Yelantsevv/iStock via Getty Images

Australia, Japan, and Singapore are the few markets within Asia Pacific that have achieved full liberalization of their power markets. With the commodity price hike seen in the past year, these markets are also experiencing power prices increases to levels never seen before. However, the effects are diverse as differences in their power market structure and power tariff structure translate to different sensitivities to commodity prices, resulting in different government responses in addressing the issue at hand.

Evaluation of these markets reveal large shares of thermal capacity, and the remaining dominance of the incumbent power companies or large vertically integrated companies have translated to different sensitivity of the wholesale market to post-COVID-19 demand recovery. In all three markets, supply disruptions as well as power capacity shortages owing to sudden outages have also exacerbated the impacts of the high commodity prices. In addition, existing retail contract structures affect the ability of retailers to pass on the wholesale price risks to end users, resulting in a number of small retailers going out of business.

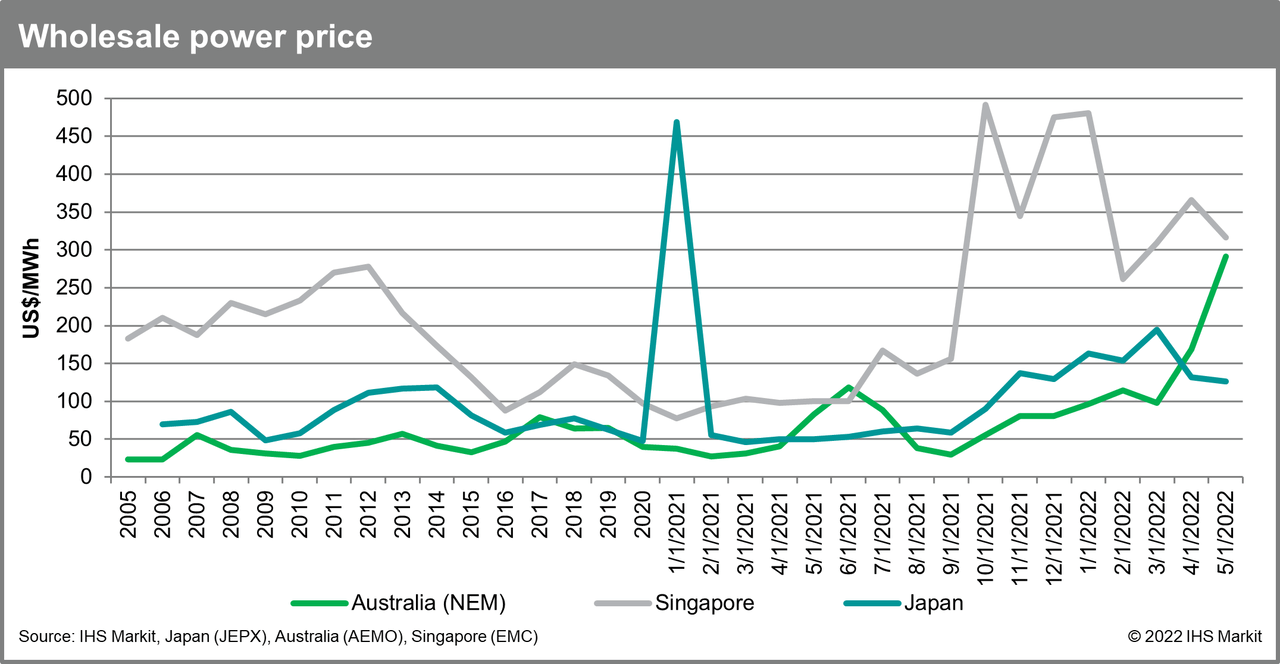

Wholesale power prices in the three markets have increased by 112% to 281% year-on-year (y/y). Singapore, with the highest share of thermal capacity within its power mix, has been hit the hardest, followed by Australia where thermal generation maintains a majority share. In both of these markets, wholesale comprises 100% of power retail, while the exposure in Japan is only 35%. The least affected in terms of price, but nonetheless significantly higher on a year-on-year basis, is Japan where the exposure of wholesale market is still 35% of the retail market, despite its comparatively high thermal capacity in the power-mix.

Incumbent power retailers return to the spotlight as the power price surge drives small retailers out of business: High prices have negatively affected the revenue margins, driving a number of smaller retailers without their own generation facilities out of business. The market share of these retailers is still small; however, this may mark the beginning of future impacts should current conditions continue. Larger retailers have also not been left unscathed, resulting in a call for market reforms.

Government measures announced in the three markets range from ensuring security of fuel and supply and protecting businesses through short-term fixed price contracts to launching a full independent investigation to holistically reevaluate the power sector. Long-term measures such as developing power futures and other market mechanisms are needed — all against the backdrop of energy transition and net-zero ambitions, which all three markets have announced.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment