Tyler Kaufman/Getty Images Entertainment

Investment Thesis

Foot Locker (NYSE:FL) has sold off following Nike’s decision to focus on selling direct to consumer. Nike (NKE) had a very stretched valuation throughout 2021, and has been telling investors new stories about how the company can grow.

Direct to consumer sounds good and all, but it may be less efficient and less realistic than the market expects. With the price of gasoline haven risen so dramatically, it is not very efficient to ship one pair of shoes at a time to consumers’ doorsteps. And, that is if consumers even want that in the first place. Shoes need to be purchased in-store so that consumers can try them on, ensure they fit, and test the products’ comfort. Knowledgeable employees provide advice on the sneakers’ functions and features. Also, many of Foot Locker’s teenage shoppers are unlikely to be shopping online with a credit card in hand, but instead shop in-store with cash. Foot Locker thus plays a vital role as an intermediary in the process of purchasing a pair of shoes.

Warren Buffett likes to think of the stock market as a character who knocks on your door every day and presents you with prices:

This imaginary person out there – Mr. Market – is kind of a drunken psycho. Some days he gets very enthused, some days he gets very depressed. And when he gets really enthused, you sell to him. And if he gets depressed, you buy from him.

Mr. Market has gotten quite depressed when it comes to Foot Locker. While risks remain, we see returns of 17% per annum in the decade ahead.

Buying A Dollar For 50 Cents

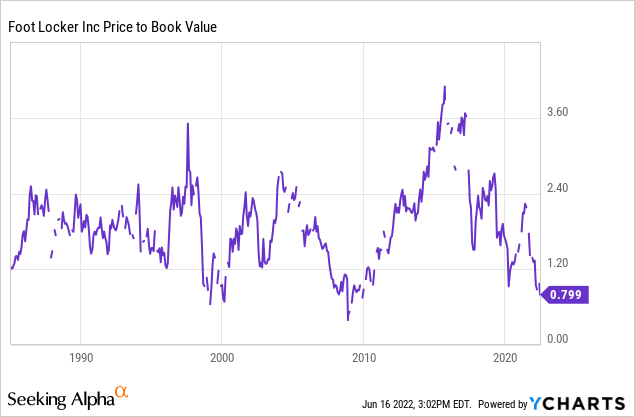

Famed value investor Mohnish Pabrai likes to look for opportunities where, “Heads I win, tails I don’t lose much.” This is the case for an investment in Foot Locker stock, which now trades for less than book value despite its 26% return on equity.

Foot Locker’s price to book (P/B) is near where it traded in 2000, 2009, and 2020, signaling we may be near the bottom once again. Just a few years ago, the company’s P/B was at 3.6x. This is a tale of market irrationality as investors swing from fear to greed and vice versa. Bear in mind that the company made some large acquisitions of late and may have overpaid.

Shareholder-Friendly Management

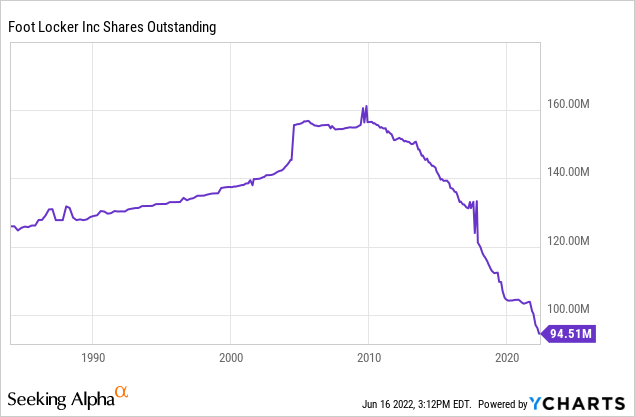

Foot Locker’s management has actually been quite shareholder friendly. The company has been repurchasing shares like crazy, and has enough working capital on the balance sheet to continue that trend. The company has a $1.2 billion share repurchase program. Foot Locker also has a 5% dividend that is well covered by net income.

Risks

First, Foot Locker is reliant on a select few suppliers/manufacturers such as Nike. If the company were to lose a major brand, it would make their store less appealing to shop at. The good news is that Foot Locker is so large, that companies like Nike prioritize them as a partner. If a company like Nike did cut out Foot Locker, it would be a huge hit to both companies’ sales and profits.

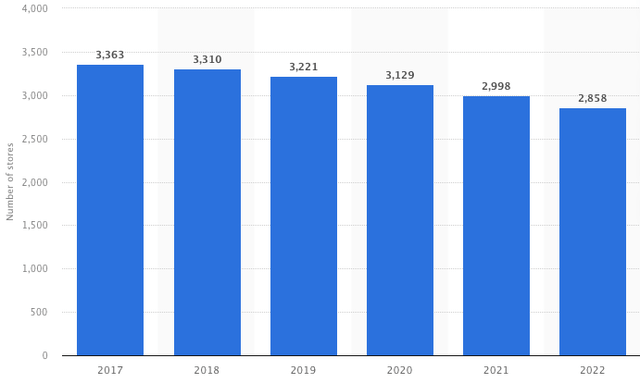

It is difficult for Foot Locker to establish a moat that protects it from competition. You could argue the company has an economies of scale or brand moat that has allowed it to remain competitive since 1974. But, this is a fairly weak argument as competitors often enjoy the same advantages. Competition is thus a risk, whether it be Nike, Amazon, or brick-and-mortar retailers. Foot Locker is also focusing on selling more through its e-commerce sites, and its store count has decreased:

Number of Foot Locker Stores Worldwide (Statista)

Investors will also have to keep an eye on how management is handling the company’s liabilities. The company had $2.77 billion of capital leases and long-term debt in the past quarter.

A Contrarian Growth Story

Foot Looker should be able to grow its FCF per share at 6% per annum over the decade ahead.

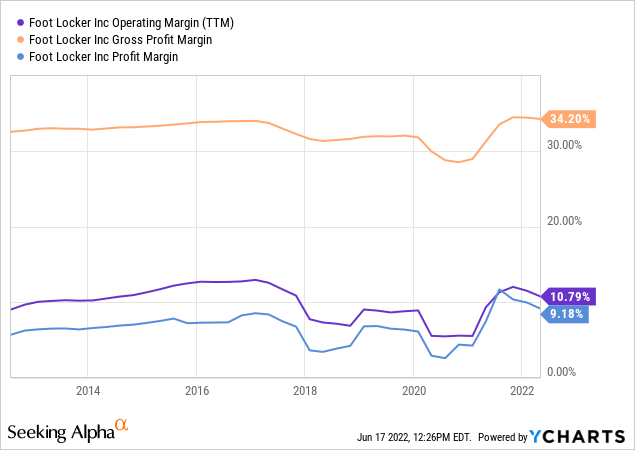

The company’s margins have been remarkably stable despite all of the pressures surrounding the business:

There was of course a drop-off in 2020 as malls and retail stores around the country closed in the midst of the pandemic, but we have seen a rebound since.

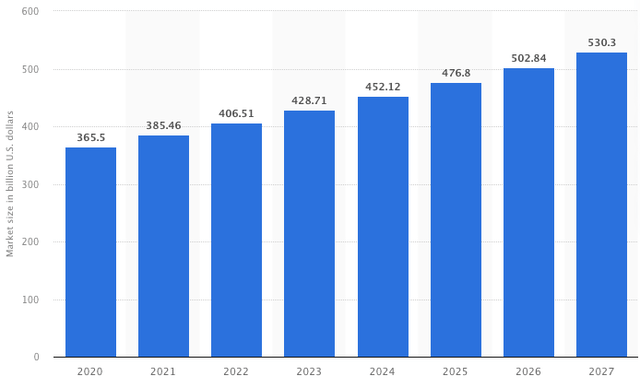

Many of the pressures Foot Locker faces have been covered above, so let’s cover the tailwinds the company enjoys. The company’s new acquisitions show promising growth. On top of this, there are the macroeconomic tailwinds. The U.S. is the company’s primary market. Wages in the United States are projected to grow at 4.8% per annum through to 2032, increasing the spending power of Foot Locker’s customers. Spending power in some of the company’s global markets could grow even faster. Globally, the footwear market is projected to grow at 5.5% per annum through to 2027:

