Really Design/iStock via Getty Images

FlexShopper (NASDAQ:FPAY) is an American lease-to-own financing provider. The company allows sub-prime credit consumers to pay for furniture, electric appliances and electronics in 52 weekly installments charging very high interest rates.

Catering to sub-prime consumers, FPAY has high default levels. Added to its complicated lease accounting model, FPAY financial statements are difficult to understand to find out real profits. My own calculations, taking some precautions, shows that the model seems profitable.

Being a risky business, FPAY pays sky-high interest rates on its also complicated financing, high as 16%. Besides its risks, industry analysis does not reveal FPAY has a significant moat. If the equity investor wants demands a correspondingly high rate of return, the current share price is too high.

Additionally, the company might present moral concerns to some investors, given that it charges sky-high interest to sub-prime customers allowing them to purchase sometimes unnecessary goods.

Note: Unless otherwise stated, all information has been obtained from FPAY’s filings with the SEC.

FPAY’s competitive position and industry

FPAY provides consumer financing to very sub-prime customers. The company allows a consumer to pay for furniture, electrical appliances or electronics in 52 weekly installments. For that service, it charges sky-high interest rates, of at least 100% annually.

FPAY’s business model is considered lease-to-own or rent-to-own. Technically, the customer is not asking for a loan, but rather renting the object, paying weekly lease installments, after which the customer gains ownership of the object. The customer has the option of returning the object at any time and cancel any future lease payments. However, in reality, the leased products lose most of their value while in charge of the lesee, therefore these leases are actually high-risk loans.

I consider FPAY to be a company that provides financing, independently of when the transfer of rights occurs. It is true that it provides financing to a special group of customers in a special way, but it is financing anyway. Let’s analyze the competitive characteristics of the industry.

In terms of bargaining power with customers, FPAY is in a good position. The sub-prime customer that, unable to afford a less than necessary good like an iPhone or a TV set, pays for it in installments while absorbing 100% interest, is not likely very financially savvy. This customer will not be looking at the lease covenants and comparing among financial options.

In my opinion the trick in this segment is availability. FPAY has to be where the customer generates the want for the object, that is either on an online or brick-and-mortar store, providing the financing quickly to close the deal. FPAY seems to believe the same, because it has several methods to quickly allow the customer to splurge on an item. For example, the company claims that its proprietary rating system can provide a credit limit for a new user in minutes. The company also offers pre-approved credit limits in a FlexShopper Wallet, and provides retailers with digital systems to quickly check credit availability. If the store is not connected with FPAY, users can send a picture of the object they want to acquire to FPAY, that will check credit availability and send the object to the customer.

Another advantage for FPAY is that it does not own stores, a difference from competitors like CONN, AAN or RCII. First, this concentrates the business model around the financing aspect. Second, it allows FPAY to provide financing to customers from many retailers.

FPAY could eventually find a lot of competition from two groups of bigger players. First, big retailers like Amazon could develop their own buy now pay later systems, and some actually have. They will compete with FPAY if they start lending or leasing to sub-prime consumers. A second group is other financial institutions with experience in sub-prime lending. FPAY is still a small player, would not be able to compete with these.

Financial businesses face a problem most businesses do not have, and that is filtering their own customers. In order for FPAY’s operations to be profitable, it has to maintain a somewhat contained default level, which means saying no to some people asking for leases. As we mentioned, FPAY has to decide whether or not to lend/lease and how much quickly, on an automatized fashion. According to the company, one of its competitive advantages is a good credit rating algorithm to decide how much to lend to whom. Of course the extreme interest rates charged by FPAY cover for enormous default losses, usually above 30% of leases.

In terms of supply, FPAY’s main raw material is capital. I will detail a section for capital structure exclusively but suffice is to say now that FPAY faces interest rates above 15% yearly, showing that the business is very risky. As mentioned, the financial industry is competitive, therefore we can assume that FPAY is getting a rate that closely represents its risk.

