Solskin

One of the advantages of being disorganized is that one is always having surprising discoveries.”― A.A. Milne

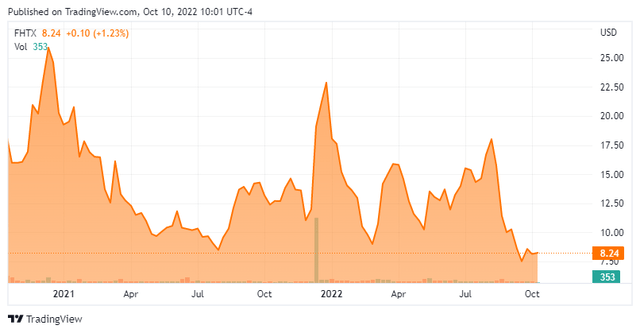

Today, we take our first look at Foghorn Therapeutics Inc. (NASDAQ:FHTX). This small biotech concern came public in 2020 and now finds itself in Busted IPO territory. In a testament to how cruel 2022 has been to small biotech concerns, Foghorn is one of myriad biotech stocks that currently trade for less than the net cash on its balance sheet. The company does have a bevy of early stage drug candidates currently in development. An analysis follows below.

Company Overview:

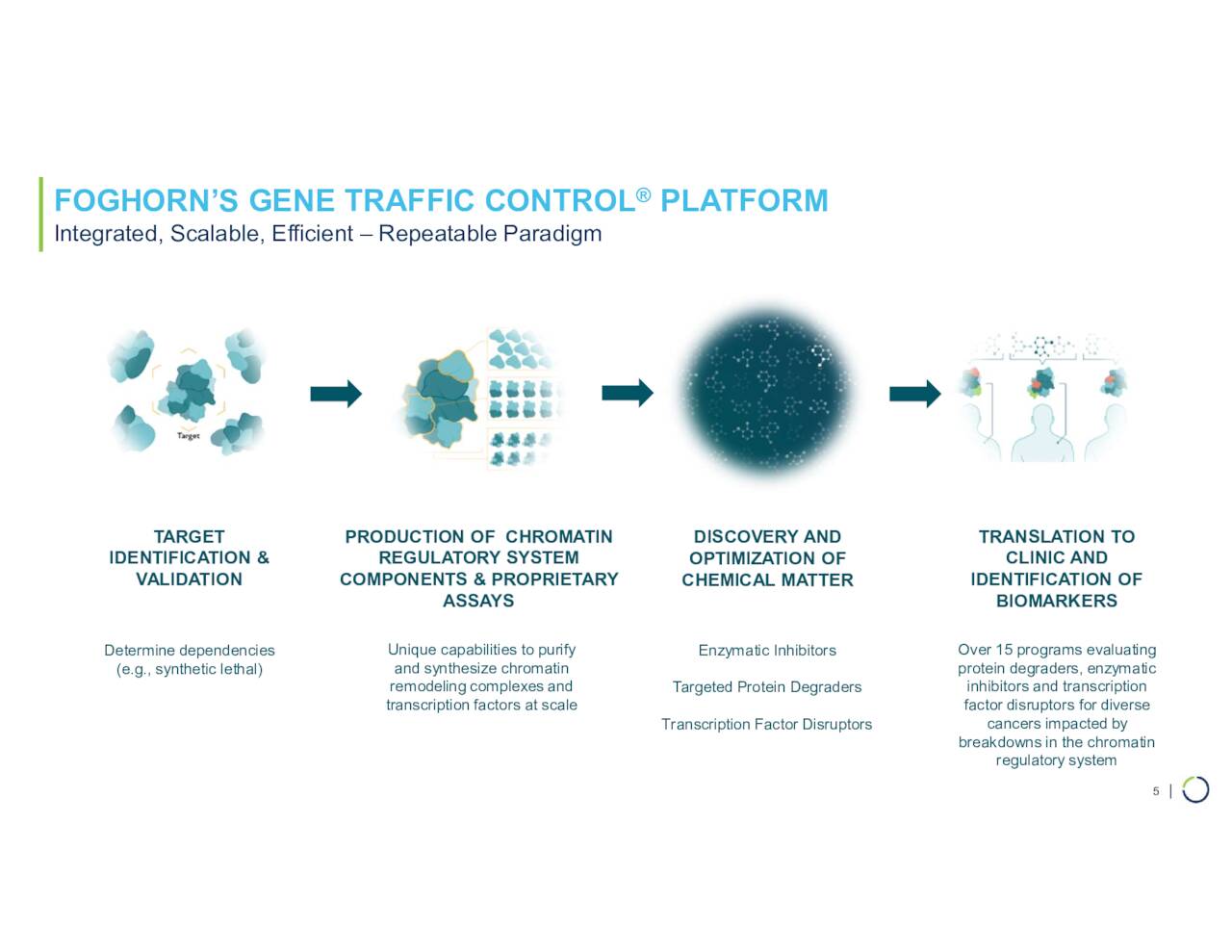

Foghorn Therapeutics is based just outside of Boston in Cambridge, MA. This clinical-stage biopharmaceutical company is focused on developing medicines targeting genetically determined dependencies within the chromatin regulatory system. The company develops drug candidates utilizing its proprietary Gene Traffic Control platform that identifies and validates potential drug targets within the system. The stock currently trades for just over $8.00 a share and sports an approximate market capitalization of $330 million.

