Samantha Ward/iStock via Getty Images

The recent market malaise has created so many buying opportunities in great companies, it has actually become difficult to choose between the options. I happen to think we’ve already seen the bottom, or we are very close to it, so I’ve been taking on much more risk in the past week or so.

The stocks of companies that tend to carry recession risk have been destroyed in recent weeks, even after the beating they took in the first five months of the year. That has generated buying chances that we may not see again for years, and I’m looking to take advantage.

One such name is Floor & Décor (NYSE:FND), a leading hard surface flooring and accessories in the US. I love the company’s growth story, its leadership position in the segment, and now, the valuation. I’ve been on the sidelines for a long time with FND because of the valuation, but Mr. Market’s incessant pessimism has dropped a great opportunity into the laps of those that want to own one of the best growth stories in all of retail.

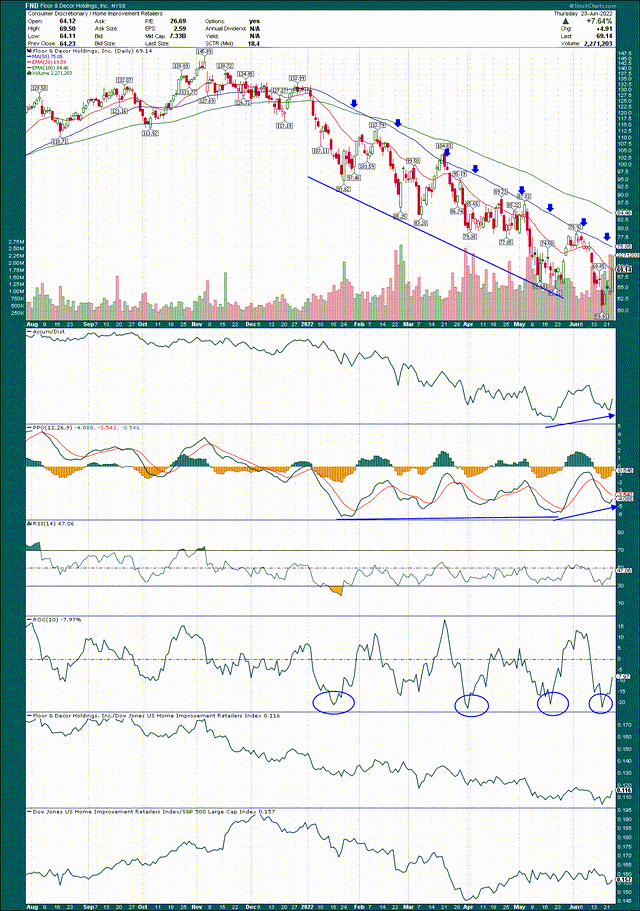

FND has been in a downtrend since last November, along with just about everything else that is even remotely growth-oriented. However, it appears to me that the downtrend is ending, and that we’ll look back on prices in the $60s as a tremendous opportunity to buy.

I’ve notated a channel that has formed this year using the 50-day SMA as the upper bound and the trendline I drew as the lower. The stock bounced right off of that lower trendline earlier this week, and I full expect a test of the 50-day SMA. But that sequence of events has occurred several times this year, so why is this time different?

First, momentum is not only not going lower, but it is actually improving on this most recent sequence. The PPO is a terrific medium term momentum indicator that I use on every chart I look at, and it is because you can learn so much about a stock’s price action from it. In this case, the PPO showed for lows that were in almost exactly the same area while price made four new lower lows. This most recent lower low (the fifth one) was accompanied by a higher low in the PPO, indicating bullish momentum is building and by extension, selling pressure is abating. That’s exactly what we want to see at a sustainable bottom and I think we have it.

The accumulation/distribution line is similarly making a higher low, corresponding to the same behavior in the PPO.

Finally, one piece we’re not seeing is relative strength, either from the group or from FND itself. FND has underperformed home improvement retailers, a group that is dominated by Home Depot (HD) and Lowe’s (LOW). Still, we’ve seen a bit of an uptick in the group since April against the S&P 500 while market participants are freaking out about a recession. That tells me these fears are overblown, and that means there are buying chances in the sector. I see FND as one of those, and probably the best one at the moment.

