Sjo/iStock via Getty Images

FLEX LNG (NYSE:FLNG) reported continued strong results in the second quarter. With a large stockpile of cash, the company chose to issue a special dividend to return some of that to shareholders. This quarter further illuminated the presence of Flex’s interest rate hedges and the value of its long-term charters. Though there wasn’t too much excitement; with a strong (and strengthening) balance sheet, reliable income from time charters, and a sustainable high yield, steady as she goes is as good as it gets.

Strong Continued Results from Impeccable Charters

Net income for the second quarter came in at $44.3 million or $0.83 per share. Though this is less than the first quarter, once adjusted for significant gains on interest-rate linked derivatives, adjusted net income for the second quarter improved significantly to $32.5 million ($0.61 EPS) from $23.8 million ($0.45 EPS) in the first quarter. The fair value gain on derivatives in both the first and second quarter reflects the company’s foresight in hedging against interest rates, reflected humorously in this quarter’s report:

Unlike the Federal Reserve, we have been ahead of the curve, hedging a substantial part of our interest rate exposure prior to inflation concerns surfacing. We are therefore booking further gains on our interest rate hedges.

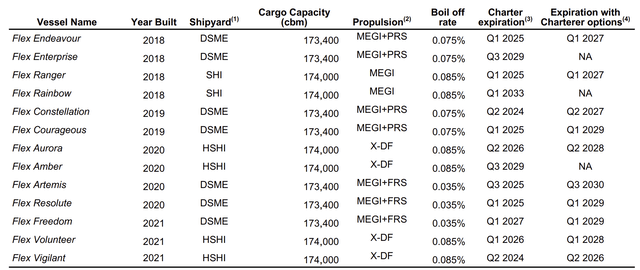

The company also signed new contracts on three vessels in June, further extending its charter backlog and putting two formerly variable rate charter vessels on fixed rates. As you can see in the chart below, Flex has fixed charters for years, many with additional options for extensions. The nearest two availabilities are in mid-2024, all but guaranteeing the company’s income for several years.

Of these vessels, 12 are on fixed charters and only the Flex Artemis is on a variable rate charter, representing the company’s only remaining exposure to the spot market.

Revenue for the quarter of $84 million was right in line with guidance of $85 million. Management reiterated guidance of $90 million for the third quarter and $90-100 million for the fourth. This boost is expected from new charters commencing during the third quarter. Additionally, there is implied tightness in the LNG carrier market ahead of the impending cooler months:

Amid the gas rush, daily charter rates for existing tankers that traders will take hold of between mid-September and mid-November have risen to $105,250 a day, up from about $64,000 now and about $47,000 a year ago for vessels heading from the U.S. to Europe, according to Spark Commodities.

This bodes well for the company’s singular vessel on a variable charter. Additionally, with few capital expenses, other than dry docking in the second half of next year at around $3 million per vessel, Flex LNG’s free cash flow could increase as the company improves its debt profile.

Balance Sheet Improvements

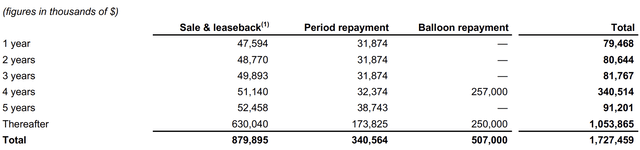

Flex LNG had $283.7 million in cash at the end of the second quarter, up from $174 million in the first quarter. This new cash largely came from the company’s ongoing debt optimization. The company’s debt load increased for the second quarter by around $100 million from the previous quarter, corresponding roughly to the increase in cash.

Fortunately, the company’s repayment schedule is far out and expected to only improve in the coming quarter as the company aims to unlock a further $100 million in cash and improved debt terms.

As mentioned above, the company has significant interest rate hedging, with the interest rate on 63% of the company’s outstanding debt fixed through 2024, further explained on the conference call:

If we look at the SOFR portfolio that is on average remaining duration of 8.9 years at 1.9% fixed rate, that is attractive compared to the 10-year SOFR rates of 3.1. And also for our LIBOR swap portfolio, which is a shorter duration of 2.8 years compared with the two-year swap rates at 3.7. Overall, this gives us a hedge ratio of 63% on the total debt excluding any utilization of the RCF.

This quarter, the company is focused on unlocking an additional $100 million in cash through refinancing, while also extending the company’s debt maturities and improving the financing terms and costs thanks to its improved credit rating.

Same ol’ Dividend (and One New Dividend)

Flex LNG is still paying a $0.75 dividend this quarter, which gives us a generous annualized yield of around 8.4% after Wednesday’s close. Additionally, with $283.7 million in their pocket, Flex’s management decided now was a good time to offer shareholders a little bit extra and announced an additional $0.50 payment this quarter.

The normal $0.75 dividend will cost around $39.86 million with the current number of shares outstanding. With the addition of the special dividend ($26.57 million), the total cost for this quarter’s dividend comes to $66.43 million. This is a payout ratio of over 200% of this quarter’s $32.5 million adjusted net income. However, I still believe that Flex still offers a sustainable dividend (minus the special dividend), even with a payout ratio of 123%. This is largely because the company had net cash from operating activities of $52.1 million for this quarter, up from $42.5 million in the first quarter, and Flex also has a large cash pile.

Possible Expansion (But Responsibly)

One additional note, in response to a question on the conference call, was that Flex is open to consolidation but, unlike many other less-responsible management teams, is not pursuing fleet growth at all costs:

…we are also open for consolidation. I think we have a very good stock. The stock is the biggest market cap of any LNG shipping company in the world is fairly liquid, both in Oslo and New York.

So of course, we could be open for consolidation where we are rather kind of acquiring ships to the issuance of new stocks to those people who have maybe private ships. So we are flexible in nature. We are looking at opportunities. But if we are to grow, it has to be accretive. We like the dividend. So if we are doing something, we also have to make sure it’s good for existing shareholders. We’re not going to pursue growth just to grow our fleet and build a bigger empire. We’re very happy with the status today, and we can certainly continue just operating with the existing fleet if we deem that to be more effective than going.

Flex’s management understands that the $250 million investment for a new ship that won’t be delivered until 2027 just isn’t an attractive use of cash right now. Especially when you already have such a new fleet.

Instead, the company is prioritizing providing value to existing shareholders with the stellar fleet it already has. For me, this conference call only reinforces my faith in Flex’s management team. Being open to possibly issuing stock to take on privately held ships could be accretive to the company and its shareholders, on the right terms. And I trust Flex’s management team to know when that deal is right. I don’t know for certain that we will see such a combination, or possibly another merger, but I trust that it will be well thought out if it does happen.

Valuation

Flex LNG’s valuation has climbed significantly this year, showing that investors have to pay for quality, even in a tough market. The company’s forward price-to-earnings ratio of 12.38 is well above the trailing 7.15 from when I first covered the company back in March. My previous valuation, which I have stuck with, of $31.9 has now been exceeded by 12% after Flex closed at $35.76 after earnings.

With the company’s earnings visibility now clear through 2024 and the company likely to improve its financial condition further before then while paying out a healthy dividend, I feel like Flex LNG is fairly valued. There is no longer the strong equity upside that I pointed to in March (FLNG is since up 67%). However, I believe Flex LNG’s valuation is well justified. The company is trading at just above 11 times its projected 2023 earnings.

Though I think there is the possibility that Flex could further appreciate (Golar LNG (GLNG) is trading at 20 times earnings), its main attraction now is the offer of a safe 8% dividend and stable earnings.

Takeaway

Flex LNG’s second quarter only serves to further solidify the validity of the company’s “steady as she goes” management style. Flex LNG isn’t here to try to be the biggest or the best but to prudently produce solid returns for shareholders. The company’s special dividend is only further evidence of that and juices the yield up to 10% (not that we were complaining about 8%). With charters fixed through 2024 and ongoing refinancing expected to improve debt terms and unlock further cash, Flex LNG is in a better position than ever. Even if shares are now trading at a much higher premium, they remain attractive for those searching for reliable dividend income from a solid company.

Be the first to comment