September Company Presentation

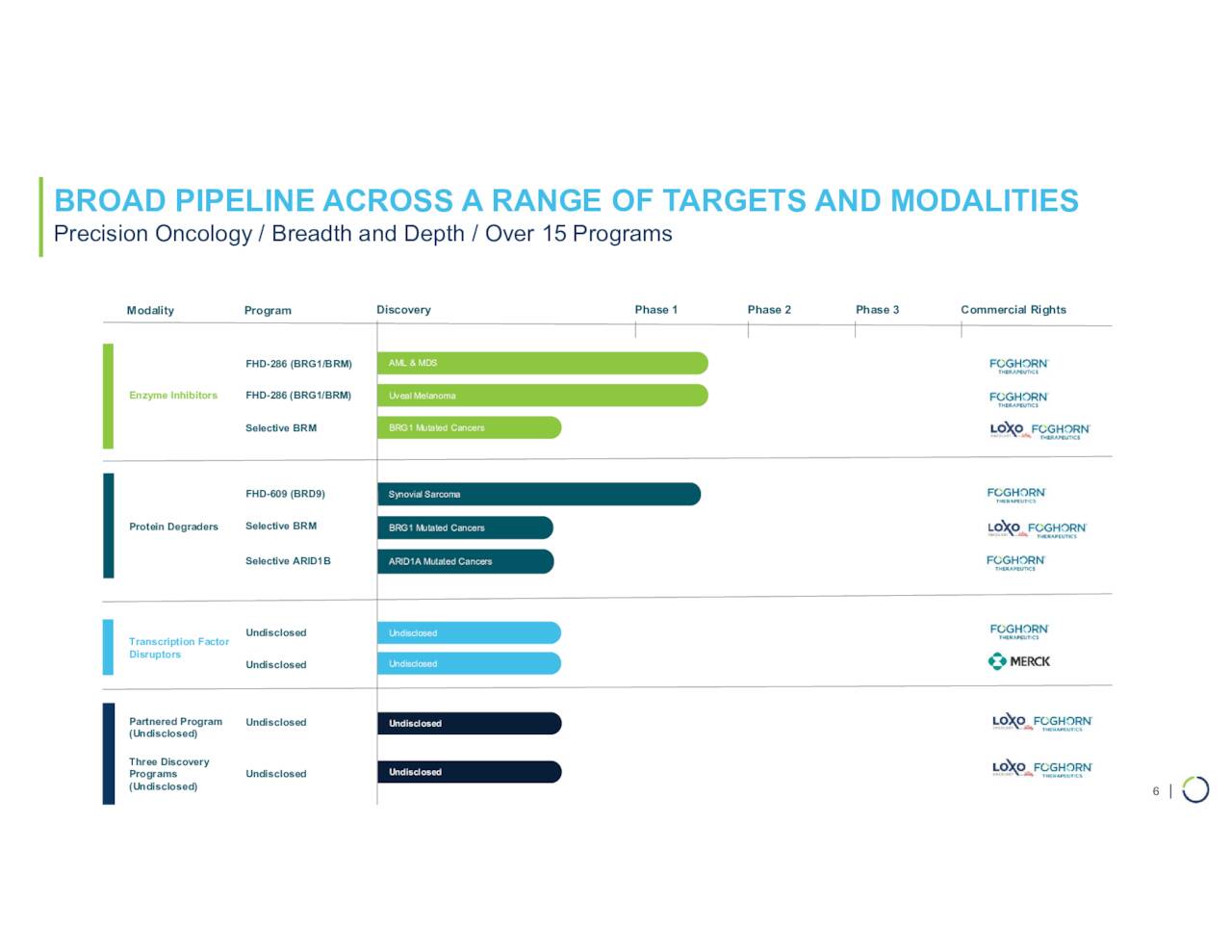

The company is utilizing enzyme inhibition and protein degradation approaches to potentially treat cancers, including uveal melanoma and synovial sarcoma. Foghorn is targeting one of the ways cells regulate gene expression by using chromatin in the so-called chromatin gene regulatory system. It has dubbed this approach “Gene Traffic Control.” Foghorn has developmental partnership deals with drug giants Merck (MRK) and Eli Lilly (LLY). The partnership with Loxo Oncology, a division of Lilly, brought in a $380 million upfront payment. The one with Merck consisted of a $15 million upfront payment as well as a potential $410 million in various milestone payouts.

