André Muller

Shares of LyondellBasell (NYSE:LYB) have been hit by increased fears about a global recession, which would reduce demand for chemicals. Its large European operations also face the headwind of high inputs costs. While LYB has a trailing P/E of 5x, earnings and free cash flow are likely to fall substantially. Given this, shares are at about fair value, though the 5% secure dividend yield offers a reason to continue holding the stock. While it is a strong operator, until the market grows comfortable understanding how far EBITDA will fall, shares are unlikely to rebound substantially.

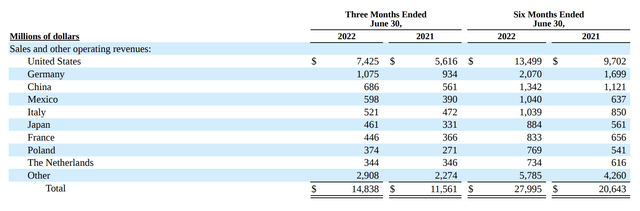

Even as the outlook has darkened, reported results to this point have been strong, though it has become clear the company has passed the peak in its cyclical earnings. In Lyondell’s second quarter, its revenue increased by $3.3 billion to $14.8 billion, but its earnings per share fell to $5.19 from $6.13 last year. Adjusted EBITDA came in at $2.5 billion from $3 billion last year. While higher energy costs and broad-based inflation increased the top-line, the pressures on the bottom line led to margin contraction. Still, that is an annualized $20 in EPS, which speaks to how strong the results are on an absolute basis, even if they have weakened somewhat.

Due to the strength of these results, in May the company raised its dividend by 5%, and shares now have a yield of 6.1%. On top of this, there was a $5.20 special dividend given strong profits recorded last year. Over the past twelve months, its buybacks, special dividends, and regular dividends account for over 14% of the share price. LYB has rewarded shareholders handsomely during its period of excess earnings.

Looking at segment results, we see weakness building in commodity chemicals, typically one of the first sectors to feel a change in the economic cycle. Americas olefins & polyolefins EBITDA fell from $1.6 billion to $900 million, while domestic demand has held up, export activity is weak given troubles overseas. Indeed, overseas olefins & polyolefins fell from $706 million to $230 million as COVID-zero hit Chinese demand and Europe weakens. These chemicals are largely a commodity business, going into plastics, food packaging, and adhesives. At $1.1 billion, this represents about half of the business.

It intermediates & derivatives unit saw EBITDA rise from $596 to $675 million due to strong pricing, but the company sees demand softening as consumer demand for durable goods declines after its post-COVID surge, which will cause widespread margin compression. This unit’s products help to create foams and oxyfuels used in welding and are a bit less commodity, which explains their relative outperformance. Its refining unit had a very strong Q2 with EBITDA up to $418 million from an $81 million loss last year. While this unit had a strong quarter, declining Mexican crude exports is a headwind, and unless it can find a buyer, it plans to shut down the refinery by the end of 2023 because of at least $1 billion in needed maintenance.

Given this, if we look at the company on an ex-refining basis since that is what LYB will look like in the near future, its EBITDA fell from $3.1 billion to $2 billion. This is a meaningful decline that occurred even as the global economy remained in a better position than it is today. Again, commodity chemical business are very cyclical. I would also note that in recent weeks other chemicals makers like PPG (PPG) and Olin (OLN) have reduced Q3 guidance. When Lyondell reports third quarter earnings on October 28, results are likely to be quite weak.

One additional concern I have is that Lyondell is a very global business. The United States accounts for about half of its sales, but it has a large presence in Europe, accounting for over 25% of the business. China is another 8% of its business, that given ongoing COVID-zero policies is unlikely to rebound in a significant way.