Regulation is a final problem of this market. To many, what FPAY does is morally questionable, given that it lends to financially unprepared people at extremely high rates. FPAY argues that if it was not for them, no one would lend to those customers. Independently of what anyone thinks, someone could push for regulations restricting FPAY business, or FPAY’s maximum rates. In fact, FPAY is not in the business of lending but in the business of leasing to avoid maximum rates in most US states. According to the NCLC, the median maximum rate on a 6-month $500 loan in the 45 states that have a limit is 35%. FPAY charges above 100%. If it branded itself as a lender, it would not be able to operate in all but 9 states.

FPAY’s capital structure and cost

Like most financing institutions, FPAY makes uses of significant leverage. As of 2Q22, the company owed $69 million on its credit facility, $12 million in notes and $22 million in preferred cumulative stock that looks a lot like debt. That is a total of $103 million.

FPAY’s credit facility allows it to borrow up to $82.5 million based on its level of leased merchandise. The facility was extended in March from a previous $63 million, and matures in April 2025. The interest rate charged is 1-month LIBOR + 11%. That means the company is currently paying about 13% for this debt.

Then FPAY has $12 million in notes with two lenders that are related to the company’s management. These notes are subordinated to the credit facility and charge 5% above the rate of that facility.

An LLC where FPAY’s CFO is a member lent $1 million, with a constantly renewing maturity that now stands at April 2023. In the same fashion, but maturing in 2024, a company where FPAY’s Chairman is manager lent first $4 million and now $11 million. In both cases the interest rate now stands at 18%.

Finally, FPAY issued $22 million in preferred cumulative stock that pays 10% annually. Although the stock does not have a redeemable date, and can be converted into common stock at an approximate price of $3.75, it still adds to the financing cost because its dividend is cumulative. The preferred stock votes as common stock, and therefore the lender (a subsidiary of PIMCO), owns 20% of the company’s votes.

The weighted average interest rate is currently about 13.5%, but growing with the LIBOR rate. Given that the credit facility seems to be the most available source of funds for growth, considering it as an anchor is useful.

What we can learn from FPAY’s capital structure is twofold. First, its lenders know it is extremely risky. Otherwise they would not be charging 11% + LIBOR; it is the highest I have seen in all of the companies I have analyzed. Second, the company has about one chance, because all of its financing is short term. If it ever falls in disgrace because of heightened defaults, it has no long term financing to fall on, besides the preferred stock and $6 million in common equity remaining.

Untangling FPAY’s profitability

Usually, financial businesses present their financial statements in a specific fashion that considers interest expense as the cost of goods sold. Even some leasing companies move interest to cost of goods sold. Also in most cases, financial businesses do not own the good purchased with the lent money, but rather a promise of payment.

FPAY’s income statement is very different because it is a lessor. In my opinion, the leasing thing is just a workaround for the maximum interest rates established in many US states. FPAY would be easier to understand if it simply considered its products as loans.

What is the problem with leasing?

First, the leased object is kept in the books and depreciated during the year in a straight-line. But the objects leased by FPAY do not depreciate in a straight-line. Once you open an iPhone box, it is no longer the same, even if you only had it for ten minutes. The same is true at the end of the contract, say for example on a piece of furniture used for a year that can be easily used longer but is already depreciated.

Second, there is no promise of payment asset like a loan. FPAY only registers a receivable once the customer became due on a payment, and then it keeps accumulating revenue on the lease until it writes the receivable off. In the meantime, FPAY recognizes an allowance on receivables that is netted from that year’s revenue. The company does not mention how much of those allowed receivables are written-back to P&L if the company recovers the object or makes the customer pay.

All of this complicates understanding the true profitability of the company. Are those receivables’ allowances correct? How many people defaulted on their l leases this year? How much is recovered from the repossessed objects? All of this is left unanswered.

In my opinion there is an easier way to make the calculations, that is also more conservative. It is based on a few conditions.

