stefanopolitimarkovina/iStock Editorial via Getty Images

Introduction

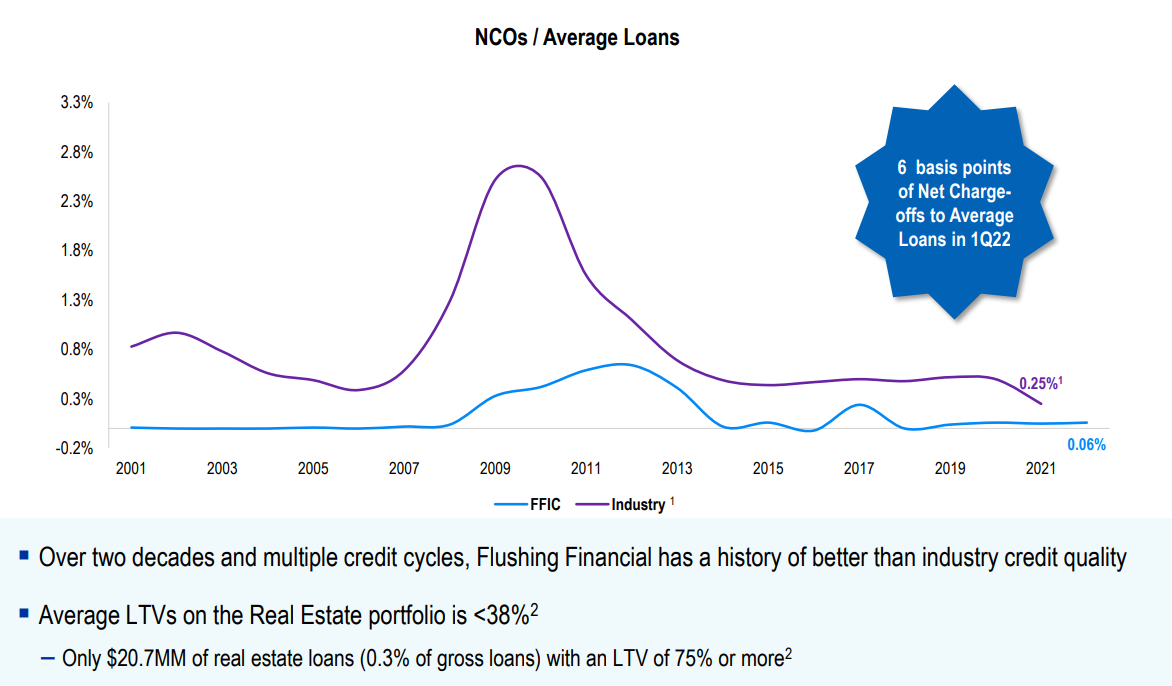

In a previous article on Flushing Financial (NASDAQ:FFIC), I was in awe of the very strong loan portfolio owned by this New York focused bank. The average LTV ratio of the real estate loans was less than 40% which in theory means that even if the value of the underlying property drops by 60%, the bank should be able to walk away without any loss. Of course some loans have higher LTV ratios than other loans but to see an average of less than 40% is definitely remarkable (and only 0.3% of the loans have an LTV ratio exceeding 75%). I have been keeping an eye on the bank since then and I continue to be impressed with how this relatively small bank is run.

Strong results in the first quarter, with very low loan loss provisions

Flushing Financial indeed still is a relatively small bank as the total balance sheet contains less than $8.2B in assets while the equity value is less than $700M. But you don’t have to be a big bank to be profitable, and Flushing was able to increase its net interest income in the first quarter of this year.

