imaginima

Although the utility space is not typically seen as particularly attractive to many investors, there are some players in this space that warrant consideration. One such firm is FirstEnergy (NYSE:FE), a provider of electricity across six different states covering many million people. Over the past few years, the financial performance of the business has been somewhat mixed. But the overall trend should be considered positive. Add on top of this management’s current plans to reinvent the firm and, assuming those plans come to fruition, the company might very well create some attractive value for its investors moving forward.

FirstEnergy’s performance is encouraging

To best understand FirstEnergy as a business, it would be helpful to break it up into the operating segments that it is divided into. First and foremost, we have the Regulated Distribution segment. This unit is responsible for distributing electricity through the company’s 10 operating firms that serve approximately 6 million customers spread across 65,000 square miles in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York. The segment also is involved in the purchasing of power for some of its subsidiaries. And it also controls 3,580 MWs of regulated electricity generation capacity located mostly in West Virginia and Virginia. Last year, this segment was responsible for 75.9% of the company’s profitability.

The other key segment that the company has is called Regulated Transmission. This provides transmission infrastructure that is owned and operated by the Transmission Companies, as well as some of FirstEnergy’s utilities, all for the purpose of transmitting electricity from generation sources to distribution facilities. This particular part of the enterprise is rather interesting in that, last year, it accounted for just 24.1% of the company’s profitability. Despite that, there seems to be a lot of value baked into the firm. In fact, in May of this year, the company completed the sale of a 19.9% interest in FirstEnergy Transmission LLC the parent company of some of the firm’s other subsidiaries, in exchange for $2.375 billion in cash. With the proceeds from this sale, as well as with the proceeds from a smaller divestiture and from a $1 billion equity issuance, the firm was successful in paying down $2.5 billion in debt in the first six months of this year.

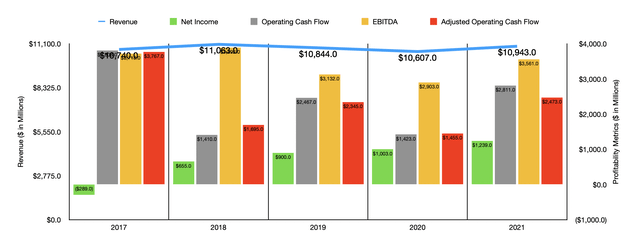

Over the past few years, the financial picture reported by FirstEnergy has been rather mixed. Revenue has demonstrated no clear trend, instead bouncing around in a fairly narrow range of between $10.61 billion and $11.06 billion. Last year, revenue came in at $10.94 billion. Despite this, profitability for the company has continued to increase. It went from a loss of $289 million in 2017 to a profit of $1.24 billion last year. Operating cash flow, however, has been quite volatile, bouncing around between $1.41 billion and $3.81 billion. But if we adjust for changes in working capital, the trend from 2018 through 2021 has been mostly higher, with the metric climbing from $1.70 billion to $2.47 billion. Meanwhile, EBITDA for the company has also been quite volatile, moving around between a low point of $2.90 billion and a high point of $3.89 billion over the past five years.

