Eva-Katalin/E+ via Getty Images

Investment Thesis

Fiverr (NYSE:FVRR) is a global online marketplace that connects freelancers offering digital services to businesses and other individuals, with services ranging from web development and graphic design to translations and illustrations; in short, anything that can be done digitally.

The company has been a beneficiary of lockdowns over the past few years, with businesses across the globe adopting remote or hybrid ways of working. Given that Fiverr is comprised of digital freelancers, this new way of working made many more businesses feel comfortable working with freelancers who they would never actually meet in person. The freelancing trend was growing before the pandemic, but companies now find themselves more open to working in a remote manner.

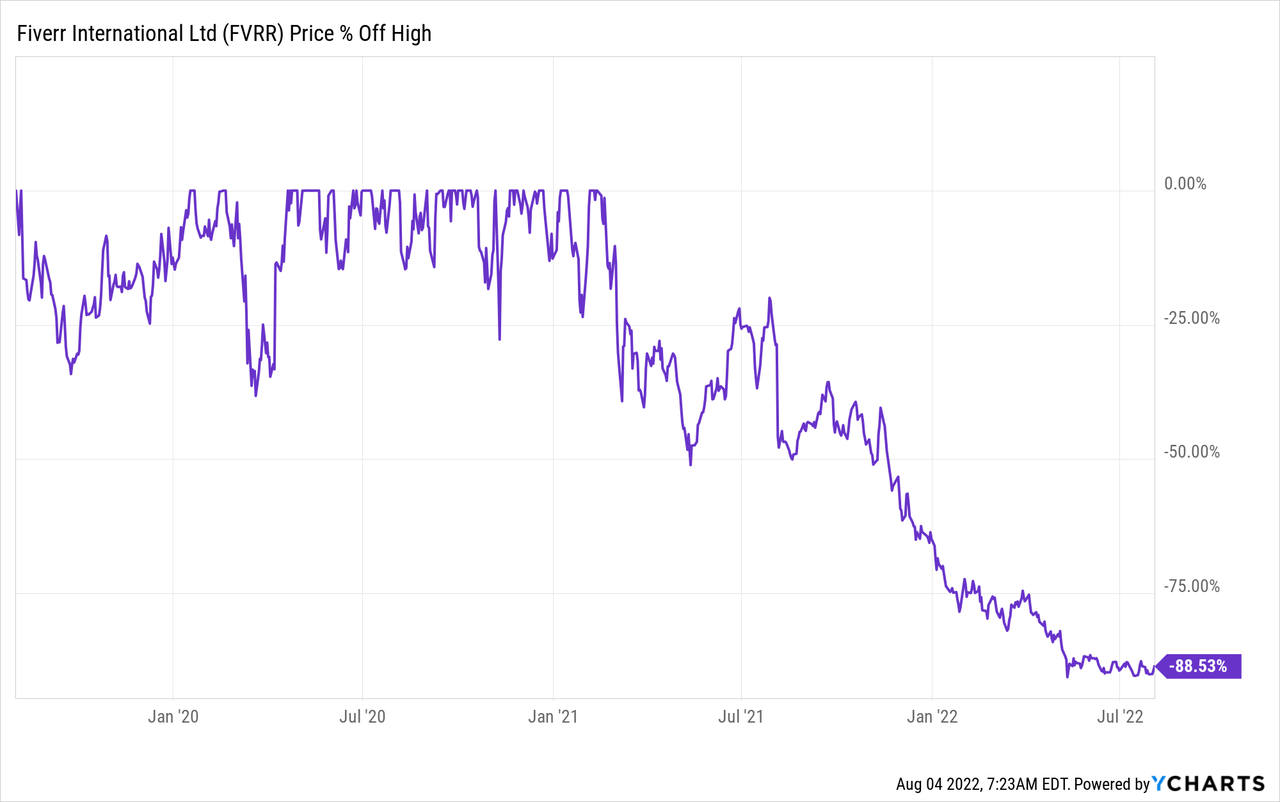

Yet as with many companies, Fiverr’s pandemic tailwinds quickly transformed into headwinds. Fiverr has historically been used more by SMBs (small and medium sized businesses), who are likely to be heavily impacted by an economic downturn or recession. These macroeconomic headwinds have been hurting Fiverr over the past 6 months and, combined with its share price bubble back in 2020 and 2021, has knocked Fiverr shares down by an eye watering 90% from their all-time highs.

