Alex Wong/Getty Images News

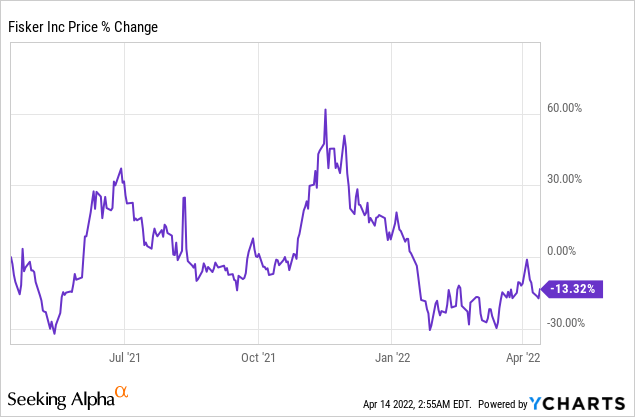

Shares of Fisker (NYSE:FSR) surged at the end of last year, but have dropped significantly from their last high of $23.75. One of the reasons why I am optimistic about Fisker is that the company’s reservations for its first-ever production car are going through the roof and the firm is slated to start production of the Ocean One SUV this year. While Fisker has not yet brought an electric vehicle to market and risks are therefore high, interest in Fisker’s product portfolio is clearly growing. The market introduction of the Ocean One sport utility vehicle could be a big catalyst for shares of Fisker and the risk profile remains skewed to the upside here!

Fisker’s Production Ramp

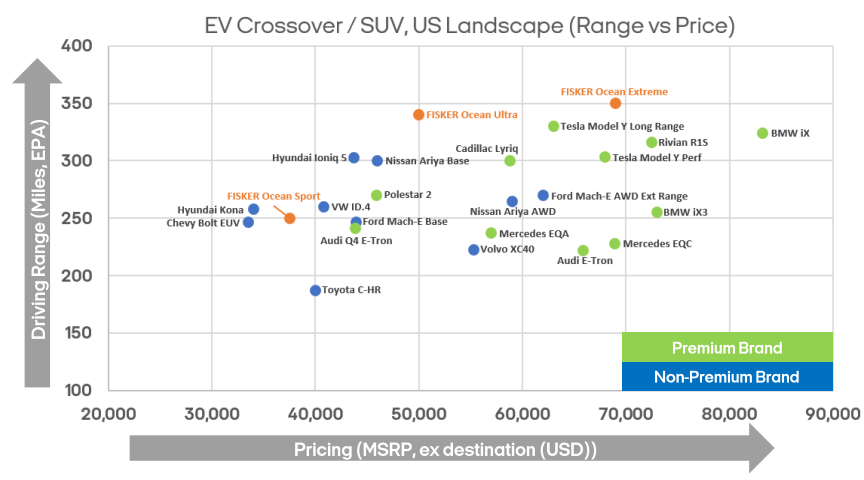

The California-based electric vehicle startup is working on bringing its first production car – the Fisker Ocean One SUV – to market in FY 2022/2023. The company has said that it expects to produce 5 thousand limited-edition Fisker Ocean One SUVs, starting later this year, with first deliveries expected to take place in November 2022. The first 5 thousand units will be the Fisker Ocean One Launch Edition and will set back reservation holders $68,999. Different configuration packages will also be available at a later stage with prices ranging from $37,499 for the base model, before federal and state tax credits, to $68,999 for the Fisker Ocean Extreme.

With the proposed prices for various models of the Ocean One, Fisker sets itself up to compete against both premium and non-premium brands in its targeted SUV segment.