September Company Presentation

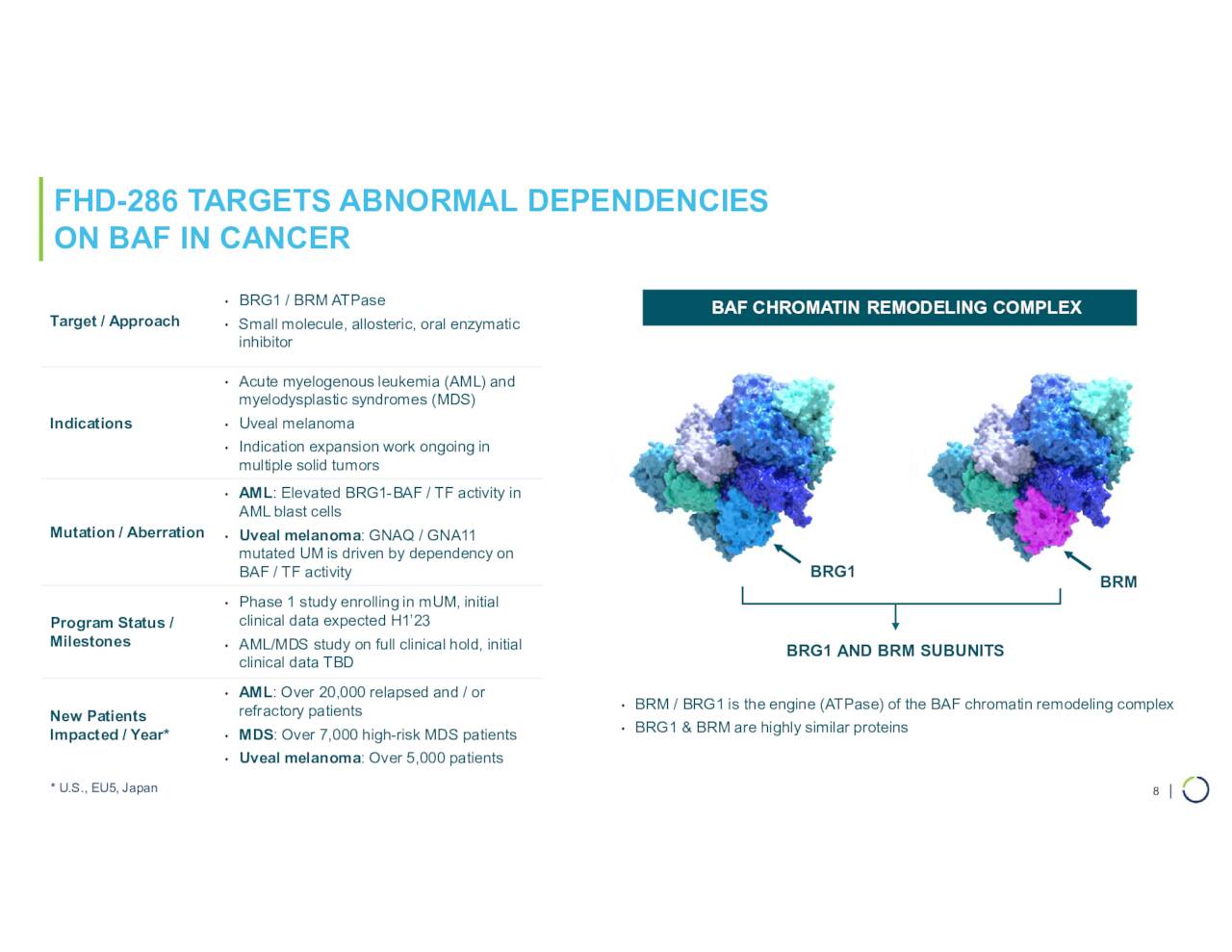

As you can see above, most of the candidates within Foghorn’s pipeline are early staged and partnered with larger drug players. One of its wholly owned candidates is FHD-286. This compound is a highly potent, selective, allosteric and orally available, small-molecule, enzymatic inhibitor of BRG1 and BRM and is targeting multiple indications.

September Company Presentation

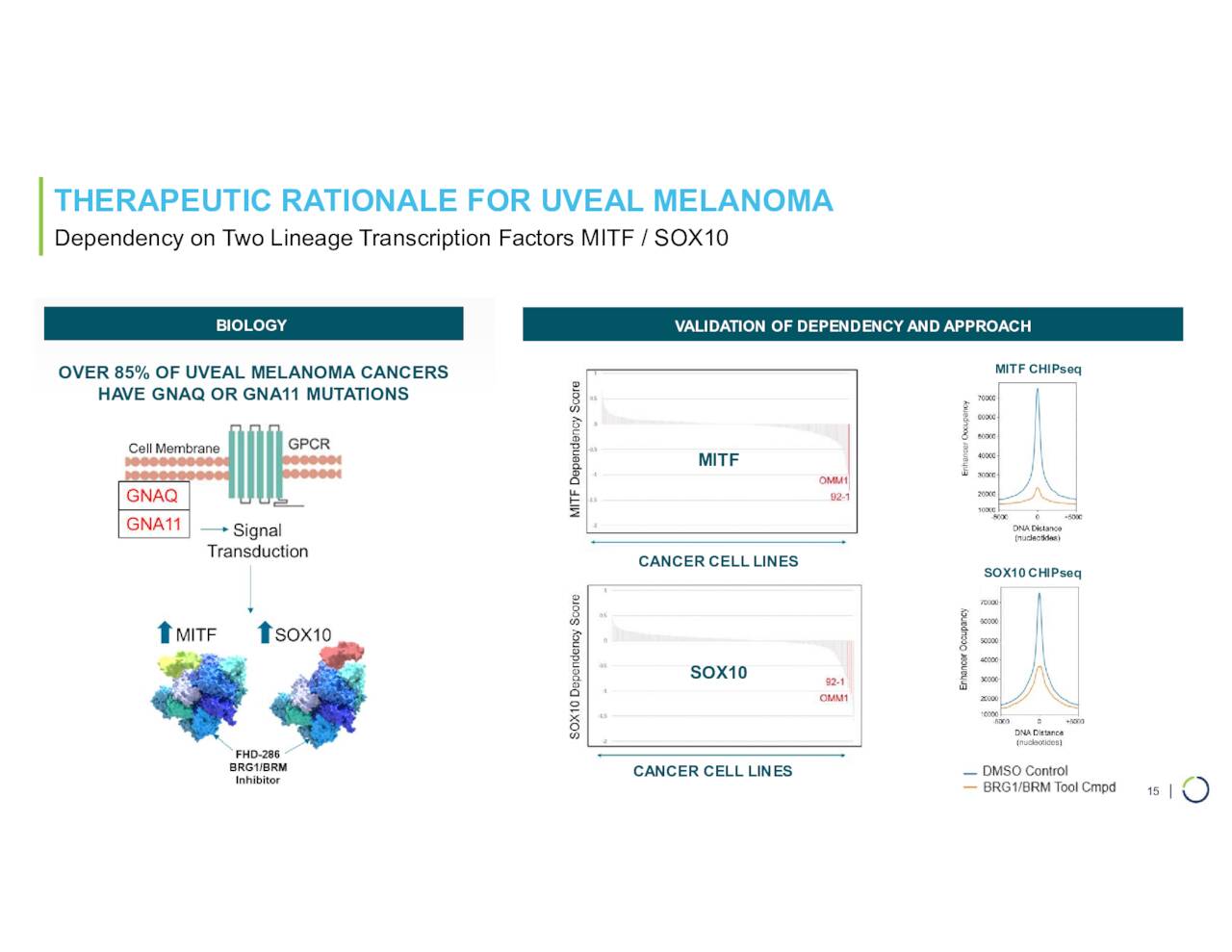

FHD-286 is in Phase I development. Unfortunately, in late August the FDA slapped a full clinical hold on the Foghorn’s phase 1 dose escalation study of FHD-286 in patients with relapsed and/or refractory acute myelogenous leukemia (AML) and myelodysplastic syndrome [MDS]. This follows a partial hold issued in May and comes as a result of additional suspected cases of fatal differentiation syndrome. The FDA has questions, and this will require further analysis before the hold could be potentially lifted. A Phase 1 dose escalation study of FHD-286 in metastatic uveal melanoma (mUM) will continue as plan. Initial results from this trial should be out in the first half of 2023.

