past five years, which is $601 million. I want to be cautious about the growth rate we use for this DCF analysis due to the risk factors we’ve previously discussed, including the decline of American malls and the over-reliance on NKE. Therefore, we’ll use a modest 5% growth rate over the next ten years. From there, we’ll use a 2.5% growth rate to determine the terminal value. Finally, we’ll use a discount rate of 9.95% based on a calculation of the weighted average cost of capital. The sum of the free cash flow is $9.92 billion. Dividing this figure by the 154 million shares outstanding, we end up with an intrinsic value of $64.46. Therefore, based on this DCF calculation, investors stand to gain 103.61% from the current share price.

An over 100% return sounds great, but it may be too good to be true. Therefore, we should verify this intrinsic value using another valuation method, a comparative analysis. The 5-year average P/E ratio for FL is 11.70, which compares favorably to the current P/E of 6.49. If we take FL’s earnings per share from the trailing 12 months of $4.95 and multiply it by FL’s 5-year average, we end up with an intrinsic value of $57.92, which represents an 80.70% return.

Summary

Though the DCF analysis and comparative analysis show that FL is grossly undervalued, I am still hesitant to say FL is a buy. For FL to reach its 5-year average P/E again, there needs to be some catalyst that drives its earnings higher. Though FL is working to move its stores out of malls, introducing new store formats, and diversifying away from its largest vendor, I feel these are moves that need to happen to prevent earnings from declining rather than grow them. I believe the new CEO, Mary Dillon, is a great addition and the right woman for the job, but it’s still very early in her tenure, and I haven’t read much about her plans to turn the business around. FL faces many challenges, and the current low valuation reflects this, but for now, I’ll hold until I see more catalysts for growth.

Be the first to comment