I have seen many beaten down companies report Q2 results & see their shares rise, as a lot of negativity is currently baked in – judging by the pre-market share price decline of ~10%, Fiverr does not fall into this category. So why has the market decided to punish Fiverr for its latest results? Let’s dive in.

Earnings Overview

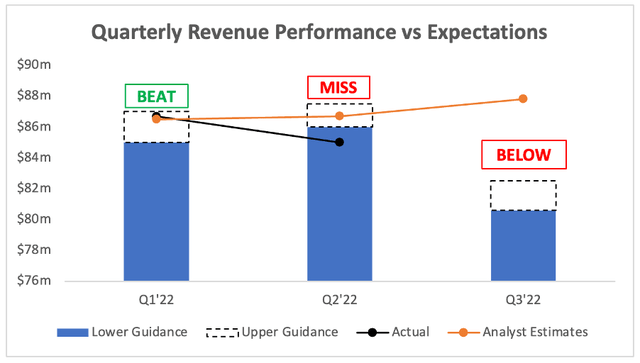

Starting with the top line, and Fiverr’s revenue of $85m (+13% YoY) came in below analysts’ estimates of $86.7m, and also came in below management’s guidance of $86-$87.5m. To add more pain, the guidance for Q3’22 revenue of $80.5-$82.5m came in well below analysts’ estimates of $87.8m, so this is the first reason that shares are getting whacked.

Investing.com / Fiverr / Excel

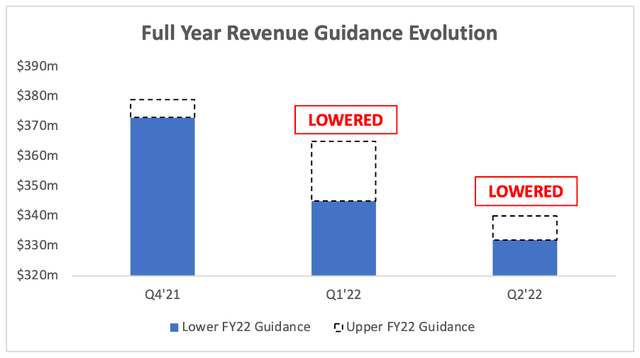

Reason number two for the drop is Fiverr’s full year revenue guidance, which has been lowered once again. To put this in perspective, the YoY growth guided by management has gone from 25-27% in Q4’21, to 16-23% in Q1’22, and is now at 12-14% in Q2’22. That is an extremely rapid deterioration, and certainly raises some questions about this management team’s ability to accurately forecast & understand their industry.

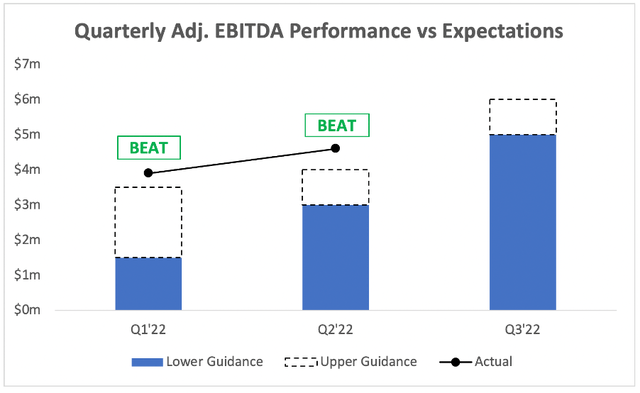

It’s not all doom & gloom however, as Adjusted EBITDA came in above management’s guidance, with Fiverr posting $4.6m vs guidance of $3.0-$4.0m – hurray!