Fisker

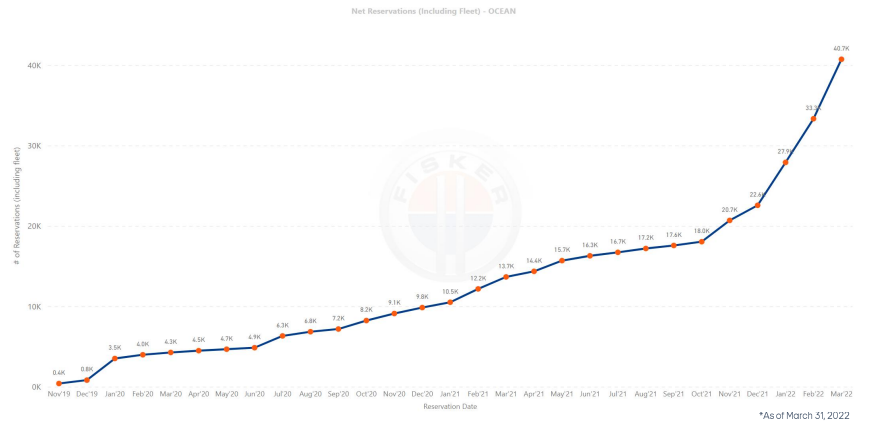

In a release from March 2022, Fisker said that it has amassed more than 40 thousand reservations for its first electric vehicle so far. When I last took a look at Fisker, in November 2021, the EV startup had less than 20 thousand reservations: 17.5 thousand retail and 1.4 thousand fleet reservations. I estimated at the time that Fisker could amass 40 thousand EV reservations by Q4’22, so the firm is doing a lot better regarding preservations than I expected.

Since November, Fisker doubled Ocean One reservations and pre-orders have started to really take off in FY 2022… as you can see in the following chart.

Fisker

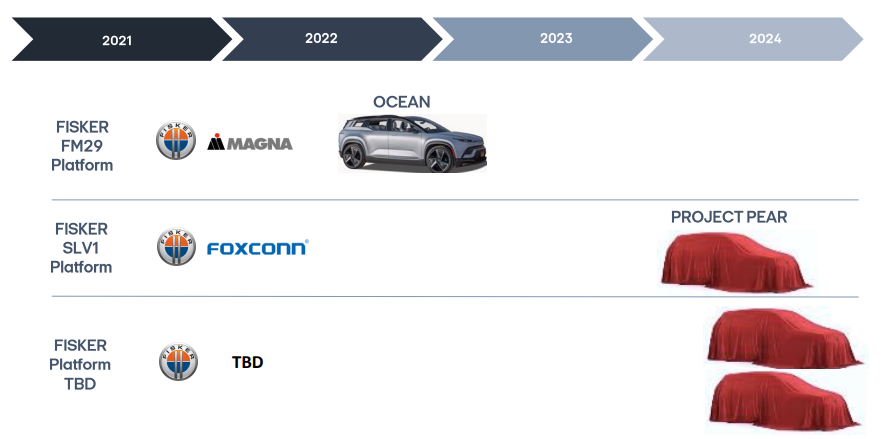

While the Ocean One SUV is the first electric vehicle that the company is bringing to market, the EV startup has a filled product pipeline and ambitions that go well beyond just selling one all-electric sport utility vehicle. Fisker’s second production car – so far only code-named Project Pear – is set to launch in FY 2024 and will be manufactured by Foxconn in the U.S. Foxconn acquired a manufacturing plant from Lordstown (RIDE) in FY 2021 to aid its expansion into the North American market. New EV product launches, subsequent to the Fisker Ocean One market introduction in November, could create additional fantasy in the Fisker name going forward.

Fisker

Massive Addressable Market And Estimated Revenue Potential

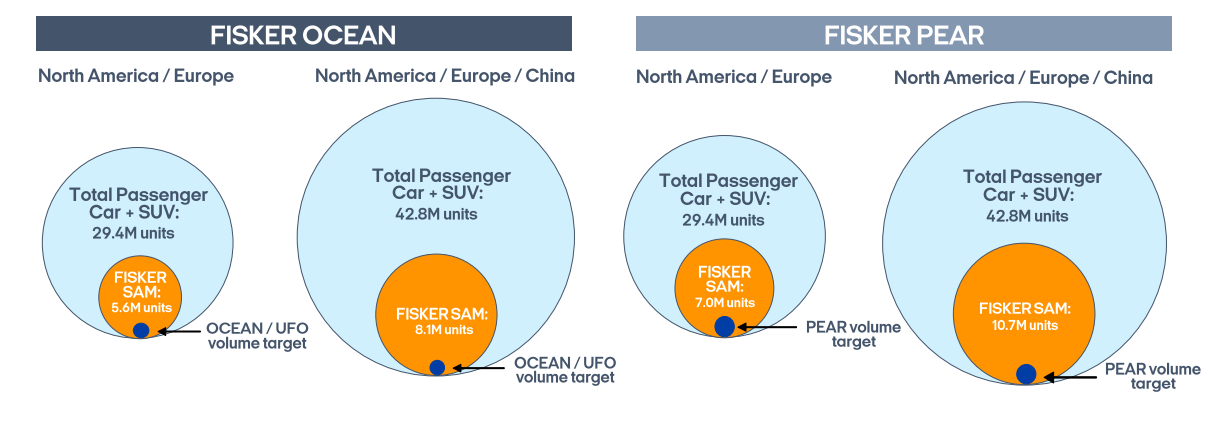

Electric vehicle adoption is rising which explains the popping up of so many different EV manufacturers that want a slice of the growing EV pie. The EV market opportunity for Fisker is enormous and the firm expects to face a total global addressable market of 8.1M units for the Fisker Ocean One SUV alone.

Fisker

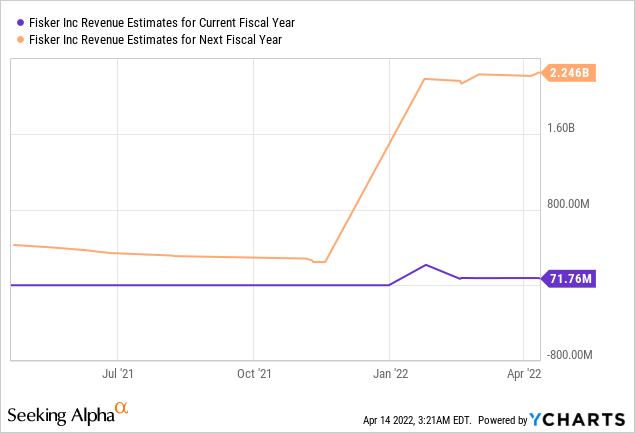

Assuming that Fisker could service just 2.5% of this total addressable market implies a potential sales volume of 200 thousand units. With a price sticker of $50 thousand per EV, Fisker is looking at a long-term sales potential of around $10B. However, Fisker is not going to come anywhere near this sales volume in the short term. But revenues are still set to ramp up at the end of the year and Fisker’s top line is primed to grow exponentially in the years following the Ocean One launch. Top line estimates provided by Seeking Alpha indicate that Fisker’s revenues will explode from virtually nothing to $2.2B in FY 2023.

Fisker currently has a market cap of $3.8B… which is a lot for company with no revenues and considerable risks as the firm moves into the mass production stage. But, Fisker’s long term revenue potential in the SUV market is clearly there and surging reservations indicate that buyers see it the same way. With a market cap of $3.8B, Fisker sells at a P-S ratio of 1.7 X, which is a reasonably valuation factor considering the top line upside that awaits Fisker.

Risks With Fisker

Fisker is still in the development stage and has not yet sold a single electric vehicle, putting reservations aside. Meaning, as opposed to EV startups like NIO (NIO) or Lucid Group (LCID), risks with Fisker are significantly higher and production delays have the potential to hurt the stock in the short term. Fisker also has no revenues yet and is expected to stack up losses for a long time before it reaches profitability. Investors that consider buying Fisker must be aware of these risks. Timeline risks are likely Fisker’s biggest risks until the startup starts making first customer deliveries.

Final Thoughts

Shares of Fisker have dropped off significantly from last year’s highs but the drop creates a buying opportunity for investors that believe in Fisker’s long-term growth strategy and production ramp. Fisker could revalue higher as the firm supplies updated Ocean One reservation numbers and kicks off production!

Be the first to comment