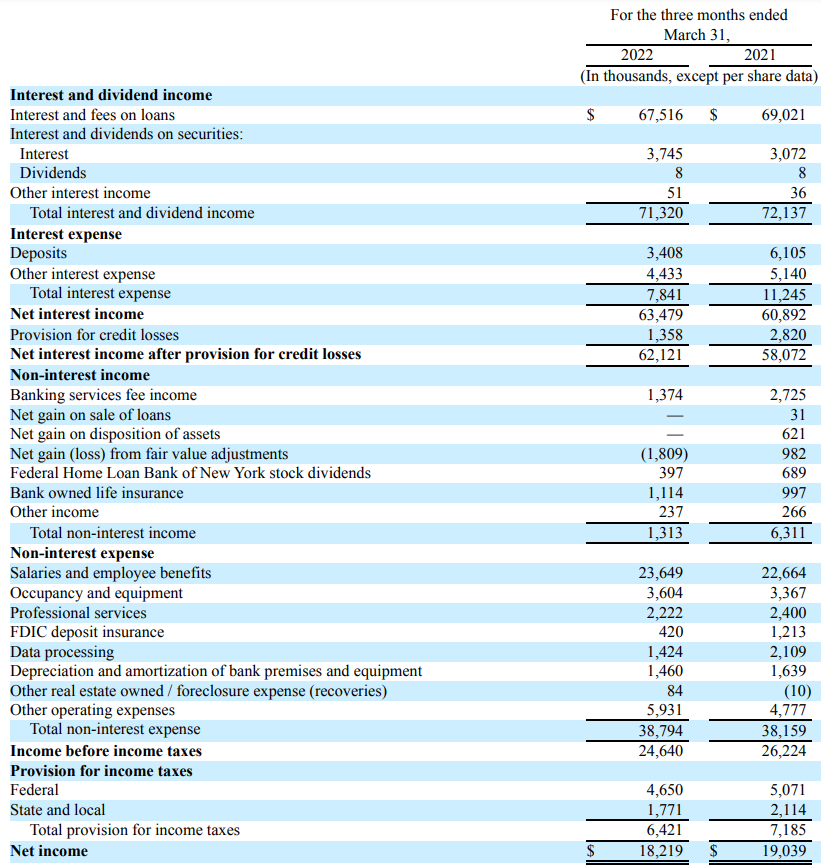

While the interest income decreased from $72.1M to $71.3M, the total amount of interest expenses decreased at an even faster pace, from $11.2M to $7.8M which resulted in an increase of the net interest income by almost 5% to $63.5M. Thanks to the strong loan book and very low LTV ratios, the bank was once again able to keep the allowance for loan loss provisions very low: in the first quarter of this year, it only recorded just under $1.4M in provisions.

FFIC Investor Relations

As the bank is a ‘pure’ commercial bank trying to make money on the difference between the interest it pays on deposits and the interest it charges on loans, the non-interest income is exceptionally low ad just $1.3M in the first quarter. To be fair, this included a $1.8M hit from the fair value adjustments on loans and that made the result look a little bit worse than it actually is. Additionally, the bank mentioned it incurred about $4.3M of non-recurring expenses in the first quarter.

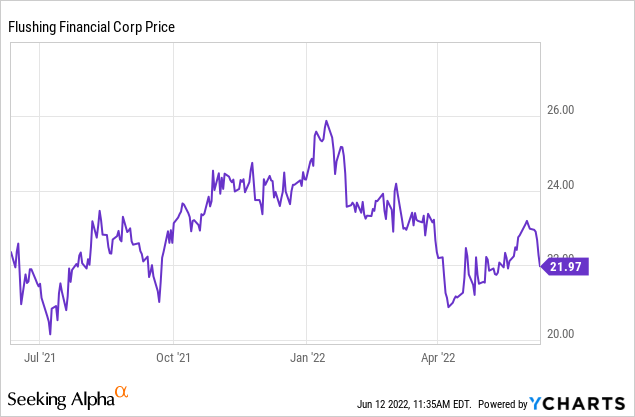

The total amount of non-interest expenses remained relatively stable (which is an achievement considering the inflationary pressure we are seeing elsewhere which caused salaries to increase), and the bottom line shows a pre-tax income of $24.6M. After paying the taxes owed on this, the net income reported by Flushing Financial in the first quarter of this year was $18.2M for an EPS of $0.58. On an annualized basis, the EPS could now be expected to exceed $2.30 this year as the increasing interest rates should create some additional tailwinds for Flushing. On top of that, Flushing has been buying back shares which means the net income will have to be divided over fewer shares outstanding and that will also provide a nice boost to the per-share performance. Flushing recently announced the increase of the total size of the buyback program. The company had 0.35M shares left under the previous approval but the board of directors has increased the total amount of shares that could be repurchased by 1M. And as FFIC is buying back stock at a rate of around 20,000 shares per week, the bank should be happy to gobble up shares at just $22.