First, once the object was paid for, it is gone, its value expensed immediately. This eliminates the complication of comparing real value to depreciation. It is conservative because if the company recovers some value from the merchandise, then it is added on top of our calculations.

Second, all receivables are defaulted and they are not recoverable. They will eventually be written down. According to FPAY any receivable belongs to a past due account. How many people, having the money, will stop paying a $100 a month TV set or iPhone? If FPAY’s customers are not paying once, they will probably not pay at all. Also, FPAY does not disclose how much in receivables is recovered each year, only how much is written down. To find out how many receivables where generated I add current period’s receivables, plus receivables written down from allowances, less previous period’s receivables. Again, this supposition is conservative, because if a customer ends up paying back, then it is added on top of our calculations.

For revenues, I consider gross revenues, not netted revenues, FPAY’s net revenues already include a provision for receivables irrecoverability, and I simply expense all receivables. Gross revenues is the money FPAY has the right to receive, and includes some receivables.

With that, FPAY has to at least pay for the merchandise it leased. Therefore I remove average gross (undepreciated) cost of leased merchandise for the year. This implies the merchandise recovery value is zero. This assumption is possible because FPAY leases ideally last 52 weeks, or a year.

Then I remove all generated receivables. This is necessary because gross revenue includes receivables that I consider defaulted and irrecoverable.

Expensing those two items I find the effective interest charged on the leases, discounting the principal and the defaults. The ratio of effective interest to average cost of merchandise is the effective interest rate.

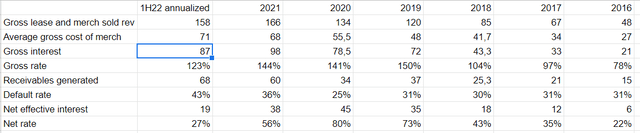

The calculations for the past 7 years are shown below. The calculations for 1H22 are annualized by multiplying 1H22 revenue and receivables generated by two.

FPAY’s reordered financial metrics (Own, based on FPAY’s filings with the SEC)

Net effective interest is the money that can be used to pay for SG&A, operating expenses, interest, taxes, and return to shareholders.

As we considered in the financing section, debts (included cumulative preferred shares) stands at $103 million. If we remove the preferred we get close to $80 million.

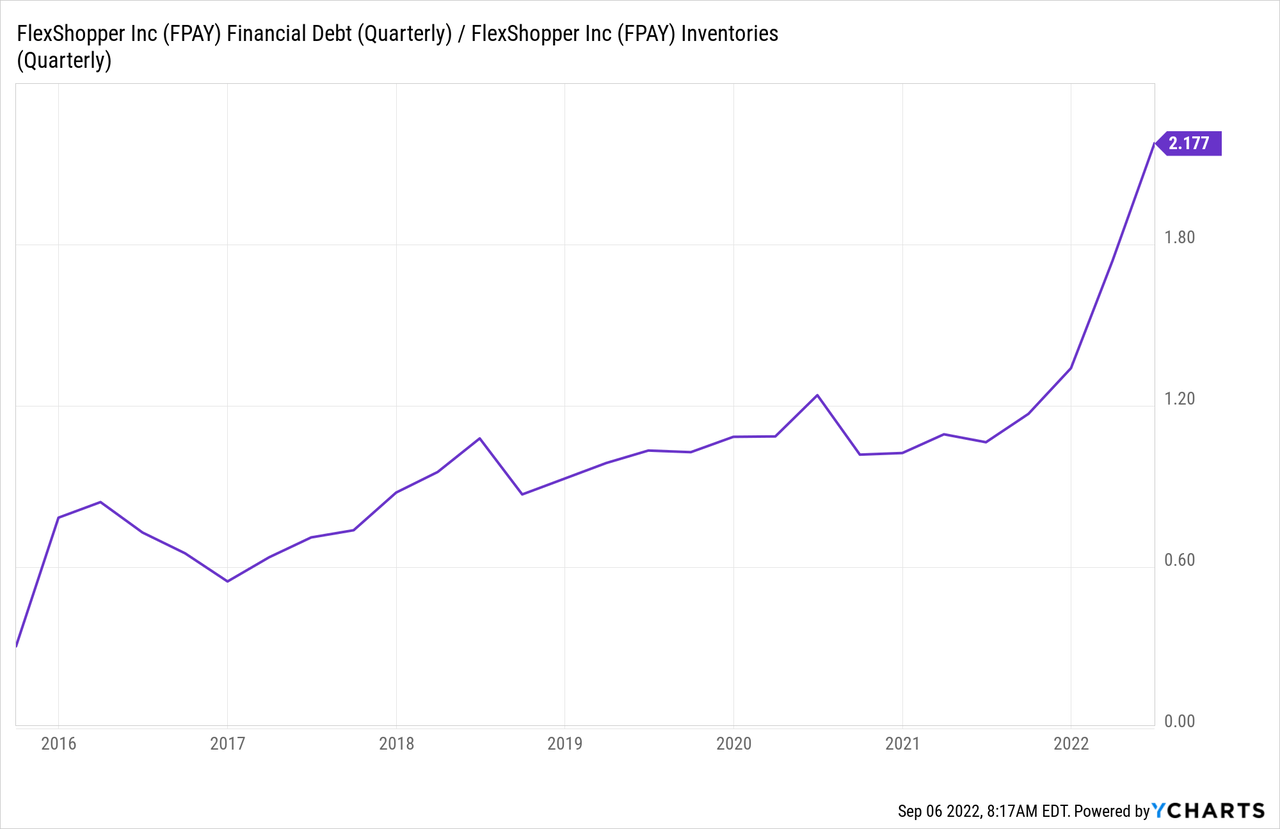

As the chart below shows, FPAY’s financial debts are not only financing inventories. If they were, the chart would show a 2 to 1 relationship (given that inventories are shown net in here).

But, in a profitable and long term scenario, similar to other financial businesses, the financing should match the loan book, which in this case is the lease book, or gross cost of merchandise. That is my assumption for long term debt levels. I consider a cost of debt of around 14%, that is, current 11% plus a LIBOR (or prime rate replacement next year) of 3%.

If we join those two assumptions, we can remove the cost of debt from the net rate obtained by FPAY, instead of removing it as a figure. This assumes that FPAY is not replacing debt with equity, and that its cost of debt does not move. They should be reviewed in future visits but for now they suffice.