Global Footwear Market Size (Statista)

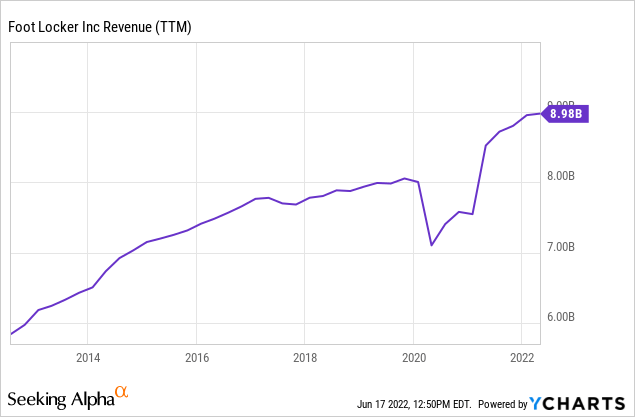

Meanwhile, revenue at Foot Locker continues to grow:

We believe analysts’ bleak outlook for Foot Locker is overdone. The company is an essential intermediary and will continue to be so. With enormous amounts of profits and working capital compared to the market cap, the company will continue to buyback shares.

If we take the average of the company’s free cash flow over the past four years, we get $616 million, or $6.52 per share. Given the tailwinds and headwinds discussed, it is possible the company is able to grow this free cash flow. But to be conservative, we are estimating zero growth. Meanwhile, the company should be able to maintain its dividend and buyback shares. If the price of the stock stays cheap enough, we estimate the company can buyback 6% of its shares outstanding per year, resulting in 52.50 million shares outstanding in 2032. This gives us $11.73 of free cash flow (FCF) per share in 2032, representing growth of 6% per annum. eBay (EBAY) is a great example of how this financial engineering works.

Valuation

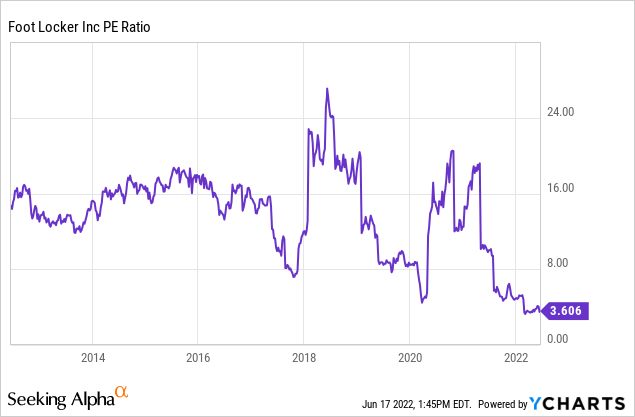

Our 2032 price target for Foot Locker is $106 per share, indicating a return of 17% per annum with dividends reinvested.

- This is the result of assigning a terminal multiple of just 9x to the 2032 FCF per share of $11.73. This is conservative given the company’s historical PE range:

Conclusion

An investment in Foot Locker appears to come with an asymmetric risk-reward. The company continues to be an essential intermediary, with enduring industry tailwinds. Sentiment and stories have driven down the price of FL stock, which now appears to be offering 17% per annum upside. Investors must continue to monitor management, suppliers, financials, and competitors going forward. However, we see an opportunity where, “Heads I win, tails I don’t lose much.”

Be the first to comment