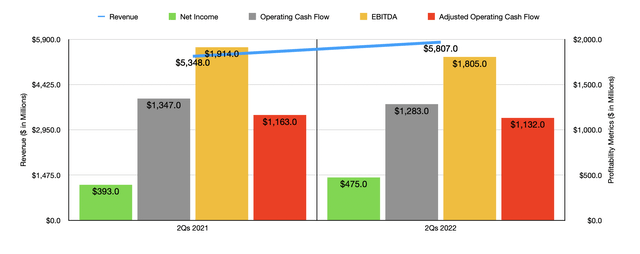

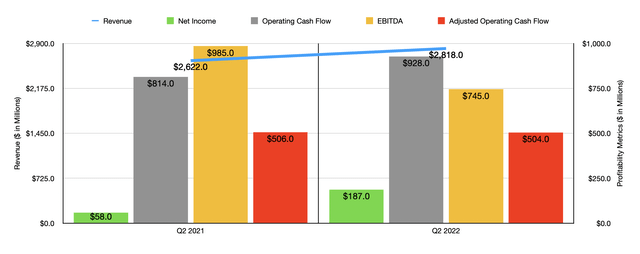

When it comes to the 2022 fiscal year, the picture for the business is looking up. Revenue in the first half of the year came in at $5.81 billion. That compares favorably to the $5.35 billion generated the same time one year earlier. This increase was aided in part by a strong second quarter, with revenue of $2.82 billion beating out the $2.62 billion achieved the same quarter one year earlier. In addition to seeing revenue rise year over year for that quarter, the company also managed to beat analysts’ expectations to the tune of $70 million. Profitability for the company has also improved for the year. Net income of $475 million in the first half of the year beat out the $393 million generated one year earlier. For the latest quarter, net income came in at $187 million. That’s over triple the $58 million generated one year earlier. Earnings per share of $0.53 in the latest quarter also beat analysts’ expectations to the tune of $0.01. As the charts above and below illustrate, however, other profitability metrics have largely been mixed, with no clear trend year over year.

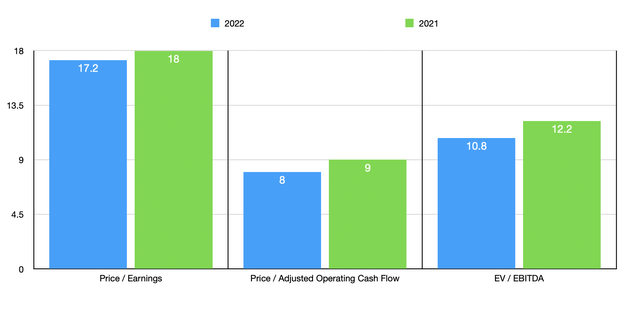

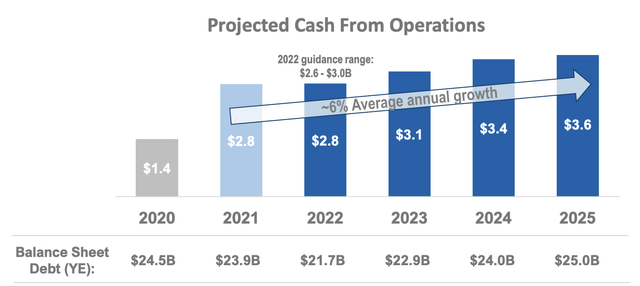

One really great thing about FirstEnergy is that shares of the enterprise look quite affordable at this time. When it comes to the 2022 fiscal year, management is forecasting net income of between $1.24 billion and $1.355 billion, with a midpoint of $1.298 billion. Meanwhile, operating cash flow should come in at between $2.6 billion and $3 billion. No guidance was given when it came to EBITDA, but if we assume that it will increase at the same rate that operating cash flow should, then we should anticipate a reading this year of $4.03 billion. On a forward basis, this all implies a price-to-earnings multiple on the company of 17.2, a price to adjusted operating cash flow multiple of 8, and an EV to EBITDA multiple of 10.8. These numbers compare favorably to the 2021 readings of 18, 9, and 12.2, respectively.

To put the pricing of the company into perspective, I also decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 5.5 to a high of 119.2. Only one of the five companies was cheaper than FirstEnergy. Using the price to operating cash flow approach, the range was from 7.6 to 10.2. In this scenario, two of the five companies were cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range was from 5.7 to 13.7. Due to the company’s high leverage, the end result was four of the five firms being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| FirstEnergy | 17.2 | 8.0 | 10.8 |

| SSE plc (OTCPK:SSEZY) | 5.5 | 10.2 | 5.7 |

| Fortis (FTS) | 23.0 | 9.4 | 13.7 |

| Entergy (ETR) | 21.2 | 7.8 | 11.6 |

| CLP Holdings (OTCPK:CLPHY) | 19.1 | 9.2 | 10.1 |

| PG&E (PCG) | 119.2 | 7.6 | 10.9 |

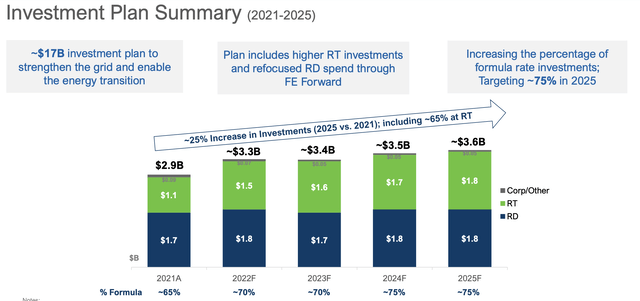

Although the company may not have been exciting in recent years, that picture could change if management is correct about their current initiatives. You see, between 2021 and 2025, the company is targeting significant investment in making the enterprise more sustainable and profitable for investors. This comes at a time when the company intends to continue paying out dividends with an implied payout ratio of between 55% and 65%. These investments are forecasted to increase the company’s rate base growth by around 6% per annum through 2025, with long-term operating earnings per share growth climbing by between 6% and 8% per year.