The current quarterly dividend is $0.22 per share resulting in a yield of approximately 4%. That’s pretty good considering the payout ratio is less than 40% of the earnings.

Flushing is ready to take advantage of the higher interest rates

Most smaller banks seem to be investing about 20-30% of their asset base in cash or securities but Flushing Financial has only invested 13.5% of its balance sheet in those assets. And that’s fine as one could argue its exceptionally low average LTV ratio on the loan book means its loan book should be safer than its peers as it can keep the loan losses limited.

FFIC Investor Relations

As of the end of March, only $26.3M of the loans were classified as ‘past due’ which is less than 0.4% of the total amount of loans outstanding ($6.6B). The total allowance for loan losses already recorded by the bank exceeds $37M so even if all loans would default and the bank would foreclose on the assets without recouping a single dollar, the current amount of loan loss allowance should already be sufficient to cover those losses. But again, with low LTV ratios across the portfolio, Flushing should be in a good position to keep the fallout limited.

FFIC Investor Relations

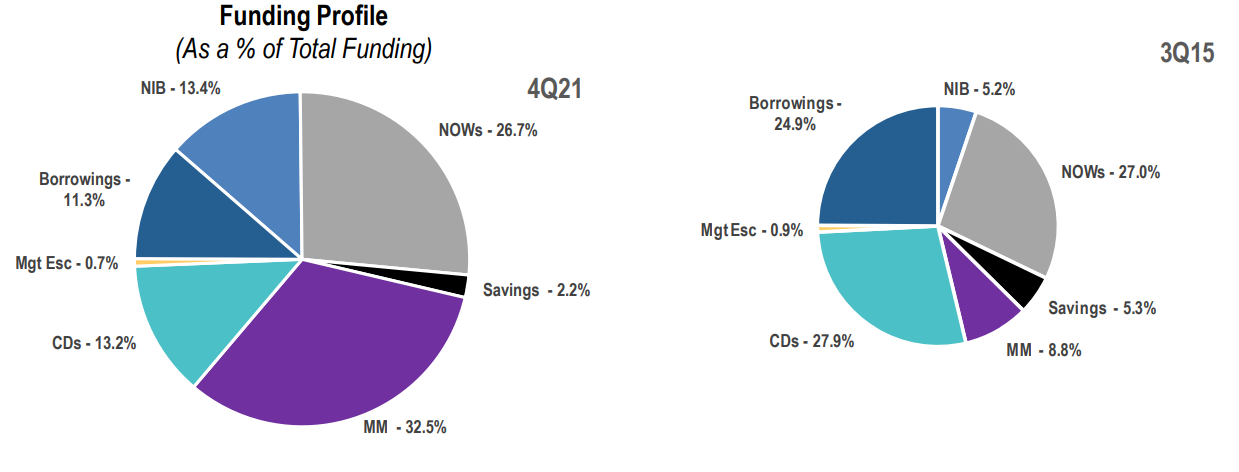

Flushing Financial also explained why it thinks it is in a better position to start the current cycle of increasing interest rates compared to 2015. Its funding profile is now more diversified with just 24.6% of the funding provided by CDs and borrowings. Those are typically higher-cost sources of funding and weigh on the net interest income and that’s why Flushing was not fully able to capture the benefits of the interest rate cycle in 2015 when in excess of 50% of its funding sources came from CDs and borrowings.

According to flushing, every 50 base point increase in the interest rates without a corresponding increase in the deposit rates would add $5M per year to the net interest income. If we would now assume the net interest margin increases by 100 bp, it’s easy to see Flushing should be able to add a few dozen cents per year to its bottom line thanks to the higher interest rates.

Investment thesis

I like the way the Flushing Financial management is running the business. Essentially, buying the stock of a bank is buying a basket of loans while hoping that basket is run well by the management. And it’s not always easy to find a bank whose basket of loans matches with your own investment criteria.

One may hate New York real estate but with an average LTV ratio of around 38%, Flushing Financial should be pretty shielded from a deteriorating New York real estate market. Flushing is currently trading at just a fraction over its tangible book value, and I think this is a good moment to establish a long position. I have been trying to write put options on FFIC but due to the very low volumes and wide spreads that hasn’t been successful, so I should probably just buy the stock outright.

Be the first to comment