Growth, growth, and more growth

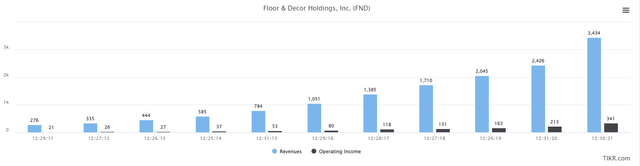

Now, let’s take a look at some of the growth FND has seen in the past, and what we can expect going forward. Let’s firs start with revenue and operating income for the past several years, both in millions of dollars.

This is the kind of hockey-stick shaped growth you want to see from a burgeoning retailer, and FND has it. Admittedly, last year’s revenue was boosted by pent-up demand from COVID lockdowns and stimulus money, a confluence of events that created unbelievable growth last year. However, we can see over the long-term, this company delivers profitable revenue growth.

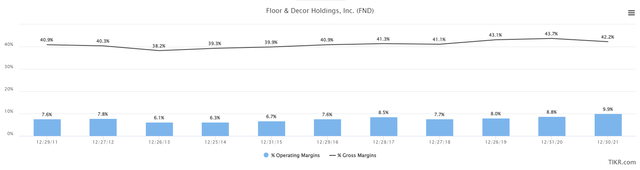

Here’s a quick overview of the margin situation, which also supports the bull case.

Gross margins don’t move a lot, which is common for home improvement retailers. FND competes in part on price, so don’t expect big movement in gross margins ahead. However, that’s okay because as the company scales its store base, things like SG&A costs are leveraged down, driving operating margin improvement. That’s what we see here, and as we’ll see below, there’s more where that came from.

Now that the historical perspective is set, let’s take a look at what we can expect moving forward.

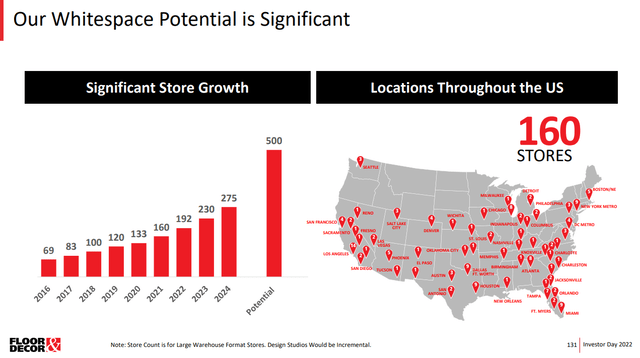

We’ll begin with the store count, which is the single biggest bullish factor from a fundamental perspective today.

The company has about 160 warehouses in the US today, but it recently raised its long-term potential to 500 stores from 400. The company is only present in 33 states, and in many of those states, it only has a couple of stores. The growth potential here is massive.

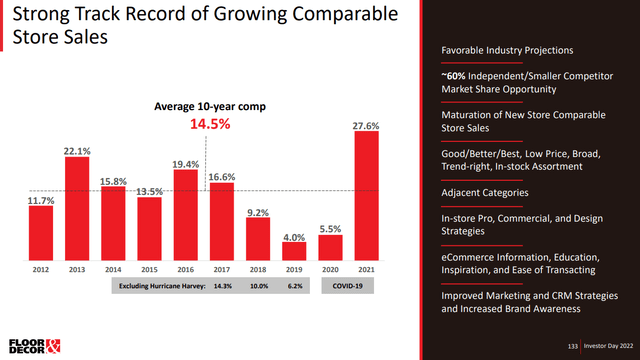

That means that FND believes it can 3X its stores from today’s levels, which should at least 3X its revenue. I say “at least” because FND has a strong history of comparable sales increases, which we can see below.

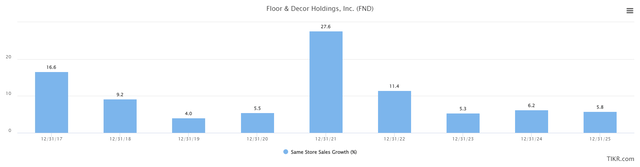

Comparable sales are everything to retailers, and FND has it, even during 2020. The average 10-year comp gain is almost 15%, a number that any retailer would love to have. Comps last year were +27.6%, which is obviously nowhere close to sustainable, but to its credit, estimates for FND’s comps this year and looking forward are still quite positive.