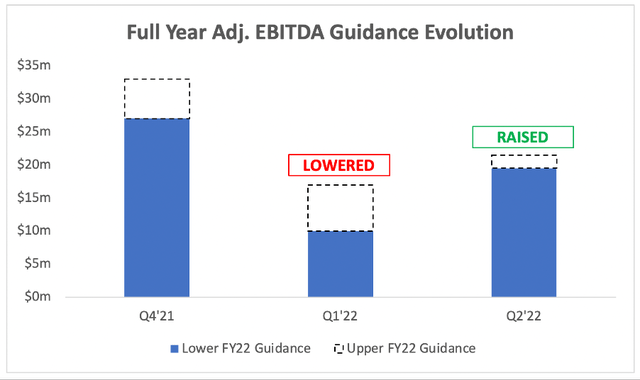

Fiverr also bumped up its full year guidance for Adjusted EBTIDA to $19.5-$21.5m, having previously guided for $10.0-$17.0m.

Despite some misses and reduced guidance on the top line, at least Fiverr is improving its profitability – but that isn’t much consolation to investors in this ‘growth’ business, so let’s see what’s caused the slowdown.

Difficult Macroeconomic Conditions

It’s a story that we’ve heard a lot this earnings season, and I can understand why Fiverr is feeling the pressure from the tough macroeconomic conditions that we have right now. It predominantly targets SMBs, who are more heavily impacted by a recession, and this is leading to the sharp reduction in revenue. Fiverr is not the first company to cut guidance multiple times this earnings season, and it won’t be the last.

In the company’s Q2’22 Shareholder Letter, management highlighted the following:

…While SMB spending grew more cautious within a shifting macro environment, we see continued expansion of wallet share especially among our larger customers.

…Growth has and will always be our priority. However, with market conditions worse than anticipated, when growth becomes expensive, instead of growing at any cost, we decided to prioritize EBITDA and free cash flow, and accelerate the pace towards our long-term target model. We believe this puts us in a stronger financial position to double down on growth investments when market conditions improve.

…Our Q3’22 outlook and updated full year 2022 guidance reflects the recent trends in our marketplace as global SMB spending grew more cautious leading to less demand for freelancers. We expect to continue improving Adjusted EBITDA from the recent cost reductions and a strengthening investment focus.

In short, Fiverr is being hit by broader macroeconomic conditions & in truth, it doesn’t seem to be able to do much about it – this is a concern. The company continues to move upmarket which would help insulate it slightly from a recession in future, but clearly that is not enough right now.

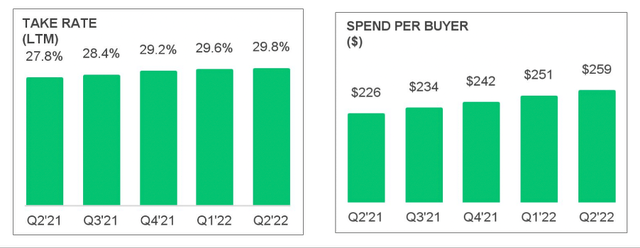

The improvement in profitability is a good sign, and there are some other positive metrics that we can look at. Fiverr’s Take Rate of 29.8% for the twelve months ending in Q2 improved sequentially yet again, and the Average Spend per Buyer also continued to improve sequentially, up to $259, whilst Active Buyers remained flat at 4.2m for the third quarter in a row (I’d call this a positive, since it isn’t declining!).

Fiverr Q2’22 Shareholder Letter

The Opportunity Remains The Same

I previously wrote an article called Fiverr: Set And Forget For The Next Decade, and I do stand by this, although with a stronger note of caution & perhaps wishing I could forget about these results. The opportunity for Fiverr remains exactly the same, as freelancing is expected to be a continually growing industry over the next decade with Fiverr at the forefront.

Fiverr cannot control the macroeconomic conditions, and although I think management should’ve done a better job with setting expectations, they are not the only management team to have been taken by surprise by the speed at which macroeconomic conditions have deteriorated. Yet this company remains free cash flow positive, and will be able to ride out the storm that is coming – and once it does, I think there will be blue skies on the other side.