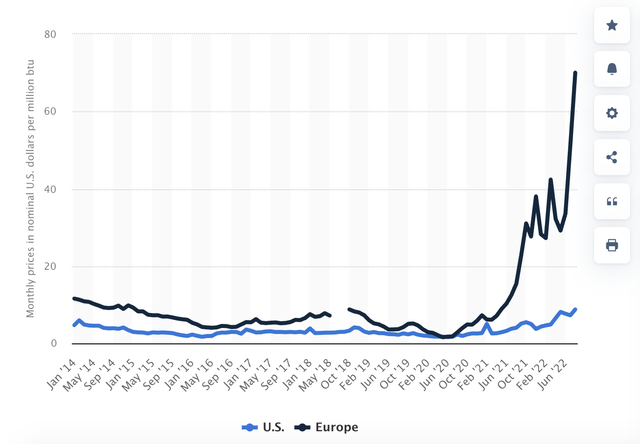

Europe is both a demand and supply problem. On the demand side, very high energy prices are squeezing consumers’ income, which is likely to cause a meaningful recession in my view. On top of this, natural gas is an input cost to most chemical processes. European natural gas prices have skyrocketed as Russia has halted exports, which is likely to persist for some time. This is going to squeeze margins, and there is even a risk of gas rationing that leads to industrial sector shut-ins.

Statista

Unsurprisingly, the company’s largest growth cap-ex program is a new olefin facility that will be located on the US Gulf Coast. With lower natural gas prices and more stable supplies, the US is a better place to be than Europe and is where LYB is seeking growth. Its overseas olefin business lost about 2/3 of its EBITDA over the past year, and with further declines, the unit is likely to see all of its earning power dissipate with the potential for segment losses likely.

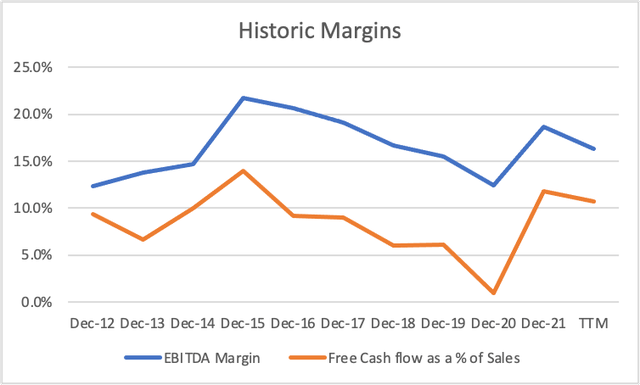

As you can see below, in 2021, the firm enjoyed nearly record free cash flow and EBITDA margins. These have begun to normalize, but I would expect them to fall below 2019 levels given an economy that is clearly weaker today than back then. When its cash flow deteriorates, it falls meaningfully. For instance , in 2016, as Europe faced recession, the oil & gas boom turned to bust and China’s economy slowed, free cash flow fell to $1.9 billion from $3.4 billion the year prior.

Seeking Alpha, my own calculation

In H1 2022, LYB’s free cash flow has $2.1 billion with nearly $800 million of working capital headwinds, or a $2.9 billion normalized pace. Over the past 12 months, it has generated over $4 billion in free cash flow, which supported the special dividend, but this pace is coming down.

If we assume margins compress below 2019 levels but stay better than the 2020 levels when there were COVID shutdowns, LYB is likely to generate about $1.5 billion in free cash flow and about $5-$5.50 in EPS over the next year.

That translates to a 6% free cash flow yield, and a 15x P/E multiple. This is not an expensive stock, but it is also not screaming cheap for a business entering cyclical decline. As it reports EBITDA declines in coming quarters, investors will be unsure how low the bottom is, or how long it will take to get there, and as such, it may take time for shares to find their footing. In the meantime, investors do collect a 5% yield, and with its $11 billion in debt less than 1x trailing 12 months EBITDA, LYB has a strong balance sheet that can withstand the downturn.

At 15x earnings, I view LYB shares as fair value in the upper $70s, if shares fall into the mid-$60s, which would give the stock an 8% forward free cash flow yield, I would be a buyer. But for now, I think investors should look elsewhere and avoid being pulled into a stock due to its cheap trailing earnings, given the declines likely to come.

Be the first to comment