Estimates are for +11% this year, and ~5% after that. Again, you’ll struggle to find many retailers with this sort of comp sales profile, and it’s a big reason why the stock was assigned such high earnings multiples in the past. If you believe FND’s ability to generate comp sales hasn’t diminished, you likely also believe the high multiples of the past have a good chance at returning. I do, and that’s a big reason why I’m so bullish right now. More on that in a bit, but let’s take a look at margins and the potential for gains there.

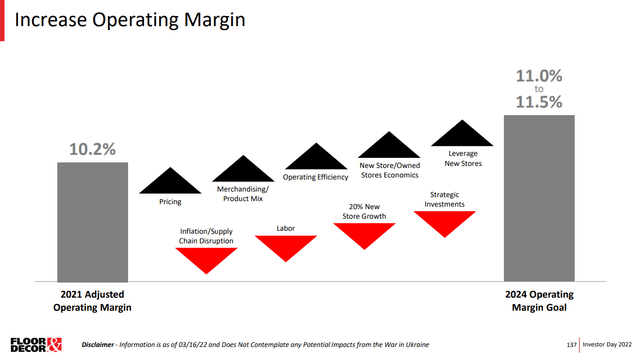

FND posted adjusted operating margin of 10.2% of revenue last year, and it sees medium-term potential at 11.0% to 11.5%. That may not sound like much, but another 80bps to 130bps of profitability on 20% revenue growth creates a very strong tailwind to earnings. If you consider the company is forecasting ~10% better profitability on each dollar of revenue in 2024, that’s yet another tailwind to earnings to throw on the pile. Of course, the company has to execute to get there on the items it the middle of this chart, but FND’s execution has been exceptional in the past. I have no reason to think it won’t continue to work.

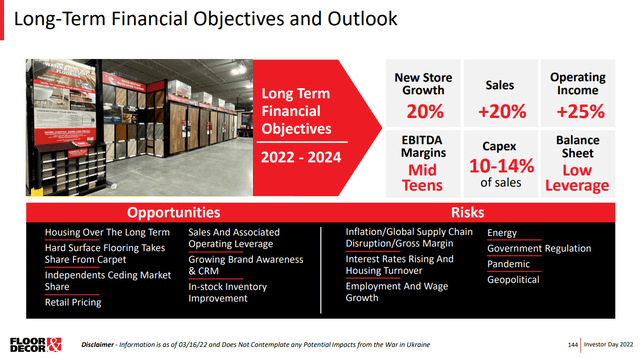

Finally, let’s boil all of this down into tangible targets, which the company provides quite succinctly in this table below.

We’re looking at 20% store growth and 25% operating income growth, which make total sense given the 1) store count growth forecasted, 2) comparable sales gains forecasted, and 3) operating income gains forecasted for the years to come. These targets, while huge numbers, look completely reasonable. This is not some startup hoping their product catches on; FND has years of demonstrated success and it is simply repeating that model over and over again.

Trough valuation? Yes, please

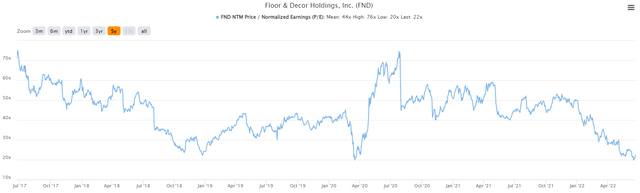

Fears of a recession, as I mentioned earlier, have driven the stock to its lowest valuation since a very brief period during the COVID panic. We’re at 22X forward earnings today, against the all-time low of 20X earnings.

That in and of itself makes FND very enticing, but when we consider the stock’s average forward P/E ratio over this period is 44X earnings, and the peak was 76X, 22X earnings sounds to me like the stock is pricing in a nasty recession already. What if we don’t get a nasty recession? FND should see enormous upside from valuation alone, irrespective of any earnings growth.

Is FND going to see 76X earnings again? Probably not, and I certainly wouldn’t own it at that valuation. But could we see 44X earnings again? Absolutely. The reason is because FND is one of – or perhaps the – best growth stories in all of retail. That commands a big multiple, and in my view, once the fears of recession have passed – either because there was no recession, or the recession shows signs of ending – FND will be off to the races higher once more.

I see the potential for this stock to double into 2023 on a valuation reset alone, I love the long-term growth story, and the chart is suggesting the end of the downtrend is nigh. FND is a terrific buy today.

Be the first to comment