Kameleon007

Investment Thesis

Flowserve Corporation (NYSE:FLS) has outperformed the broader markets meaningfully since our previous article last month gaining over 20% versus the S&P 500’s (SPY) ~4% gains. In the third quarter of 2022, Flowserve Corporation recorded an increase in aftermarket sales for both of its segments, Flowserve Pump Division (‘FPD’) and Flow Control Division (‘FCD’). The growth was driven by robust demand due to sanctions imposed on Russia, which led to a strong MRO and aftermarket environment. While the headwinds related to ERP system implementation issues, which we discussed in our previous article, negatively impacted the revenue, according to management these issues should be limited to Q3. Exiting the third quarter, the company’s backlog was $2.6 billion, the highest since 2015. Higher bookings, driven by the solid end market demand and the company’s 3D strategy, helped the company’s backlog.

The adjusted gross margin was at 27.4%, down 220 basis points (bps), due to third-quarter-specific ERP system implementation issues. Luckily these issues should not continue in the next quarter. Also, the company’s adjusted operating margin stood at 2.4%, a decrease of 460 basis points (bps) Y/Y due to elevated corporate cost and SG&A.

Looking ahead, I believe strong demand from the oil and gas end market, benefits from the company’s 3D strategy, and a high backlog-to-sales conversion rate supported by the company’s initiative of increasing the inventory level to mitigate supply chain constraints should lead to an increased revenue growth rate for Flowserve. Also, the company is undertaking steps to reduce the SG&A (as a % of total sales) and I believe this should help in margin expansion in upcoming years. Moreover, the stock is trading at a discount to its historical levels, making it a good buy.

FLS Q3 2022 Earnings

FLS recently reported lower-than-expected results in the third quarter of 2022. Sales for the quarter stood at $872.9 million, an increase of 0.8% Y/Y or 7.2% Y/Y (constant currency basis), and was above the consensus estimate of $868.1 million. This increase was driven by a rise in the aftermarket business, especially from MRO activity in the oil & gas market.

In the quarter, revenue of the Flowserve pump division stood at $592.6 million, down 1.5% Y/Y (constant currency basis) while that for the Flowserve control division was at $282.6 million, an increase of 6.2% Y/Y or 12.5% on a constant currency basis.

The adjusted operating margin stood at 2.4%, a decrease of 460 bps Y/Y due to increased corporate cost and SG&A. The disruption in the ERP system and rise in operating expenses resulted in decreased adjusted EPS, which was $0.09 down 68% Y/Y and below the consensus estimate of $0.23.

Flowserve Revenue Analysis and Outlook

In the third quarter of 2022, the revenue stood at $872.8 million, up 0.8% Y/Y or 7.2% Y/Y on a constant currency basis. This is the first time in 2 years that the company generated increased revenue growth year over year. This growth was driven by a strong MRO and aftermarket environment (especially in the oil & gas market) which resulted in increased aftermarket sales in both the segments. However, the major headwind in revenue growth was the disruption in the ERP system and foreign currency translation due to the strengthening of the US dollar. The quarter-specific ERP system issues negatively impacted the revenue and resulted in deferral of around $30 million of the aftermarket sales to future quarters.

The net sales for the Flowserve Pump division stood at $592.6 million, an increase of 4.8% Y/Y on a constant currency basis (or down 1.5% Y/Y on a reported basis). The growth was primarily driven by an 11% (constant currency basis) increase in aftermarket sales, partially offset by a 5% (constant currency basis) decline in sales of the original equipment business.

In the Flowserve Control division, revenue stood at $282.6 million, an increase of 12.5% Y/Y (constant currency basis) in the third quarter of 2022. The revenue growth was driven by the increase in net sales in both the businesses, original equipment (up 14% Y/Y, constant currency basis) and aftermarket (up 9% Y/Y, constant currency basis) due to robust demand.

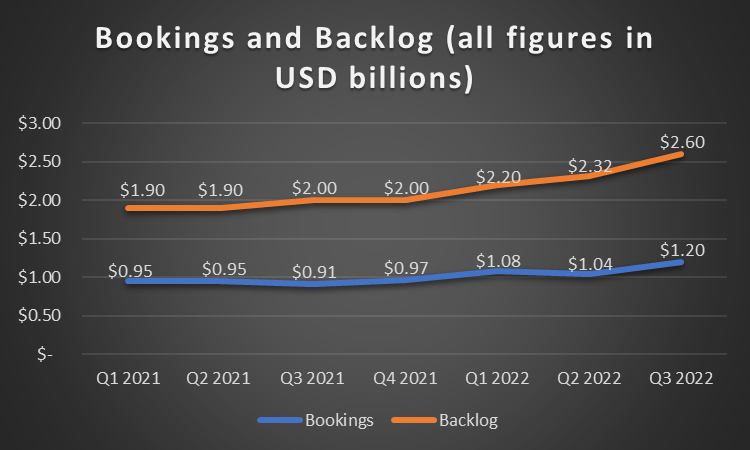

FLS Bookings and Backlog (Company Data, GS Analytics Research)

Bookings in the quarter were at $1.2 billion, which is the highest quarterly level since 2014 and it represents an increase of 34% Y/Y. The orders from original equipment were up 63% Y/Y, or 70% Y/Y on a constant currency basis, driven by growth in FPD’s OE bookings. The bookings in the FCD segment were also up 66% Y/Y, including the nuclear order win of $16 million. Because of the increase in bookings, the book-to-bill ratio improved sequentially from 1.25x to 1.30x in the quarter. In line with the 3D strategy, the focus on decarbonization helped in the growth of bookings from the market which requires CO2 reduction and energy transition plans. The 3D strategy delivered a constant currency bookings increase of over 40% Y/Y. The company won projects like the water pipeline project in Chile and the West Kauai energy project in Hawaii with the help of this strategy.

The strong Q3 bookings augmented by the 3D strategy increased the backlog to $2.6 billion (up 30% from year-end 2021). This is the highest level of backlog since 2015. In the quarter, supply chain constraints were the major headwind in the backlog to sales conversion, and to mitigate the same the company increased working capital by $75 million.

Looking forward, strong end-market demand, the company’s 3D strategy, ERP systems implementation issues receding, and a higher backlog-to-sale conversion rate should help accelerate the company’s organic growth rate in the near as well as medium term.

The demand should remain robust especially in the oil and gas market due to the sanctions imposed on Russia by the United State of America, the European Union, the United Kingdom, and several other countries. The sanctions prohibit energy exchange between Russia and these countries which increases the global demand addressed by the rest of the major suppliers. This led to the disruption of energy supplies in Europe and other countries which drove significant activity around energy security, particularly in traditional oil and gas, nuclear & LNG. I believe Flowserve Corporation is well positioned to take advantage of this situation leading to an improved revenue growth rate from its MRO activity and control division.

Also, in recent times, governments across the globe are increasing their initiatives to reduce carbon emissions which I believe should accelerate the revenue growth from the company’s 3D (diversify, decarbonize, and digitize) strategy.

Further, the disruption in the ERP system deferred the aftermarket sales by $30 million in the 3Q of 2022 but it was a quarter-specific headwind and I believe it should not adversely impact the growth rate in the future.

The company has also invested nearly $150 million YTD in the inventory, including net contract assets to support the $600 million increase in this year’s backlog level. This should assist the company to minimize any future supply chain constraints and improve its backlog-to-sales conversion rate which should accelerate the overall revenue growth rate in the upcoming years.

FLS Margin Outlook

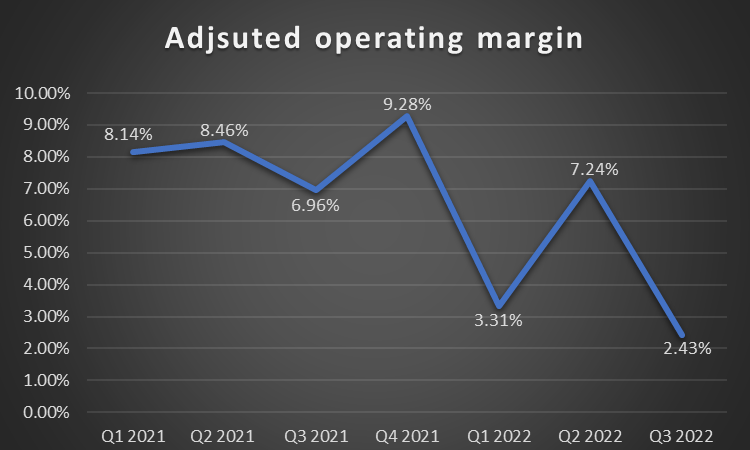

FLS Operating Margin (Company Data, GS Analytics Research)

In the third quarter of 2022, the adjusted gross margin decreased by 220 bps Y/Y to 27.4%. The decline was driven by the third quarter-specific disruption in its highly profitable North American seals business due to the ERP system conversion, which resulted in roughly $5 million of unabsorbed costs and deferred an estimated $30 million in revenue and associated margin. The adjusted gross margin was further impacted by a $1 million non-cash lease accounting adjustment, an approximate $2 million project write-down primarily on the aged backlog, $3 million related to the effects of increased costs on its estimates to complete a certain large project, and higher freight cost associated with supply chain constraints. These impacts were only partially offset by a 200-bps shift in mix to aftermarket and the impact of price increases earlier in the year.

In the recent quarter, the adjusted operating margin stood at 2.4%, a decrease of 460 bps Y/Y due to 420 bps decrease in FPD’s margins while FCD’s adjusted operating margin was flat with the prior year at 10.5%. The margin was further impacted by the elevated corporate costs and SG&A. Third quarter adjusted SG&A increased by $23 million to $224 million due to certain discrete items of roughly $18 million, primarily for expenses related to its annual actuarial assessment, the noncash lease accounting adjustment, and the in-process R&D technology investment. These actions resulted in an increase in SG&A as a percentage of sales of 250 bps Y/Y to 25.6%.

Looking Forward, I believe a stable supply chain and price increases coupled with cost reductions should contribute to margin expansion in the upcoming years. The company had made investments to increase working capital and inventory levels to improve shipping levels and to reduce any potential supply chain constraints in the future. This should mitigate supply chain related headwinds and result in margin expansion. The quarter-specific ERP system issues that negatively impacted Q3 gross margin should not continue to the next quarter. Several discrete items were associated with the operating environment and resulted in higher SG&A, but ongoing efforts to reduce these costs by the company should also result in improved SG&A (as a percentage of net sales), supporting margin expansion.

Valuation and Conclusion

Despite the recent run up, FLS Stock is currently trading at 18.47x FY23 consensus EPS estimates of $1.73. This is a discount versus its 5-year average (forward) P/E of 22.44x. I believe the worst is already behind the company and the company’s business is turning the corner. I think the stock can continue to outperform given improving fundamentals and reasonable valuations. Hence, I have a buy rating on the stock.

Be the first to comment