zorazhuang/E+ via Getty Images

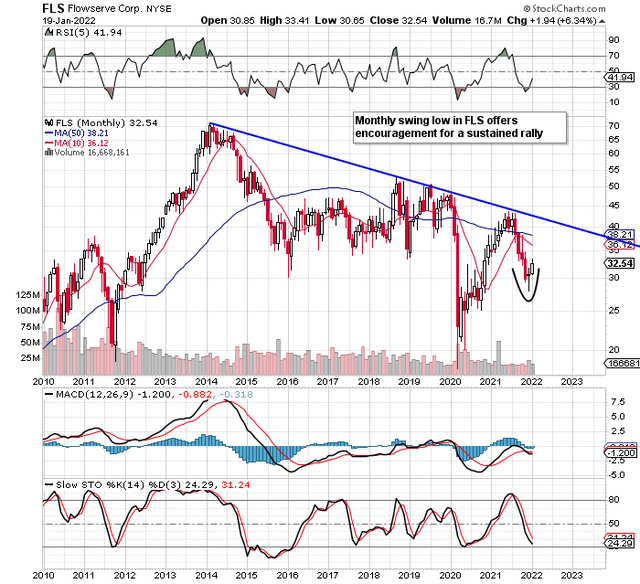

We wrote about Flowserve Corporation (NYSE:FLS) back in September of last year when we stated that the company’s dividend would eventually entice investors in here. Shares though remain down just under 4% since we penned that piece, so we have not had the up-move which we had initially expected. To gain insights on why this is the case, we initially can consult the technical charts. As we see on the long-term chart below, Flowserve shares in fact remain stuck in a bear market. Shares need to take out that heavy overhead resistance in order to finally put an end to the pattern of lower highs. Shares though remain heavily oversold and we have a monthly swing low in place. This swing low may indeed provide the thrust for shares to at least test that multi-year overhead resistance once more.

Monthly Swing Low in Flowserve StockCharts

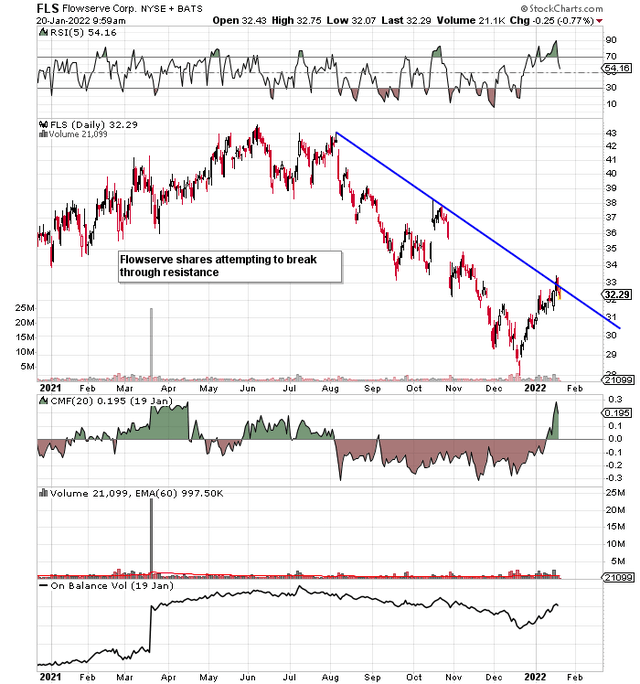

Share-price action on the daily chart also offers encouragement in that shares are currently trying to break above multi-month resistance. Furthermore, money-flow & volume trends have turned bullish, which leads us to believe that this attempt will eventually bear fruit. Chart reading is important because it takes all of Flowserve’s fundamentals into account. There are a lot of moving parts affecting Flowserve at present (supply-chain bottlenecks, inflation, labor shortages, etc.), which means the market continuously prices these challenges into the share price while simultaneously monitoring the company’s growth and projected bookings going forward.

Daily swing low in Flowserve StockCharts

For example, there is no doubt that the company would have posted higher sales and earnings in the recent third quarter but for the issues stated above, this did not pan out. Top-line sales almost dropped by $60 million to come in at $866.1 million and net profit decreased by approximately $6.3 million compared to the same quarter of 12 months prior. Looking at these numbers on the surface is not encouraging, but there is more to meet the eye here under the hood so to speak. For example, the $60 million drop in sales in Q3 would not have taken place but for the supply-chain & labor challenges the company experienced in the quarter. Now some may say that this is par for the course in the industrial space and that Flowserve will continue to be affected by external factors due to how its logistical operations are set up.

While this may be true (which may mean more pain in the short term), internal trends point to sustained growth coming here. We state this because year on year bookings rose by over 13% ($912 million) in Q3 which means the backlog over the past three quarters has risen by $115 million. Suffice it to say, the secure backlog and demand that Flowserve is witnessing across multiple end-markets will eventually be reflected in the company’s numbers. Therefore, it is all about staying in the game here long enough to be able to realize this work.

Management has already been proactive with respect to this endeavor by completing a fresh credit facility back in September. By amending its revolving credit facility through the addition of $300 million, Flowserve has gained liquidity and flexibility as the company navigates these extraordinary times. The refinancing brought the company’s cash balance to $1.5 billion at the end of Q3. Suffice it to say, given how leverage has been declining on the balance sheet and how receivables came in at a lower $946 million at the end of Q3, these are encouraging trends concerning sustained cash-flow generation.

More than half of Flowserve’s equity is made up of receivables, which is why cash-flow generation as well as its protection remain the top priority in the near term. Operating cash flow hit almost $90 million in the third quarter which means the $150+ million of generated operating cash-flow to date is trending approximately 32% higher over last year. As long as these trends continue, the company is basically putting itself in a position to realize the projected earnings growth going forward.

Suffice it to say, with shares trading with a book multiple of 2.4 and a sales multiple of 1.18, projected growth in upcoming quarters should bring these multiples back up towards the numbers we have become accustomed to over the past 5 years (5-Year averages of P/B of 3.19 & P/S of 1.42). Going forward, it is all about the timing of Flowserve’s booked projects. Can the company execute or will supply chain difficulties continue to throw a spanner in the works with respect to customers not getting served promptly? Can the company overcome its labor difficulties in a timely fashion? Shareholders are hoping these issues will be transitory. We will find out the extent of these challenges over the next few quarters.

Therefore, to sum up, we believe there is plenty of merit to the bullish technicals we are seeing at present in Flowserve. Bookings are rising and the liquidity has been strengthened to ensure the company is prepared for more uncertainty in the short term. Patience is required but, eventually, the next stop for shares is that overhead resistance on the long-term chart. We look forward to continued coverage.

Be the first to comment