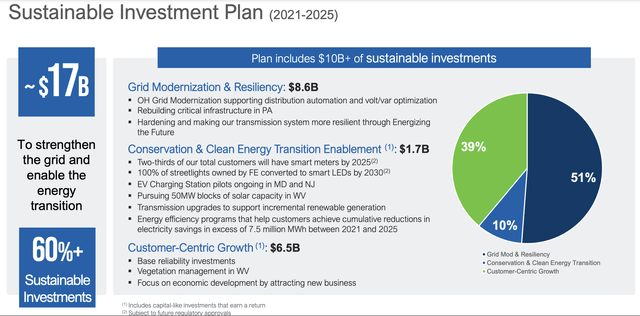

Of the $17 billion earmarked, the company plans to allocate around $8.6 billion toward grid modernization and resiliency projects. $1.7 billion is slated to go toward conservation and clean energy transition enablement activities such as pursuing 50MW blocks of solar capacity in West Virginia, embarking on the launch of electrical vehicle charging station programs in Maryland and New Jersey, transitioning two-thirds of its customers onto smart meters, and more. The remaining $6.5 billion, meanwhile, is going to customer-centric growth, which is necessary in order to grow at all in such a regulated and developed space.

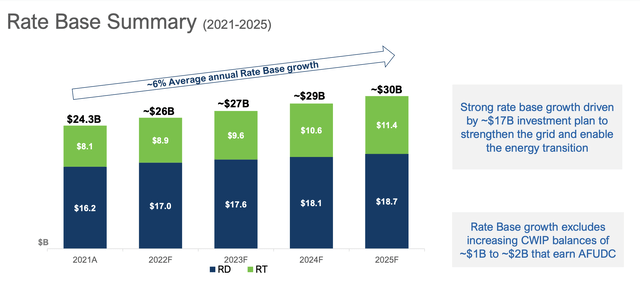

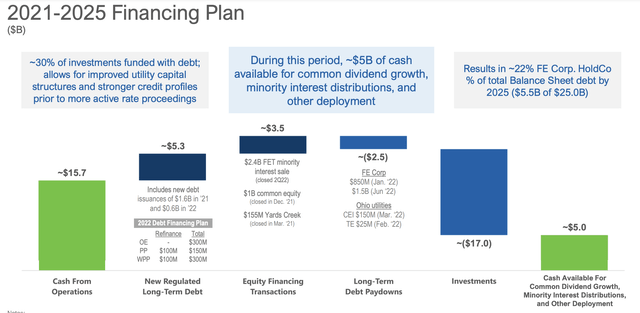

If these efforts come to fruition, then the average annual rate base of the company should expand nicely, climbing from $24.3 billion in 2021 to $30 billion by 2025. And although the company does have a great deal of debt today, it does not see much of a challenge getting the proceeds required in order for these investments to be made. You see, from 2021 through 2025, the company is forecasting $15.7 billion in aggregate operating cash flow. This should start from $2.8 billion in 2021 and should eventually hit $3.6 billion per year by 2025. The company is also expecting to raise $5.3 billion in additional long-term debt and it already captured $3.5 billion from the aforementioned asset sales and its $1 billion equity issuance.

Although the company has said that it is planning to issue some new debt, it is using some of the proceeds, as I mentioned already, to reduce some credit facility debt and term loan debt that’s on its books. This makes sense in an environment with rising interest rates since credit facility and term loan debt is always variable in nature and long-term notes are almost always fixed. And after all of these investments have been made and the aforementioned debt has been paid down, the company still expects to have around $5 billion in excess cash that it can use to fuel its dividend, engage in minority interest distributions, and using other means that it might deem necessary or advantageous.

Takeaway

Based on all the data provided, FirstEnergy strikes me as an interesting company that is undergoing an important transition. If we were to judge the company’s performance based solely on how it has done over the past few years, my feelings should be somewhat mixed. However, management has a plan moving forward and, if that plan creates the kind of cash flow management is forecasting, the picture for the enterprise should look rather nice. Add on top of this the fact that, in two out of three approaches I used to value the firm, it is trading cheaper than many of its peers, and I cannot help but rate it a ‘buy’ at this time.

Be the first to comment