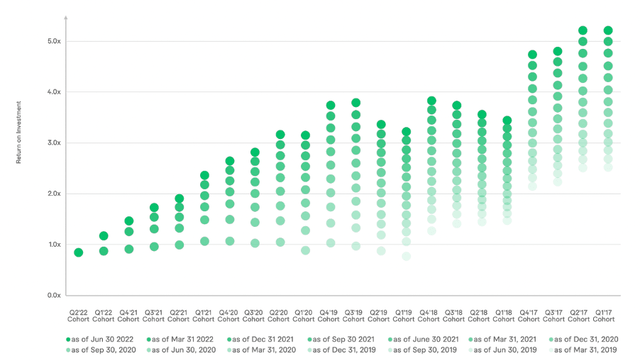

The stickiness of Fiverr’s business model also remains the same, as demonstrated in part by the fact that Active Buyers have remained constant over the past few quarters despite a difficult environment. The cohort analysis continues to show that each new cohort continues to deliver 3, 4, and 5x returns on the marketing investments to get them in the door. These companies stay on the platform, and for the past 12 months, repeat buyers contributed to 62% of total revenue on Fiverr’s core marketplace.

Fiverr Q2’22 Shareholder Letter

In terms of this longer term opportunity, Fiverr highlighted the following in its Q2’22 Shareholder Letter:

We continued to build Fiverr’s thought leadership in the freelancer industry. Our latest U.S. Freelance Economic Impact Report shows that independent work and remote work are powerful economic forces that were accelerated during the pandemic and will continue to shift how we work for years ahead. Freelancers demand more control over how they work, the projects they take on, where they work, and how much to charge – all of these are central to what Fiverr as a platform strives to provide to our community.

This quarter clearly means that the pain isn’t over for shareholders, but I like to take a time horizon of 6 years rather than 6 months (provided the company isn’t at risk of bankruptcy!), and when I look through that lens, Fiverr feels like a potential winner.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Fiverr is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

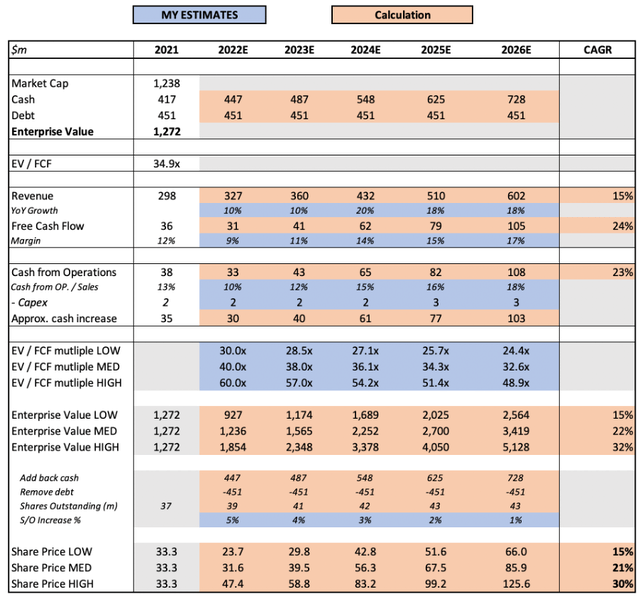

I shared details behind my assumptions in my previous article, and will only outline changes. I have updated the enterprise value in line with Fiverr’s latest results, and have assumed YoY revenue growth of 10% for 2022 – management guided for 12-14%, but I have decided to take a more conservative approach. I continue this approach by only assuming 10% revenue growth for 2023, followed by a recovery as the macroeconomic environment starts to improve.

Put all this together, and I can still see Fiverr shares achieving a 21% CAGR through to 2026 in my mid-range scenario, despite making some very conservative adjustments to the model.

Investment Thesis: On Track With Warning Signs

I still believe that my long-term investment thesis for Fiverr is on track, and I don’t think there is an awful lot the company can do to avoid the current macroeconomic pressures. I am currently just looking for it to survive the next 12 months, which I’m sure it will since it has a good balance sheet & is generating positive free cash flows. Once the economy starts to stabilize, I think that demand for Fiverr’s freelancers will pick up again – this is a secular trend, and growth won’t be hampered for too long.

That said, another guidance cut does raise some concerns about management. There is nothing here that makes me worry me too much, but investors do need to approach Fiverr with caution. Given the additional caution required, I am downgrading my view on Fiverr from a ‘Strong Buy’ to a ‘Buy’, as I still believe this to be an attractive risk / reward scenario.

Be the first to comment