September Company Presentation

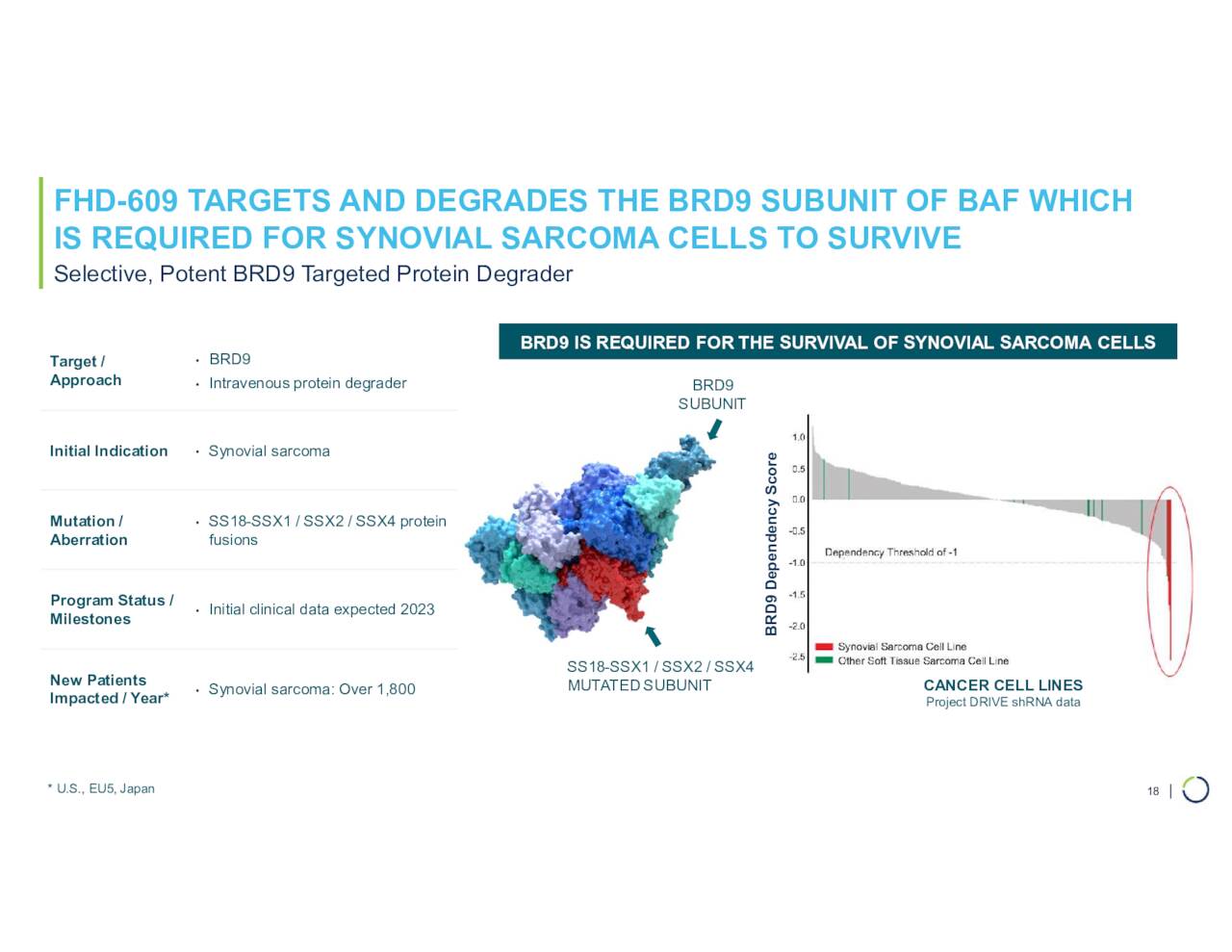

The company is currently enrolling patients in a Phase 1 clinical study evaluating FHD-609 in synovial sarcoma is also due out in 2023. FHD-609 is a potent and selective heterobifunctional protein degrader of BRD9.

September Company Presentation

All the partnered candidates in Foghorn’s pipeline are in even earlier stages of development. The company did receive $4.5 million worth of collaboration revenue via its partnership with Loxo Oncology in the second quarter and will receive a $5 million milestone payout from Merck in the third quarter.

Analyst Commentary & Balance Sheet:

So far in 2022, Wedbush, Goldman Sachs ($21 price target) and H.C. Wainwright ($25 price target) have reissued Buy ratings on Foghorn Therapeutics, while Morgan Stanley ($15 price target) has maintained a Hold rating on the stock.

Approximately one out of every eight shares of the outstanding float is currently held short. There has been no insider activity in the shares since the company came public in the fourth quarter of 2020. The company ended the second quarter of this year with nearly $395 million worth of cash and marketable securities on its balance sheet against no long-term debt. The company had a net loss of $27.3 million in the second quarter.

Verdict:

Obviously, Foghorn is many, many years from any potential commercialization. While its platform seems interesting, it is way too early in the developmental process to validate its approach. Although, the significant partnerships with Merck and Eli Lilly do seem to validate this is a potentially valuable platform. The stock has sells less than the net cash on its balance sheet.

September Company Presentation

That said, while funding is solid at the moment, the company is running at better than a $100 million annual burn rate and one of its lead programs has a clinical hold around it. There are also a dearth of major milestones on the horizon. In a more supportive overall market environment, Foghorn would probably merit a small “watch item” holding. However, given the current bear market, it is probably best to take no action around FHTX. This is a story I will circle back once the company moves into mid-stage development.

When all the details fit in perfectly, something is probably wrong with the story.”― Charles Baxter

Be the first to comment