DNY59

By Joseph Nelesen

20 and 15 years after the launches of the first ETFs based on the iBoxx USD Liquid Investment Grade (IG) Index and iBoxx USD Liquid High Yield (HY) Index, respectively, ETFs are increasingly used to trade fixed income without the necessity of transacting individual bonds. The tradability of bond ETFs has been leveraged by a growing number of investors as market stressors regularly emerge, and crises have long offered proving grounds for index-based products, including ETFs. If the recent U.K. market downturn reminds us of anything (beyond the surprising resilience of a head of lettuce), it is that liquidity can be hard to find when it’s needed. As the Financial Times recently reported, the aftermath is forcing institutions to take a hard look at how quickly they can sell assets in a crisis.

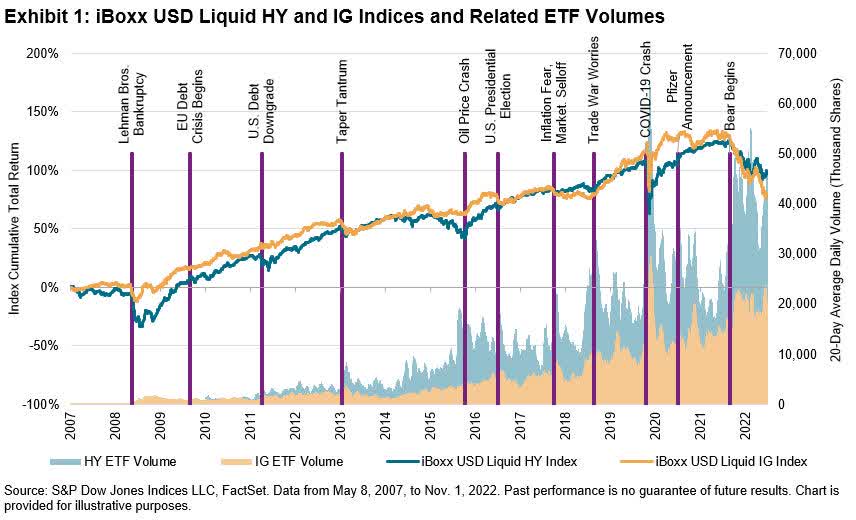

One might wonder how such situations play out around the world when more ETFs and other index products are used as potential sources of liquidity. Indeed, each market crisis since the Global Financial Crisis has tested the idea that index-based bond ETFs could provide a buffer to be traded before resorting to selling underlying bonds. As seen in Exhibit 1, increasing volumes for ETFs tracking the iBoxx USD Liquid IG Index and iBoxx USD Liquid HY Index during periods of stress over the past 15 years has demonstrated that such funds and their underlying benchmarks may be tools that react quickly during volatile markets.

S&P Dow Jones Indices, LLC, FactSet

The increasing usage of ETFs based on the iBoxx USD Liquid HY Index, for example, is facilitated by the index methodology that emphasizes holding the most-traded bonds. Applying higher minimums to issuer size and amount outstanding while also capping single issuers, the index filters the USD 1.5 trillion developed iBoxx USD Liquid HY Index benchmark universe down to just over USD 1 trillion in highly traded components. The resulting index has historically supported not only ETFs but also an expanding ecosystem of other tradable instruments. For example, in 2021 the volume of futures and total return swaps connected to the iBoxx USD Liquid HY Index was nearly five times the same index’s ETF AUM. High fund volumes and assets appear to have supported the growth of ETF options, as well as securities lending and portfolio trading.

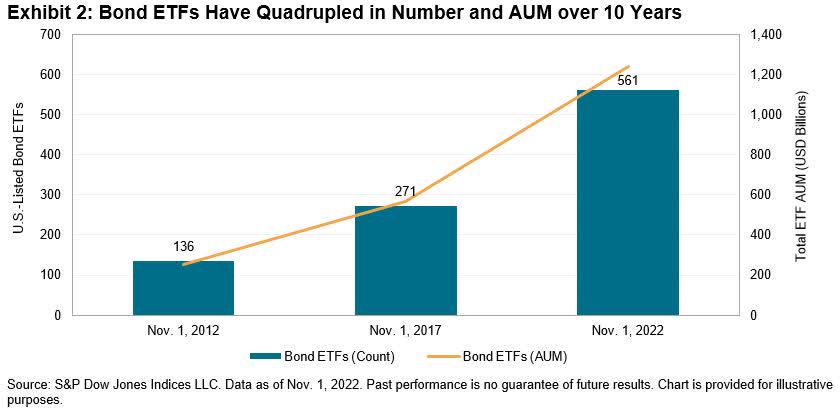

Beyond the cornerstone iBoxx USD Liquid IG and HY Indices underlying ETFs at the core of a fixed-income strategy, the proliferation of fixed-income ETFs over the past decade (see Exhibit 2) could allow for even more fine-tuning of liquid-beta sleeves that mirror broader portfolio characteristics while remaining tradable intraday, potentially reducing pressure on asset owners to use their carefully selected bonds as a source of capital in a crisis.

S&P Dow Jones Indices, LLC

In the end, index design matters. Done right, a fixed-income index has the potential to harness the most-traded segments of the bond universe and support liquid instruments.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment