Cylonphoto

This market is really tough. This is a tougher market than when we thought the world was ending in March 2020. Honestly. This selloff has been the most painful since 2008, in our opinion. This is all happening due to the rampant inflation in the world.

A couple of months ago, we were excited to see the stock of Five9, Inc. (NASDAQ:FIVN) fall below $100 and put out a great plan to scale into the stock. Today the stock blew through our downside stop. In our initial trade, we had not recommended a stop loss, so you can hold here, but we personally entered one, and got nailed. While the stock had been falling and falling along with a terrible market, where cloud stocks had been crushed, today the stock was annihilated, taking shareholder’s wealth along with it. In this column, we address the decline, as well as the performance of the name.

The CEO departs unexpectedly, creating uncertainty

This is such an impressive company, and yet the stock had been falling just like the market most of the year. We honestly are pretty shocked to have been stopped out of this trade. We think the company can dead-cat bounce from here, but there is a lot going against the company right now, and thus we are downgrading to a “Hold.”

It is reactionary, but the story has changed. Today’s collapse has been led by the sudden departure of the CEO. The CEO, Rowan Trollope, is resigning in order to run a privately held company. Now, look. People can change jobs. It is okay. It does NOT mean the company is broken, though performance is expected to decline just because of the macro landscape. It is the sudden announcement that has spooked investors, while the shorts are rejoicing. Mike Burkland, the former CEO, is coming back to take over. The market hates this.

A bit of a pre-announcement

This company solves problems for companies that they may not even know they have, but they have their own problems now. Today’s move appears overdone, but the Street is sick over this management move. Yet, the company jumped out and preannounced an earnings beat. Yes, a big beat at that versus consensus. For Q3, Five9 says it will be seeing sales of $198 million. Folks this is a $4.8 million best compared to analysts’ estimates. On top of that, adjusted EPS will be coming in at $0.38 cents per share, compared to consensus of $0.32. This is a huge beat, yet the market wants no part of it.

To us, it is overdone, but you have to hold here because without an overall market rally, the stock is likely to suffer until full earnings are reported on November 7th. We think the stock can claw back, but there is no guarantee it will or how long it will take. Could be a week, a month, or next year. We got hurt on our trade, but we still like performance of the name. Come November 7th, when the full report is released, it is not the quarterly performance that matters, but the outlook.

Growth is there, but the outlook will be everything here

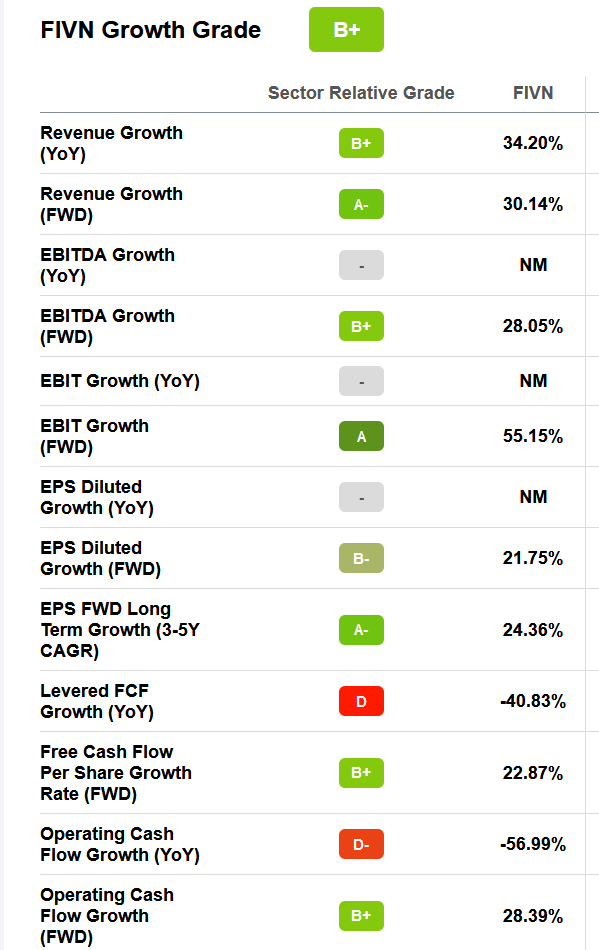

Including the just announced early results for the top line for Q3, the company is growing tremendously. The outlook, if it is strong, should result in the stock recovering. The growth grades remain strong.

Seeking Alpha FIVN growth metrics

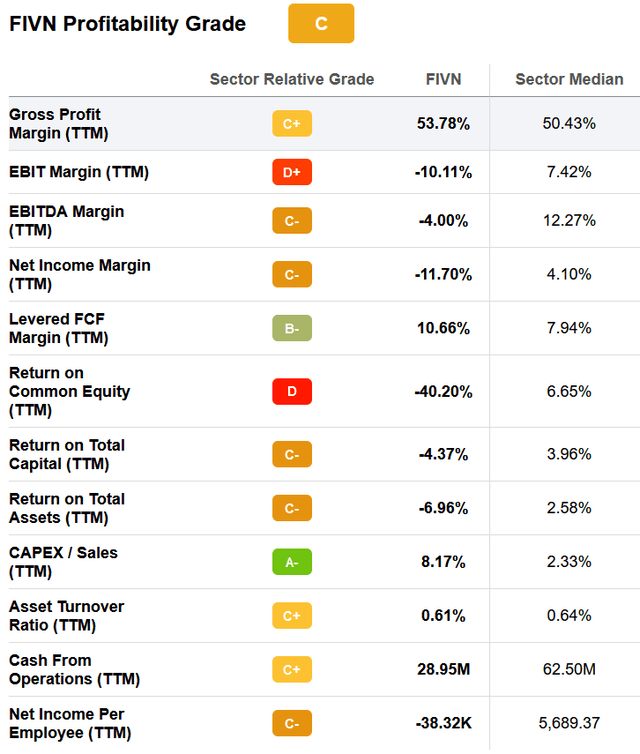

Look make no mistake, this growth is strong. The Q3 pre-announced results bolster this growth. We really like what we are seeing. We think that as a cloud stock goes, this one is not only growing but is profitable. The profitability metrics look strong still, too.

Seeking Alpha FIVN profit screener

This is a high-growth tech stock. The fact that there is average profitability relative to the overall information technology sector is huge. With today’s massive decline, the valuation of the name is very strong here. We just did not account for a massive decline like this in one day on unexpected news. It hurts.

That said, the results of the recent quarter were strong in Q2 and now looks like the results were incredible for Q3 as well. To remind you, Q2 2022 revenue increased 32% to a record $189.4 million, compared to $143.8 million for Q2 2021. Subscription revenue grew 41% year-over-year for the last 12 months. Now, regardless of what the stock has done in the last few months, operationally the company is strong. A bulk of the revenue is recurring, and this recurring revenue stream as a percentage of total revenue has been stable for many quarters. We see no change here, but the outlook when the Q3 results are reported could prove us wrong. Still, we do not see this happening. Today’s plunge is simply about the C-suite.

The company turns a profit, setting it above most of the growth tech space

As we showed above, the company is profitable. This makes it a much stronger investment than those that make no profit. Year after year there has been solid margin expansion, though there is volatility quarter to quarter for course. In Q2, the GAAP gross margin was 53.4% compared to 55.2% for Q2 2021. Adjusted gross margin was lower to at 60.7% compared to 63.3% a year ago. Given the earnings numbers that were preannounced, we think adjusted gross margin comes in at 62%-64%. Adjusted net income was $24.3 million in Q2, or $0.34 per share. Adjusted EBITDA for Q2 was $33.1 million, or 17.5% of revenue, compared to $24.0 million, or 16.7% of revenue, last year. Given what we learned today, looks like Adjusted net income will be north of $25 million, while EBITDA could be $34-$35 million, depending on interest, tax, etc. That is really nice growth.

Again, the outlook, when management talks to investors and analysts after earnings will really be the next catalyst. We will also be watching cash flows. These are key as well. For the last few quarters, operating cash flow has been strong. We see strong Q3 cash flows based on these numbers as well. Earnings are improving. And, we are looking for the year for EPS to be in a range of $1.38 to $1.40, perhaps higher with Q3 results. Unless Q4 guidance is horrendous (and we do not see this as recurring revenue is clear), the stock may be on sale.

So why is the stock really getting hit this bad. Well, let us return to our initial coverage. The whole thesis centered on one statement (in addition to the growth). We stated:

BAD BEAT Investing FIVN coverage August 2022

So now, the CEO is leaving, suggesting there is an issue with management. Could more changes be coming? Will the former CEO who is returning be competent as well? Will the outlook be changed badly? All of this unknown information has caused the Street to panic and sell.

Final thoughts

We loved this stock coming under $100, and it is down 40% from there now. It is less about performance and all about the reason we bought the stock: management. This change was a surprise. On valuation, growth, and profit, however, we think you stick with the name, unless, like us, you got stopped. We got caught here playing defense. One solid approach could be to sell puts here to get exposure if you like the name.

Be the first to comment