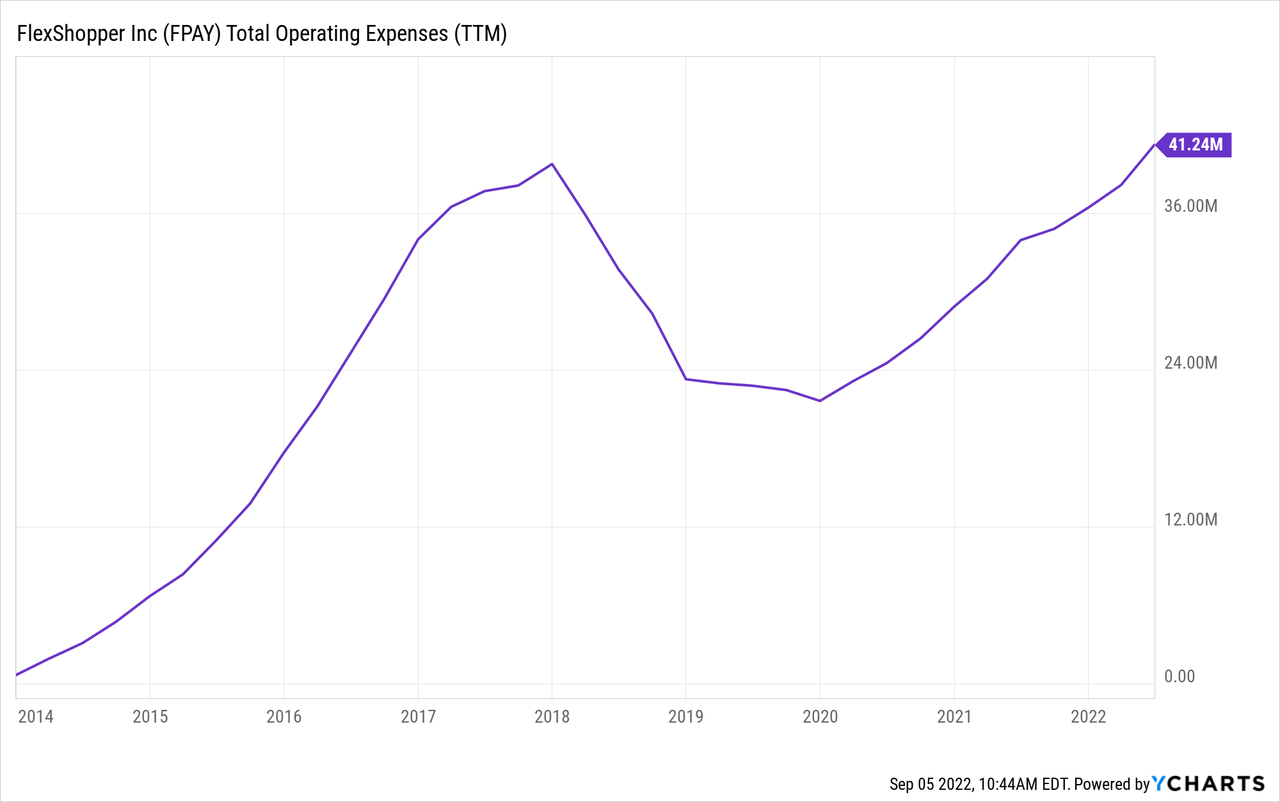

Total operating expenses, above, includes both SG&A and operating expenses, I think $40 million is a valid estimate of forward operating expenses, although it is trending upwards. For many financial businesses, operational expense efficiency is one of the most important competitive advantages. In a competitive market, only the most efficient generate profits. Therefore operating expenses have to be followed closely in future reviews, but for now we consider $40 million going forward.

FPAY has a market capitalization of $50 million. The stockholder needs a 14% rate of return, just to match what debt holders get. To generate 14% on $50 million, FPAY should generate $7 million in net income. I do not consider growth, but I am also considering a low required rate of return, given that equity usually requires more return than debt.

Adding back taxes that at about 26% between federal and state (Florida), we find pre-tax income of $9.5 million to generate $7 million in net income. FPAY has NOLs for $60 million that do not expire and therefore could avoid some of those taxes for years, but we are avoiding that in a long term calculation.

Therefore, after subtracting interest expenses and before operating expenses and taxes (kind of how a bank orders its income statement), FPAY should generate around $50 million. That is, $40 million for operating expenses, $2.5 million in taxes, and $7 million in net income.

As I mentioned, we can consider FPAY like a bank, that earns a net interest margin on its assets. FPAY’s interest earning assets are its leased products. As the table with the reordered financial statements shows, the effective rate that FPAY gets after expensing defaults has moved a lot, from 25% in 2016 to 80% in 2020, back to 27% this year. A big factor influencing these effective returns is the level of defaults. A reduction from 43% to 38% in the default rate this year would move the effective rate from 27% to 40%.

Therefore, determining a long term effective rate of return, or the mean around which it would move around the business cycle, is difficult. Just to show the calculations that follow to reach a value for the company, let us define the effective rate at 40%. That is, after expensing all receivables, which we consider irrecoverable defaults, FPAY can repay all of its inventory and has 40% of the inventory value left as interest.

In the banking industry this would be called gross interest, from which FPAY should remove the interest it pays on its own debt. We assume a 15% rate for debt.

Given that we considered that the debt level should follow the gross cost of merchandise, and that FPAY’s gross interest is also derived from gross merchandise, it is possible to subtract the debt rate from the gross rate to find something akin to the net interest margin. In this case, assuming 40% and 15% debt, we arrive to a 25% net interest margin.

Going back to the rate of return and necessary net income section, we mentioned that to cover operational expenses, taxes and generate a $7 million yearly net income, FPAY needed $50 million in net interest. Assuming a net interest margin of 25%, calculated above, FPAY needs to lease merchandise for a gross value of $200 million.

The problem is that FPAY currently only has $70 million in leased merchandise. With the assumptions provided, FPAY is far from being able to provide a decent return on its current stock price.

However, two things need to be considered. First, these are backward looking calculations. In the future FPAY could make several improvements, like reducing SG&A, or reducing the level of defaults.

For example, if the default rate fell from the current 43% to 24%, FPAY would generate a net interest margin on its leases of almost 70%. That means FPAY would be able to generate a 14% return on its market cap ($7 million net income) with only $70 million in leased merchandise. If the default rate were 30%, close to what was prevalent for most of the 2016/2021 period, FPAY would generate a 55% net interest margin on leases, and its lease book would need to be $90 million.

Other issues: loan business, shareholders, management

FPAY started scaling a loan repurchase business this year that is kind of difficult to understand. I have not included any information of that business segment in this analysis because the company has not yet published a 10-K explaining about it. I do not like the idea very much though, for several reasons.

First, the company did not explain the business thoroughly on its latest 10-K because it was on a test phase, but on 1H22 they increased their loan book by $22 million, out of nowhere. Second, these loans are originated by an undisclosed “bank partner”, with no explanation to mention if it’s a related party. Third, being short-term loans they should have caps on interest, but with $5 million generated in revenues and fees against an average loan book of $11 million, or a rate of 45%.

Fifth and most important, the accounting is also messy. Instead of recognizing a simple amortization scheme with allowances for defaults, the company decided to both recognize revenue, which I guess is interest, plus changes in fair value. Fair value is calculated as Level 3 FV, meaning mark to model fair value. If you hear mark to model loan book in subprime lending, grab your wallet. The company mentions several times on its 10-Q for 2Q22 that Management can change both specific assumptions and the results of the models if it does not agree. So it is mark to model or management beliefs, worse.

Therefore, I will wait until FPAY’s FY22 10-K explains the new loan business in more detail. Until then, I will try to obtain more clues from the always less informative, and unaudited, 10-Qs.

Finally, important shareholders are also worth mentioning. One of PIMCO’s funds holds 20% of the voting participation in cumulative preferred stock. The lender of the credit facility, Waterfall Asset Management, owns another 8%, in the form of non cumulative preferred stock. Finally, the company’s Chairman, Howard Dvorkin, owns 23% of the stock.

The company’s Chairman is interesting because it is an influencer on debt relief, Chairman of the site Debt.com, that helps people pay down debts. He openly advocates for people becoming more financially literate and prudent by avoiding credit card use and paying cash. However, he is running this business where people are offered expensive debt to pay for things they do not need. He also does not disclose being the Chairman of FPAY on any of its social media (Twitter, LinkedIn) or on its personal webpage.

The company’s CEO, Richard House, comes from a related business, Atlanticus Holdings, founded by him and others in 1997, and where he was President until 2014. Atlanticus is little bit more prime, serving credit cards and auto loans.

Conclusions

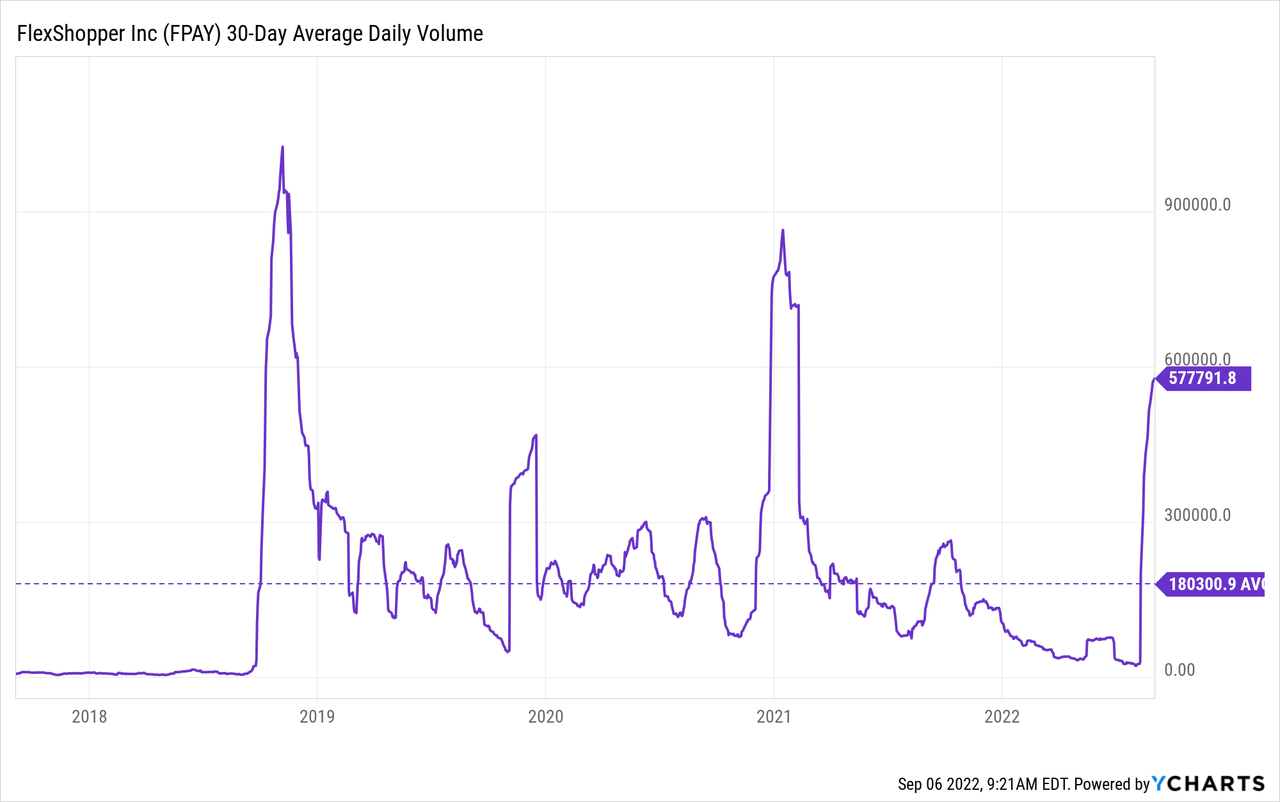

FlexShopper is a new business, and its share price is volatile. It is not very thinly traded, with the average of the 30-day average daily volume at 180 thousand shares. As can be seen in the chart below, volume can grow and dry fast as well.

The stock has moved a lot lately, almost doubling in one month. I do not think that current prices are cheap. I have my doubts about the viability of the business, but it does not seem outright unprofitable according to my reordering of the accounting.

The lease book or default rate need to get a 15% return on the stock price are assumptions. You can tweak the model, it also serves for future comparisons.

I do not recommend FPAY right now, but I will keep following it. In the future, the most significant potential positive catalysts would be: a reduction of default rates, even in an adverse macroeconomic context; a reduction in SG&A expenses relative to the lease book; debts moving in line or below but not above the gross lease merchandise cost. Finally, I would like to know more about the new loan business, for this I will need to wait until next year.

Be the first to comment